HaiKhuu Daily Report - 09/29/2025

Good morning, and happy Monday!

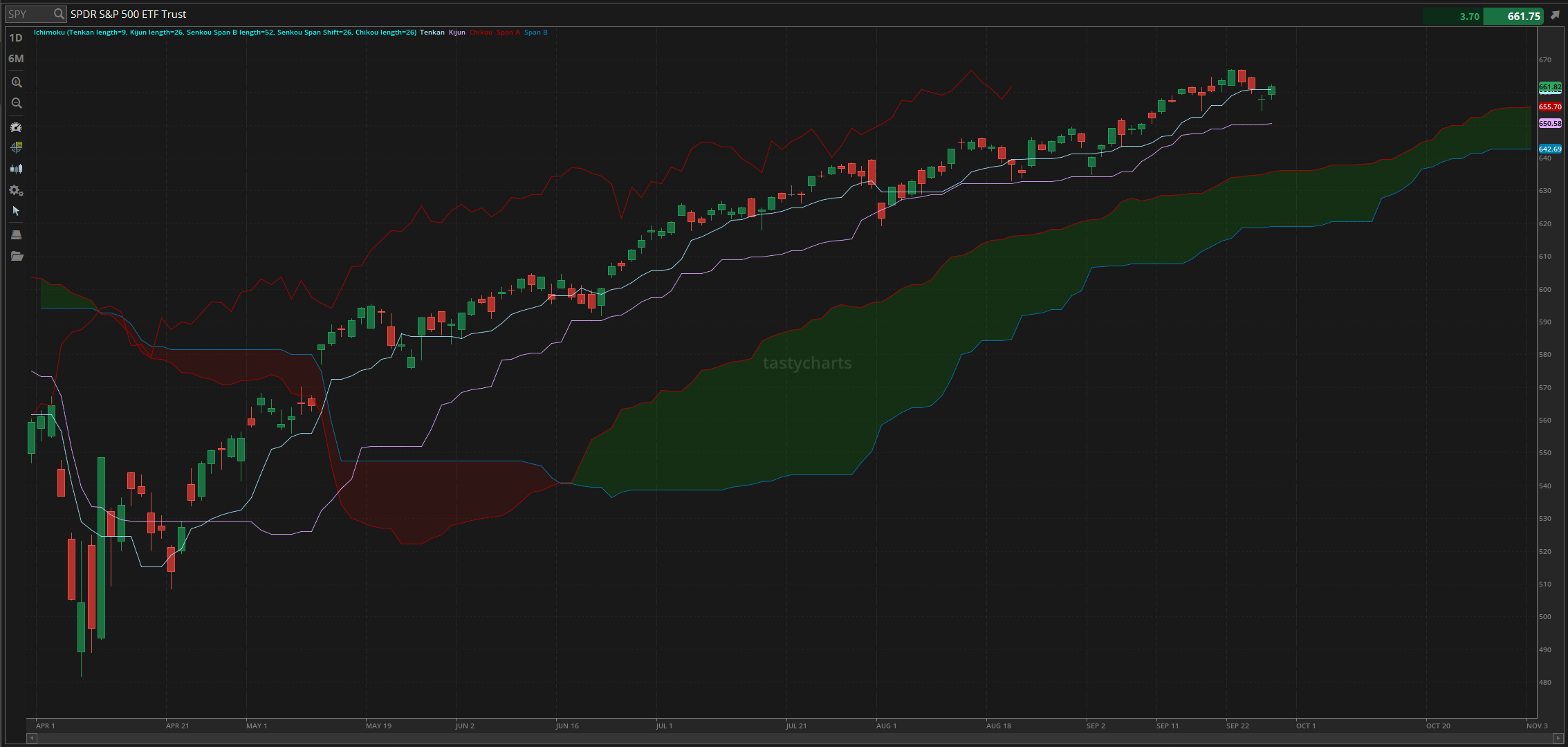

I hope you all had an exciting weekend full of adventures and wonderful weather, and are ready for another interesting time for the markets! At the time of writing this report, markets are slowly strengthening, displaying mild confidence during the pre-market session, but it is nothing of any major significance. Please continue to tread lightly while $SPY is in a state of confusion as we test daily resistance. However, be aware that this may be a repeat of the rallies seen over the past couple of months, where we make higher highs and higher lows.

One interesting thing to note at this level is that $SPY is trading at a neutral level on the fear and greed index. We are not fearful, we are not greedy, we are just confused. We may see a shift in the markets in the near future, but given the confidence we are seeing, it genuinely would not surprise me if we receive a news catalyst soon that causes a larger directional move.

Please be cautious as you enter this week. Understand that many traders will face difficulties, but opportunities will consistently be available and provide us with opportunities to realize significant gains. Please just tread lightly, practice safe risk management, and have a great time.

We do have economic news this week, so make sure to check out our WEEKLY PREVIEW. We do not have any significant earnings or economic news to look out for, but every event this week will be impactful not only to the markets but also to everyone attempting to trade. So please, be smart, be safe, and have some fun this week!

Good luck trading, and let’s continue to see NEW all-time highs!

The updated $SPY daily levels are as follows:

Conversion Line Support: $660.82

Baseline Support: $650.58

Psychological Support: $660

Daily Cloud Support: $635.85

Thoughts & Comments from Last Week

Last week was an extremely tough week to trade, despite $SPY reaching a new all-time high. Traders had opportunities, but I would say that the large majority of traders, unfortunately, realized some losses, unless they were following the Allen Strat. Then, they printed throughout the entire week. I just want to extend my congratulations again to everyone for achieving another all-time high, and I hope you all made the most of last week!

We started the week with $SPY trading at $662.20. We dropped heavily throughout the pre-market session and essentially watched as $SPY “rallied” from the bottom, recovering everything that was lost. We continued to rally up and make a new all-time high on Monday, which was followed by another new all-time high on Tuesday. Back-to-back all-time highs before watching as $SPY dropped throughout the rest of Tuesday, throughout the entirety of Wednesday, and watched as the markets dove like crazy on Thursday.

Thursday, in my opinion, was the worst trading day of the entire week, watching as there was a gap down on a day-to-day basis, watching as $SPY sold off and made the official low of the week, trading at $654.40, and watching as $SPY really killed traders with an intraday movement of roughly $0.10. So, I am not saying that Thursday was the worst day of the week, but Thursday was the worst day of the entire week.

Thankfully, the markets did show strength and opportunity on Friday. We watched as $SPY continued its rally from the bottom, pushing slowly and consistently throughout the majority of Friday. The index was able to recover the daily conversion line support, and many traders were able to realize gains attempting to trade on Friday.

It was genuinely an insane week where we officially ended with $SPY trading at $661.82, down $0.38 for the week, or down 0.06%. I am not saying that the markets were good, but what I will say is that opportunities were consistently amongst us, and that many traders had a great time with so many insane opportunities. So, please continue to make wise decisions and have a fantastic time this week! Let’s see where the markets take us from here and only print in the process!

S&P 500 Heat Map - 09/26/2025

Thoughts & Comments for Today - 09/29/2025

Let’s talk about how amazing and confusing these market conditions are currently looking. With everything that is being presented at this moment, despite the confusion, these conditions are primed to break out again. I know I was personally more skeptical recently, but with the continuation of general market strength and everything being presented to us, I do not see a reason why anyone should be overly pessimistic. Continue to remain a skittish bull, look to trade organizations you understand so that you can trade confidently.

As stated before, the markets are back in neutral on the fear and greed index. This is a double-edged sword as that means there is no overly optimistic purchasing at this level, but that means at the same time, we can see an increase in confidence and buying in the near future. So, just continue to watch that gauge when looking at general market sentiment.

I am seeing weakness in cryptocurrencies at the moment, which does not seem to be negatively impacting the general market sentiment at the moment, but know that realistically, I do believe that cryptos can and will continue to come down in the short term. I will look to purchase SOL again when given a chance. PT for entry is 160-180, ideally the lower side of that if possible. So, I do not want to be a hyper bear on crypto, but I will tell you all that I feel that it is at a “fair” price right now, and that I do not want to purchase it until it’s at a discount.

The best moves, though, in my opinion, are going to be looking not at the tech names that are going insane, but looking at the organizations that have been downtrending for the past couple of weeks. Look at $ORCL, $GOOGL, $AMZN, and $META. All are great names that have just had a tougher time. I am not saying that you should look to purchase any of these organizations RIGHT NOW, but watch their trend. Once they have become a deep value purchase, once they are discounted enough against the market where they finally need to reverse, that will be one of the best, and easiest holds you can have.

Again, do not enter too early, and wait until there is that sign of a reversal on a larger timeframe that you can capitalize on.

I will warn you as usual, that many traders are going to get murdered in these conditions, but I do want to say with 100% confidence, that profit potential will increase heavily during this time. Traders who are lucky, traders who are confident, and traders who understand how to navigate volatility are going to be the individuals that realize a significant amount of gains during this time. The increased volatility we are seeing at these prices will result in larger dollar swings. Portfolios will be made and lost in a matter of seconds. So as long as you are smart, safe, and are realizing a signficant amount of gains, it is an amazing time.

Do not be passive in these market conditions, but do not be overly aggressive as you will be quickly humbled by the markets.

Just watch for a breakout though as $SPY is back above the daily resistance levels and are providing us some absolutely insane opportunities to realize some gains. Please, just be smart, be safe, and have an amazing time trading today.

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $TSLA, $NVDA, $PLTR, $META

Speculative: $PTLO, $RIVN, $ADT, $ALLE, $KHC, $BUD

Long Dividend: $JEPI

Long Investment: $PTLO, $BUD

Short: $BRK/B

Crypto: SOL

Economic News for 09/29/2025 (ET):

Pending Home Sales - 10:00 AM

Notable Earnings for 09/29/2025:

Pre-Market Earnings:

Carnival (CCL)

After Market Earnings:

Progress Software (PRGS)

Jefferies Financial Group (JEF)

Inventiva S.A. (IVA)

Vail Resorts (MTN)

Wrap up

Hopefully, market conditions will continue to remain strong throughout the entire day, and we will be provided with opportunities to realize gains consistently. Many traders will, unfortunately, have a difficult time trading today, but such is simply life. Just make sure to practice safe risk management, and have an amazing time.

Good luck trading, and let’s start this week strong!!!