Weekly Algorithm Review: 04/29/2023 to 05/05/2023

Performance Rankings

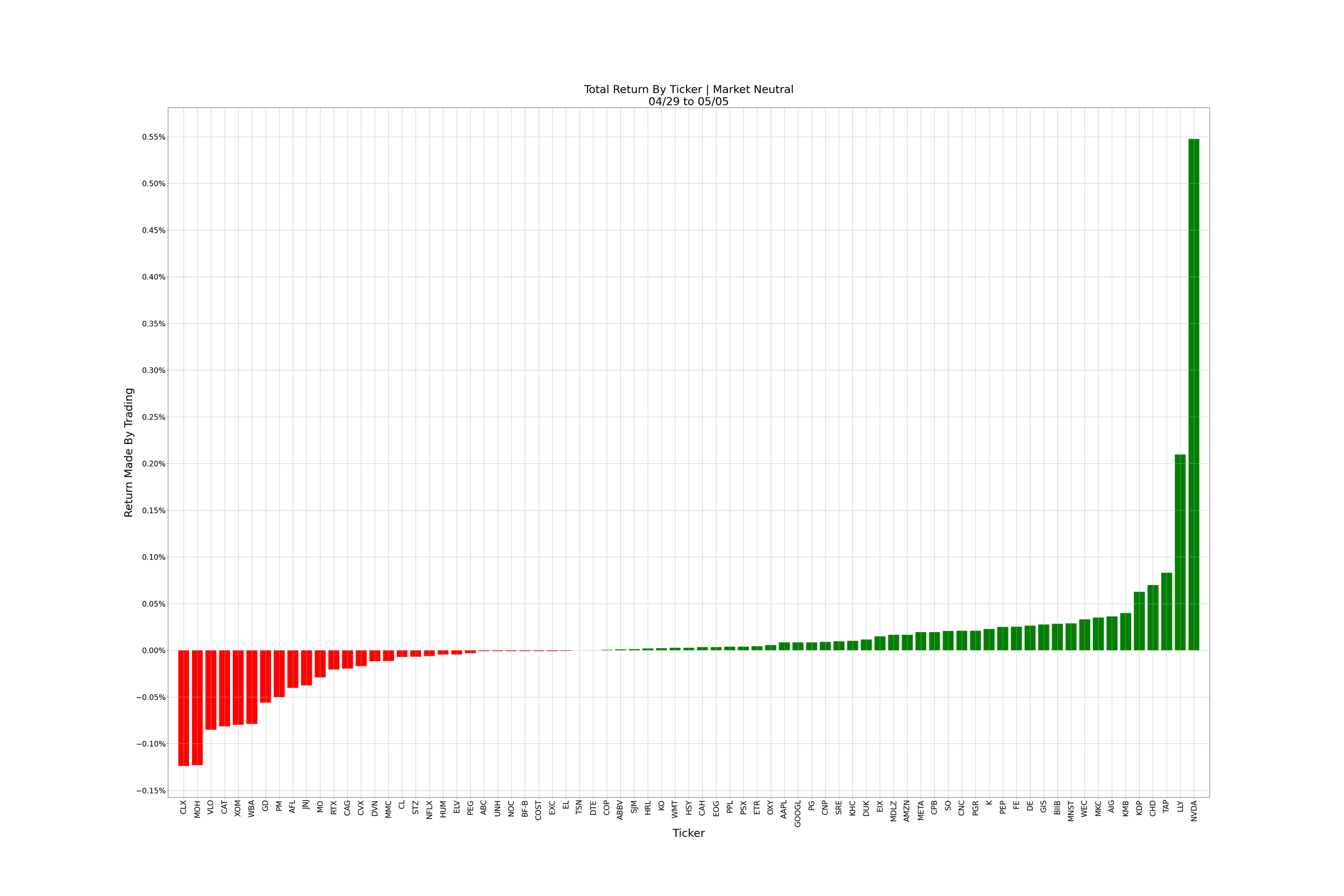

Market Neutral: +0.65%

Variable Market Neutral: +0.2%

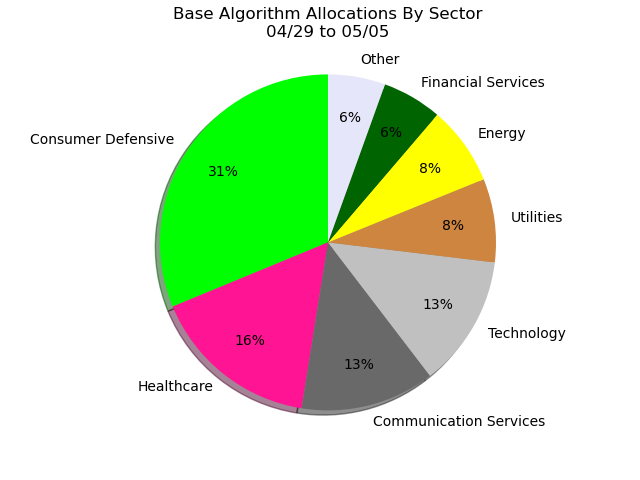

Base Algorithm: -0.11%

Variable Sector Neutral: -0.29%

Sector Neutral: -0.32%

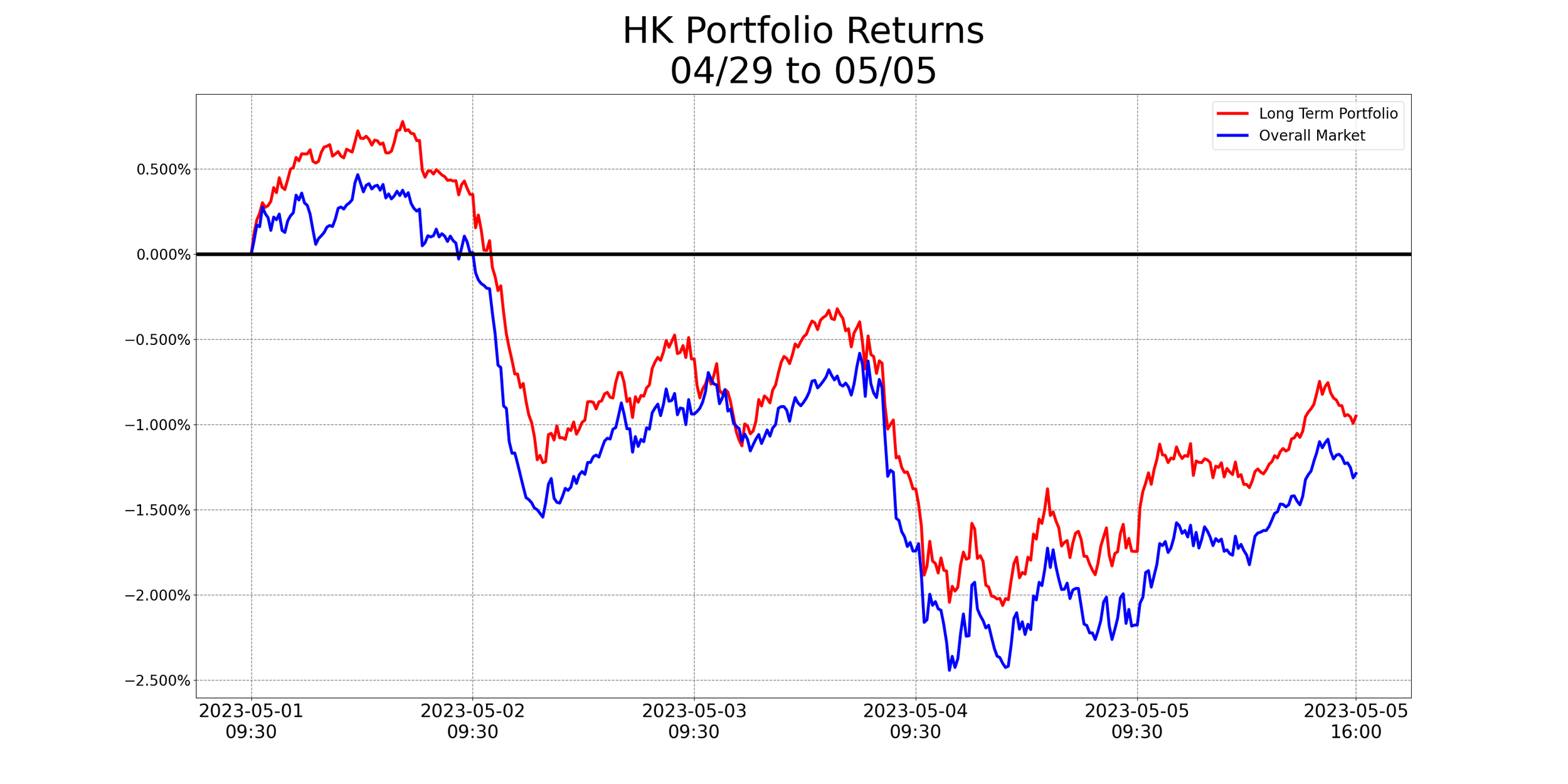

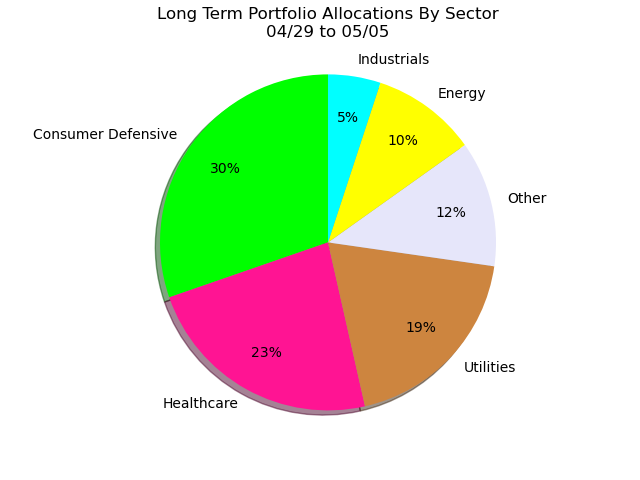

Long Term Portfolio: -0.95%

Overall Market: -1.29%

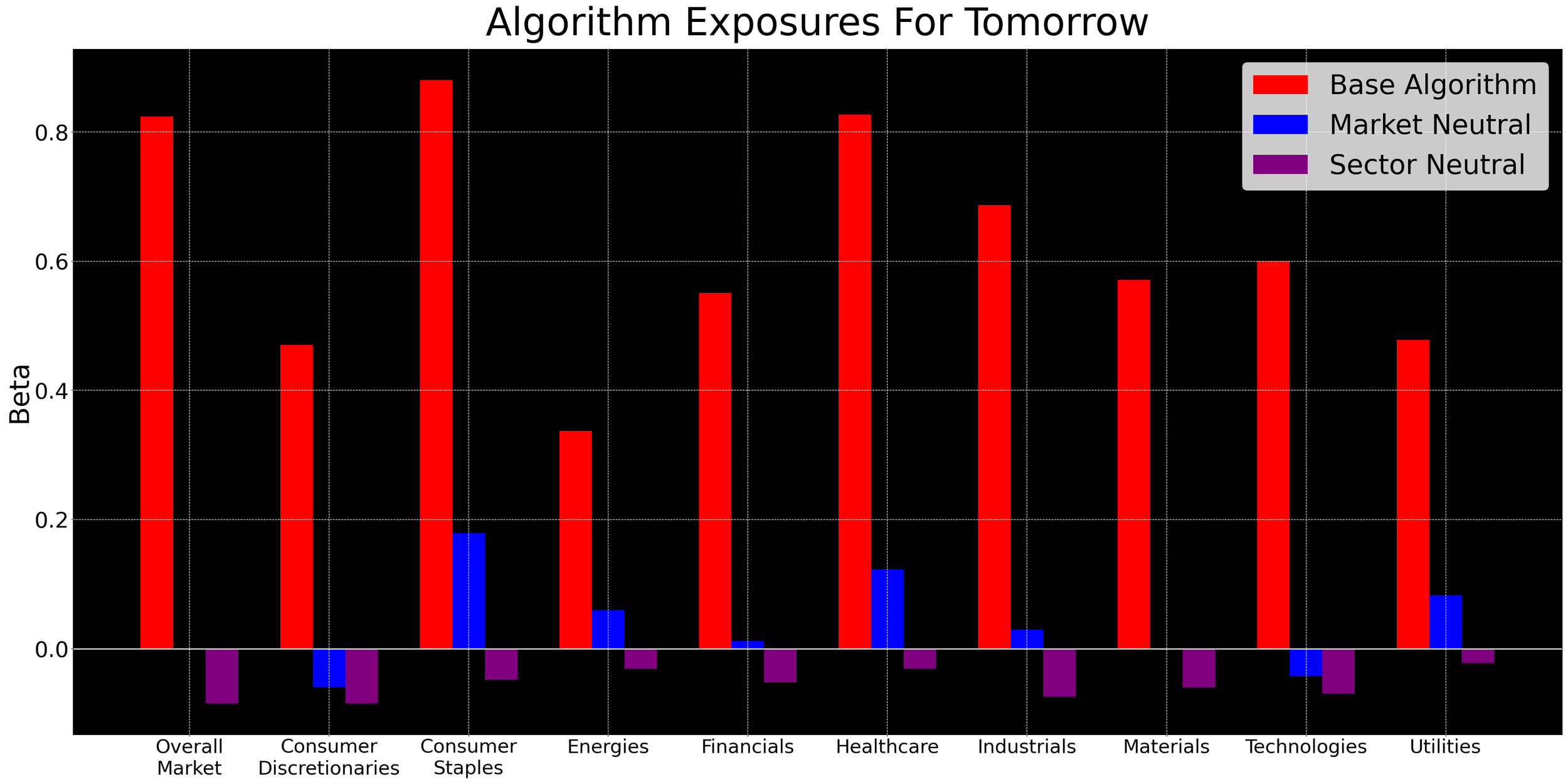

Overall, this week was roughly what we expect to see on a market downturn. Our long term portfolio outperformed the market overall, with our base algorithm further outperforming that - and our market neutral system doing even better. This netted us a 118 bps victory with our main algorithm this week - a great success for us!

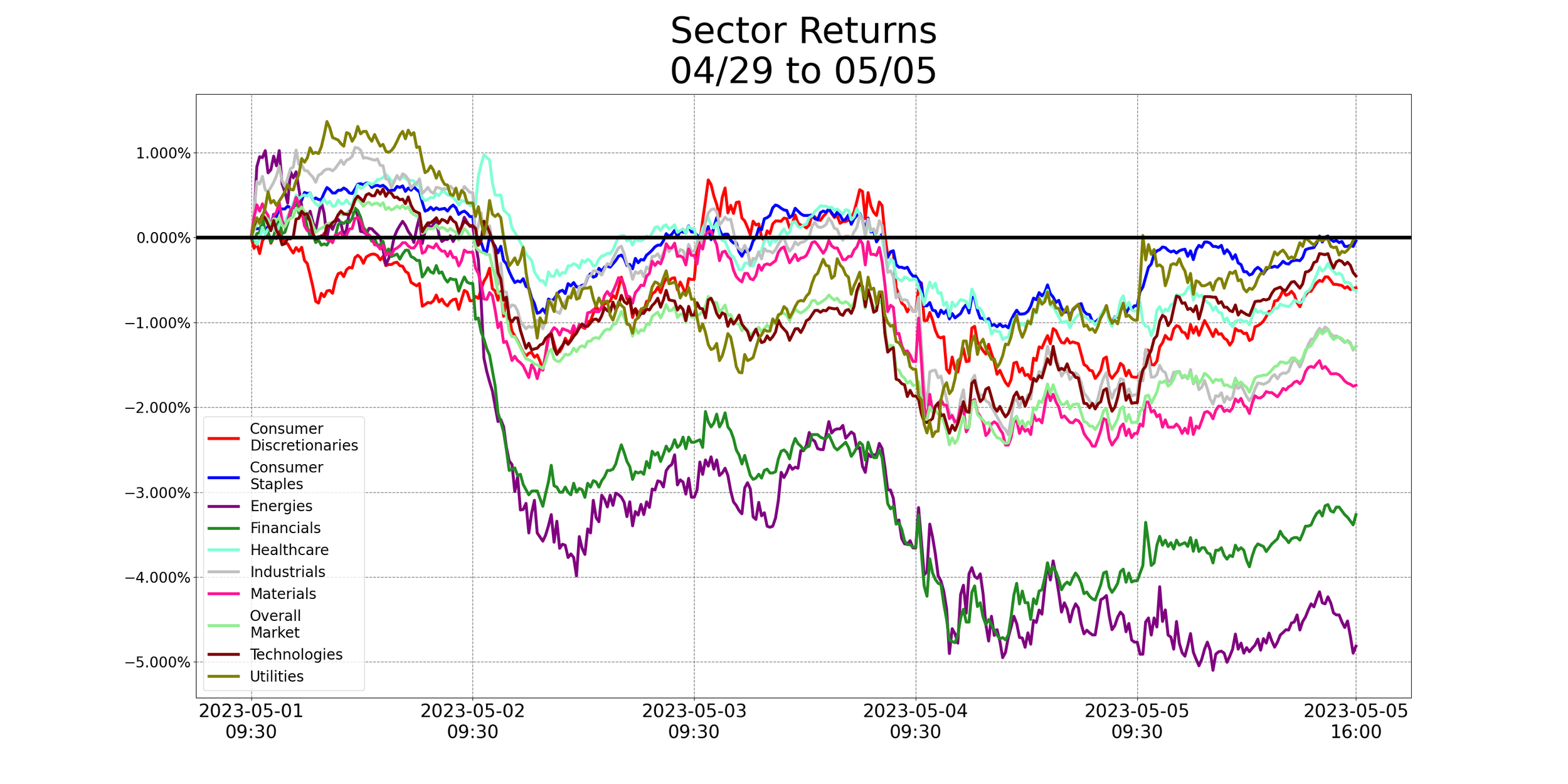

Even the variable systems fell in between the base algorithm and their respective hedgers. The only slight anomaly this week was our sector-hedgers, but this can be explained by simple variance.

Our sector neutral algorithms missed the train on NVDA this week. We aren’t considering this a red flag, because it’s only 1 ticker missed, and only for a few days - way too small a sample size to draw any meaningful conclusions.

All in all, we’re fairly happy with performance this week. I’m maintaining my red flag on NVDA for the time being. It worked out well this week, but it’s still a lot of exposure, and our base algorithm would have outperformed even if we hadn’t held any of it.

What’s In The Pipeline?

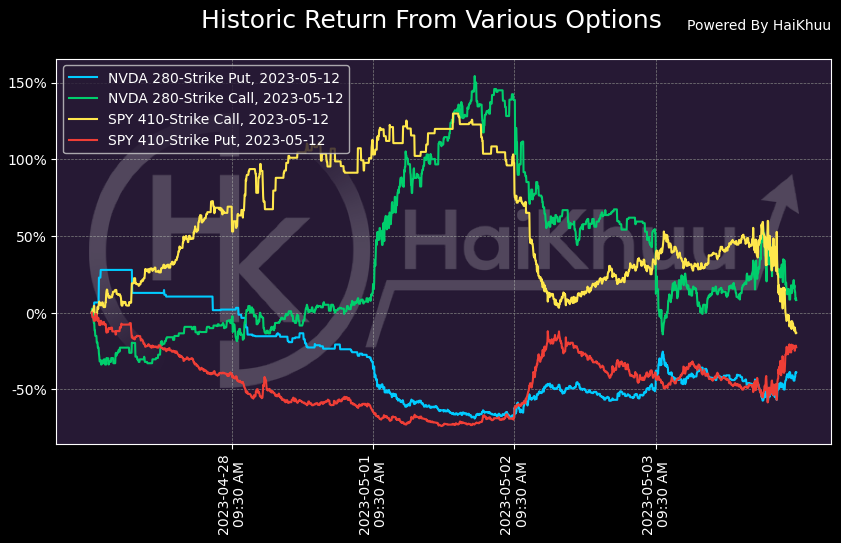

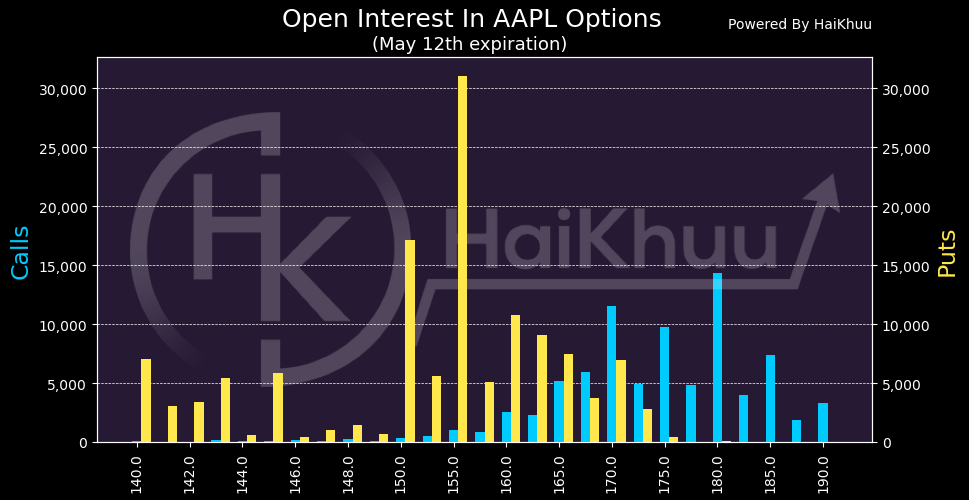

We’re working on a big update to our grapher bot: options data! This update is going to be a long project, since these charts are often more complex. Expect historic data, backtesting capabilities, and some utilities to help plan out your trades.

(This one depicts a simple iron butterfly on SPY)

Misc. Data For The Week