HaiKhuu Daily Report - 08/20/2025

Good morning, and welcome to CONFUSION BABY.

Market momentum should start to pick up soon, and we should all expect to see a larger directional move in the near future, but the question is, what will be said over the next couple of days, how will the markets react to what is said, and where do we go from here? We have FOMC minutes coming out later today and a lot of economic news dropping pre-market tomorrow.

I wish I knew with 100% certainty where we were headed, because if I did, we would all be retired with a Lamborghini on the beach. But that is just something in the works. Just sit back, and do what you can to navigate these conditions accordingly, and I will try my best to help spiritually guide you through this confusion.

Be fluid with your positions, as well as your direction and sentiment.

Markets and plans are constantly changing, so avoid getting too bullish or bearish. It is easier to follow the trend and look for confirmation of a reversal than to hold a position stubbornly, which can lead to losses. Just remember, bulls will print money in these conditions, bears will print money in these conditions, but pigs will be slaughtered. Do not get greedy.

I’ll talk more about how to navigate these conditions later on in the full report, but for now….

Good luck trading today, and let’s hope $SPY holds this support!

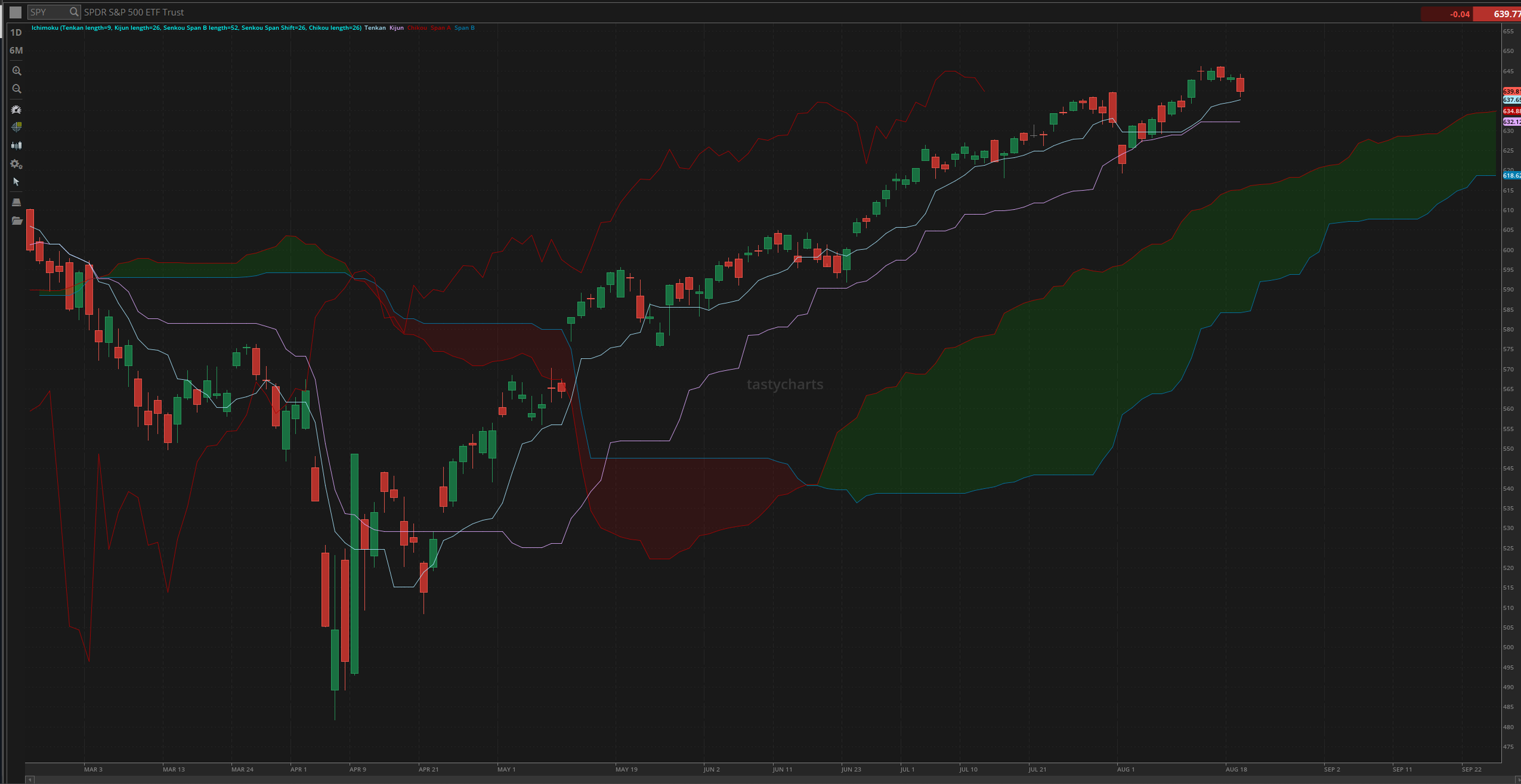

The updated $SPY daily levels are as follows:

Conversion Line Support: $637.65

Baseline Support: $632.12

Psychological Support: $630

Psychological Resistance: $640

Daily Cloud Support: $615.08

Thoughts & Comments from Yesterday - 08/19/2025

Yesterday was an absolutely disgusting day for the overall markets. Momentum and sentiment were slightly bearish throughout the entire day, and it was not a fun time to trade unless you were bearish tech, long $INTC, or took risk off. But that is just part of trading in these confusing, all-time highs!

So, we started the day with the markets ever so slightly red, opening at $643.10, conditions picked up after open as $SPY slowly moved up throughout the first hour, going on to make the official high of the day at $644.10, before remaining neutral around that level before remaining neutral for the rest of the first hour.

After that, our fate was sealed. The markets started to sell off, and essentially the rest of the day was weak, with continued bearish momentum.

We observed $SPY selling off after the first hour, continuing through lunch and the beginning of the afternoon, before finding some neutrality after reaching the day's official low at $638.48. Conditions at the bottom were again gross and slow, but thankfully, we saw a slight recovery into close.

In the final five minutes of the day, $SPY popped up ever so slightly and went on to close the day trading at $639.81, down $3.50 for the day, or down just over 0.5%.

That was a gross day for the markets; $SPY went on to test the daily support level, and conditions were just disgusting across the board. I hope you all had a great time and enjoyed the opportunities the markets continued to provide to us. $INTC saved the day for most of us, carrying our portfolios on a slightly bearish day for the markets. However, it is not a good sign to see mild weakness leading into the economic news I expect over the next couple of days.

Just continue to make the most out of these conditions, and let’s all hope for the best!

S&P 500 Heat Map - 08/19/2025

Thoughts & Comments for Today - 08/20/2025

So, going into today, the only thing that matters is FOMC minutes. There might be a couple of external BS things that occur that impact the markets in some form or fashion, but just know that the only real major economic event, and only event you should look out for today, is the FOMC minutes.

Minutes come out at 2:00 PM EST, which sucks because we have to play the waiting game, but it will be essential for us to watch out and process these minutes as they will heavily impact our financial future. The decisions about rates, rate cuts, and the rate at which the rates will be cut will all heavily impact both our and the general market sentiment.

When the minutes come out, unless there is an extremely large discreptency between what we expect and what is presented, there should not be a large directional move the moment the information is dropped, but go into this with the expectations that we are going to see a momentum based move afterward, which ultimately ends up positively benefitting everyone who is attempting to trade. Just as long as you are following the momentum and not fighting any trends.

Again, bearish plays are viable. For a long time, I made fun of anyone bearish on the larger markets, but now bearish plays are viable again. Just make a note of this: despite the strength and optimism in the markets, and the opportunities being presented to us, there may also be weakness and catalysts that result in selling events.

So please just tread lightly and make sure to practice safe risk management, mostly while attempting to trade around FOMC minutes today.

I do not recommend attempting to trade short term option contracts before FOMC. Still, I do recommend that if you are trying to trade stuff like that, that those short term contracts can play out beautifully towards the end of the day after theta has burnt a large portion of the contract, and you are not paying as much premium to play the last two hours of a 0-dte contract.

These conditions do look slightly more bearish going into open. I will say that now, and I will happily reaffirm my stance in the case that market conditions look better or worst by open, but as long as $SPY us below $640, that is a short term sign of weakness, but as long as we remain above the daily conversion line, we can continue to enjoy peacefully, before things start to pick up and maybe sell off again.

As long as we can survive the next couple of days, and as long as there is not certain death in the markets, I do expect to see a continuation of the overall market strength that we’ve seen, but I am going to call it how it is, mostly when market conditions are less than ideal at this exact moment. Hopefully, things get better soon, but we will see what happens after the news comes out!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $TSLA, $INTC, $NVDA

Speculative: $RIVN, $ARTL, $PTLO

Long Dividend: $JEPI

Long Investment: $INTC

Short: $BRK/B

Crypto: Sol (?) - Just watching

Economic News for 08/20/2025 (ET):

FOMC Minutes - 2:00 PM

Notable Earnings for 08/20/2025:

Pre-Market Earnings:

Target Corp (TGT)

Estee Lauder Companies (EL)

ZIM Integrated (ZIM)

Analog Devices (ADI)

TJX Companies (TJX)

Baidu (BIDU)

Kanzhun Limited (BZ)

Futu Holdings (FUTU)

Lowe's (LOW)

After Market Earnings:

Toll Brothers (TOL)

Coty (COTY)

Nordson (NDSN)

Wrap up

Hopefully, markets don’t just absolutely collapse on us over the next couple of hours; that would be tragic, going into FOMC minutes. But just remember to expect volatility over the next couple of days. Things were slow for the previous two days, but things should start to pick up quickly, and hopefully it does not result in the markets selling off heavily. So, we will make the most out of today, and have a fantastic time.

Good luck trading today, and let’s see what JP has in store for us!