HaiKhuu Daily Report - 08/11/2025

Good morning, and happy Monday!!!

I hope you all are ready for another fantastic week for the markets with a genuine shot at making a NEW all-time high today! Market conditions are looking strong at the moment with $SPY currently up during the pre-market session, and we are approximately TWO dollars away from making that NEW all-time high.

Market conditions are confused, but extremely strong, which should continue to provide us with some great opportunities across the board. The only question at this point is whether we can continually capitalize on this strength and what we can do to make the most of it.

I wish I had the perfect answer to tell you how to generate 129% on your portfolio today, but that’s not the case. So, just make sure to do everything in your power to make the most of these conditions, as many traders will be too passive or safe to capitalize on these conditions heavily.

This is THE time to take on risk. You all know that I do not promote sketchy or unsafe positions, but just know that these are those types of market conditions that can genuinely provide us with some insane opportunities to realize a significant amount of gains. So again, do NOT be passive this week!

We do have MANY major earnings and economic news coming out this week, so check it out HERE, to prepare accordingly for the week!

Good luck trading this week, and let’s continue to see NEW all-time highs!

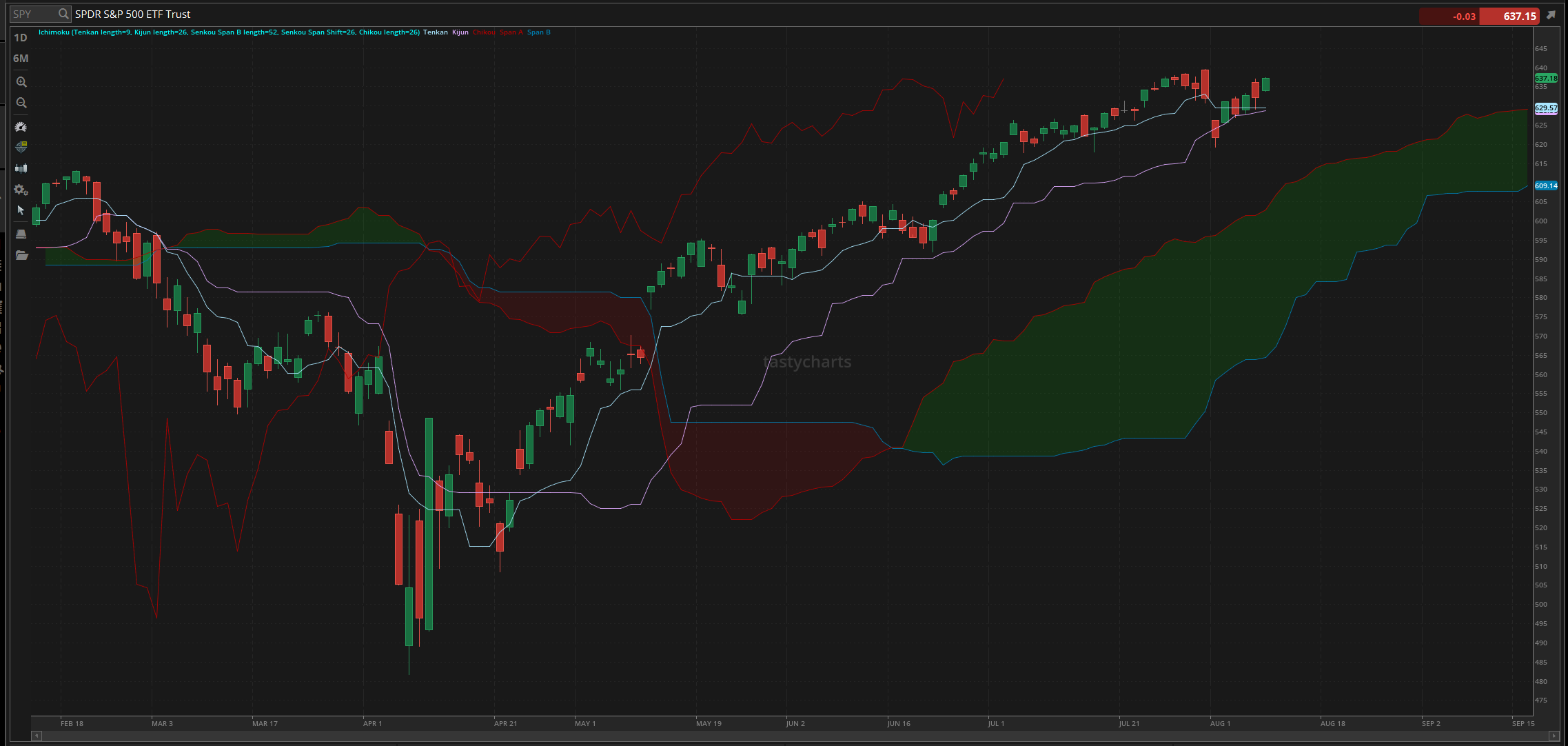

The updated $SPY daily levels are as follows:

Conversion Line Support: $629.57

Baseline Support: $628.86

Psychological Support: $630

Daily Cloud Support: $602.83

Thoughts & Comments from Last Week

Last week was a beautiful yet tough week for the markets. We recovered nicely after the drop from the previous week and watched as the markets consistently displayed strength. Although it wasn't easy to capitalize on the markets consistently on an intraday basis, opportunities were consistently presented to us throughout the week as the markets displayed strength during the recovery process.

So, we started the week with $SPY trading at $625.67. Market conditions were strong at open, and we watched as the markets displayed significant strength throoughout the entirity of Monday, dropping back and displaying weakness throughout the entirity of Tuesday, to watch as the markets broke out once again on Wednesday, and this is when things started to heat up as $SPY was bouncing off the daily support levels and showing strength.

We rallied into close on Wednesday trading at $632. We watched as $SPY gapped up on Thursday, opening the day at $636, before quickly selling off heavily, making the official low of the day at $629, before bouncing back up and ending the day trading at $632, opening up essentially the run way for the markets on Friday, and that is when things started to pick up.

On Friday, market conditions were significantly more ideal, with continued strength in the markets and consistent upward trends. However, the biggest difficulty arose from the high level of nutrality. We started the day with $SPY at $634, up from the previous close, and watched as the markets moved up heavily right from open. Conditions were strong, opportunities were presented to us, and traders should have been able to easily generate some gains.

The biggest issue is on Friday was the fact that there was almost no momentum across the board. After $SPY rallied to test and break $636 on Friday, the markets essentially remained at that level for the majority of the day, and really did not provide us with great opportunities to trade on an intraday basis, but in my opinion, it was kind of a perfect way to end the week of recovery, as that does open the flood gates for us all today.

We went on to make the official high of the week, trading at $637.64 last week, and $SPY went on to end the week trading at $637.18, meaning that $SPY was up $11.50 for the entire week, or up approximately 1.8%.

I was not a fan of the market conditions last week. Still, given the strength and confidence provided, it is almost impossible to beat these conditions, especially with short-term neutrality. Again, hopefully you all were able to realize significant gains in the process, and had a wonderful time!

S&P 500 Heat Map - Last Week

Thoughts & Comments for Today - 08/11/2025

Today is setting up to be a great day for the markets. The question is, will that sentiment remain, will traders remain confident, and will the markets continue to go up? I do not know. I wish I had all the answers and could tell us exactly where the markets are headed, but given the current situation, it wouldn't surprise me if markets genuinely broke out and we went on to make a new all-time high. I am not saying conditions will be perfect all day, but with the strength and confidence going into open, I genuinely believe this should be a good day for the markets.

If you are going to attempt to trade today, my warning for you is not going to be weakness in the markets, but more so a warning about neutrality. With the way the markets have been moving over the previous couple of weeks, we have seen a significant amount of weakness and neutrality. The weakness is quickly bought back up, and as long as you are in strong positions, you should ultimately be fine. The issue comes from neutrality, mostly if you have any positions that naturally have some sort of “contango” effect or theta. You will watch as your position simply loses money with no "hope” of getting it back. Yes, maybe the option contract you purchased moved back in YOUR favor, making the contract worth slightly more. Still, the fact that every option contract is worth slightly less as time passes is going to be something that kills many retail traders not only today, but in these market conditions.

But, as I have said, please do not be left in the dust. Many traders are not going to be comfortable or confident in these conditions, so as a result, they will simply not trade due to that lack of confidence. Can I argue against those people for their decisions? No, not at all. But at the same time, in the case that the markets are breaking out, there is almost no reason why you should not attempt to capitalize on the strength.

Just do not be passive, and make sure to practice safe risk management. This means either scaling your positions properly, or simply just making sure you are doing your own due diligence prior to entering any positions so you are both comfortable and confident holding a position that might not be performing well. A great example of this right now is my bag hold position on $PTLO. I am not a fan of this movement, I do not like the price action, but I understand the organization, their operations, and I believe that the price I entered was a very fair and reasonable price. The fact that the price dropped 20% after my initial purchase is unfortunate, but it just means I have an opportunity to purchase more shares of this organization at a discount, and can continually hold with strength.

So, just make sure to practice safe risk management today, and try to find some hidden gems across the board. I would love to watch as we go on and make a new all-time high in the general markets, and I love the fact that we are less than 0.5% away from making that high. We just need to watch as the markets trickle slowly, and we have a genuinely amazing time. So, let’s make the most out of today, and realize a significant amount of gains!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $PTLO, $RIVN, $JEPI, $INTC, SOL, $TSLA, $NVDA, $BRK/B

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $INTC

Economic News for 08/11/2025 (ET):

None Scheduled

Notable Earnings for 08/11/2025:

Pre-Market Earnings:

monday.com (MNDY)

AAON (AAON)

MAG Silver Corp (MAG)

Franco-Nevada Corporation (FNV)

Barrick Mining Corporation (B)

Dole plc (DOLE)

Owens & Minor (OMI)

After Market Earnings:

BigBear.ai (BBAI)

Compass Minerals (CMP)

AMC Entertainment (AMC)

Celanese (CE)

Proficient Auto Logistics (PAL)

ACV (ACVA)

Getty Images (GETY)

Guardian Pharmacy (GRDN)

Wrap up

Hopefully, market conditions will continue to remain strong and we will continue to be provided with insane strength, momentum, and opportunity. I expect to see continued market strength, so make wise decisions today, enjoy a fantastic time, and do everything possible to maximize your profit potential. Many traders are going to have a great time this week, so make the most of it!

Good luck trading, and let’s start this week strong!!!