HaiKhuu Daily Report 8/25/2023

Good morning and happy Friday! Hope you all are having an amazing morning and are excited for what today has in store for us! Markets are up at the time of writing this report and looking relatively strong at this time. It would not surprise me to see some bullish momentum to end this week off with some relative strength, mostly after the selling-off that incurred yesterday, but at the same time, these market conditions are confusing and very difficult to navigate.

We have a significant amount of economic speakers today, so expect to see a lot of movement in the overall markets and understand that there will be a lot of conflicting points that come up that will impact the momentum in the markets.

Please continue to make smart decisions and practice safe risk management, as people who are taking a significant amount of risk are the ones who are going to be impacted the heaviest by this indecisive market movement. Tread lightly on these market conditions, do not be overly bullish or bearish, and simply follow the momentum in the markets.

Good luck trading and take advantage of this market momentum!

The updated $SPY daily levels are as follows:

Conversion Line Resistance: $439.83

Base Line Resistance: 446.23

Strong Psychological Resistance: $440

Weak Psychological Support: $430

Cloud Resistance: $445.41

Cloud Support: $432.53

Thoughts & Comments from 8/24/2023

Yesterday was a tough time for the general markets with a significant amount of bearish momentum that was unexpected after a beautiful movement up as a result of $NVDA earnings.

We started the day beautifully green, with $SPY opening the day above major resistance, trading at $444.66, and looking bullish. We quickly dropped right from open, and that felt like it was simply the beginning of the end. The drop was short-lived, as the markets quickly bounced up from the relative low, making the official high of the day trading at $445.66, and looking relatively strong. Despite this strength though, we quickly started to sell off, and the bearish momentum came back extremely quickly back into the markets.

$SPY dropped and officially went black for the day approximately 45 minutes after the markets opened, signaling that we are most likely going to continue to move down for the majority of the day, and that is exactly what happened. $SPY dropped and dropped some more.

Going into the lunchtime lull, we were actively testing $440 on $SPY and it seemed the selling did relatively slow down, but as we had extremely low volume, $SPY did make a dip right at Noon EST, making a relative low trading under $440. The markets did bounce back up and break above $440 as people started to come back from lunch and allocate into the markets. This buying though was short-lived, as sellers quickly matched the buying at an overwhelming rate, causing the markets to continue to move down.

The markets continued to drop though for the rest of the day, with no solid bullish momentum, and as a result, we watched as the markets continued to bring more fear into the retail space.

Power hour was not any better, as the markets continued to drop for the large majority of the time, with no opportunities to scalp to the upside, and the final result was that $SPY continued to dive into close, making the official low of the day, trading at $436.86, and closing the day trading at $436.89, down $6.14 for the day, or approximately 1.4%, with an intraday bearish movement of -1.74%.

It was an absolutely terrible day for the markets as a result of $NVDA dropping approximately 6% from the top, and people realizing a significant amount of losses as a result of this.

I hope that you all have been doing alright, and were able to survive trading yesterday. Days like yesterday are the reason why I am always advocating for proper risk management, and to tread lightly on market conditions that are not optimal. Please continue to practice safe risk management, and follow the momentum in the markets.

Let’s see what today has in store for us and have a great time in the process!

Thoughts & Comments for Today, 8/25/2023

Today is going to be another interesting time for the general markets. $SPY is looking strong at this moment with lots of opportunities to gain confidence. $SPY is up nicely at the time of writing this report and I think that realistically we can continue to see relative strength throughout the day. As I have been saying before, do not be overly bullish nor bearish in the markets at this point, as you can expect to see a significant amount of chop in the short term, so do what you can to maximize your profits.

It will be very interesting to see what happens as $SPY is looking strong, but we are coming up on major psychological, and technical resistance in the markets right now.

Watch out for $SPY $439.83 as that is the daily conversion line resistance, and watch out to see what happens around $440 on $SPY. If we break through, there is going to be a significant amount of confidence in the markets, but just make sure you are treading lightly, as market conditions are going to be relatively choppy today.

As long as you are fluid with your positions in the markets, you will be able to realize a significant amount of gains, with relative ease as a result of this. Just continue to trade and follow the momentum in the markets. We are looking strong going into the market open, but if there is a relative shift throughout the day, or early in the morning, just make sure to simply follow the momentum in the markets, and do not fight any trends. If we continue to look strong, this will be a great opportunity to sit back, relax and enjoy.

I know I’ve been saying this for a while, and will continue to say it though. Look to actively day trade and scalp in these market conditions. If you are dead set on a direction, and have a conviction on the movement, you may be correct, but you may also be wrong in the short term. I’ve noticed this to happen to a lot of the best traders. They are right in the direction they want the markets to go, but the markets move against them ever so slightly, making them overthink their position and get stopped out of a play due to the psychological impact, while in reality, if they simply just stepped away from the screen for a short period of time, the would have been able to realize gains, with ease.

If you are able to actively day trade, what will happen is that a lot of these traders will be able to capitalize on this movement in the markets, and realize gains on a very consistent basis as a result of this. They may not get the large overall movement, but they will be able to enter and exit positions extremely quickly, as they have conviction on how the markets are going to move in a short period of time, with enough confidence that there is not much downside risk, and if there is any real downside risk, they are able to navigate the conditions accordingly to minimize the risks that are incurred.

Personally, I do not know how much active trading I am anticipating doing today, but if I get into anything, it will either be getting long equity in $DIS and grabbing some general scalps in the markets. But if I do not have conviction about the overall direction, I am just going to sit back and continue to study, as over-trading in these market conditions is going to be overly risky, and there is no reason to not have confidence while attempting to trade, mostly in these conditions.

If you want to watch any of my allocations, they will be posted live in the HaiKhuu Discord.

HaiKhuu Proprietary Algorithm Report:

Yesterday was a great day for our systems as a result of the long-term portfolio outperforming the markets by such a large margin. Despite this massive win, we still are not extremely optimistic about the current conditions nor are attempting to lift the hold on the algorithm in the near future. We apologize for this ongoing hold, but I would rather have these positions be on a tentative hold and not have our endorsement than endorse something that we cannot back with confidence. We will still continue to provide positions and updates for both transparency and consistency's sake, so just be smart, be safe, and practice safe risk management with all of these positions.

To get an in-depth analysis of our algorithms' performance, check out Asher’s Report!

The results of yesterday are as followed:

Baseline:

$SPY: -1.74%

Our Results:

Market Neutral: +0.31%

Sector Neutral: +0.19%

Variable Sector Neutral: +0.07%

Variable Market Neutral: -0.03%

Long Term Portfolio: -0.28%

Base Algorithm: -0.43%

With our tests not being concluded yet, we are still not endorsing any of these positions and recommend you take everything with a grain of salt

Utilize this list more so as a watch list & confirmation bias for positions you may be interested in entering, than a blind signal to enter. If you take any of these positions, make sure you are practicing safe risk management in the process and do what you can to maximize your profit potential at this time!

DISCLAIMER - This is not financial advice. Utilize these trades with caution. These predictions are generated via our proprietary trading algorithm without taking into account market conditions, news, or any external biases. This is not a signal to buy or sell any equities, and we do not guarantee success. Take these at your own risk.

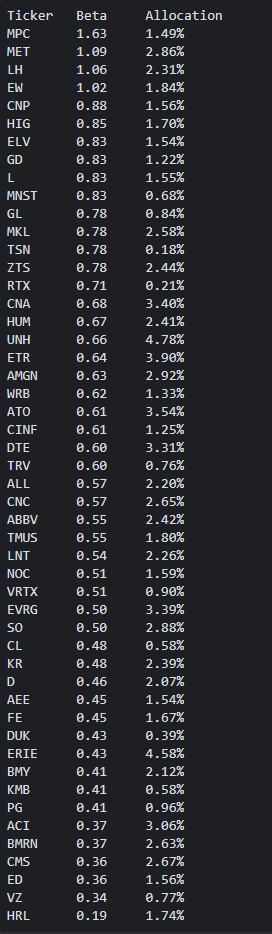

Algorithmic Alerts for 8/25/2023

My Personal Watchlist :

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY , $DIS, $NVDA , $AAPL, $MSFT, $TSLA, $AMD, $MAT

Position Opportunities:

Follow the momentum in the markets

Open up hedges for any positions you want to hold

Exit all positions you are not comfortable holding

Watch for a breakdown

Hold cash to allocate accordingly at the bottom

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $DIS

Economic News for 8/25/2023

University of Michigan Consumer Sentiment, Final - 10:00 AM ET

Powell Gives Opening Speech at Jackson Hole Summit - 10:05 AM ET

Notable Earnings for 8/25/2023

Pre-Market Earnings:

SatixFy Communications (SATX)

Ubiquiti Inc. (UI)

IperionX Limited (IPX)

Bridgeford Foods Corp. (BRID)

Wrap up

Overall, this is going to be an interesting way to end the week. Please be smart and take advantage of the opportunities that are available right now, but please just be smart and follow the momentum in the markets. Things are looking good at the moment, but we can see a shift in market momentum anytime throughout the day. So please just take this into account while actively trading, and be smart in the process of everything.

Good luck trading, and let’s end this week strong!