HaiKhuu Daily Report - 08/19/2025

Good morning, and happy Tuesday!

Wow, the neutrality in the markets yesterday was rather disgusting, but it has opened up opportunities for us all to capitalize on these market conditions with relative confidence. Please continue to tread lightly on these conditions, as neutrality is never a fun time to attempt to trade. During the process, many traders are unfortunately going to get burnt by either chop or theta.

I warned you all about this yesterday, and I believe that we are most likely going to see another day of neutrality in the markets. Obviously, I hope that does not happen as it would genuinely be a terrible time if $SPY remained within a +/- $1 range throughout the entire day again. So, if youare trying to trade or capitalize on today, keep your guard up, because I genuinely believe this is going to be a fight.

Just a quick shout-out: $INTC has broken back above $25 after news of a $2B investment from SoftBank. Interesting movement and acquisition from SB. Considering everything that's happening, with SB looking to purchase, Trump attempting to buy 10% of the organization, and numerous other significant events, I believe this organization is well-positioned to do wonderfully.

We will discuss $INTC and navigating these market conditions further in this report. For now, approach today with a neutral mindset and focus on maximizing your profit potential. Opportunities should consistently present themselves to us; now it is just a matter of doing so.

So, let’s have a fantastic time and make the most out of today!

Good luck trading, and let’s print some cash!

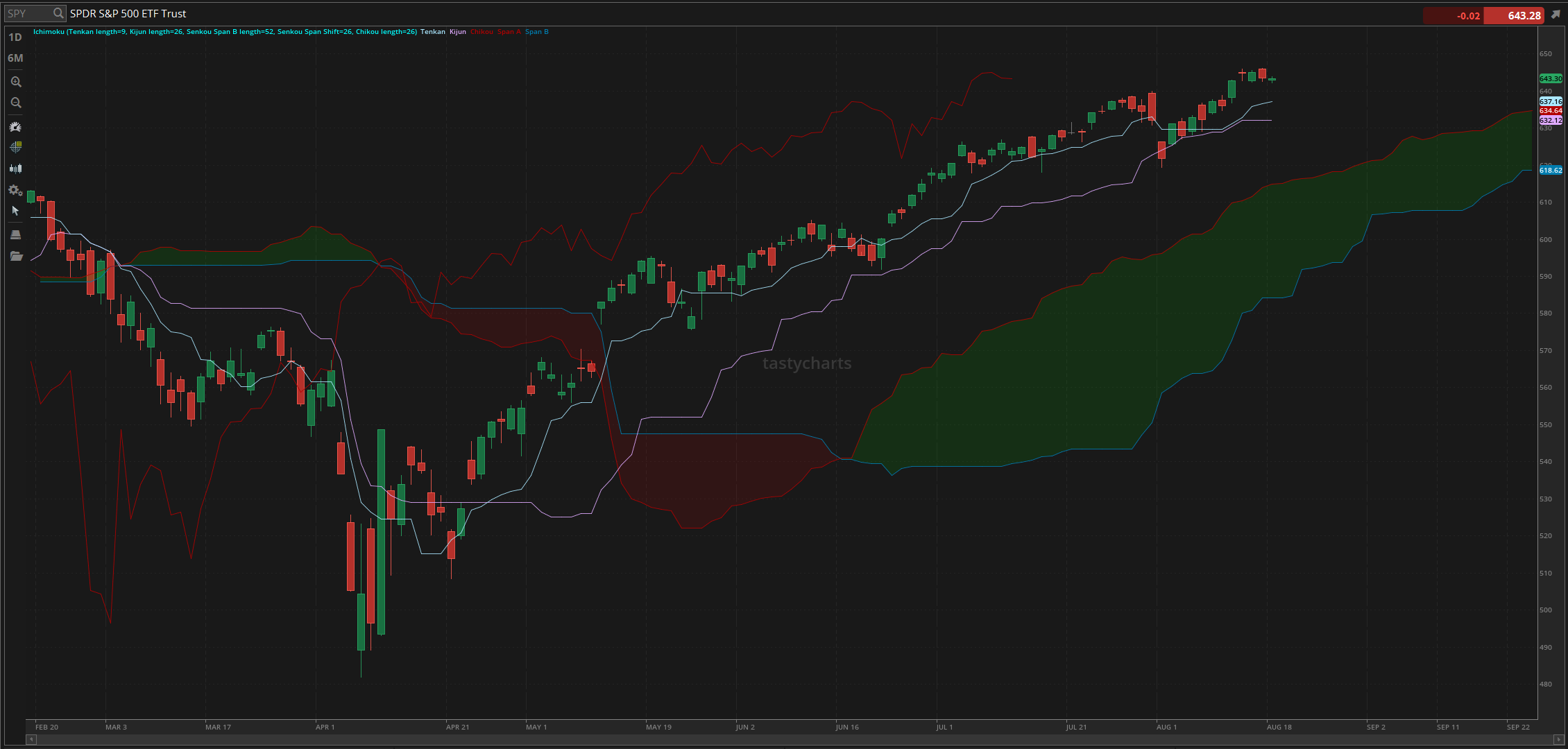

The updated $SPY daily levels are as follows:

Conversion Line Support: $637.16

Baseline Support: $632.12

Psychological Support: $640

Daily Cloud Support: $614.96

Thoughts & Comments from Yesterday - 08/18/2025

Yesterday was an terrible day for the markets. I warned you all about neutrality before open, and anyone who simply listened or watched along would have been able to dodge yesterday with relative ease and should have remained relatively unscathed. Hopefully, you were all well-prepared, as it’s almost as if someone predicted it perfectly before it open!

So, we started yesterday with $SPY opening at $642.86. Market conditions were strong, as we remained relatively choppy for an extended period, staying around the $643 level for the day and essentially within a +/- $1 range. The majority of the day was honestly extremely slow and neutral.

There were times where the marketsd move around slightly in that range, with $SPY going ojn to officially make the low of the day at $642.18, down $0.70 from open, and watched as $SPY made the official high of the day leading into close trading at $643.93, meaning from the top to bottom, there was less than a $2 move.

We officially ended the day with $SPY remaining neutral, down $0.14 for the day, or down 0.02%, with an intraday bullish movement of $0.44.

I am not trying to downplay how neutral and disgusting yesterday was; there was genuinely nothing we could have talked about in any capacity without overhyping the day. But that is simply just life and these market conditions. I genuinely hope that each and every one of you was able to capitalize on the lack of momentum yesterday and listened to the warnings to prepare accordingly. Those who prepared had a fantastic time and consistently realized gains, while anyone who attempted to trade the chop likely had a tough time. But hey, such is life, so we see where the markets take us today and have a great time!

S&P 500 Heat Map - 08/18/2025

Thoughts & Comments for Today - 08/19/2025

Today is setting up to be another interesting time for the markets. With the way that everything is sitting at the moment, we are seeing a lot of confusion and difficulties as a result of neutrality and lack of momentum. This is not something that “should” generate fear, but can be an instance where fear is generated. But, this neutrality at the moment is not a result of a lack of buying, or an increase in selling, but more so as people are simply sitting on their hands leading into the weekend. We have FOMC Minutes coming out tomorrow, a lot of economic news coming out on Thursday, and Jackson Hole starts Friday.

So, I am not saying that today is going to be a continuation of the neutrality, but I do genuinely believe that realistically, market conditions are going to be tougher to navigate as fewer traders are attempting to allocate into the markets leading into the next couple of days. There will be quick opportunities to scalp and day trade, but those will be inconsistent and far and few in between.

If you are attempting to trade, just please continue to practice safe risk management and to make some smart decisions. Unfortunately, many traders will generate a significant amount of losses. Again, I am not attempting to scare anyone, but realistically, in the case that the markets move against you or remain neutral, there is no direction in which you can take the markets.

You'll be stuck there, either trying to allocate into $SPY or buying $600,000 worth to get 1,000 shares. When $SPY moves up $0.10, you'll make $100 on your $600,000 investment. So again, I am not saying that opportunities will not be available to us, I am not saying that traders cannot capitalize on the movement in the markets. Still, we are in a point where with the inconsistencies of the markets, and the lack of momentum, I am expecting to see significant difficulties from the large majority of traders who are attempting to allocate into the marekts.

For those attempting to allocate today, my recommendations will remain essentially unchanged from what I've discussed over the past couple of weeks. Be careful and tread extremely lightly on these conditions. These conditions are ideal for holding long-term positions and navigating short-term market momentum.

I know we've discussed $INTC extensively over the past couple of days, and I am sure you're familiar with the organization. However, let’s revisit them, as many of our users have allocated into $INTC at a phenomenal price. Last night, we received news that SoftBank is investing $2B in $INTC, which led to a significant rally in $INTC stock. Traders have received this information well, mostly after hearing the news that Trump was interested in getting a 10% cut of the organization (Roughly 10B), where in reality, with the conditions that the markets are seeing, it is almost hard not to realize gains, unless you are actively scalping and getting extremely unlucky.

So, what does this mean for you?

Now that $INTC is up significantly, with some traders being up more than 40% from initial entry, it would almost be criminal for me not to tell you all to consider taking profits off the table, realizing some gains, and being smart in the process. Many traders can easily realize a significant amount of gains during this time, and many more are going to have a great time, so please, consider selling some of your $INTC to take risk off the table, take some exposure off, and simply just enjoy the momentum and opportunities that are being presented to us.

But, one thing I will say at the same time. With everything going on, with the strength that is flooding the markets with $INTC and the buying momentum that is happening at the moment, I would highly recommend that you all still take some profit off the table, but retain some exposure so you can continue to capitalize on the strength and opportunities presented to us!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $TSLA, $INTC, $NVDA

Speculative: $RIVN, $ARTL, $PTLO

Long Dividend: $JEPI

Long Investment: $INTC

Short: $BRK/B

Crypto: None (Literally, no live exposure)

Economic News for 08/19/2025 (ET):

Housing Starts - 8:30 AM

Building Permits - 8:30 AM

Notable Earnings for 08/19/2025:

Pre-Market Earnings:

Home Depot (HD)

Medtronic (MDT)

Viking Holdings (VIK)

XPeng (XPEV)

Amer Sports (AS)

Opera Limited (OPRA)

Premier (PINC)

After Market Earnings:

James Hardie Industries (JHX)

ZTO Express (ZTO)

Jack Henry & Associates (JKHY)

La-Z-Boy (LZB)

Chemical & Mining Co (SQM)

Auna S.A. (AUNA)

Keysight Technologies (KEYS)

Wrap up

Hopefully, market conditions break out and are not stuck in a state of neutrality, while $INTC breaks out and goes on to hit our PT of $35. Expect some neutrality going into all of the news over the next couple of days, and just tread extremely lightly. Risk management is going to be key to your success, so just please be smart, safe, and secure during this time.

Good luck trading, and let’s kill it today!