HaiKhuu Daily Report - 07/16/2025

Good morning, and happy Wednesday!!! Man, I feel like this week already is starting to fly by, and man, are these conditions looking tough. $SPY is currently below the daily support levels, and traders are getting to a point of relative confusion with a new all-time high occurring yesterday, yet traders are overly excited to attempt to trade. So, fair warning to everyone that despite market conditions being ideal, I would advise everyone to practice extreme caution right now.

Despite market conditions still remaining strong overall, this short-term weakness does not bring any confidence. We are seeing $SPY testing these daily support levels, displaying weakness from yesterday, and traders are genuinely worried on what might happen as a result of DJT here in the short term, so please continue to tread lightly and practice safe risk management while allocating today, please be cautious attempting to pick up any positions today, and do what you can to make sure you do not get sliced.

I will say again that right now, as boring as these market conditions are and sound, I just want to say thank you to everyone who has been a part of or has participated with us over the previous couple of weeks. Market conditions have been relatively slower on an intraday basis, but that is simply just a part of life and the gross opportunities that are available to us, so we will see where things go from here and have a great time!

Good luck trading, and let’s try not to lose today.

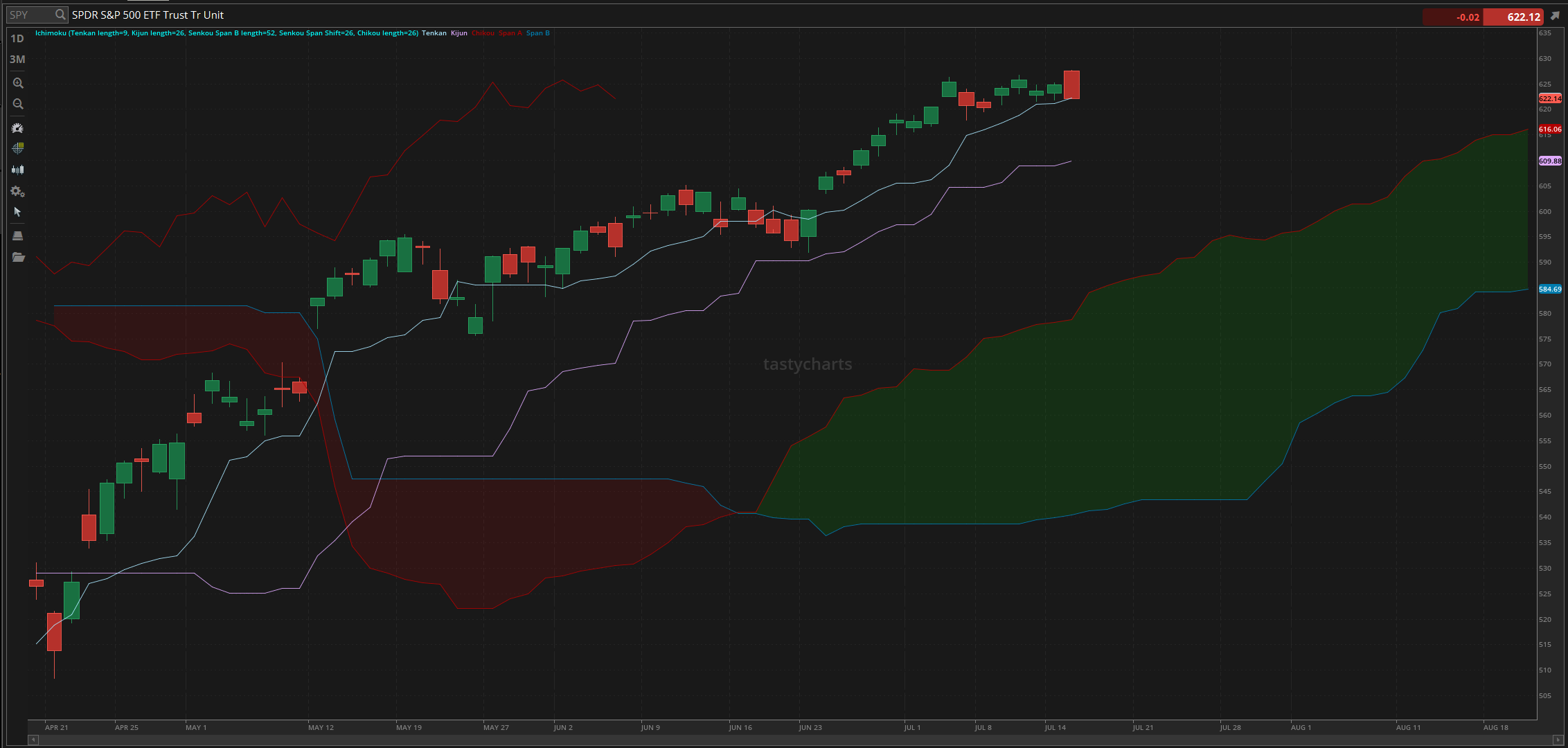

The updated $SPY daily levels are as follows:

Conversion Line Support: $622.24

Baseline Support: $609.88

Psychological Support: $600

Daily Cloud Support: $578.78

Thoughts & Comments from Yesterday 07/15/2025

Yesterday was an absolutely amazing fairytale that resulted in a horrible nightmare. Many unrealized losses were generated in real time, traders had difficulty across the board, and no one was realizing any significant gains. Hopefully, no significant losses were generated, but man oh man, after looking at the performance of the markets yesterday, seeing the heatmap right now, and experiencing that in real time, man was that a rough one.

We started the day with $SPY pushing higher during the pre-market session, and conditions were extremely optimistic. $SPY opened the day at $627.56 and went on to make the official all-time high, trading at $627.86 before coming down, continuing to come down, and getting absolutely destroyed in the process.

$SPY quickly went from a new all-time high to selling off 100% of the gains that were generated before the start of the lunchtime session, only to continue to hope the market moves up, only to watch as we continually dropped throughout the entire afternoon. We did make a relative low around $623 into the afternoon and tested green once again leading into power hour, but again, conditions were less than ideal as $SPY sold off once again leading into close, and man, were those conditions tough.

Market conditions continued to be less than ideal the entire power hour as $SPY continued to drop, and we faceplanted into close as Donald Trump kept talking, resulting in $SPY officially ending the day at the low of the day, trading at $622.14, down $2.67 for the day, or down roughly 0.4%.

Again, I am not going to say yesterday was a good day. It was not a good day at all in any way, shape, or form. Many are not happy with the shift in the market momentum, but this is why I consistently talk about not fighting the trend. Anyone who followed the trend and made bearish allocations early in the day had a phenomenal time, yet anyone who attempted to buy the dip or scalp towards the upside had a tough time. So, let’s see where the markets go from here, and have an absolutely amazing time!

S&P 500 Heat Map - 07/15/2025

Thoughts & Comments for Today - 07/16/2025

So, today and tomorrow, in my opinion, are going to be some of the tougher days in the markets. Today is going to be tough as a result of the conditions and earnings going on; tomorrow is going to be tough as a result of the news and earnings going on. Regardless, as much as I would love to gas up these conditions and talk about how great every opportunity available is, it is just tough, realistically, attempting to do that when market conditions are less than ideal here in the short term.

If I am being real with you all, I do expect many of you to have a genuinely difficult time attempting to trade and allocate. This is not an attack on anyone's personal ability to trade, but this is just one of those scenarios where realistically, with the way the markets are moving and how we are allocated, it is going to be difficult to realize any form of significant gains unless you are allocating way too much money, or you are stupid lucky.

Without trying to hide anything. Again, I will say this with 100% certainty and confidence that this is going to be a tough day, and losses will be generated in the process. Again, not trying to hide my thoughts and sentiments leading into today.

Hopefully, market conditions shift and there are opportunities to capitalize on the strength in the markets, but at the same time, I just want to remain as comfortable and confident in my ability to navigate these conditions. With the ongoing volatility and current office though, we are not seeing that same level of generalized bullish momentum that everyone is hoping for and expecting at this price. Again, I don’t want to be overly optimistic and pray that the markets only continually move up from here, but this is just one of those days where, realistically, the lower our expectations, the less disappointed we will become.

So, how should you attempt to navigate these conditions? Well, honestly, here in the short term, I do not recommend that you attempt to do anything crazy. Traders are going to have a difficult time attempting to allocate here, but there will be opportunities to buy the dip as a result of what is going on at the moment.

I am not going to advise you to blindly purchase anything, but look for an opportunity to buy some great organizations at a relative discount. Again, I do not know where the bottom is, nor when we are going to inevitably reverse, so I am still looking towards the downside, but know that in reality, with the way the markets are trending, it is almost impossible to know where the bottom is, but that is half of our job is to time out what we believe is the bottom and make the most of it… sooooooooooooooooo just do what you can to navigate these conditions here in the short term, and when I see anything pop up, I’ll let you all know.

Just please, once again, make sure to practice safe risk management. I hope that I am wrong with my sentiment read going into today, but with the way conditions are looking, I would have to say that statistically, I am expecting more difficulties than anything right now. So tread lightly, protect your bottom line, and pray the markets don’t get slaughtered!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $JEPI, $INTC, $RIVN, $TSLA, $AAPL, $NVDA, $BRK/B

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $INTC

Economic News for 07/16/2025 (ET):

Producer Price Index - 8:30 AM

Core PPI - 8:30 AM

Fed Beige Book - 2:00 PM

Notable Earnings for 07/16/2025:

Pre-Market Earnings:

Bank of America (BAC)

ASML Holding (ASML)

Goldman Sachs (GS)

Progressive (PGR)

Morgan Stanley (MS)

Johnson & Johnson (JNJ)

PNC Financial Services (PNC)

M&T Bank Corp (MTB)

Prologis (PLD)

Commerce Bancshares (CBSH)

After Market Earnings:

United Airlines (UAL)

Alcoa (AA)

Kinder Morgan (KMI)

SL Green Realty (SLG)

AAR Corp (AIR)

Banner Corporation (BANR)

First Industiral Realty Trust (FR)

Great Southern Bancorp (GSBC)

Home Bancshares (HOMB)

Synovus Financial (SNV)

Wrap up

Hopefully, with all of the volatility, confusion, and weakness across the board, we are able to pull a rabbit out of a hat here. I believe many traders are going to have an extremely difficult time trading today, so please make sure you take advantage of these opportunities, but at the same time, being realistic with your expectations of these markets and practice safe risk management. Some will generate some gains today, but I am telling you with confidence that the majority will unfortunately realize losses during this time.

Good luck trading, and let’s make the most of today!