HaiKhuu Daily Report 7/03/2023

Good morning and happy Monday! Hope you all are excited about this extremely short week for the markets! Just as a reminder, markets end early today with the equity markets closing at 1 PM EST today, and the markets are CLOSED tomorrow for July 4th. This should be an extremely quick, and fun time for the markets today, so look to take advantage of the opportunities that are presented to us right now!

Historically today is a bullish day for the markets, and markets are looking strong at the moment, so look to take advantage of the movement in the current market and attempt to capitalize on this lower volume. This low volume should lead to significant buying, but it is just a matter of watching the confidence in the markets and capitalizing on the general momentum.

This should be fun today so good luck trading today and let’s make some bank!

Thoughts & Comments from 6/30/2023

Last week was a fun time for the markets with a significant amount of opportunity to actively trade and realize some gains. We continually hit new 52-week highs throughout the week and the markets displayed a significant amount of confidence in the process of everything.

The week started off relatively slowly, with $SPY opening the week trading at $432.62 and showing some weakness in the markets. We continually came down throughout the day and made the official low of the week trading right around $431, before picking up slightly into close.

Tuesday was a bullish day for the markets as everything continually pushed up toward the daily resistance level. For the next couple of days, we chopped around that daily resistance level around $437 as the markets had to decide to break out or come down, and on Thursday, we officially closed the day above that daily resistance, providing us an amazing opportunity to capitalize on some bullish movement in the markets.

Friday was an amazing time for the markets. As we broke and held above that daily resistance level, it showed there was a significant amount of confidence that everyone could have easily capitalized on.

We started the day with $SPY trading at $441.42, coming down slightly to make the low of the day at $441.11, and continued to consistently push throughout the entire day providing us with a lot of confidence in the markets. We did see a slight lull during lunch, where $SPY did come back down to $442, but there was so much confidence in the markets that as volume came back, there was a significant amount of bullish movement.

Going into power hour, the close really did not provide us with enough confidence to continue to push the markets up consistently, but we were able to see a break out that ultimately lead to $SPY making a new high of the day, and a new 52-week high for the markets. $SPY popped up to $444.30, but shot down right into close. This definitely was an institution buying and reallocating, but hey, a high is a high right?

We ended the week with $SPY trading at $443.28, up $5.17 for the day, or approximately 1.18%, with an intraday bullish movement of 0.4% and up $10.65 for the week, or approximately 2.5%.

It was an amazing week for the general markets providing us with a significant amount of realized gains in the process of everything. I hope you all were able to capitalize on the momentum in the markets and realized some gains in the process of everything! Great job trading last week and let’s see what this week has in store for us!

Thoughts & Comments for Today, 7/03/2023

Today as I said before is a shortened day for the markets, so I personally am not expecting to see a significant amount of both volatility and volume today. It is historically a bullish day for the markets, so there will definitely be a lot of opportunities to trade and realize some gains. Look to ride the momentum in the markets and follow the direction we are trending. It will be extremely difficult to fight any trends today and will be even harder trying to time out a relative bottom or top.

The day will be over extremely quickly, so expect to see larger movements in the markets right around open and close, and having a short lull around 11-12 EST.

I would not recommend attempting to allocate today if you are attempting to get into any general swing trades or equity positions, as today is going to be a day for the traders.

Traders, while attempting to trade today please be careful. As I have said before, look to follow the momentum in the markets and follow the direction. It will be extremely difficult to capitalize on the bullish momentum today via attempting to scalp what you believe is the top or the bottom, so simply get into a day trade in a position you are comfortable in that you believe has a lot of confidence today, and capitalize on that accordingly.

If you get lucky, you might be able to capitalize on some scalps, but it will be extremely difficult to navigate these markets consistently with confidence today.

My personal strategy for the day is to go into the day without any intentions of forcing any entries or exits. If I see an opportunity that is worth actively attempting to capitalize on, I will look to play it. For me to want to enter into anything, I would want to see a lot of confidence in the position, while setting a tight stop and continually adjusting that play on the way up.

I wouldn’t want to force any trades in the markets, and I especially do not want to enter assuming there is not a significant amount of confidence. I am looking for opportunities in the markets, but I am not desperate to want to force any trades. I would rather sit out and relax on a shortened day in the markets, than force a position that, will ultimately lead me to realize a significant amount of losses, and I would recommend the same to you.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

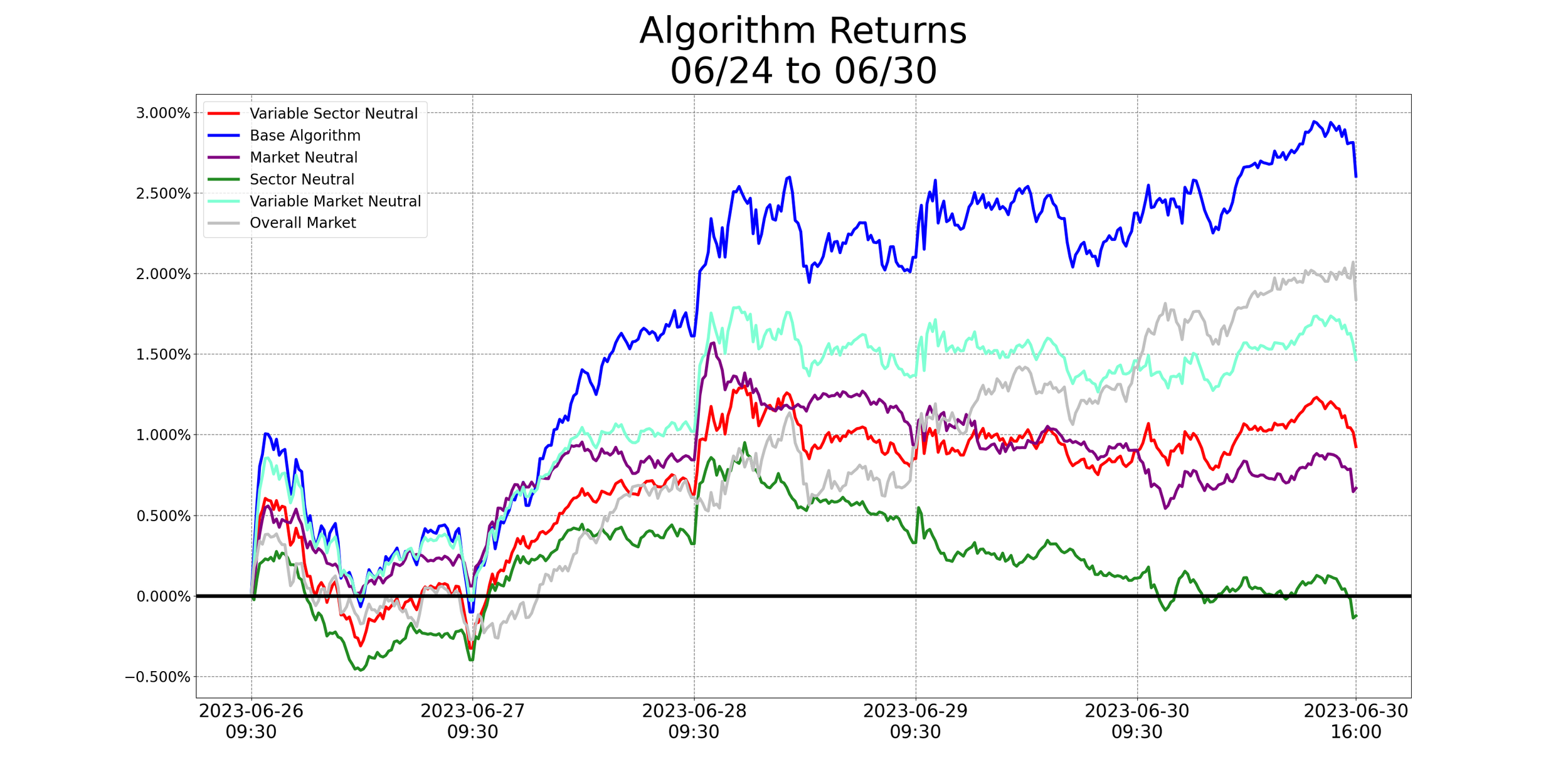

HaiKhuu Proprietary Algorithm Report:

Last week was an amazing week for both the markets and our systems. Our long-term portfolio was able to outperform $SPY by a significant margin and I am very excited about those results, and the technical analysis was able to slightly outperform the fundamental analysis it was built on. The slight beat was not of any major significance in terms of returns, but it is still an absolute win knowing that the portfolio beat out our fundamental analysis.

To get an in-depth insight into what we are working on and the results of last week, check out Asher’s Report!

The results of last week are as followed:

Baseline:

$SPY: +1.84%

Our Results:

Base Algorithm: +2.6%

Long-Term Portfolio: +2.56%

Variable Market Neutral: +1.46%

Variable Sector Neutral: +0.92%

Market Neutral: +0.67%

Sector Neutral: -0.13%

With market conditions being shortened today, I would advise caution with these positions. Everything is valid from a technical analysis standpoint, but the markets are going to be relatively difficult to navigate without a solid plan. Make sure to do your own due diligence prior to entering into any of these positions and make sure to practice safe risk management. Today is going to be one of those days when the goal is to set a stop in guaranteed profit as soon as possible. Assuming that everything works with a significant amount of confidence, you should be able to realize some gains with relative ease.

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

Algorithmic Alerts for 7/03/2023

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $VIX , $NVDA, $TSLA , $AAPL , $DIS, $RIVN, $BABA

Position Opportunities:

Ride the momentum in the markets

Hedge the positions you want to hold

Set stops in guaranteed profit for any position you are in profit in

Cut all positions you are not comfortable holding

Exit positions you are comfortable taking profit on

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN

Long-Term Riskier EV Play - $RIVN

Economic News for 7/03/2023

S&P flash U.S. manufacturing PMI - 9:45 AM ET

ISM manufacturing - 10 AM ET

Construction spending - 10 AM ET

Notable Earnings for 7/03/2023

Pre-Market Earnings:

None Scheduled

After-Market Earnings:

None Scheduled

Wrap up

Again, today is a shortened day for the markets, look to follow the general momentum for the day, but look to capitalize on any and all of the opportunities available to us in these market conditions. Scalp only when you have confidence, but look more towards entering into strong day trades and simply ride the momentum in the markets. Make some smart plays, realize some gains, and enjoy the shortened day with the markets closing at 1 PM EST, knowing the markets are closed tomorrow!

Good luck trading today, and let’s make some bank!