HaiKhuu Daily Report - 02/13/2026

Good morning, happy Friday, and welcome back to the $680 magnet zone!

These conditions are BRUTAL, as traders are presented with both beautiful opportunities to trade and insane opportunities to incur significant losses. Hopefully, you all survived the volatility of yesterday and are ready for another irrational day for the markets today.

$SPY is back in that $680 magnet zone, traders are fearful, and the markets have made the promise of irrationality and inconsistencies true.

I am not promising anything, but I said yesterday to follow the general market momentum, and that there was weakness in the system, and that exact same sentiment is true today. Hopefully, we don’t sell off once again to end this week bloody red, but at the same time, after every minor sell-off, there is a minor recovery.

So, I am not necessarily promising or guaranteeing that the markets recover today, as we can easily continue to sell off from this magnet zone, but when we do recover, I am expecting a quick and sudden recovery that is unexpected by many. I want to be bullish and optimistic that the markets are going to recover from here, but at the same time, I need to make sure we all remain solvent.

I’ll talk more about my general market sentiment and thoughts on a recovery later on in the full report, so for now, just continue to practice safe risk management, protect your bottom line, and do everything you can to end this week strong!

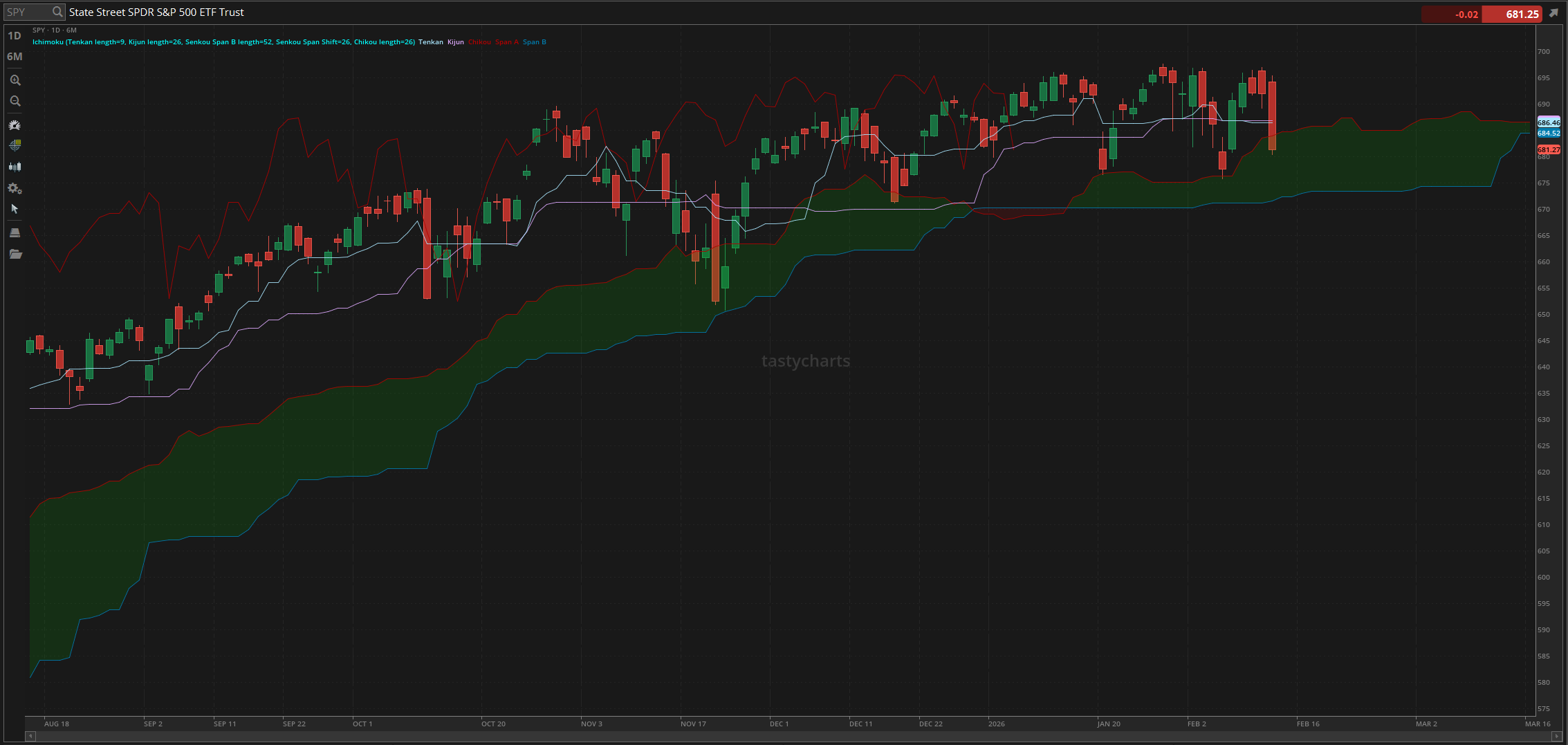

The updated $SPY daily levels are as follows:

Conversion Line Support: $686.46

Baseline Support: $686.82

Psychological Support: $680

Daily Cloud Support: $683.91

Thoughts & Comments from Yesterday - 02/12/2026

Yesterday was an absolutely bloody day for the markets that the large majority of traders did not expect, and man oh man did the markets get slaughtered. Very few came out of yesterday unscathed, and very few were profitable. Traders had great opportunities to scalp and trade on an intraday basis, as long as you followed either my entries, or simply followed the market momentum. Congrats to anyone who attempted to follow us into our $COIN bear play as the alert during the pre-market session on a short, absolutely killed it yesterday!

But back to the markets, $SPY started the day moving up slightly from the previous close, officially opening the day trading at $694.35. Market conditions at open were relatively uneventful as we watched the markets move up $1.00 to make the official high of the day, trading at $695.35, before coming back down ever so slightly, and watched as the markets continued to display weakness throughout the day.

$SPY officially went black for the day, leading into the lunchtime lull, and that is where the selling started quickly. Before we knew it, $SPY went red, went to break down to $690, and went to sell off and hit $685, all before Noon EST. Within less than an hour period, $SPY had dropped over $10, and many traders were slaughtered in the process.

After the selling incurred, we watched as the markets kind of remained stagnant and chopped around that $685 price point, before ultimately coming down once again, and making the official low of the day, trading at $680.37 before bouncing back up and hitting $681.27 to officially end the day.

We ended the day with $SPY down $10.69 from the previous close, or down roughly 1.5%, with an intraday bearish movement of approximately $15 from the high to the low. We were expecting a large directional move leading into the markets yesterday, but just being completely honest, I do not believe the majority of traders expected that level of selling. So hopefully you all were able to survive the madness of the markets yesterday, and are ready for some more general confusion leading into today!

S&P 500 Heat Map - 02/12/2026

Thoughts & Comments for Today - 02/13/2026

Today is going to be an extremely difficult day to comment on, especially this early during the pre-market session. At the time of writing this report, $SPY is currently testing and trying to break below the $680 magnet zone. This is obviously not a great sign of these market conditions, and traders should be extremely careful and cautious while attempting to trade and allocate today.

There is a very real possibility that the markets only continue to sell off from here. I am not trying to be bearish or overly pessimistic when I say this, but in reality, with the way the markets are moving, it is almost hard not to be overly fearful. Please, just tread lightly and practice safe risk management in these conditions. Traders genuinely can lose a significant amount of gains in an extremely short period of time, and traders can and will continue to have difficulties navigating these conditions.

I am not saying that it is not possible for a recovery, but I am just warning you about the case that we continue to sell off.

In the case that we do see a recovery in the markets, just know that I am under the full expectation that we can easily continue to rally and display all of the strength necessary to achieve it. Obviously, I don’t want to be overly bullish or scare anyone with my sentiment, but with the way the markets stand, it will be almost impossible to do anything with confidence in the markets.

Your bullish plays look great until the markets come down heavily, and your bearish plays look great until the markets recover quickly.

There is no set and stone easy win or direction you should look to take today, so please, remain fluid with your active allocations, and prepare accordingly for a difficult time.

For my personal gameplan leading into today, I am still retaining all of my long exposure in the markets and am trying to do everything I can to minimize the risks assosiated at these prices. I will not be adding to my long holdings at this point, but I will be looking to actively scalp and day trade on an intraday basis. I don’t know if I will attempt to trade option contracts today, but there is a very real possibility of it happening.

It all just comes down to how the markets react here in the short term. I would be the most confident in allocating long in the case that there is a continuation of the selling in the markets, and finally see a sign of a reversal, then and only then will I announce and alert an entry into some 0-dte long $SPY calls. If there is not a point of confidence like that, though, here in the short term, I will be more focused on long allocations in the markets, and just making small “safe” scalps throughout the day, so keep your eyes peeled, though, as I do anticipate trading this confusion and volatility.

Just please, tread extremely lightly and just know that traders genuinely are getting deleted left and right from the markets with this volatility, so just continue to make the most out of these conditions, and have an absolutely amazing time! e

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $RIVN , $ORCL, $NVDA, $TSLA, $AMD, $PLTR

Speculative: $PTLO, $RIVN, $CVX, $UNH, $AIFF

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: $MSTR, SOL, BTC

Economic News for 02/13/2026 (ET):

No News Scheduled

Notable Earnings for 02/13/2026:

Pre-Market Earnings:

Cameco (CCJ)

Advance Auto Parts (AAP)

Enbridge (ENB)

Wendy's International (MGA)

Magna International (MGA)

TC Energy (TRP)

Wrap up

This is going to be a hectic day for the markets, mostly with the way that $SPY is trending during the pre-market session. Please just make sure to tread lightly, practice safe risk management, and just do everything in your power to make the most out of this volatile time in the markets. We are all about to have a lot of fun, so let’s realize some gains and have an amazing time!

Good luck trading, and let’s make the most out of today!