Quadruple Witching Meaning and Dates in 2023

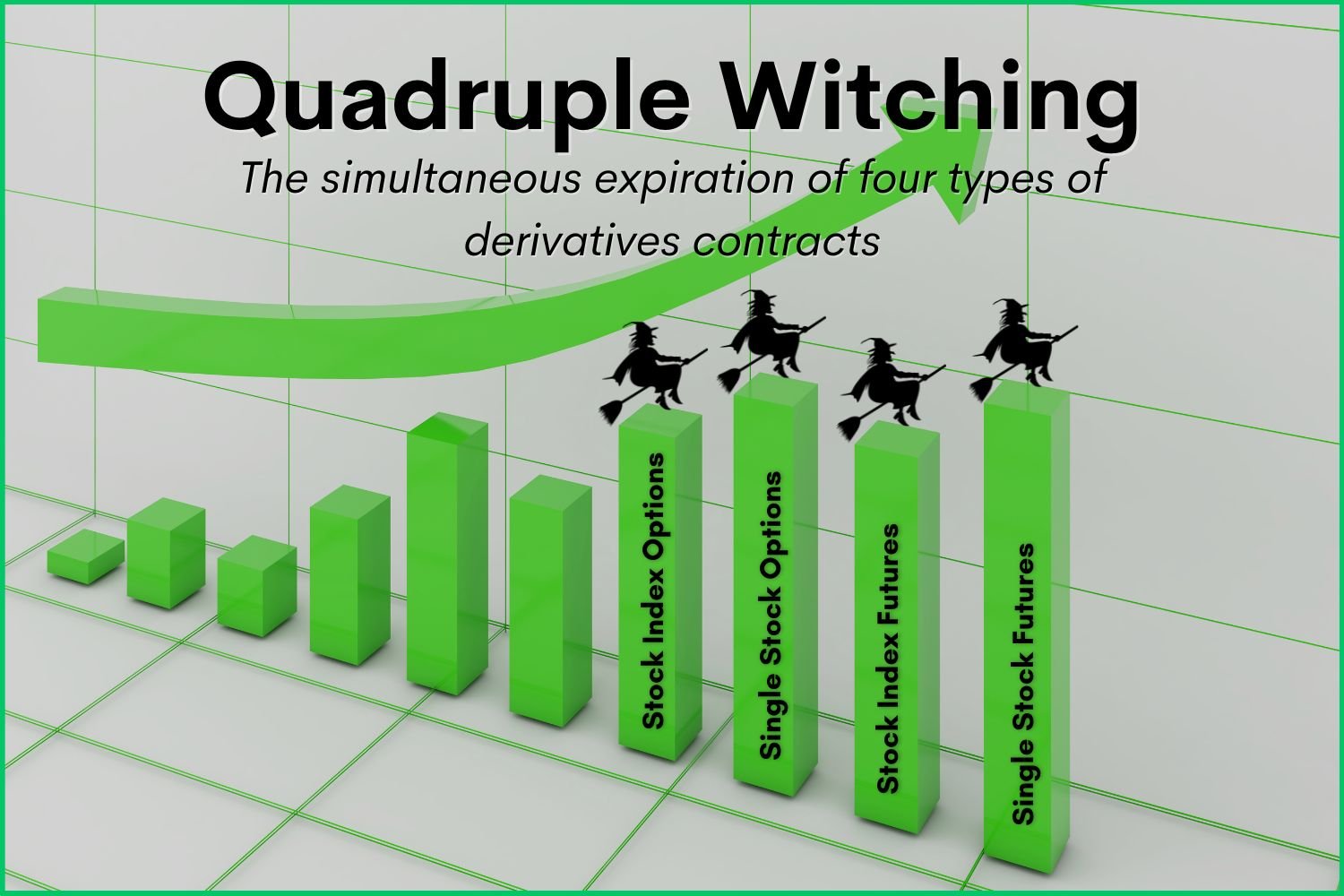

Quadruple witching is a term that refers to the simultaneous expiration of four types of derivatives contracts: stock index futures, stock index options, stock options, and single stock futures. However, since single stock futures stopped trading in the U.S. in 2020, the event has effectively become “triple witching.”

This event occurs on the third Friday of March, June, September, and December. Volume generally increases on these days since many traders are rolling over and closing out expiring derivative contracts.

Despite the increase in trading volume, triple witching does not usually cause increased market volatility but rather a lot of chop throughout the day.

Quadruple Witching Dates 2023

These are the dates for 2023:

March 17

June 16

September 15

December 15

How Does Quadruple Witching Impact the Markets?

Quadruple witching can have a significant impact on the market, primarily through an increase in trading volume. This is because when derivatives expire, traders must close or adjust positions, which can trigger significant volume and order flow.

For example, a trader who holds a long position in a stock index future may decide to sell the future and roll it to the next expiration date.

Traders who hold a short position in a stock option may decide to buy back the option and roll it to the next expiration as well, causing increased trading volume.

The impact of quadruple witching may vary depending on the market conditions, the liquidity of the contracts, and the expectations of the traders.

Some traders may try to take advantage of arbitrage opportunities or price discrepancies that arise from quadruple witching. Others may try to avoid trading on these days to reduce transaction costs or risks.

Types of Contracts That Expire on Quad Witching

The following contracts expire simultaneously on quad witching:

Stock Index Options

Stock index options are contracts that give the buyer the right, but not the obligation, to buy or sell a specific stock index at a predetermined price and date. For example, an S&P 500 (SPX) call option gives the buyer the right to buy the S&P 500 index at a specified strike price before or on the expiration date.

Single Stock Options

Single stock options are contracts that give the buyer the right, but not the obligation, to buy or sell a specific stock at a predetermined price and date. For example, an Apple call option gives the buyer the right to buy Apple shares at a specified strike price before or on the expiration date. There are many options strategies to utilize to trade single stock options.

Stock Index Futures

Stock index futures are contracts that obligate the buyer or seller to buy or sell a specific stock index at a predetermined price and date. For example, an S&P 500 future (ES) obligates the buyer or seller to buy or sell the S&P 500 index at a specified price on the expiration date.

Single Stock Futures

Single stock futures are contracts that obligate the buyer or seller to buy or sell a specific stock at a predetermined price and date. For example, an Apple future obligates the buyer or seller to buy or sell Apple shares at a specified price on the expiration date.

However, as mentioned earlier, single stock futures stopped trading in the U.S. in 2020.

Quadruple Witching vs. Triple Witching

The difference between quadruple witching and triple witching lies in the number of financial contracts that expire simultaneously.

Quadruple Witching: This refers to the simultaneous expiration of four types of derivatives contracts: stock index futures, stock index options, stock options, and single stock futures. However, since single stock futures stopped trading in the U.S. in 2020, the event has effectively become “triple witching.”

Triple Witching: This is essentially the same as quadruple witching but without the single stock futures. So, it involves the simultaneous expiration of three types of derivatives contracts: stock index futures, stock index options, and stock options.

Both events occur four times a year, on the third Friday of March, June, September, and December. On these days, trading volume typically surges as traders adjust their portfolios and roll some contracts. Despite the increase in trading volume, triple witching does not usually cause increased market volatility.

How to Learn More About Trading

If you want to learn more about trading and investing in the stock market, you can join the HaiKhuu Trading community. HaiKhuu offers free daily morning reports, live trading calls, and a community of thousands of like-minded traders and investors.

You can also access educational resources, market insights, and trading tips from experienced professionals. Whether you are a beginner or an expert, HaiKhuu can help you achieve your financial goals. Join today and start your trading journey with HaiKhuu!