HaiKhuu Daily Report 12/26/2023

Good morning, and happy Tuesday! I hope you all had a wonderful holiday season and are ready for what should be both the fastest and slowest week for the markets. Conditions are looking relatively neutral at the time of writing this report, but we are expecting to see significantly less general momentum in the markets. I’ll talk more about my general sentiment in the markets and what I expect to see soon, but just remember that low volume and strong momentum are bullish signs for the markets. So let’s watch this Christmas Rally unfold in front of our eyes and watch as there is general market strength into the end of the year.

This should be a fun time with relatively lower market momentum.

Let’s end this year strong, and let’s see what happens. I’ll put together my general thoughts and sentiment for 2024 this week so you. But for now, make some smart decisions and try to make the most out of these market conditions!

Good luck trading today, and let’s see what the markets have in store for us!

The updated $SPY daily levels are as follows:

Conversion Line Support: $470.01

Baseline Support: $462.59

Strong Psychological Support: $470

Daily Cloud Support: $436.34

$SPY Year-to-Date, +24.38%

Thoughts & Comments from Last Week

Last week was a relatively slower week for the markets. There were a couple of opportunities to capitalize on general market momentum, but it was difficult trading with confidence outside of a few larger movements in the markets. The overall week was relatively a wash despite making a new 52-week high on $SPY. It was a slow week for the markets, which did present some opportunities to trade, but not much confidence in the process.

We started the week off relatively slow, with $SPY trading relatively neutral on Monday. $SPY opened the week trading at $470.98 and displayed strength at the time but continued to remain relatively neutral throughout the day. We did have a relatively wider range throughout the day as $SPY did drop below the $470 support, making the low of the day at $469.89 and having a high of the day trading at $472.98, but we ended the day with $SPY trading at $471.97. There was a wide range to trade throughout the day, but on an overall basis, $SPY only moved up a dollar intraday and did not make a large impact on the markets.

Tuesday was a significantly better day for the markets as $SPY did move up. We watched as $SPY made a new 52-week high and displayed continued strength throughout the day as $SPY opened trading at $472.53, above the previous close, and made the official low of the day trading at $0.08 below the open price. Markets continued to rally throughout the day, and we continued to push new 52-week highs into close, where the official high of the day was $474.92, and we ended Tuesday trading at $472.45.

Wednesday was genuinely an extremely tough day for the markets, which provided us all with great opportunities to trade and more opportunities to load up on equities, but it was very tough on traders across the board. $SPY opened the day slightly higher than the previous close and pushed up to make the official 52-week high, trading at $475.89. It was looking extremely good until, during the back half of the day, the markets started to display weakness, and as the weakness grew, the markets continued to slip. $SPY continued to push new lows as it continued to fall. People blamed 0-DTE contract traders for the fall, but in reality, it was a mix of everything that caused the fall. Lots of emotions were left unchecked as traders were continually trying to catch a falling knife, but ultimately, anyone who attempted to time out the bottom was hurt in the process. We ended the day with $SPY making the official low trading at $467.82, and ending the day recovering slightly, trading at $468.26. This was the largest movement we had seen in the previous couple of months, and it was extremely difficult to capitalize on it.

Thursday was an alright time for the markets with a significant movement and a large intraday range, but it at least provided us with many great opportunities to trade and capitalize on the opportunities that were available to us! We opened the day trading at $471.33, up nicely from the previous close, but watched as $SPY went and tested a lot of traders' faith as $SPY dropped to make the official low of the day, trading at $468.84 before recovering and rallying into the close. During the final hours of the trading day, $SPY rallied from the bottom, making the official high of the day trading at $472.98 and ending the day at $472.70. Market momentum was very difficult to navigate at that time and stopped many traders, but we cannot deny that there were no opportunities that were presented to us throughout the day.

Friday was a relatively slower day for the markets, but as expected, had an extremely significant range that we could have all capitalized on. We started the day with $SPY, opening the day trading at $473.77, up nicely from the previous close, and displayed a significant amount of strength at open as the markets rallied and made many traders a significant amount of gains. But after the initial rally was over, that was it for the bullish momentum for the day. $SPY continually dropped throughout the day and slowed down during the lunchtime lull, before recovering slightly after, seeing some slight bullish momentum after being black for the day, only to have an extremely sharp sell-off right before 2 PM EST. $SPY went on to make the official low of the day, trading at $471.70 and recovering slightly afterward. We ended the day with $SPY trading at $473.65, up $0.95 for the day, or up approximately 0.2%, but was down on an intraday basis.

It again was a relatively slower week for the markets as the overall movement throughout the entire week was only $2.69, or roughly up 0.57%, but at the same time, it provided us all with some amazing opportunities to trade both the bullish and bearish sides of the markets. This should be a fun week for the markets, filled with hopefully a slow grind up for the Santa rally, so let’s see what the markets have in store for us this week and realize some gains in the process!

Heatmap - $SPY 12/22/2023

Thoughts & Comments for Today, 12/26/2023

This week should be an interesting time for the markets. I am not really going to talk much about today specifically, but more so my thoughts on the general week in the markets. Historically, this is the week that we call the “Santa Rally” where the markets move up on slower volume. With the way the markets are setting up at this moment, it seems that this could very much be the case. There is relative strength in the markets, and we can very easily see a breakout towards the upside. I would not suggest actively allocating heavily into the markets on this sentiment, but I would take it into consideration as a confirmation bias if you are attempting to trade.

I believe that this week should be very difficult to navigate with confidence if you are actively attempting to trade, and I believe that general market momentum will be relatively slower, with some bullish overall sentiment in the markets.

One thing that I will warn you all about is the downside risk in the markets right now. With the movement we have seen in 2023, it would not surprise me to see both retail and institutional level investors and traders look to take profits on many of the positions that they’ve entered into, with many organizations moving up significantly over the previous year. It would not surprise me to see some people cutting positions. Some examples of the insane rallies we’ve seen are $NVDA moving up 250% over the previous year, $TSLA moving up 130%, and $META moving up 200%. This is something that you should genuinely consider as a possibility to cause a relatively minor sell-off in the markets.

In the case that we do see the markets start to sell off slowly, I do at least think that it is going to be on an organizational basis and only hit certain positions that are up heavily. Fundamentally solid organizations that are undervalued, investments, and positions that have underperformed will not be sold off, but many of these relatively higher beta stocks that people agree are “overvalued” will be the primary contenders for positions to be sold off.

For anyone who is attempting to allocate into the markets over the next couple of days, I would suggest staying away from actively scalping and looking more towards attempting to day trade. With market momentum slowing down, there will be many opportunities to scalp, but they will be far and few between and difficult to spot with confidence in real-time. With day trading, you will be able to find better allocations in the markets and will be able to ride the general market momentum with relative confidence. It will be easier to simply ride the market momentum over the course of a day or throughout the week than attempting to time out perfect positions every time.

Just continue to be smart and practice safe risk management in the process, as many traders are going to have a lot of difficulties navigating these conditions with confidence.

For my personal allocations this week, I think that I am going to be looking to be more passive into the end of the year. There are many positions that I am already in that I want to continue to hold, but at the same time, I do not have the confidence to attempt to trade under these conditions aggressively. I’ll scalp when I see opportunities to do so, but I do anticipate allocating into day trades throughout the week to ride the market momentum. These next couple of days are going to go by extremely quickly, but at the same time, I will not have the level of confidence I need to want to allocate heavily.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

Markets were tough to capitalize on last week on an intraday basis. There was not good momentum, and as a result, we saw the long-term portfolio underperform against $SPY, and the base algorithm underperformed heavily against the long-term portfolio. I am not happy with these results, but I am okay knowing that the performance of the algorithm has done extremely well over the entirety of this year. We will be posting a yearly recap on the algorithm's performance later, which will give us a bigger picture of the performance over time.

The results of last week are as follows:

Baseline:

$SPY: -0.27%

Our Results:

Sector Neutral: -0.19%

Market Neutral: -0.21%

Long Term Portfolio: -0.46%

Variable Market Neutral: -0.51%

Variable Sector Neutral: -0.65%

Base Algorithm: -0.85%

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

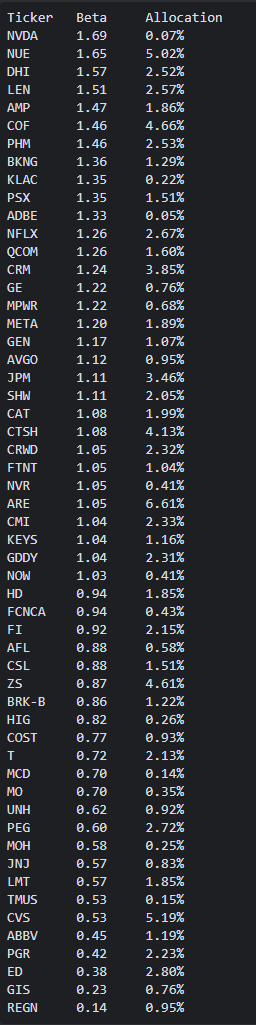

Algorithmic Positions

[12/26/2023]

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $BABA, $X, $FNF, $KO, $AMD, $TSLA, $MSFT, $AAPL

Position Opportunities:

Trade the market momentum

Take profit on positions

Limit your downside risk

Hedge your positions

Consider getting bearish exposure

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $KO

Long-Term Auto Sector - $F

Speculative Re-Entry - $DIS / $RIVN

Economic News for 12/26/2023

Chicago National Activity Index - 8:30 AM ET

US CaseShiller 20 YoY - 9:00 AM ET

House Price Index - 9:00 AM ET

52-Week Bill Auction - 11:30 AM ET

2-Year Note Auction - 12:00 PM ET

Notable Earnings for 12/26/2023

Pre-Market Earnings:

None Scheduled

After-Market Earnings:

None Scheduled

Wrap up

This should be an extremely fun week for the markets with slower momentum but many opportunities to realize gains. Take advantage of the opportunities that are presented to us, but practice safe risk management in the process. Follow the momentum in the markets, do not be overly aggressive, and look to realize gains throughout the process. Let’s end this year strong and prepare accordingly for 2024! This has been a great year sofar, so let’s end it on a high note!

Good luck trading, and let’s see what the markets have in store for us today!