HaiKhuu Daily Report 11/23/2022

Good morning and Happy Wednesday! The markets are looking optimistic today so get ready for what is going to be a phenomenal time. With $SPY testing $400 last night and breaking above $400 going into the holidays, we are looking bullish and confident. I do expect there to be increased volatility today, but I do expect general bullish momentum.

Just a reminder, we have FOMC minutes coming out at 2 pm EST today, tomorrow is off for Thanksgiving, and Friday is a half day with the markets officially closing at 1 pm EST!

Thoughts & Comments from 11/22/2022

Yesterday was an amazing day for the markets! There was a significant amount of bullish momentum, which was able to sustain itself throughout the day. $SPY opened the day trading at $396.66, dropping down quickly to make a low of the day at $395.16 before ultimately starting to grind up for the whole trading day.

While the markets were trending up, $SPY went on to go from making a low of the day at $395.16 to actively testing major resistance at $400 into the close. $SPY went on to make a high of day officially into close at $400.07. We ended the day trading at $399.90, up +5.31 (1.35%) with a positive intraday movement of +0.82%.

It was a beautiful day for the markets with great opportunities to the scalp and realize a significant amount of gains while giving us the ability to sit back and watch as our strong actions continue to move up accordingly.

Hopefully, you all were able to enjoy the general movement of yesterday and capitalize on the opportunities that were presented to you. It was a great day for the markets with lots of potential!

$SPY ONE MINUTE INTRADAY CHART 11/22

Thoughts & Comments for Today 11/23/2022

Today as I said before, will be a day full of opportunities to trade, mostly leading into the holiday break. There will be a significant amount of active trading going on today, as well as lots of momentum that will be driven directly from FOMC.

My personal expectations for the morning will be slight bullish momentum on lower volume as $SPY is trading above $400, which will ultimately start to slow down around noon EST into the lunchtime lul. During that lunchtime lul, I expect the markets to slowly sell off, and once we hit that relative bottom, I would expect to see a significant amount of buying momentum leading into FOMC.

Once the minutes come out, there will be significant momentum and an increase in active volume. There will be an increased risk of actively trading during this time, but there will be significantly more potential for increased profits.

Please be careful while actively trading during this time, but capitalize on the opportunities that present themselves.

Realize gains quickly and capitalize on the momentum in the market as a result of FOMC minutes.

My personal game plan for today is to open day trades in the morning, sell toward the relative peak and ride cash for the majority of the day. Leading into that lunchtime lul, I will look to pick up some $SPY and ride it for an hour or two leading into FOMC. Once the momentum picks up, I will look into selling into that hype and realizing some short-term gains.

Once minutes come out, and there is significant movement in the markets, I will look to quickly scalp and trade during that time and increase both risk and general exposure to be able to actively generate realized gains during that time.

This is obviously a very risky strategy, but in the case that it works out as expected, we will be able to increase profits significantly during this time.

I’ll let you all know when I get my allocations in the HaiKhuu Discord and give you all an opportunity to scalp alongside me.

HaiKhuu Proprietary Algorithm Report:

Yesterday was a great day for the algorithms, but unfortunately, the markets did beat us by a slight margin. This is nothing we are worried about, thankfully, and we are going to continue to improve our systems accordingly to increase our success rate and profitability. Please be on the lookout for our newest improvements and updates, and don’t forget to respond to the market sentiment game every day!

If you want to read more in-depth about the performance of all of our algorithms, please check out Asher’s report.

The results of yesterday are as follows:

Baseline:

$SPY: +0.82%

Our Results:

Long-Term Portfolio: +0.39%

Base Algorithm: +0.1%

Variable Sector Neutral: +0.1%

Variable Market Neutral: -0.11%

Sector Neutral: -0.25%

Market Neutral: -0.45%

Today will reflect our plans that I have disclosed earlier. We will be looking to actively allocate into the base algorithm in the morning going and anticipate exiting these positions early prior to the lunchtime lul. After the lunchtime lul, we will allocate into $SPY with the anticipation of day trading into FOMC. We will play the aftermath with active trades that I make on $SPY and attempt to realize as many gains as possible.

Please be on the lookout for when I ultimately exit all of these allocations for the day and continually enter and exit throughout the day!

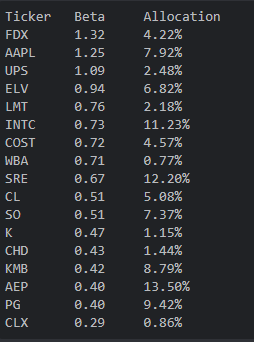

All positions will be disclosed prior to markets opening.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 11/23/2022

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $TSLA , $AMD , $META , $AAPL , $MSFT , $BABA

Free Equity List:

Safe - $SPY

Risky - $META , $AMZN , $RBLX , $BABA

Position Opportunities:

Look to allocate into strong equities that you anticipate holding until the end of the year

Pick up some leaps in organizations you are bullish on over the span of a couple of years ($GOOG/L, $AMZN, $META)

Pick up broad market ETFs slowly ($SPY / $QQQ)

Sell short-dated CSPs with the intention of collecting premium on Friday (Risk Recommendation: $BABA)

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN

Long-Term Safe Play - $BA

Long-Term Speculative Play - $META

Short-Term Speculative Play - $RBLX

Economic News for 11/23/2022

Durable goods orders - 8:30 AM ET

Core capital equipment orders - 8:30 AM ET

Initial jobless claims - 8:30 AM ET

Continuing jobless claims - 8:30 AM ET

S&P U.S. manufacturing PMI (flash) - 9:45 AM ET

S&P U.S. services PMI (flash) - 9:45 AM ET

UMich consumer sentiment index (final) - 10 AM ET

UMich 5-year inflation expectation (final) - 10 AM ET

New home sales (SAAR) - 10 AM ET

Fed Chair Jerome Powell speaks at the Brookings Institution - 1:30 PM ET

FOMC - 2 PM ET

Notable Earnings for 11/23/2022

Pre-Market Earnings:

Deere & Company (DE)

Full Truck Alliance (YMM)

Kingsoft Cloud Holdings (KC)

After-Market Earnings:

None

Wrap up

Overall, please just be smart while trading today. Limit the amount of exposure you have, and capitalize on the opportunities that are available.

Don’t forget we have FOMC minutes coming out at 2 pm EST and that markets are closed tomorrow.

Happy Thanksgiving and let’s make some bank today!