HaiKhuu Daily Report 6/15/2022

Good morning and happy hump day. Markets are looking significantly better pre-market than they have in the previous couple of days. Things are looking optimistic and exciting going into FOMC today. Please as always, be extremely careful and wary about the current market situation. Today with FOMC, we are either going to pump heavily or dump hard today. Please tread lightly on these current market conditions and assure that you personally are taking the highest level of risk management possible.

Capitalize on the volatility of the day when given an opportunity, don’t do anything stupid, and continue to realize gains when you have the opportunity to do so. Please be smart going into FOMC today at 2 pm EST, I don’t recommend taking many active trades into FOMC, but I highly suggest each and every one of you trade the aftermath.

PWWR 5:36am EST -

$SPY 375.80

$BABA 107.00

$BA 123.00

$TSLA 660.58

$AAPL 133.5

$MSFT 246.50

Thoughts & Comments from 6/14/2022

Yesterday was genuinely an incredibly tough day for the markets. Most things hit a 52-week low, with $SPY hitting $370.59. There were many opportunities to actively trade and scalp, but in general, it’s been a tough and relentless time for the markets. $SPY closed the day at $373.87 −$1.13 (0.30%), which does seem bad on paper, but if you note that they were down -1.6% from open into the low of the day, you’d be surprised.

The day-to-day movement of $SPY was not too crazy at -0.3%, but the intraday volatility and momentum was insane. Hopefully, you capitalized both on the bullish and bearish side of the trading opportunities yesterday. There were many including an insane 6% intraday run on $TSLA, a beautiful 6.5% daily movement on $BABA and $BA up 7.75% from the bottom.

Great day to trade, that was honestly a significant amount of fun to actively trade… But oh boy, was it a sketchy day in general.

Hopefully, you all realized a significant amount of gains when given an opportunity to do so throughout the day.

$SPY 6/14/2022 ONE MINUTE INTRADAY CHART

Thoughts & Comments for Today 6/15/2022

Today should be a beautiful or bloody terrible day for the markets. Personally like I’ve said many times in the HaiKhuu Discord, I am bullish on today but skeptical about the outcome. Personally. I purchased some at the money call contracts on $SPY yesterday in speculation of today.

This was a very risky play, but assuming that everything works out will be beautiful.

Please be extremely careful trading leading up to 2 pm EST. FOMC will move the markets heavily and be sure to tune into the HaiKhuu Exclusive Trading Call at the time and watch what unfolds on the market.

Practice safe risk management, have stops in place for positions prior to FOMC, and good luck trading as things are going to be insane.

I expect, that we will see a slight bullish movement into 2 pm EST (Chop included), a heavy pump into FOMC, followed by a sharp sell-off to new LOD, followed by buying up into JP speaking, and absolutely taking off when JP speaks. Realistically, I’d give it a 60/40% chance that I am right on this.

Lots of traders are going to lose a LOT of money today because they gambled incorrectly, got stopped out of their trades, or revenge traded. DON’T be one of those traders. Please be extremely careful and assure that you are practicing the highest level of possible safety going into this event.

My personal recommendation for anyone who is looking to take a position will be split into a two categories;

Majority of Retail Traders:

Wait until there is the initial movement is over, and play the direct aftermath in the direction the markets pick

Day Traders:

Trade in the morning and attempt to close out most, if not all open trades by lunch

Play the hype leading up to FOMC (1 pm EST - 2 pm EST), and close out of that with profit.

Play the dip of FOMC and scalp up

Buy the 2nd / 3rd dip and ride up until JP speaks

Ride the play during/after JP speaks. Either he takes us to the moon or, short the markets until close

HaiKhuu Proprietary Algorithm Report:

The algorithm did alright yesterday. There were some very heavy mixed results for the day.

Benchmarks; $SPY moved down roughly ~0.8% yesterday open to close

Pilot: -$43

Intraday Alerts: +0.91%

BAOSAC: -1.38%

The pilot did alright as we were cash-heavy and I was able to minimize exposure via trading and scalping on the Pilot throughout the day.

With the FOMC and the expectation of high volatility and momentum, we are deciding to hold only cash right now in the pilot with zero intentions of making any purchases at open.

We will be looking to scalp and play the after-math / live trading alerts if given an opportunity. Other than that, no positions are planned.

Any and all positions will be announced in real-time for entry and exit for the Pilot Fund account.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

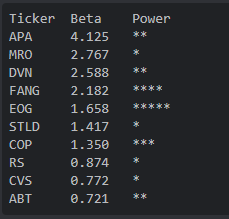

Generated entries for 6/15/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $AMZN , $GOOGL , $TSLA , $AAPL , $MSFT , $BABA

Free Equity List:

Safe - $SPY

Swing Opportunities:

Continue to hold cash and stop out of positions you personally don’t have confidence in. Cash is going to be king over the next couple of weeks.

I would advise against actively trying to find any short-term swing plays and either go quick and be nimble with day trades or only take strong long positions at the moment.

LONG OPPORTUNITIES:

Long Term Dividend - $GAIN*

Major Splits - $GOOGL

Relatively Safer Long - $BA, $INTC

Economic News for 6/15/2022

Retail sales - 8:30 AM ET

Retail sales excluding vehicles - 8:30 AM ET

Import price index - 8:30 AM ET

Empire state manufacturing - 8:30 AM ET

NAHB home builder index - 10 AM ET

Business inventories - 10 AM ET

FOMC statement - 2 PM ET

FOMC projections - 2 PM ET

Fed Chair Jerome Powell news conference - 2 PM ET

Notable Earnings for 6/15/2022

Pre-Market Earnings:

John Wiley & Sons (WLY)

After-Market Earnings:

None

Wrap up

Overall, FOMC is going to be huge for the markets and will ultimately decide where the markets go today.

Tread lightly, realize gains when you have the opportunity to do so, and have a great time.

Good luck today. May the odds be in your favor.

If you are not a part of our free Discord, click HERE to join