Weekly Algorithm Review: 12/16/2023 to 12/22/2023

Performance Rankings

Sector Neutral: -0.19%

Market Neutral: -0.21%

Overall Market: -0.27%

Long Term Portfolio: -0.46%

Variable Market Neutral: -0.51%

Variable Sector Neutral: -0.65%

Base Algorithm: -0.85%

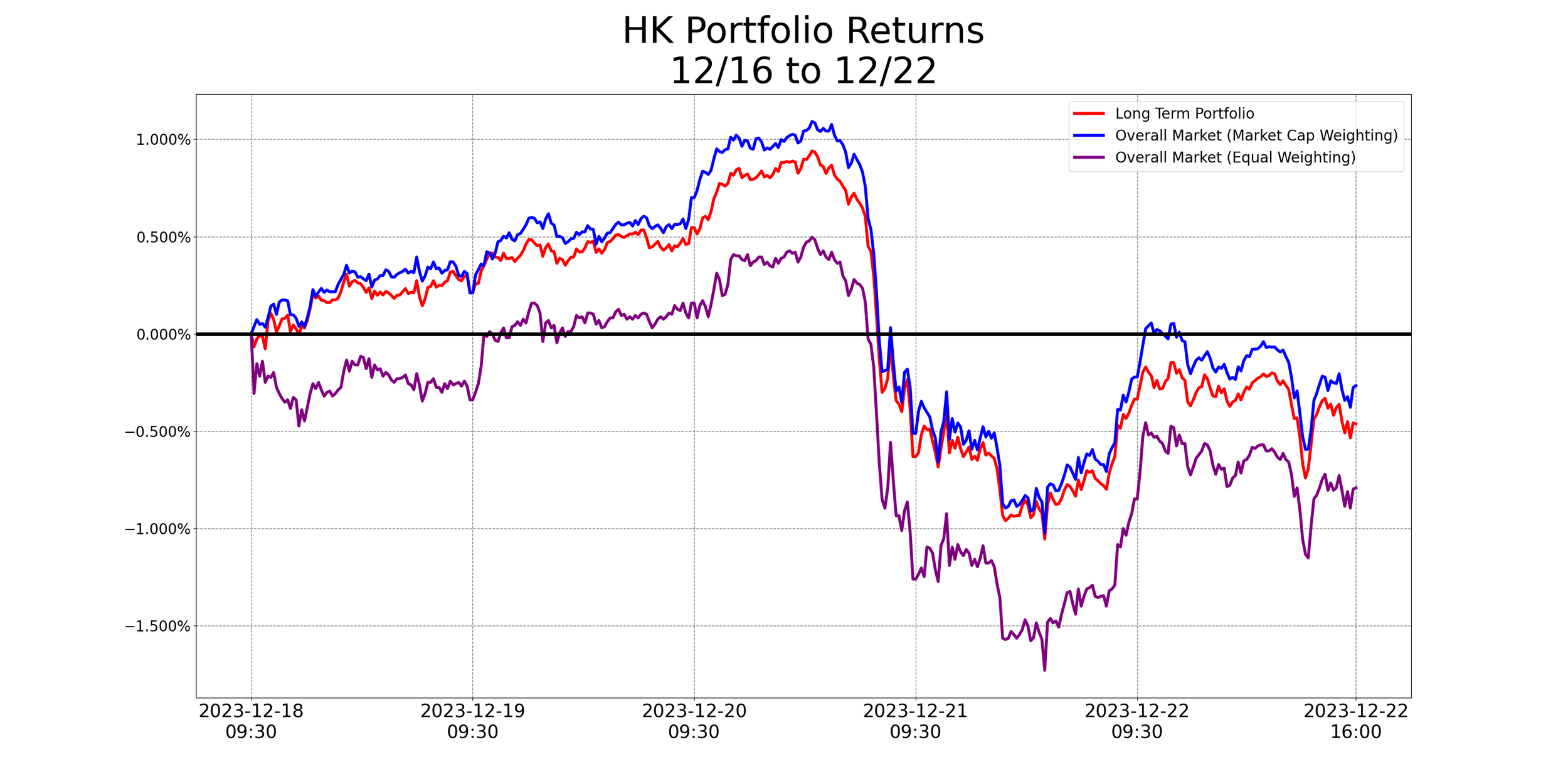

This was a weaker week for our algorithm, under-performing by 39 bps. That isn’t a trivial under-performance, but not a huge one either. Regardless, after our massive out-performance last week, I’m feeling okay with it. The portfolio performed similarly - bad, but not terrible, and certainly not enough to offset its strong performance from last week.

Looking at our returns by ticker, there aren’t 1 or 2 easy reasons for the under-performance this week. The only real standout is ARE, losing us around 25 bps, but we would have under-performed even without that. The distribution of returns is overall flatter, however, as we like to see.

Looking at sector distributions, we can get a little more information. As is typical, the algorithm allocated into similar sectors as the portfolio, but there are some differences we can notice. The algorithm’s most obvious over-allocations were Technologies and Energies - neither of which had a great week. Its biggest under-allocations on the other hand - Consumer Defensive and Industrials - were at the top.

Ultimately, we aren’t reading this week as a red flag. We aren’t expecting our system to out-perform every week, and we’re coming off of 3 wins in a row.

What’s In The Pipeline?

Our experimental intra-day algorithm is cumulatively up 0.67% - down from last week when it was up 1.02%, giving us a loss of 0.35% this week. It’s still very much in the green, though this backs up my theory that it’s slightly over-fit (not to the point of unprofitability, but that we can’t expect it to turn a profit every week). I’d be comfortable giving it a public beta right now, but we’re going to hold off on that until the new year. We’d like to see an extra week or two of data, and besides, the week between Christmas and New Year’s isn’t a great time to launch things.

Misc. Data For The Week