HaiKhuu Daily Report 11/25/2022

Good morning and happy Friday! Hope you all had a good Thanksgiving. Today is going to be a slow, low-volume day for the markets, so I will keep this report relatively short. Markets close today at 1 pm EST.

Please be cautious if you are attempting to trade today due to this low volume. Historically, today is a bullish day, but as always, be extremely careful.

Due to the slow movement of the markets today and the relatively low volume, I am expecting people who are attempting to trade to either realize a minimal amount of gains, or get burnt actively attempting to scalp, without any momentum to assist them.

Just watch out for opportunities to buy long for next week and be smart with your positions. Don’t get caught overtrading today and do not fomo into any allocations! Go find some black Friday deals, sit back and relax on this half day for the markets.

Thoughts & Comments from 11/23/2022

Wednesday was an interesting day with many opportunities to actively trade. Anyone who followed the gameplan we made to trade around FOMC minutes should have been able to realize a significant amount of gains in the process.

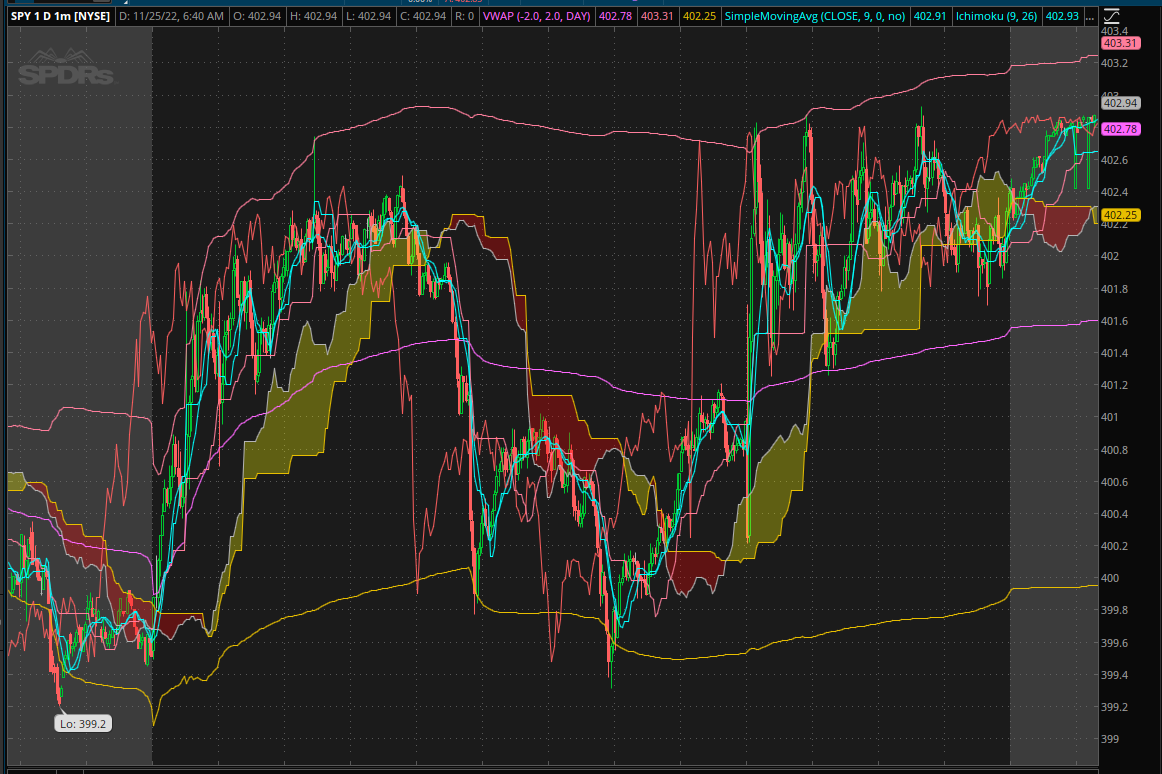

Going into open, $SPY made an official low of day trading at $399.20 and opened at $399.56. The seconds the markets opened though, we went on a beautiful and steady run in the morning to make an official high trading around $402.50, before starting to sell off, and the sell off we watched was significant. All of the gains that were incurred before lunch were lost, as $SPY dropped down to make an intraday low trading at $399.40.

Leading into FOMC, we watched as the markets were bought up, and broke above $400 and moved up until minutes officially came out.

When minutes came out, $SPY quickly pushed up significantly and tested $402.80. and brought a significant increase in volume to the markets. That $402.80 mark was significant as it tested that level three times and unfortunately was not able to break above that resistance. Market movement was choppy after the fact, with $SPY coming down and testing support before moving back up and chopping around.

There were many great opportunities to scalp throughout the day as well as many opportunities to realize a significant amount of gains.

$SPY ended the day trading at $402.42, up +$2.52 (0.63%) with an intraday movement of +0.72%.

Hopefully you all capitalized on the opportunities that were presented to you and realized some gains. It was a great day to trade with a significant amount of opportunities to trade!

$SPY ONE MINUTE INTRADAY CHART 11/24

Thoughts & Comments for Today 11/25/2022

Today as I stated before, is going to be a relatively neutral day with low volume that will be purely momentum based.

In the case, the markets create a bearish trend, expect low volume and selling throughout the day.

In the case we are looking strong, watch out for the markets to slowly trend up, giving us an opportunity to sit back, relax and realize a small amount of gains.

Historically, this is a bullish day for the markets, but do not expect too much from today. Anyone who is over-allocated, actively FOMOing into plays, or trying to force anything today will get burnt. Look for opportunities to quickly scalp, but ultimately just sit back, relax and enjoy the day.

I personally am not going to be trading that much today, but I will look to sell premium to capitalize on the 0DTE opportunities, despite the premium being relatively low. I do not expect a significant amount of gains to be realized today, but as always, there will be opportunities to trade.

Just be smart, practice safe risk management, and realize some gains in the process of everything.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

Wednesday was a great day for our systems as well as our active strategy to realize gains and outperform the markets. Our strategy worked out perfectly, and we outperformed the markets by a small margin. Unfortunately, the gains could have increased significantly in the case that our final trade on $SPY worked out as expected, but C’est la vie, we still beat the markets and was able to relax throughout the day.

If you want to read more in-depth about the performance of all of our algorithms, please check out Asher’s report.

The results of yesterday are as follows:

Baseline:

$SPY: +0.72%

Our Results:

Base Algorithm 0.59%

Variable Market Neutral 0.45%

Long-Term Portfolio 0.31%

Market Neutral 0.03%

Variable Sector Neutral 0.01%

Sector Neutra l-0.42%

Today, despite the flat movement with slight bearish momentum pre-market, we will be allocated directly into the base algorithm today.

This position, despite being a full allocation of the portfolio, will be a relatively safe play, where in the case we have a rough time, we do not have to actively stress too much as I will be minimizing general risks and limiting downside potential.

If the markets aren’t strong, we will cut all positions extremely early and call today a wash.

All positions will be disclosed prior to markets opening.

DISCLAIMER - Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. We cannot guarantee success. Take these at your own risk.

Generated entries for 11/25/2022

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $TSLA , $AMD , $META , $AAPL , $MSFT , $BABA

Free Equity List:

Safe - $SPY

Risky - $META , $AMZN , $RBLX , $BABA

Position Opportunities:

Look to allocate into strong equities that you anticipate holding until the end of the year

Pick up some leaps in organizations you are bullish on over the span of a couple of years ($GOOG/L, $AMZN, $META)

Pick up broad market ETFs slowly ($SPY / $QQQ)

Sell short-dated CSPs with the intention of collecting premium on Friday

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN

Long-Term Safe Play - $BA

Long-Term Speculative Play - $META

Short-Term Speculative Play - $RBLX

Economic News for 11/25/2022

None

Notable Earnings for 11/25/2022

Pre-Market Earnings:

None

Wrap up

Overall, just be smart trading today. There will be opportunities to trade, but expect low volume and momentum throughout the day.

Please be smart today, relax and enjoy your weekend! Don’t forget the markets close today at 1 pm EST.

Good luck trading today, and let’s make some bank! Have a great weekend everyone and enjoy your black Friday!