HaiKhuu Daily Report - 09/15/2025

Good morning, and happy Monday!

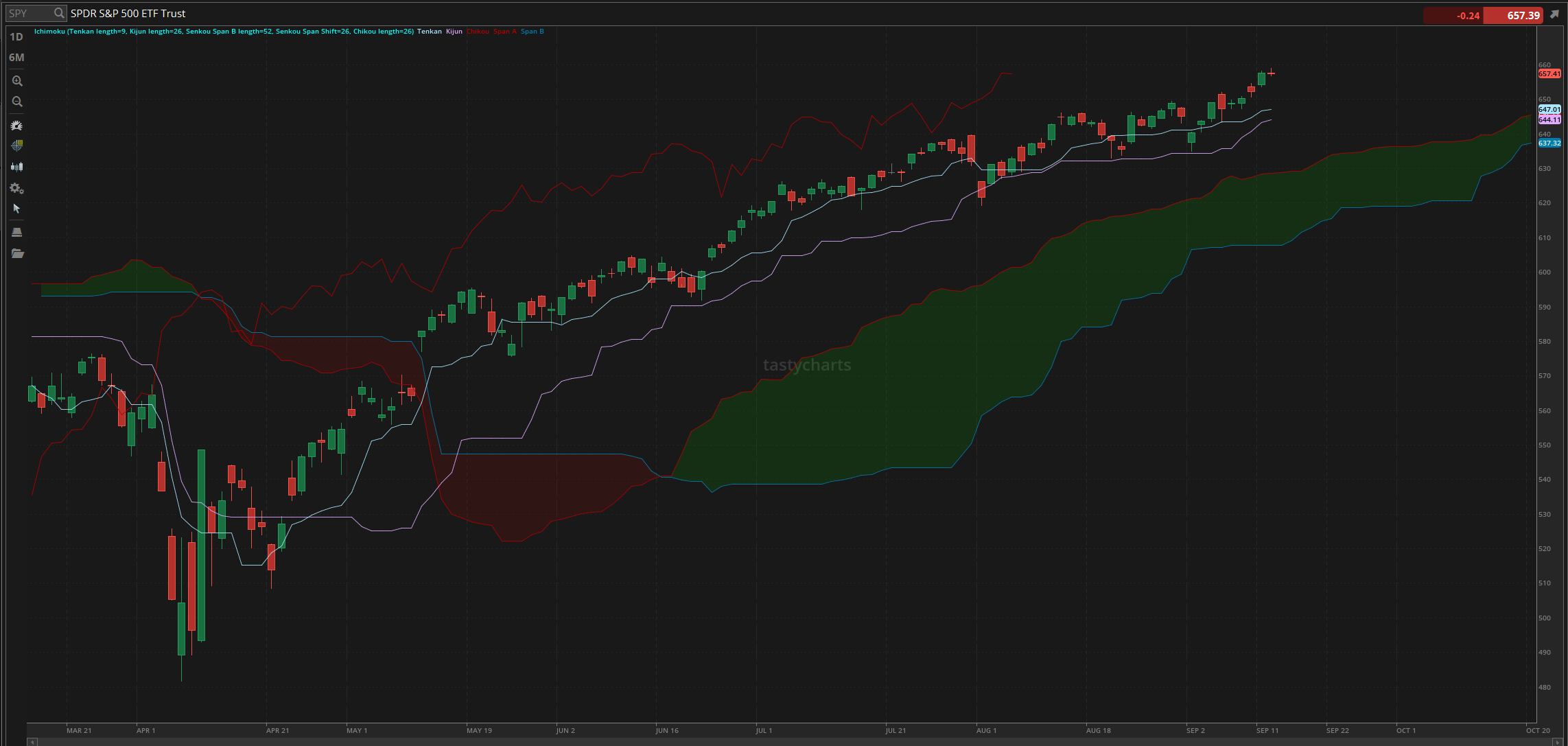

I hope you all had a wonderful weekend, and welcome to another phenomenal week for the markets! Conditions are still looking extremely strong as markets have retained this $650 level. Traders are optimistic, confident, and excited to see where the markets go this week, and I hope you all are ready to have some fun. We will see the Fed’s decision on rates on WEDNESDAY, where we are currently pricing in a 25 BPS rate cut. It will be interesting to see where the markets take us from here, but I am excited to enjoy these conditions.

Given the current market conditions, I advise everyone to tread lightly and practice safe risk management. Many traders will face significant challenges in trading, but opportunities will also emerge. So, follow the trends, don't try to be a wizard in these conditions, and have a great time.

Opportunities to trade will be amongst us, so prepare accordingly, leading into the FOMC's decision on rates this week.

Make sure to check out our WEEKLY PREVIEW, as there is a lot of economic data this week!

Good luck trading this week, and let’s continue to see NEW all-time highs!

The updated $SPY daily levels are as follows:

Conversion Line Support: $647.01

Baseline Support: $644.11

Psychological Support: $650

Daily Cloud Support: $628.63

Thoughts & Comments from Last Week

Last week was an amazing yet confusing and difficult week to navigate. $SPY went on to make new all-time highs as Larry Ellison became the richest man in the world for a little bit of time, and we watched as traders had a significant amount of difficulty both with the $GEMI IPO and the new all-time highs. I hope that you all were alright after last week, and were able to enjoy the interesting market conditions. Traders genuinely were 50/50 on either printing a significant amount of cash, or having a difficult time, it just depends where you were allocated, and how strong and confident you were with your position.

So, we started last week with $SPY trading at $648.82. Market conditions were relatively strong and everyone was optimistic leading into the week. $SPY was on pace to finally break and hold above $650 on it’s third test, and we watched as we finally broke through that level part way through Tuesday. That was the beginning of the euphoria stage in the markets as we saw some FOMO purchasing after breaking above $650 and continually making new all-time highs throughout the rest of the week, every single day until we officially ended the week.

It was honestly a lot of fun seeing $SPY make alltime highs four days in a row, breaking on Tuesday, Wednesday, Thursday, and again on Friday, where $SPY made the official standing all-time high trading at $659.11, up heavily throughout the week, and we watched as we officially ended the week with $SPY trading at $657.41, up $8.59 for the week, or up roughly 1.3%.

I am not saying that the market conditions of last week were absolutely perfect as they were not, but traders across the board should have only continued to win with the skittish bull, and should have realized a significant amount of gains in the process. It definitely was a tougher time as traders did realize some losses in the process, but anyone and everyone could have taken advantage of the market conditions and had some fun. So, we see where the markets ultimately take us today, and continue to make the most out of these phenomenal market conditions!

S&P 500 Heat Map - Last Week

Thoughts & Comments for Today - 09/15/2025

Let’s talk about today and these market conditions. Considering the current market trends and the way everything is looking. I expect a continuation of general market strength, but I advise you to tread lightly, as the FOMC’s decision on the interest rate is later this week.

Assuming that rates come down, despite the strong general market conditions, that is NOT a good sign for the markets. People often misunderstand that cutting rates is beneficial, which is not the case. You only cut rates when the economy is weakening, and as bad as this sounds, there is a significant amount of strength in the markets. Markets are at all-time highs, and those who are at the extremes are feeling the most at the moment, but as bad as this sounds, the average American's condition today is better than it was this time a year ago. If we did not cut rates then, I do not see a reason other than political pressure to cut it now.

Make a mental note that in the case that you hear someone say that the markets ARE going to go up as rates come down, MAY be correct by coincidence, but I am telling you right now with 100% confidence, that rate cuts come as a result of sentiment revolving the economy, if the economy is weak, that is when rates will get cut to attempt to stimulate the ECONOMY. There is a difference between the markets and the general US Economy.

Outside of politically motivated reasons, rates will not cut for random BS reasons, so again, remain rational while many are attempting to navigate rate cuts for the first time.

Opportunities will be amonst us to actively trade during this time, and my suggestion to you will be to look to actively trade higher beta tech stocks during this time, mostly if rates are going to get cut as that will heavily benefit the outstanding debt that they currently have in circulation as debt will become “cheaper”

A great organization to look at during this time, as much as I hate saying this, is $AAPL. I hate the concept of holding this organization long, but short term, they have a significant amount of debt on their books that should cause the organization to trend positively the next couple of days. Again, I am not saying that you should look to take on a significant amount of risk, or even allocate there, but I think that $AAPL, out of all of the tech organizations that are available right now has the best value entry, as other organizations are already over priced and moving.

You can easily just follow the momentum and follow the trend, but if you do that and are wrong, just remember that you are paying a premium just to have the opportunity to enter, while others are entering into fundamentally solid organizations at a discount.

Be smart, be safe, and practice risk management during this time. Many traders are genuinely going to have a difficult time while attempting to trade today, so do what you can to make the most out of these strong conditions.

One speculative side bet that I made was allocating into the polymarket bet of “no rate change”. At the moment, the markets are pricing in a 98% chance that there is an adjustment in rates. There is a 2.2% chance that there is no change, and that honestly is a fair prediction. This is where the hail mary comes in. I do not advise this at all in anyway shape or form, this is not financial advice, this is literally just a side bet to piss away money, but in the case that it hits…. it will HIT. If you throw like $20 into “no change” right now into the polymarkets, assume 100% of that $ is burnt, but in the case that this hits, that is almost 50:1 return at this point. Again, there is a priced in 2.2% chance of no change, I think the markets are extremely strong at the moment, so this is just something that is extremely speculative that I wanted to put on your plate. Again. Assume there is a 98% chance you lose ALL of your money on this bet, so only bet like $20 or something. This is just a fun side bet.

So let’s have some fun trading today, let’s realize some gains, and print some money.

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $AAPL, $TSLA, $NVDA, $INTC

Speculative: $RIVN, $PTLO

Long Dividend: $JEPI

Long Investment: $INTC

Short: $BRK/B

Crypto: SOL

Economic News for 09/15/2025 (ET):

Empire State Manufacturing Survey - 8:30 AM

Notable Earnings for 09/15/2025:

Pre-Market Earnings:

Hain Celestial Group (HAIN)

After Market Earnings:

Dave & Buster's Entertainment (PLAY)

Wrap up

Hopefully, the markets continue to rally from here, and we only continue to show strength in these conditions. Obviously, everything at this point is going to be speculative. So please, tread lightly, practice safe risk management, and do what you can to maximize your profit potential. Many traders are going to realize a significant amount of gains today, so let’s remain positive and have a great time!

Good luck trading, and let’s start this week strong!!!