HaiKhuu Daily Report - 07/29/2024

Good morning, and happy Monday! I hope you all had a wonderful weekend, and are excited for another great week for the market! This should be an interesting week for the markets with FOMC and many major earnings coming up. Please tread lightly as $SPY has broken below all levels of daily support, and as a result, $SPY is either going to display a significant amount of strength as it reclaims those support levels, or we will see the inevitable drop. Conditions are looking good, at least during the pre-market session, but we all know that pre-market is not the same as when markets close on Friday, so continue to tread lightly and do what you can do to capitalize on these market conditions. In the case we rally, traders are going to have an amazing time, and in the case, the markets do not rally… just make sure to limit your downside risk as much as possible. Regardless, this is going to be a fun week for the markets as a result of everything going on all at once, so expect to see some volatility and turbulence!

Just as a heads up, here are some of the major news events happening this week!

Monday:

Earnings: McDonalds

News: Dallas Fed Manufacturing Index

Tuesday

Earnings: Sofi, PayPal, BP, Pfizer / (AH) AMD, Microsoft, EA, & Starbucks

News: Housing Price Index & JOLTs

Wednesday

Earnings: Boeing, Mastercard, Altria, / (AH) Meta, ARM, Qualcomm, Carvana, eBay

News: Chicago PMI & FOMC w/ Jerome Powell Speaking

Thursday

Earnings: /(AH) Amazon, Apple, Intel, Coinbase, Snapchat

News: Jobless Claims, S&P Global Manufacturing PMI

Friday

Earnings: Exxon, Chevron

News: Unemployment Data & Durable Goods

If you’d like to see the full weekly preview, click HERE!

Good luck trading this week, and let’s have an amazing time!

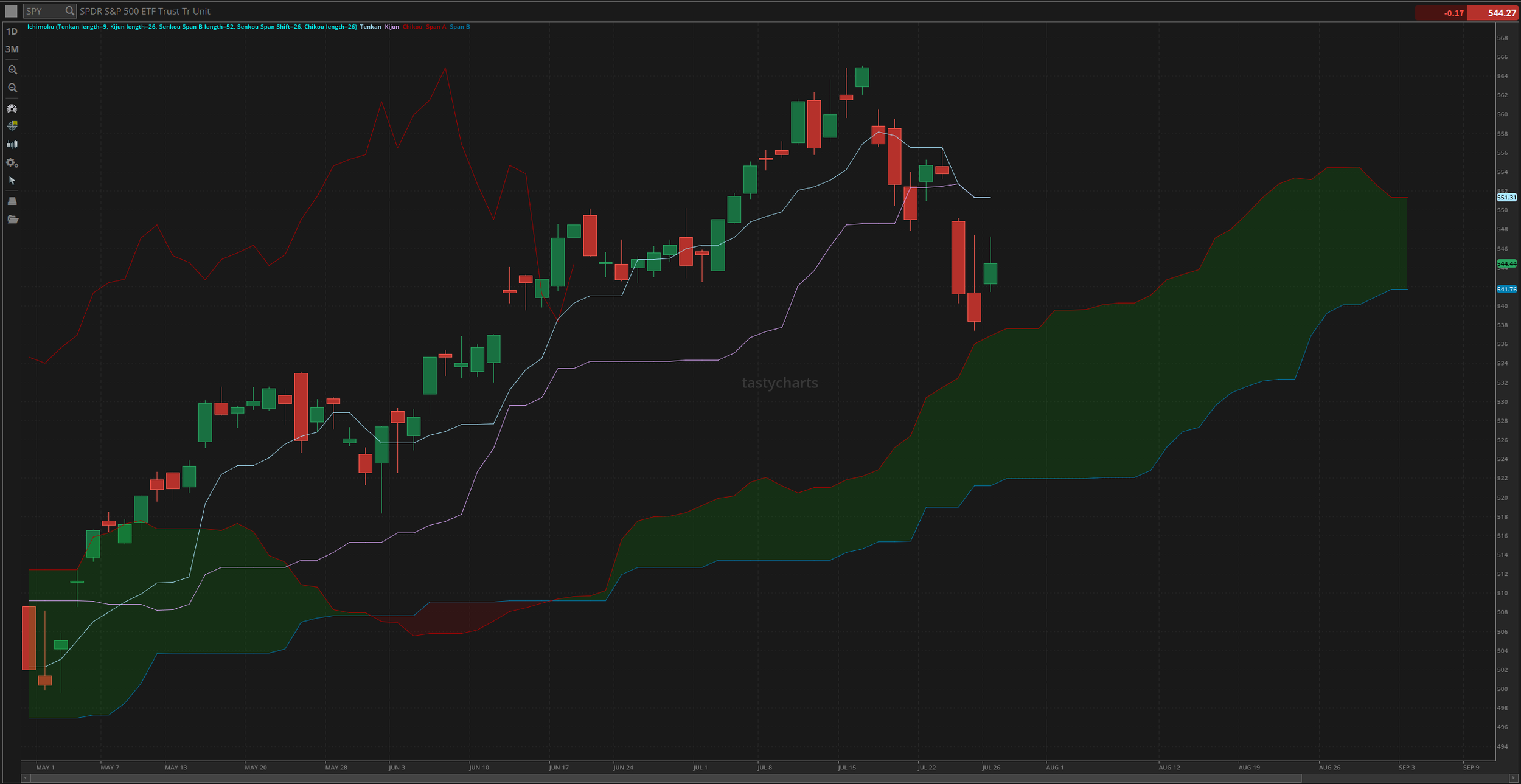

The updated $SPY daily levels are as follows:

Conversion Line Resistance: $551.31

Baseline Resistance: $551.31

Psychological Support: $540

Daily Cloud Support: $537.66

$SPY Daily Candles - [07/26/2024]

Thoughts & Comments from Last Week

Last week was a really rough week for the markets, but opportunities were consistently amongst us. We saw weakness come from a lot of the mega-cap tech organizations while other organizations did phenomenally. It was more so a matter of what you were watching. If you were allocated into $RTX or $LMT, you’d have an amazing time, but if you were watching as $SPY broke below many of the major support levels on the daily, you would have had a terrible time. We have reached fear on the fear and greed index, and conditions are only continuing to look tough, but again, opportunities have been amongst us, it’s just a matter of if you were able to catch those opportunities. I hope you all were able to navigate these conditions accordingly, and realized some nice profit in the process!

We started the week with $SPY opening at $553, down roughly 3% from the previous all-time high, and watched as $SPY remained relatively neutral throughout both Monday and Tuesday. Conditions were not looking the best, and we remained relatively neutral remaining within a tight channel between the daily conversion line and resistance. The big movement happened on Wednesday, as during the pre-market session, $AVGO dumped on earnings, resulting in all other semiconductors diving with it, taking down the entire market. Wednesday was the largest bearish movement we’ve seen in almost two entire years, resulting in many traders, unfortunately, getting burnt in the process, but thankfully, opportunities remained amongst us, and we were able to capitalize on the predictable conditions. Markets closed on Tuesday with $SPY trading at $553.78, and we closed Wednesday with $SPY trading at $541.23.

Conditions were not great either on Thursday, but I will say that we were able to accurately predict an almost perfect doji candle, with $SPY dropping down to the daily cloud, bouncing off support, and absolutely ripping. The low of the day on Thursday was $537.45, and the high of the day was $547.45. We unfortunately came back down to close, where we ended the day trading at $538.41, making the official low of the week and continuing to make trading difficult for the large majority of traders.

Thankfully, Friday was a better day for the overall markets and provided us with some great opportunities to trade and realize a significant amount of gains in the process. We started the day with $SPY trading at $542.28 and watched as there was consistent bullish momentum throughout the entire morning, into the early afternoon as $SPY made the official high of the day trading at $547.18. Conditions were not perfect, but were optimal for the scenario. Markets did drop in the back half of Friday, but thankfully, we were able to retain the large majority of the gains that were generated at that time, where we ended the week with $SPY trading at $544.44, up $6 on Friday, but down roughly $9 for the week. The 1.5% downside was not the worst we’ve seen, but it definitely made trading difficult for the large majority of traders out there.

Regardless of how the markets did last week, opportunities were consistently amongst us, it was more so just a matter of being able to realize gains in the process. Hopefully, none of you got burnt heavily last week, but if you did, that is unfortunate. Life moves on, and so do the markets! Make back any losses generated last week, and let’s have an amazing time this week!

S&P 500 Heat Map - 7/26/2024

Thoughts & Comments for Today - 07/29/2024

Today should be a fun way to start the week. With the way the markets look right now, we are seeing significantly more strength in the markets than we saw this time last week. $SPY has come down heavily from the top, but we are testing fear on the fear and greed index. This is a sign that the markets are about to move heavily. It is just a matter of which direction we pick. As I said before, because we are under major levels of support right now, the question is are we going to rally and reclaim those levels of support, or are we going to dump. There is going to be almost no between. We might see some consolidation as people are going to be confused waiting for a direction, but as I have been saying, I do expect to see $SPY testing the cloud and possibly breaking into that support level in the month of August. So please tread lightly, as unless conditions get better here in the short term and we watch a bounce, we will not see the amount of confidence necessary to retain the strength in the current markets. I would not advise attempting to over-leverage yourself in these conditions, but I would always advise taking advantage of the markets.

With the way everything is sitting right now, there is a lot of value in the markets, but it all comes down to your personal sentiment to see how you feel. If you are not feeling confident in these market conditions, then there is absolutely zero reason why you should attempt to overleverage yourself and allocate now because you will be able to get better positioning, but I will say that semiconductors, despite still being overbought on a larger timeframe and are overvalued, are currently oversold here in the short term and are undervalued. Look out for an opportunity to capitalize on semiconductors this week if given an opportunity to do so.

I do like the fear that the markets have brought back over the past two weeks, as $SPY has been extremely consistent and bullish for too long, and a minor correction is necessary. I do hope that we come down more, but it is just a matter of if we are able to remain consistent in the process, and do what we can to maximize our profitability in the process. I believe that many traders should be able to capitalize on these market conditions with relative ease, but it is just a matter of, again, being able to remain consistent in these market conditions and being able to realize gains with both comfort and consistency. Traders have had a difficult time over the previous week, but that discomfort and difficulty makes it significantly easier for myself to feel more comfortable in the markets. I personally don’t like when conditions are too optimistic, but at the same time, as long as opportunities are amongst us, that is all that matters to me.

Please just continue to do what you can to maximize your profit potential this week, but also just remember that regardless of how the market conditions are, you should protect your bottom line and practice safe risk management. It is a lot easier not to lose money than to make losses back, so keep making good decisions and realize gains consistently. Risk-free exposure is always a win as there is absolutely zero downside risk, and then setting stops in guaranteed profit and continuing to move up is an easy win. Just be smart and safe while conditions are less than optimal.

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $GOOG/L, $TSLA, $AMD, $INTC, $NVDA, $MSFT, $AAPL

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $INTC

Economic News for 07/29/2024 (ET):

Dallas Fed Manufacturing Index - 10:30 AM

3-Month Bill Auction - 11:30 AM

6-Month Bill Auction - 11:30 AM

Notable Earnings for 07/29/2024

Pre-Market Earnings:

McDonalds (MCD)

onsemi (ON)

Royal Phillips (PHG)

CNA Financial (CNA)

Tilray (TLRY)

After-Market Earnings:

Sprouts (SFM)

CVR Energy (CVI)

Sensata Tech (ST)

Amkor Tech (AMKR)

Flowserve (FLS)

Cushman & Wakefield (CWK)

Hologic (HOLX)

Beyond (BYON)

Wrap up

Hopefully, market conditions continue to get better, but this is just a warning not to count your chickens before they hatch. Anything can happen, its just a matter of being able to capitalize on the direction and momentum in the markets. Do what you can do to maximize your profit potential, and have an amazing time in the process. I hope we all will be able to realize gains with both ease and confidence this week, so let’s have an amazing time and do what we can to maximize our profit potential. I think this is going to be a great time, so let’s have some fun and make the most of this week!

Good luck trading, and let’s see what $SPY does today!