HaiKhuu Daily Report - 12/31/2025

Good morning, and happy Wednesday! Welcome to the LAST trading day of 2025. It has been an honor to trade with you throughout the previous year, and I love the fact that you all are here on the final day of the trading year. I hope you all are ready for another low-volume, low-volatility day for the markets, because man, this day is gonna be another interesting one!

If today moves anything like the previous couple of trading days, go into today expecting lower momentum and volume in the markets. Conditions can be strong and filled with opportunity, but unless we do something extremely irrational in the markets, I genuinely believe the likelihood of that happening is slim.

Whatever you do, just make sure to end this year strong. $SPY is currently up 18% YTD, and up 40% from the bottom.

Anyone who says this hasn’t been a great year for the markets did not take advantage of the insane momentum that was provided to us, nor did they print as much as we have.

Congrats to everyone again for surviving all of 2025; you have to survive one more day to make it into 2026.

Good luck trading today, and let’s end this year strong!

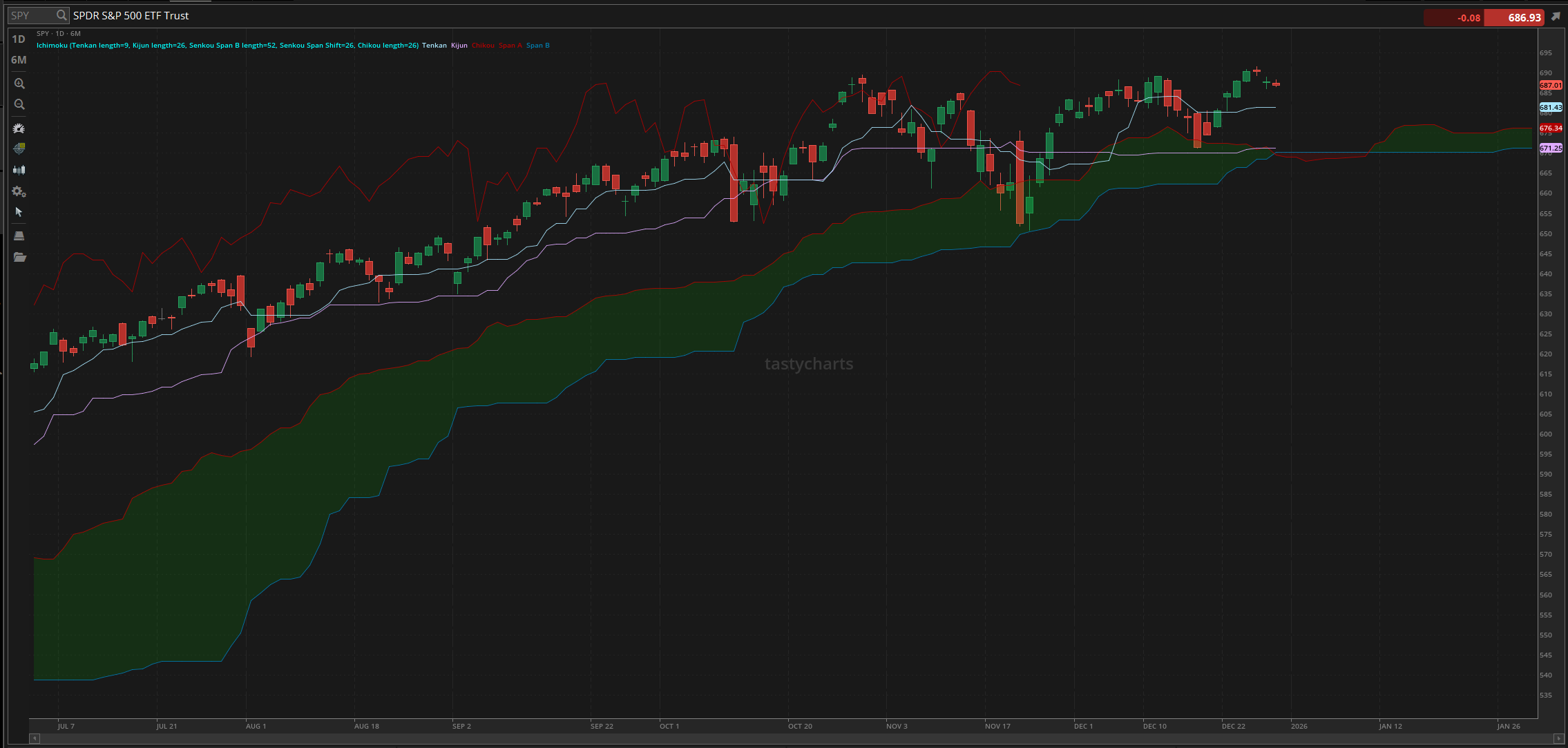

The updated $SPY daily levels are as follows:

Conversion Line Support: $681.43

Baseline Support: $671.25

Psychological Support: $680

Daily Cloud Support: $670.16

Thoughts & Comments from Yesterday - 12/30/2025

Yesterday was a snoozer and a half for the markets as we went into the day under the expectations of seeing low volume; the entire day lacked volume, volatility, and any sort of excitement. It is unfortunate, but it was highly anticipated leading into the day, so hopefully you all heard our warnings and prepared accordingly as a result.

We started yesterday with $SPY opening at $687.43, down slightly from the previous close, and watched as multiple times throughout the day, we watched as there was extremely mild bullish and bearish momentum. $SPY went on to test $688 before selling off and making the official low of the day at $686.58, and we watched as $SPY rallied slightly leading into the lunchtime lull, making the official high of the day trading at $687.43.

Market conditions were great, depending on how you allocated, and were honestly just lackluster for the majority of traders. We watched as $SPY remained within an extremely tight range on an intraday basis, having less than a +/-$1 range throughout the day.

Conditions were really slow, momentum was nonexistent, and the only people who really lost were those who did not accomplish anything yesterday or were stuck forcing trades in an extremely tight, slow market. Hopefully, no one was caught in a cycle of overtrading, and hopefully, no one lost a significant amount of gains. Still, regardless of how you allocated, you should not have lost too much overall, assuming that you held strong positions throughout the entire day.

We then went on to drop slightly leading into close, where $SPY remained in that range, and officially ended the day at $687.01, down $0.84, or approximately 0.12%. That means $SPY dropped $0.40 from its open price, and maintained that +/- $1 range throughout the entire day.

So, I am not going to say that it was an extremely neutral day for the markets…. but it was an extremely neutral day for the markets. Hopefully, you all had some fun, and let’s see where the markets take us today!

S&P 500 Heat Map - 12/30/2025

Thoughts & Comments for Today - 12/31/2025

Today will be an interesting time for the markets. If everything acts the way that it has over the previous couple of trading days, we should all expect another day of relatively mild neutrality. I do not believe that we are going to get a sizable breakout by the end of the year, but I would be happy to be wrong on that sentiment. So, the same sentiment I’ve provided over the previous couple of days remains.

Go into today expecting extremely low volume and neutrality. In the case that there is any sort of movement in the markets, assume that it is short-term irrationality and will not act consistently. In the case that there is a break in either direction, that break is going to be a directional movement that will result in people attempting to fight that trend. So, in the case we do get a directional move. Do NOT fight that trend. Simply follow the market momentum and do what you can to end the year strong.

The one concern I have for many traders today is that they will go into today and attempt to force trades and allocations. While it’s never bad to want to trade, forcing trades, mostly when $SPY is in an extremely tight range without the support necessary for a significant movement, means that you are taking on significantly more risk and exposure to attempt to realize gains, most likely resulting in considerably larger losses.

The comfortable and confident traders are not the individuals I am worried about today. Realistically, those traders are done trading for the year and won’t do anything that would result in significant losses today. It is those who overtrade and overallocate that are the ones who will get hurt.

I mean, look at yesterday. Assuming you attempted to trade $SPY almost anytime within the afternoon session, you had to be able to capitalize on a $0.10-0.25 cent range. I do not know about you, but I do not believe that it is worth it to attempt to trade $700,000 worth of shares to capitalize on a $100 movement.

Go into today treading lightly, be prepared to strike in the case we get an opportunity to do so, but just be rational with your decision-making. This is not the time to attempt to force any trades, and this is the time that you should honestly just sit back, relax, and reflect on how you traded this year.

Think about the trades that worked well, and contemplate ways to recreate it. Think about the plays that did not work out, and think about the reasons they failed. Look to replicate the winning strategies provided to you in 2025 again in 2026, and get excited knowing that regardless of where the markets take us, that HaiKhuu will be here by your side the entire time through 2026.

Thank you again for spending your 2025 with all of us here, and let’s kill it together in 2026!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

Tech: $ORCL, $NVDA, $TSLA, $BABA, $MSFT

Speculative: $PTLO, $RIVN

Long Dividend: $JEPI

Long Investment: $PTLO

Short: $BRK/B

Crypto: SOL

Economic News for 12/31/2025 (ET):

Initial Jobless Claims - 8:30 AM

Notable Earnings for 12/31/2025:

Pre-Market Earnings:

No Earnings Scheduled

After Market Earnings:

No Earnings Scheduled

Wrap up

This has been an insane year for everyone. I hope you all had a wonderful time actively trading with all of us throughout 2025. I just want to say again, thank you all for being here, and thank you all for putting up with my voice over the previous year. I am excited to see what adventures 2026 brings for us, and want to see the opportunities that will be available. We will make the most out of today, and end this year strong. Congrats again for surviving 2025, and let’s make it through today!

Good luck trading, and let’s see where $SPY ends the year!