HaiKhuu Daily Report 6/17/2022

Good morning and Happy Friday everyone! Hope you all are excited about the three-day weekend.

It’s been an intense time for the markets recently so this time away will be nice. Make sure to get outside, get some fresh air, and relax.

Markets are currently green at the moment of me writing this report, with some of the biggest movers on my personal watchlist being $BABA up 10% and $REV up 50%

Current Prices when writing this report:

/NQ 11287

$SPY 368.55

$BABA 110

$REV 3

$MSFT 247.40

$AAPL 131.40

Thoughts & Comments from 6/16/2022

Yesterday was a bloody day for the markets, there was not much we can unfortunately do. I am sure that most of you, unfortunately, lost all of the unrealized gains from the FOMC pump the day prior as we dropped and made new 52-week lows throughout the day.

$SPY went from $383.90 on Wednesday to close at $365.07 yesterday. $SPY made a new 52-week low at $364.08. From top to bottom, that is almost a 20-point move on $SPY or a 200-point move on /ES. We are down about 500 points on /ES since last week.

This has been a string of what is some of the worst days we’ve seen in the markets in a long time, and I hope you all are able to stay afloat. Weeks like this week are the reason why I was advocating to hold more cash a couple of weeks back. Hopefully, you all were able to sell and hedge positions with the warning.

Things on the markets are going to continue to get a little bit worst before things get significantly better, we are not out of the murky waters yet, but at least there is light at the end of the tunnel. We are already broken significant levels of support on the markets, and as we go down, the supports become stronger and stronger. When we do find this bottom, buy the opportunity and scalp it on the way up. I expect this opportunity to come within the next 4-6 weeks. Please be smart and safe during this time between then and now, and when there is the given opportunity… Go heavy and capitalize on the cheap equities when you can.

Don’t forget that you are not in the markets for short-term movement, but you are in for a lifetime of investments and market exposure. In 6 months / 1 Year / 3+ Years, when the markets have moved up and are significantly higher than they are now, you will look back and not even remember any of this pain.

Continue to tread lightly and be strong. Most individuals have already drowned trying. If you are here today reading or listening along. Keep doing what you are doing, because you’re able to maintain your market exposure, keep a strong head on your shoulders and continue. 98% of traders you know have not been able to say that over the previous two-years.

Heat map 6/16/2022, pretty much no green. Only red.

$SPY 6/16/2022 ONE MINUTE INTRADAY CHART

Thoughts & Comments for Today 6/17/2022

Today is looking significantly better of a day into open. I personally am still skeptical of the current market situation. Things were moving up nicely through the pre-market session, but have come down from the relative highs.

We should see many great opportunities to day trade and scalp today, and expect a significant amount of volatility today with Quadruple witching. Capitalize on this volatility and momentum when you are given the opportunity to do so. With volatility high, it is not a terrible idea to sell contracts and collect premium with the cash that you are holding. Look into selling some highly OTM 0DTE CSPs/CCs on positions you have. Never hurts being able to collect premium freely on a day like today, that will be one of the safest moves you can make right now.

Continue holding cash for another couple weeks as things are getting sketchy and allocate into long positions that you have confidence in. Regardless of market conditions, DCAs on Safety plays / Dividend plays should only continue to net you a great return over the course of the next couple months.

I personally added more to $GAIN on the dip yesterday. Current allocation; 240 shares and will only continue to add to it with time. It is right now 99.25% of my Robinhood portfolio.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

The algorithm, unfortunately, followed the market yesterday with its ugly downturn. BAOSAC and the intraday trading bot lost money intraday.

Thankfully, with correct judgment and guidance in the pilot account yesterday. We thankfully were able to beat the markets as we had literally zero allocations for the day, beating both the market and the systems heavily.

In continuation of this reserved stance on the markets, we are not looking to get any allocations again today. I repeat, we are NOT purchasing any allocations nor have the intention on doing so. Our portfolio is 100% cash and we will be waiting for more market downturns to go long with the intention of holding the position, as well as actively trading and navigating the markets when the situation does not look as bearish. Until then, we will be more reserved and hold more cash.

If there are any allocations that are decided to be created, I will alert them in real time and notify everyone about the position.

Please be careful taking any alerts today due to high volatility.

-

Side note; we are working with new AI technology with our systems. We are utilizing deep learning / a neural network for actively trading on the network. At the moment, our results seem too good to be true providing a substantial return in our back tests.

This system is highly profitable in the backtests leading us to believe either we are onto something crazy successful, or there is a major oversighting somewhere leading us to perform better than expected. Either way, I will keep you updated on the progress of this new update.

TLDR; Our system beat the market over the past month by 10%. Either we are all going to be rich, or we are doing something wrong.

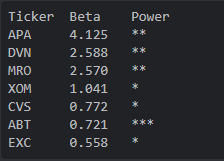

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 6/17/2022

My Personal Watchlist :

Note, just because something is on my watchlist, does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $AMZN , $GOOGL , $TSLA , $AAPL , $MSFT , $BABA

Free Equity List:

Safe - $SPY

Risky- $AAPL & $MSFT

Swing Opportunities:

Continue to hold cash and stop out of positions you personally don’t have confidence in. Cash is going to be king over the next couple of weeks.

LONG OPPORTUNITIES:

Long Term Dividend - $GAIN

Major Splits - $GOOGL

Relatively Safer Long - $BA

Economic News for 6/17/2022

Industrial production index - 9:15 AM ET

Capacity utilization - 9:15 AM ET

Leading economic indicator - 10 AM ET

Notable Earnings for 6/17/2022

Pre-Market Earnings:

None

Wrap up

Overall, Good luck trading today. Don’t forget about the three-day weekend and have an amazing time. Realize some gains today, trade quickly when given an opportunity to do so, and please, just have an extremely relaxing weekend. We will all need to mentally and physically relax after this week.

Kick some ass today, Don’t do anything stupid and make some bank.

If you are not a part of our free Discord, click HERE to join