HaiKhuu Daily Report - 12/30/2025

Good morning, and happy Tuesday! I hope you all are ready for another neutral and slow day for the markets! Conditions should be fun, but man, oh man, is this going to be a difficult day for many traders.

As I’ve said over the previous couple of trading days, this week is going to be an entire wash, filled with extremely low volume and irrationality in the markets. There will be opportunities to scalp and day trade, but at the same time, we are going to watch as many traders are stuck in the process of attempting to capitalize on neutrality, and ultimately get burned as a result.

If you are attempting to trade today, please continue to tread lightly as more and more individuals are tuning out leading into the new year. Opportunities to trade will be available to us, but they will be far and few between. Please go into today expecting neutrality with the possibility of a momentum-based move, but be under the expectation that we are not going to see much overall movement. Once there is a confirmation of momentum, do not fight any trends.

Trend fighters and people overtrading will have an extremely tough time today.

The one toss up we have today is FOMC minutes being released around 2pm EST today. I’ll touch more on that later on in the report though.

As long as you are in strong equity positions and are not overallocating, I genuinely do not see a reason why you should not be able to capitalize on these conditions with relative confidence, so make some great decisions and realize some gains today, leading into the end of the year!

Good luck trading today, and let’s watch as $SPY breaks out!

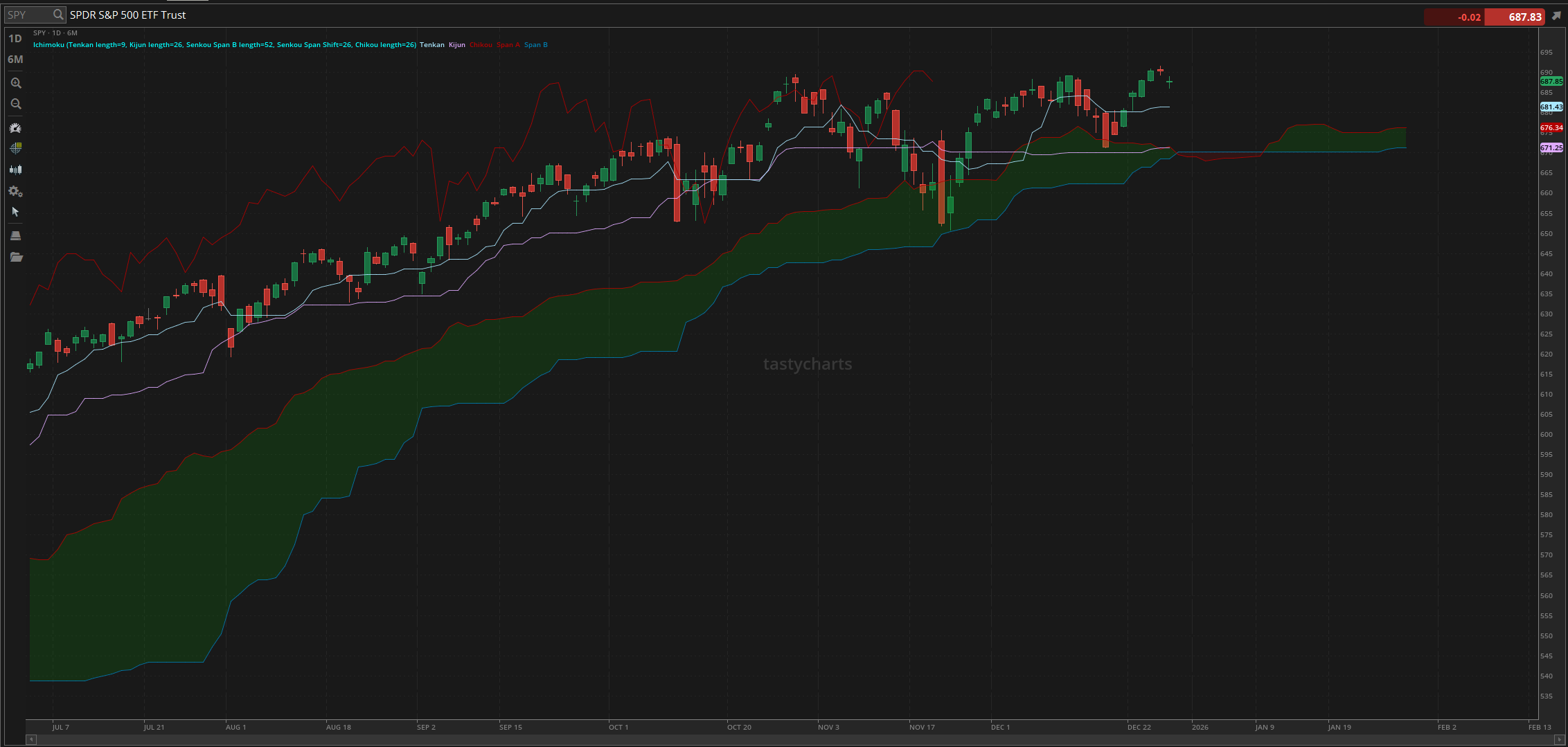

The updated $SPY daily levels are as follows:

Conversion Line Support: $681.43

Baseline Support: $671.25

Psychological Support: $680

Daily Cloud Support: $672.39

Thoughts & Comments from Yesterday - 12/29/2025

Yesterday was a gross day for the markets, but leading into the day, it was completely expected. Hopefully, you all heard the warnings that I wrote in the report and took that to heart while attempting to trade yesterday. The overall lack of momentum and opportunity was very easily predicted, and many traders should have had a relatively easier time simply watching the markets and not forcing any allocations. So as long as you listened to our warnings yesterday and allocated accordingly, you should have had an alright time!

We started yesterday with $SPY opening at $687.52, down about $3 from the previous close, watching as the markets were less than ideal throughout the morning. We did watch as $SPY quickly popped and went on to make the official high of the day, trading at $689.20. The early morning bullish momentum was short-lived as the next three hours were filled with mild bearish momentum, as we watched as $SPY went on to make the official low of the day during the lunchtime lull, making the official low of the day at $686.07.

Market conditions at the bottom were less than ideal, but thankfully, it provided us with opportunities to allocate towards the upside, where $SPY thankfully reversed and showed mild bullish momentum into the back half of the trading day, where $SPY went to test $688 once again, leading into close.

There was mild bearish sentiment leading into close, where we officially ended the day with $SPY trading at $687.85, meaning $SPY dropped $2.50 overall for the day, or just shy of 0.4% overall, but the disgusting part that I warned you all about, on an intraday basis, $SPY moved a total of $0.30, meaning that overall, $SPY moved up less than 0.05% on an intraday basis, meaning we were pretty neutral overall.

Again, hopefully you all listened to our warnings and prepared accordingly for yesterday, as many traders genuinely had a tough and terrible time, but those who prepared accordingly for yesterday honestly should have done phenomenally, so let’s see where the markets take us today and go from there!

S&P 500 Heat Map - 12/29/2025

Thoughts & Comments for Today - 12/30/2025

Today should be a fun time for the markets. Leading into the end of the year, I am under the full expectation that everything that I have brought up over the previous couple of reports will continue to remain true today. I am going into today with the expectation that we are going to see lower volume, lower volatility in the markets, and inconsistencies around the board. Those inconsistencies are going to heavily impact the large majority of individuals and cause them to allocate irrationally.

Once traders start to act irrationally, the markets will only continue to become more inconsistent in the short term, and as a result of that, anyone who is forcing trades or needs any “normality” in the markets is going to ultimately end up having a tough time.

I am not stating any of this in an attempt to scare any of you, but this is just one of those times where I genuinely believe that the large majority of individuals who will attempt to force any trades will have an unfortunate time.

Yes, some individuals will be able to catch opportunities and scalp here and there, but I am telling you all now, statistically going into the end of the year, with the way the markets are trending, I am not overly ambitious or excited about everything. Please, just be smart, be safe, and rational while attempting to trade.

Again, just to state my thesis so everyone understands what I believe we are getting into today:

Despite the fact that we are getting FOMC minutes today, I am expecting lower volume, low volatility, and overall neutrality in the markets, unless we get a directional momentum-based move. Then, the sentiment will follow the direction of the markets, depending on whether we are overly bullish or bearish. So just tread lightly and practice safe risk management.

Do not force any trades, and do not do anything you are not comfortable doing. If you believe you are taking on too much risk in the markets in the short term, you most likely are taking on too much risk. So just be smart and safe while you attempt to trade today, and you should be fine leading into 2026.

Just remember, this is your final chance to harvest losses for the tax year, so if you are not prepared for the tax season, this is your last shot.

And as a final reminder, markets are OPEN the ENTIRE day tomorrow, while they are CLOSED on New Year's (Jan 1st - Thursday), and Jan 2nd (Friday) will be extremely low volume with a directional momentum-based move.

Be smart. Be safe. And just have some fun leading into the end of the year. Much love y’all, and I am excited to see where the markets take us today!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $ORCL, $NVDA, $TSLA, $BABA, $MSFT

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 12/30/2025 (ET):

Chicago Business Barometer (PMI) - 9:45 AM

FOMC Minutes - 2:00 PM

Notable Earnings for 12/30/2025:

Pre-Market Earnings:

No Earnings Scheduled

After Market Earnings:

No Earnings Scheduled

Wrap up

Hopefully market conditions are not too slow leading into today, but I know that many individuals are going to have a tougher time navigating this neutrality. Just make sure that you are not over allocating or overtrading during this time as many individuals who want to trade will force positions that are less than ideal. Please just practice safe risk management into the end of the year so we can start 2026 strong, and have an amazing time!

Good luck trading, and let’s see where $SPY takes us!