HaiKhuu Daily Report - 10/17/2025

Good morning, and happy Friday! Wow, this has been a hectic week for the markets. We’ve seen extreme volatility and neutrality playing around this $660 magnet zone. Please, continue to practice safe risk management and protect your bottom line. Many traders are going to realize losses as a result of these market conditions.

This is not an attack on anyone, or anyone’s positions, but I am telling you again going into today, that I believe that this is going to be one of those days that there again, I am expecting losses to be generated. I obviously hope they do not because we do not stay in business if you all are not profitable, but again, going into today, I am going to warn you all to please protect yourself.

Many traders are going to overtrade at this level because they do not understand the risks that are involved with allocating heavily here, but I will talk more about navigating these conditions later on in the report. For now, just continue to sit back, relax and have an amazing morning.

Good luck trading today, and let’s see if $SPY chops today!

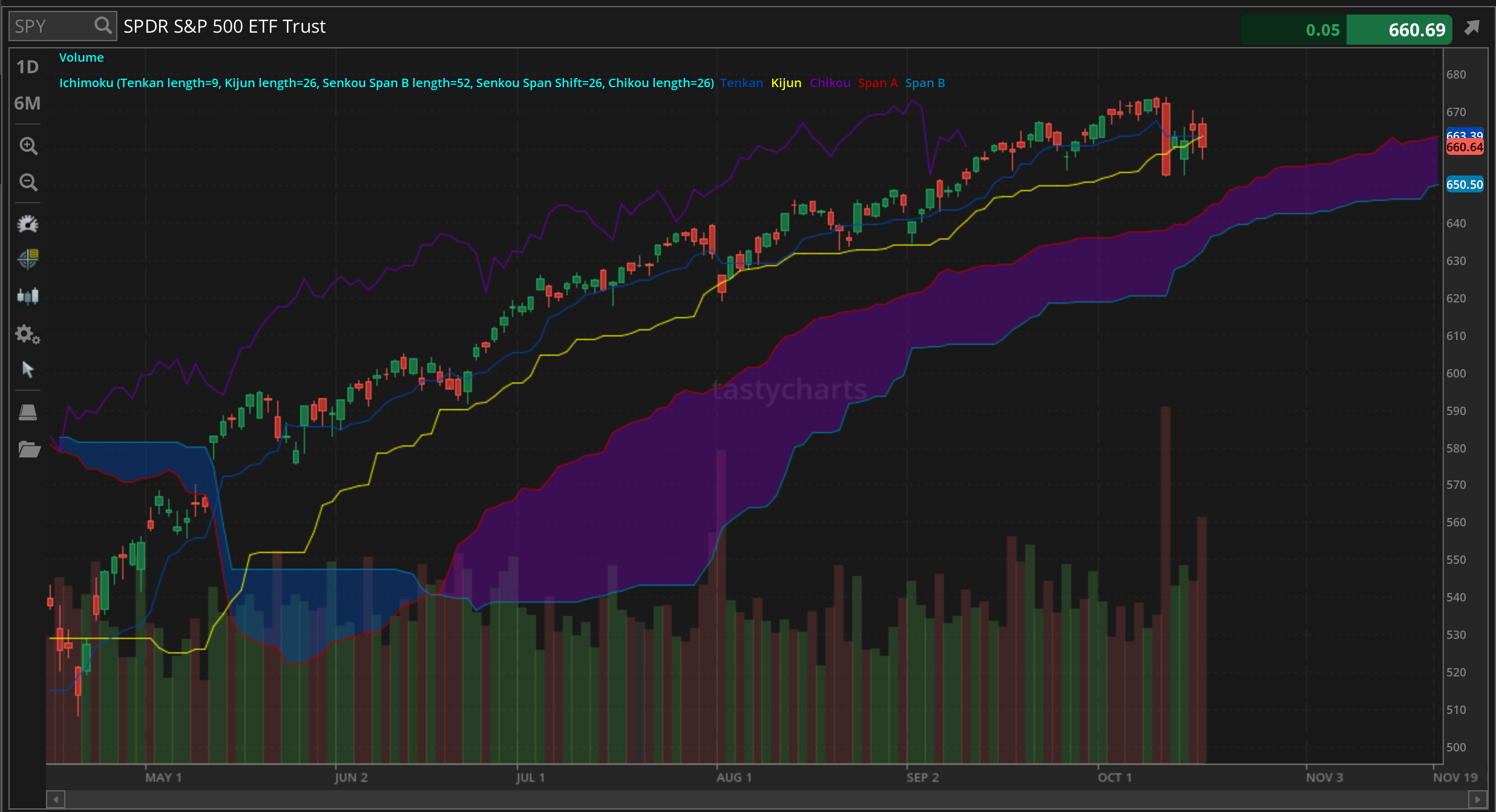

The updated $SPY daily levels are as follows:

Conversion Line Support: $663.39

Baseline Support: $663.39

Psychological Support: $660

Daily Cloud Support: $642.76

Thoughts & Comments from Yesterday - 10/16/2025

Yesterday was a rather disgusting day for the overall markets, but there were consistent opportunities to trade and realize a significant amount of gains. Traders were presented with consistent opportunities to follow the momentum and realize a significant amount of gains. It is unfortunate how difficult yesterday was, but it’s fun because that is just a part of being in the markets!

So, we started the day with $SPY trading at $666.89. Market conditions were alright as $SPY was relatively mild around open, displaying ever so slight confusion and generalized strength. Markets were great after selling off slightly then rallying to the official high of the day at $668.70, before starting to display some weakness leading into lunch.

$SPY quickly went from the official high of the day, to selling off and hitting $665, to selling off and quickly bouncing at $660, before breaking below, making the official low of the day at $657.11, and thankfully recovered ever so slightly leading back into close. We officially ended the day yesterday with $SPY trading at $660.64, down $5 overall, but down a little bit over $6 from open.

As I said before, yesterday was not going to be a great day for the markets, nor traders. I felt bad saying that yesterday, but as I am sure you all know at this point, I am not doing say of this because I personally am extremely about being bearish in the markets, but I am saying this to try and protect you all as much as possible. So, please continue to protect your bottom line, and have a great time actively trading today!

S&P 500 Heat Map - 10/16/2025

Thoughts & Comments for Today - 10/17/2025

Today as I have said before is going to be a difficult day to trade. Market conditions have been less than ideal as traders are having a genuinely tough time. People are confused and do not know how they want to allocate just yet. This is not necessarily a bad thing, but with the state of the markets and the placement we are at, just understand that many traders are at risk right now.

Again, this is not a comment on anyone’s personal allocations nor their ability to trade, but this is a comment regarding the general market conditions and the risks that are involved in the short term.

I do not believe in this, but we have seen the first of many bearish signs necessary to hit the markets. $SPY is remaining relatively strong at these highs, but we are now back in fear on the fear and greed index, which is also followed up with $SPY testing daily supports, as well as the fact that we are forming a weak bearish TK cross under.

So, no part of this is meant to be overly bearish and attempt to get you all excited about these conditions. This is one of those days where realistically, many traders are going to generate losses as $SPY chops around this $660 market and plays with peoples emotions on a larger basis until we start to get a directional move.

That directional move may happen today, and just understand that in the current placement of the markets, statistically, we are more likely to see market downside than upside right now. It all comes down to market sentiment as well as people’s ability to navigate!

Just please, continue to practice safe risk management and mitigate as much risk as possible. Many traders are going to again have a difficult time, and we are seeing bearish signs across the board. Please tread lightly, practice safe risk management, and just have an amazing time today.

If the markets break out, do not fight the momentum, and if the momentum slows down, do not fight any trends.

Again,I will be away for the day, I apologize for that, but I will be back and around 24/7 when I am back in office on Monday! I do not anticipate trading today, and that hurts my soul, but it will be fine!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $INTC, $TSLA, $NVDA, $ORCL , $TSM

Speculative: $PTLO, $RIVN, $ADT, $ALLE, $KHC, $BUD

Long Dividend: $JEPI

Long Investment: $PTLO, $BUD

Short: $BRK/B

Crypto: SOL

Economic News for 10/17/2025 (ET):

Housing Starts - 8:30 AM

Building Permits - 8:30 AM

Import Price Index - 8:30 AM

Capacity Utilization - 9:15 AM

Notable Earnings for 10/17/2025:

Pre-Market Earnings:

Ally Financial (ALLY)

SLB (SLB)

State Street (STT)

Autoliv (ALV)

American Express (AXP)

Fifth Third (FITB)

Huntington Bancshares (HBAN)

Regions Financial (RF)

Truist Financial (TFC)

Wrap up

Hopefully this is going to be one of those days that markets don’t absolutely crash on us. I do not like the weakness being driven by technical indicators on a larger timeframe so this is going to be one of those times that I advise extreme caution as I genuinely do believe traders are going to get wiped today. Please be smart, please be safe, and let’s have an amazing time!

Good luck trading, and let’s end this week strong!!!