HaiKhuu Daily Report - 07/15/2025

Good morning and WELCOME TO THE THUNDER DOME. Nah, just kidding, it’s Tuesday. The market conditions are looking great heading into today. I'm not sure about you, but I’m incredibly optimistic about these conditions today.

I was predicting it yesterday, and I am going to stick by it today. We are about to hit new all-time highs in the markets, and everyone should be relatively optimistic in these conditions.

Also - I promised everyone in the DISCORD free pizza in case we do not hit a new all-time high today, so make sure to join us for some free pizza today!

As I have said before, I only want to see slight new all-time highs for the sake of longevity, but as conditions get stronger, it is hard not to be overly optimistic and hope that we continue to break out.

Please continue to capitalize on these extreme market conditions and maximize your gains as much as possible today. With the opportunities available, it would be unfortunate if anyone squandered this chance.

So, good luck trading today, and let’s see $SPY make that NEW all-time high.

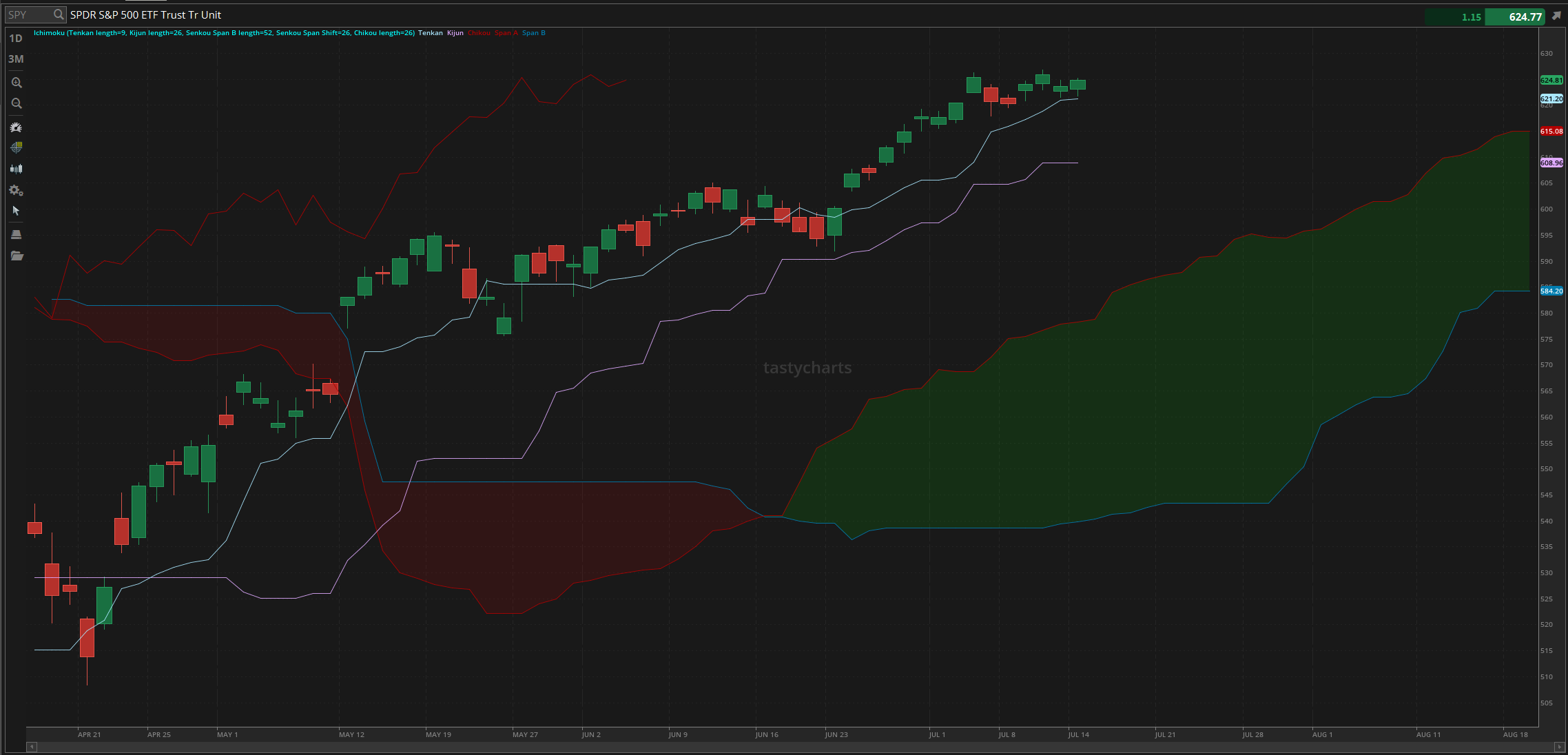

The updated $SPY daily levels are as follows:

Conversion Line Support: $621.20

Baseline Support: $608.96

Psychological Support: $600

Daily Cloud Support: $578.26

Thoughts & Comments from Yesterday 07/14/2025

Man, yesterday was a tougher day for the overall markets. Not because conditions were absolutely terrible and people continued to lose a significant amount of money, more so the opposite, where traders did not have any great momentum nor opportunities to trade, resulting in either overtrading, chopping, and losses, or else you really didn’t do much else. Regardless, a few opportunities were presented to us during that time, and traders hopefully made the most out of yesterday!

So, we started the day with $SPY opening at $623.20. Conditions at open weren’t necessarily bad as we opened slightly below the previous close, and watched as $SPY quickly dropped to make the official low of the day, trading at $621.80 before chopping around and remaining neutral until the lunchtime lull.

Conditions around open did not do much, and thankfully, we were in a position to watch as the markets moved up slightly, leading into the lunchtime lull, and finally breaking out after the fact. $SPY quickly went on to test $625 early in the afternoon, and as bad as this sounds, pretty much the entire afternoon was uneventful as we remained in that level until close, where $SPY went on to officially end the day trading at $624.81, up $1.19 for the day, or up roughly 0.2%.

As much as I love these conditions and the opportunities that are available, days like yesterday are unfortunately part of the conditions and are some of the gross days we have to navigate. Regardless, these conditions are great and $SPY is strong, so let’s continue to make the most out of everything, have a fantastic time trading today!!!

S&P 500 Heat Map - 07/14/2025

Thoughts & Comments for Today - 07/15/2025

Today is looking significantly stronger for the overall markets. I do not want to sound overly optimistic going into today, but I genuinely believe that we will continue to see strength and opportunities. The question is, how far up will the markets move from here, and how comfortable are you in your ability to capitalize on these conditions? Obviously, it will be difficult to know exactly where the markets are going to move at this level. Still, at the same time, with the consistency in the markets, it is almost hard to lose in these conditions, assuming you are continuing to hold your long and strong US equities.

Please continue to do what you can to maximize your profit potential. I do not say this lightly when I say that I believe many people will generate a significant amount of gains in a short period of time.

I will say, that what I personally want to happen to the markets, versus what I believe will happen today are going to be extremely different. Given my personal expectations for the markets to move up, I anticipate seeing a significant amount of bullish momentum, gradually unfolding over the course of a couple of weeks. It will result in market makers generating a significant amount of cash, as traders are burned by chop, and new retail traders flood into the markets to justify the movement.

If the markets move up too quickly, we won't get the headlines necessary to create irrational purchasing. However, I will say that we are in a position where we can very easily and realistically break out heavily. All we need is a single headline or an update about the trade talks, and $SPY can move up or down $25 extremely easily as a result. So, as much as I want the markets to continue to trickle up, I do expect there to be a high likelihood you will hear us continue to say that the markets are making new all-time highs.

So, if we are breaking out, there will be scalping opportunities that consistently and continually present themselves to us. I would highly recommend that if you are attempting to trade these conditions right now, I would look to lengthen your timeframe. Instead of attempting to scalp and trade over a couple of seconds, look more towards day trading today.

This is not me attempting to make a comment on anyone’s ability to navigate these market conditions, but is one of those situations where I believe that conditions are going to be choppy, inconsistent and difficult to navigate, so assuming conditions remain that way, instead of capitalizing on a 0.05% movement on $SPY, why not attempt to make a position with a better return and get 10-20x that return by holding your position for an hour versus a minute.

This is easier said than done, and none of this constitutes financial advice. Please tread lightly, practice safe risk management in these conditions, and have a great time. Good luck trading today, and let’s absolutely kill it!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $JEPI, $INTC, $RIVN, $TSLA, $AAPL, $NVDA, $SPCE

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $INTC

Economic News for 07/15/2025 (ET):

Consumer Price Index - 8:30 AM

Core CPI - 8:30 AM

Industiral Production - 9:15 AM

Capacity Utilization - 9:15 AM

Boston Fed President Susan Collins speech - 2:45 PM

Dallas Fed President Lorie Logan speech - 6:45 PM

Notable Earnings for 07/15/2025:

Pre-Market Earnings:

JPMorgan Chase & Co (JPM)

Citigroup (C)

State Street Corp (STT)

Wells Fargo & Co (WFC)

Bank of New York Mellon (BK)

BlackRock (BLK)

Albertsons Companies (ACI)

Ericsson (ERIC)

AngioDynamics (ANGO)

After Market Earnings:

J.B. Hunt Transport Service (JBHT)

Hancock Whitney Corporation (HWC)

Fulton Financial (FULT)

Kestra Medical Technologies (KMTS)

Pinnacle Financial Partners (PNFP)

Wrap up

Hopefully market conditions continue to remain extremely favorable for us and provide us with some great opportunities to ride some strong momentum and watch as $SPY reaches these new all-time highs. Again, I do not want to be overly optimistic, but these conditions are extremely strong, and everyone should remain bullish and optimistic as long as the momentum continues to remain strong. Let’s see what the markets have in store for us a realize some gains today!

Good luck trading, and enjoy these new all-time highs!!!