HaiKhuu Daily Report 6/16/2022

Good morning and happy Thursday! Yesterday was insane and we are having a crazy Pre-Market session today.

Hope you all are doing well and are excited about what the markets have to bring today. Please be cautious and continue to tread lightly through the end of this month. FOMC in the short term was a major event, but with GDP readings at the end of the month… you have to remember the issues with the market and the current location. $SPY has made a new 52-week low Pre-Market PWWR $370.03

Continue to be safe and practice risk management when it comes to your allocations. Hedge your positions, selling off allocations, and holding more cash into the next month and a half will be great leverage in the case of a major market downturn.

Thoughts & Comments from 6/15/2022

Yesterday was a slow, interesting, but grueling day for the markets leading up to FOMC. Markets moved extremely slowly and it was difficult to trade as the candles continued to simply chop back and forth without necessarily picking a direction. If you were able to scalp intra-candle during this time, I am sure you were having a tough time.

Things really picked up leading into 2 and 2:30 pm EST.

Trading during and after FOMC was intense. Lots of crazy candles both upwards and downwards. The feds raise rates by 75 basis points in the June FOMC meeting, trying to fight against inflation. This is the biggest increase in 28 years.

As a result, we rallied and made a new high at $383.90 on $SPY after Jerome Powell concluded his meeting.

We saw incredible selling after the pump, $SPY dropped more than 1% from the high of the day but regardless, $SPY closed green for the day at $379.20 +$5.33 (1.43%).

Beautiful day to actively trade, a beautiful day to actively manage your positions / sell at the top, a beautiful day to scalp at the bottom, and great opportunities to short the FOMC pump.

$SPY 6/15/2022 ONE MINUTE INTRADAY CHART

Thoughts & Comments for Today 6/16/2022

Today is looking like an intense day for the markets. We have seen this time and time again, where the markets rally into Jerome Powell speaking, causing the markets to rally extremely hard, then sell off the day after to a point even lower than where it was prior to the pump. Hopefully, you were able to short or grab some puts at the top yesterday. $SPY is down significantly and things are not looking optimistic for the day.

$SPY at the moment is trading at $370.50 and is looking bearish on both the intraday 1 & 5-minute charts. Watch out for $370.59. If we open above that point (old 52-week low), we can be optimistic for the day, but if we are below $370 on $SPY at open or throughout the day, please be extremely careful.

Continue to hedge your positions and prepare for what is coming up over the next couple of weeks. Realistically, I don’t want the markets to drop, but if we do, I want to say that we have a major support level at $350 on $SPY. Give it a couple of weeks and if this blood continues, I feel this is the range is at the higher end of prediction ranges, but with another major market downturn right now, I am comfortable saying $350 would be the “bottom” for now. We may have to adjust that if there is no sign of reversal at $350. Hopefully we never even come down and test these levels, but the beginning of July really will be an intense time for the markets.

Capitalize on this volatility when you can. Equities will be shocked today so there will be a great opportunity to scalp to the upside, but take profits quickly when given the opportunity to.

It is getting to the point where you can sell extremely OTM CSPs and collect a significant amount of premium. If you are looking for something to make money on the cash you are holding, look to sell 1DTE highly OTM CSP. I would not recommend actively selling any farther dates right now due to market location.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

6/16/2022 Pre-Market $SPY, New 52-Week low $369.44

HaiKhuu Proprietary Algorithm Report:

The algorithm did alright yesterday, in typical fashion, when the markets rally hard, the algorithm unfortunately is not able to perform as well as the markets. C’est la vie.

We are working on new strategies to utilize the algorithm alerts with new systems to help navigate these market conditions. As things get worst on the market I want you guys to be able to get stronger, longer-term allocations. IE; Swing trades / Investments that are curated on multiple levels.

I do not have a timeline for when we are able to get this fully produced and published for you all, but with talks of a recession, it will be a great opportunity to test out longer-term strategies and purchase allocations that are fundamentally undervalued that we believe will go up from a technical standpoint.

We will keep you updated on this and its progress. This will be great for everyone who is looking for swings & investment alerts.

Today though, for personal reasoning, I am not interested in allocating any money from the Pilot into the markets. I may take some scalp trades when given an opportunity with confidence, but I am not trying to do anything too risky in these current market conditions.

Please take all alerts and trades with caution today.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

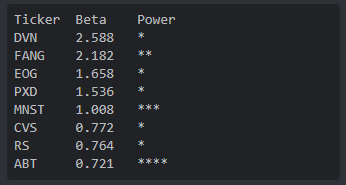

Generated entries for 6/16/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $AMZN , $GOOGL , $TSLA , $AAPL , $MSFT , $BABA

Free Equity List:

Safe - $SPY

Risky- $AAPL & $MSFT

Swing Opportunities:

Continue to hold cash and stop out of positions you personally don’t have confidence in. Cash is going to be king over the next couple of weeks.

LONG OPPORTUNITIES:

Long Term Dividend - $GAIN

Major Splits - $GOOGL

Relatively Safer Long - $BA

Economic News for 6/16/2022

Initial jobless claims – 8:30 AM ET

Continuing jobless claims – 8:30 AM ET

Building permits (SAAR) - 8:30 AM ET

Housing starts (SAAR) - 8:30 AM ET

Philadelphia Fed manufacturing index - 8:30 AM ET

Notable Earnings for 6/16/2022

Pre-Market Earnings:

Krogers (KR)

Jabil (JBL)

Commercial Metals Company (CMC)

111, Inc (YI)

After-Market Earnings:

Adobe (ADBE)

Beyond Air (XAIR)

Wrap up

Overall, please be extremely cautious while actively trading today, markets are in a difficult spot and things should realistically be very choppy, but bearish over the next couple of weeks. Tread lightly, not only today but for the rest of the month.

Realize some gains when given the opportunity, don’t do anything crazy. Capitalize on this momentum and volatility though when given an opportunity.

Good luck today everyone, we are going to need it.

If you are not a part of our free Discord, click HERE to join