HaiKhuu Daily Report - 12/29/2025

Good morning, and happy Monday! I hope you all had a wonderful weekend and are ready for a confusing and interesting time for the overall markets.

Given how everything is trending at the moment, I expect many traders to have a difficult time trading today. This will result from ongoing market conditions leading into the end of the year.

Market momentum is strong despite the fact that $SPY is down slightly at the time of writing this report, but I genuinely believe that over the next couple of trading days, we will lack both volume and momentum, where the large majority of the remainder of the year will be neutrality in the markets, which is followed by slight directional momentum-based moves.

If anyone is going to attempt to trade this week, please stay away from strategies that require a significant amount of volume or volatility to be successful.

Many traders are going to overallocate and force trades going into the end of the year, and I am going to warn you that it may not be the best strategy.

Traders can and will have a great time to end this year. We have absolutely killed it this year and have enjoyed this insane rally from the bottom. Now, the question is, where do we go from here into the end of the year, and what can we do to capitalize on it?

I’ll tell you all my personal plans for my allocations later on in the full report, but for now, just please make sure to check out the WEEKLY PREVIEW, as this is going to be a hectic week!

Congrats on surviving 2025, and I cannot wait to see what 2026 has in store for us!

Good luck trading this week, and let’s continue to see NEW all-time highs!

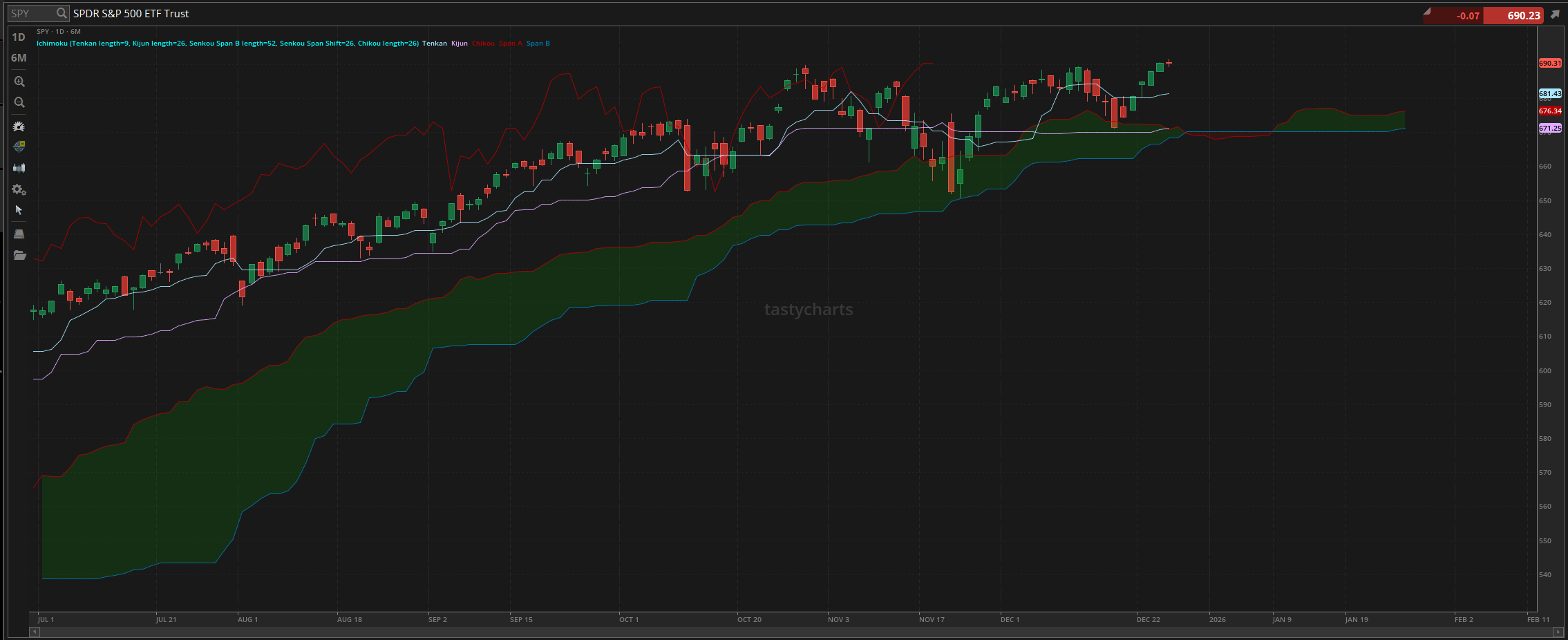

The updated $SPY daily levels are as follows:

Conversion Line Support: $681.43

Baseline Support: $671.25

Psychological Support: $680

Daily Cloud Support: $670.92

Thoughts & Comments from Last Week

Last week was a short and hectic week for the markets. We went into the week knowing that it would be impacted heavily, with a half day on Christmas Eve, and Christmas Day off, resulting in a 3.5-day trading week, which realistically was a two-day trading week. Volume was slow, there was significant neutrality, but we saw a beautiful continuation of the strength we’ve seen over the previous couple of weeks, with $SPY making a NEW all-time high in the process! I hope you all had a great week and realized some gains!

We started last week with $SPY trading at $683.95. Market conditions overall were alright as we were not overly bullish or bearish to start the week, but watched as conditions were relatively strong and optimistic. Traders could have very easily allocated into the markets, but it all came down to where, when, and how you attempted to allocate at the “top”. Those in strong positions should have had zero issues simply holding their positions and continuing with that generalized strength, but market conditions remained neutral through Monday, then showed slight bullish momentum early Tuesday morning, which was followed once again by neutrality.

Conditions really were not overly bullish but remained essentially flat after breaking out on Tuesday, which was followed by a test of $690 on Wednesday.

The neutrality we saw between Monday and Wednesday would have been extremely concerning if it hadn't been expected, but honestly, I would say it would be more concerning not to have expected that neutrality as a trader.

So, half a day on Wednesday, an entire day off on Thursday, and then we watched as half the world took the day off on Friday, but man, that was a mistake for many.

We watched as on Friday, $SPY went on to make the official all-time high, trading at $691.55, essentially making the same thesis that I’ve stated before, where $SPY will continue to make new all-time highs, but the highs are essentially just inching above the previous high so we get the headlines, before coming right back down. We officially ended the week with $SPY trading at $690.31, the highest recorded weekly close on $SPY.

I hope that you all were able to realize significant gains and had a fantastic time in the process. Anyone and everyone should have been able to capitalize on last week's strength, and I hope you all were able to realize significant gains. Some individuals had a tougher time, but many absolutely printed in the process. So, I hope you all absolutely killed it last week and are ready for what this week has in store for us!

S&P 500 Heat Map - 12/26/2025

Thoughts & Comments for Today - 12/29/2025

Today will be another interesting time for the markets. With three trading days left in the year, go into this expecting low volume, irrationality, and inconsistencies. Traders over the next couple of days are going to have a great time, and traders over the next couple of days are going to have a tough time. It all just comes down to how you allocate, when you allocate, and where you allocate.

With the strength and confusion that we are seeing in the markets, it genuinely would not surprise me to see if we saw neutrality which was followed by a larger directional move.

If you are attempting to trade throughout the rest of the year, I will warn you that there are going to be many individuals who take the rest of the year off at this point, so if you are attempting to trade option contracts, or a strategy that involved increased volume and volatility, to adjust your style at least until next week as many individuals are going to have a difficult time doing so.

Be smart, be safe, and do everything in your power to make the most of these conditions.

Many people will incur significant losses from overtrading, so here is your warning to avoid it.

As long as you go into today with the expectations that the markets are not going to act rationally today and throughout the rest of the year, I do not see a reason why anyone should lose a significant amount in the process. It is those who don’t practice risk management or force an allocation that ultimately are going to be the ones who get burned while attempting to trade today.

If you do decide to overtrade, I am telling you right now that statistically, the majority of you are going to regret it. Some may end up extremely profitable as a result, but I am telling you that statistically, the large majority of individuals are not going to have a good time while attempting to trade, and the majority of individuals will lose a significant amount of money in the process.

So don’t over trade, practice safe risk management, and be smart.

The people who are going to have the easiest time through the rest of the year are those who are in strong postitons that are up 30-40% and are simply not watching the markets and enjoying their time. So don’t be irrational, and you won’t lose your portfolio.

I do not personally anticipate trading or allocating too much going into the end of the year. I may attempt to scalp a couple of times given an opportunity to do so, but outside of that I am telling you right now with almost certain confidence that I do not anticipate any serious or large allocations going into the end of the year!

On a side note, I have started my 2026 watchlist and thesis. It has not been completed yet, but I will be working on it accordingly during some of this downtime throughout the rest of the year.

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $ORCL, $NVDA, $TSLA, $BABA, $MSFT

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 12/29/2025 (ET):

Pending Home Sales - 10:00 AM

Notable Earnings for 12/29/2025:

Pre-Market Earnings:

No Earnings Scheduled

After Market Earnings:

No Earnings Scheduled

Wrap up

Hopefully, we see a reversal in the overall markets and strength into the rest of the year. I am bullish and optimistic to see where the markets take us from this point, but at the same time, I am going to tread lightly and make sure that we are practicing safe risk management in the process. Many individuals are going to realize a significant amount of gains with relative ease today, while others are unfortunately going to fall asleep behind the wheel, so let’s see where this week takes us and prepare accordingly for some neutral confusion!

Good luck trading, and let’s start this week strong!!!