Technical Analysis

Options Trading

Fundamental Analysis

Recent Posts

Call Options: How You Can Trade Them With Examples

Discover what call options are and how you can trade them profitably.

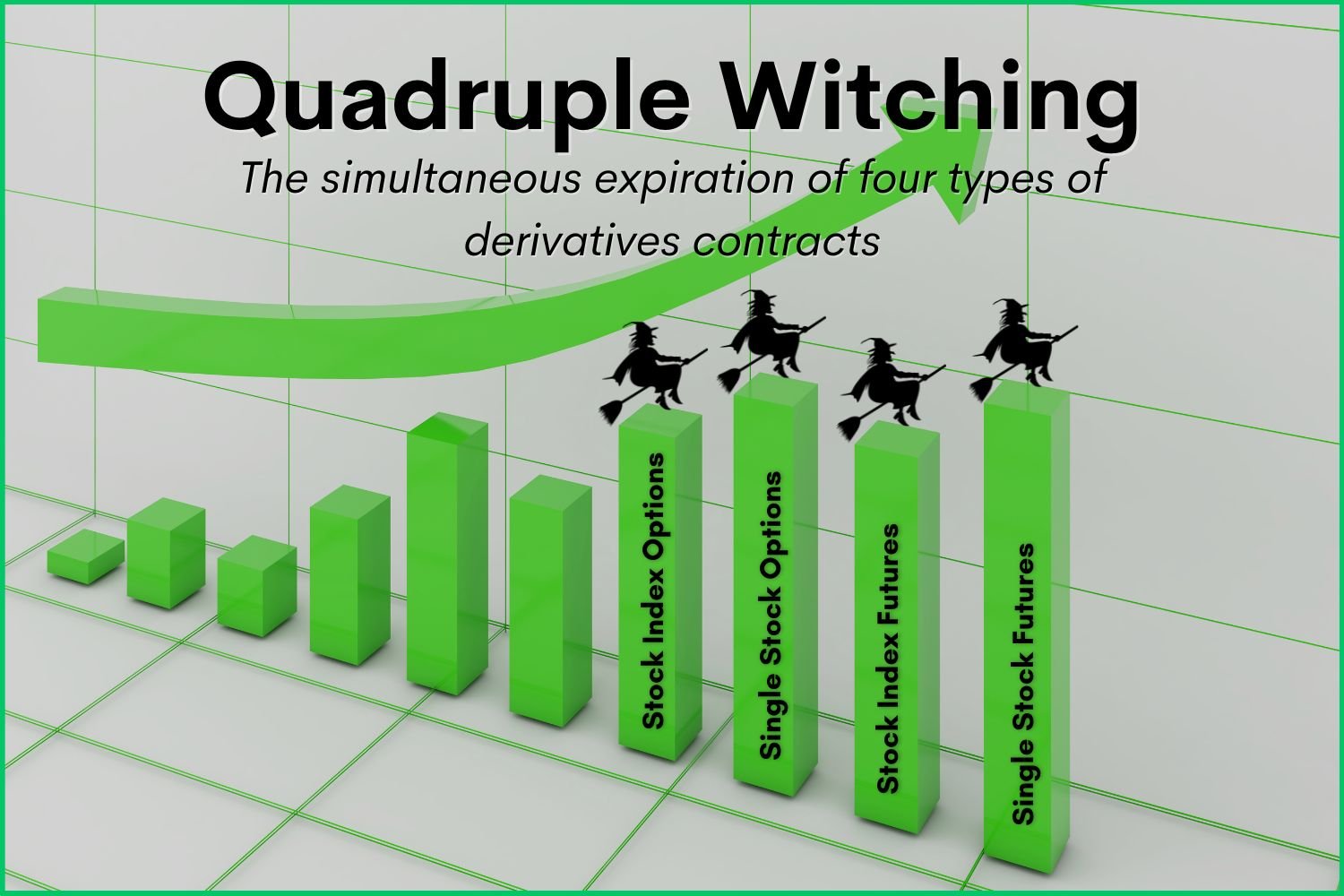

Quadruple Witching Meaning and Dates in 2023

Discover the triple witching meaning and why they are significant for traders.

The 5 Best Options Strategies for High Implied Volatility (IV)

Discover the best options strategies for high implied volatility environments.

The 6 Best Options Strategies for Small Accounts

Learn the best option strategies for small accounts, how to trade options with low capital, and how to manage risk effectively.

Intrinsic Value vs. Extrinsic Value in Options Trading

Learn the difference between intrinsic value and extrinsic value in options trading and how they affect your strategies.

Call Debit Spread Options Strategy Explained

Learn about call debit spread options strategy, including its definition, examples, max profit & loss, breakeven price, and more.

Bear Put Debit Spread Option Strategy

Learn about put debit spreads, a bearish options trading strategy with limited profit and loss. Discover how to construct, calculate, and manage a put debit spread.

Option Delta Formula, Meaning, and Calculation Explained

Discover the meaning of options delta, and how to calculate option delta with the correct formula.

Short Strangle Option Strategy: A Guide for Traders

Learn how to profit from a neutral market with the short strangle option strategy. Find out the risks, rewards, and adjustments of this strategy.

Jade Lizard Options Strategy: Should You Trade It?

Learn about the Jade Lizard options strategy, an advanced trade that combines a short put with a call credit spread.

Notional Value Meaning: Assessing Risk in Derivatives Trades

Explore notional value in derivatives trading, its meaning, role in risk assessment, and impact on options, swaps, and futures.

Option Volume vs. Open Interest: Key Metrics for Options Traders

Explore the key differences between option volume and open interest, their significance in options trading, and insights for informed decision-making.

Realized vs. Implied Volatility | You MUST Know the Difference

Learn about realized vs. implied volatility in options trading. Discover how to calculate both and whether implied volatility is overstated.

Short Straddle Options Strategy | What is a Short Straddle?

The short straddle options strategy involves selling ATM options when you believe implied volatility will drop, and the stock will remain stagnant.

Iron Butterfly Options Strategy | What are Iron Butterflies?

The iron butterfly options strategy is an excellent way to short volatility and take advantage of theta decay as an options trader.

What are Calendar Spreads? | Calendar Spread Options Strategy

Calendar spreads are a low-risk options strategy that you can use to take advantage of the volatility term structure with a slight directional bias.

What is a Call Credit Spread? | Bear Call Spread Explained

A call credit spread is a bearish options trading strategy that benefits from a drop in implied volatility.

Bull Put Spread | What is a Bull Put Credit Spread?

A bull put credit spread is a defined risk trade that benefits from an increasing stock price and decreasing volatility.

Broken Wing Butterfly Options Trading Strategy | The Skip Strike Butterfly

The broken wing butterfly is an excellent options trading strategy with several advantages over a standard credit spread.

Options Vega Explained | Options Greeks Guide

Discover how options vega cam affects your options trading positions and how to utilize it to make better trades.