The 5 Best Options Strategies for High Implied Volatility (IV)

Implied volatility (IV) is a metric used to forecast the expected move of a stock. IV does not pick a direction but rather gives an expected move up or down.

When IV is high, it means that the market expects a large price movement in the near future. This could be due to earnings, news, events, or other factors that create uncertainty and risk.

High IV also means that options are more expensive since they have a higher chance of being profitable.

Selling vs. Buying Options When IV is High

When IV is high, options are more expensive, and therefore, it is generally best to use option selling strategies. Option selling strategies involve collecting premium by selling options and hoping that they expire worthless or decrease in value. Option selling strategies benefit from high IV because they can collect more premium and profit from theta decay (the loss of value due to time).

Buying options when IV is high can work out since IV can continue higher, but it just takes a single day for IV to drop and theta to crush option prices.

Option buying strategies involve paying a premium to buy options and hoping that they increase in value. Option buying strategies benefit from low IV because they can pay less premium and profit from gamma.

The Best Option Strategies for High IV

There are many high volatility options strategies, but some of the best include short strangles, short straddles, credit spreads, iron condors, and short puts.

1- Short Strangles

The short strangle involves selling an out-of-the-money (OTM) call and an OTM put. This is a good high implied volatility option strategy because options are more expensive, and you can collect more premium. The short strangle also has a wide profit range since you can profit as long as the stock stays within the two strike prices.

However, the short strangle also has unlimited risk since you can lose money if the stock moves beyond the two strike prices. The short strangle also requires a lot of margin and capital since you are selling naked options.

2- Short Straddles

Similar to the short strangle, the short straddle involves selling two options, but instead of OTM options, you sell at-the-money (ATM) options. This is a good high volatility option strategy because options are more expensive, and you can collect more premium. The short straddle also has a higher probability of profit since you can profit as long as the stock stays close to the strike price.

However, the short straddle also has unlimited risk since you can lose money if the stock moves away from the strike price. The short straddle also requires a lot of margin and capital since you are selling naked options.

3- Credit Spreads

Credit spreads are a two leg strategy where you either sell a call and buy a higher strike call with the same expiration date (call credit spread) or sell a put and buy a lower strike put with the same expiration date (put credit spread). This strategy benefits from high volatility because you collect more premium. However, unlike the short strangle and straddle, credit spreads have limited risk since you buy an option to hedge your position.

Credit spreads also require less margin and capital since you are not selling naked options. However, credit spreads also have a lower probability of profit since you need the stock to stay below or above the spread. Credit spreads also have a lower return on capital since you are paying for the hedge.

4- Iron Condor

The iron condor is a combination of a call credit spread and a put credit spread. This strategy benefits from high IV because you collect more premium, and your profit range would be wider. The iron condor also has limited risk since you buy options to hedge your position.

The iron condor also requires less margin and capital since you are not selling naked options. However, the iron condor also has a lower probability of profit since you need the stock to stay within the two spreads. The iron condor also has a lower return on capital since you are paying for two hedges.

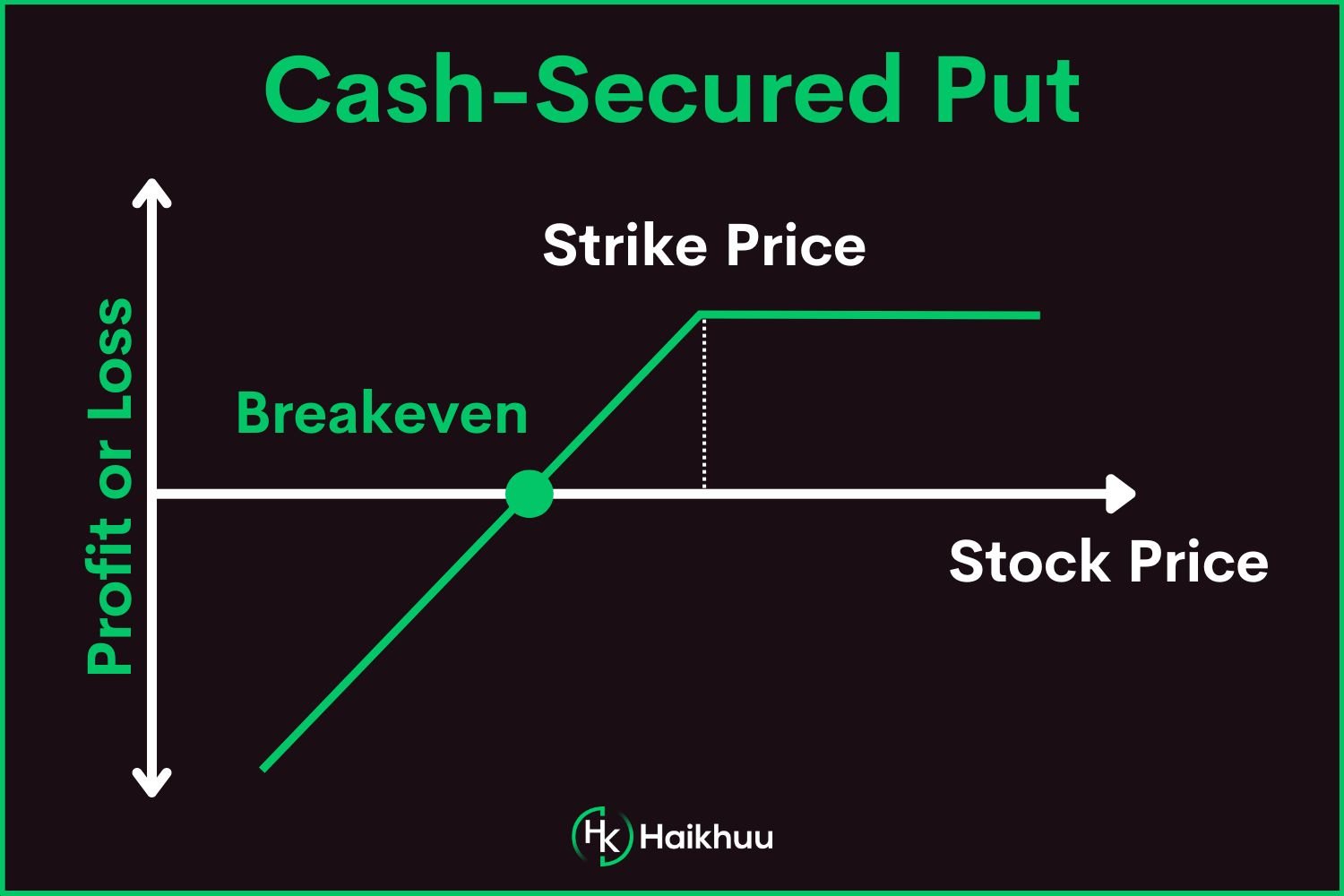

5- Short Put

The short put is one of the best strategies when IV is high because when IV is high, generally price is low, and the short put is a bullish strategy. Therefore, if price moves sideways, up, or even slightly down after selling a short put, you will profit. Short puts only get you in trouble when IV rises and price drops sharply after you enter.

The short put involves selling an OTM put and hoping that it expires worthless or decreases in value. This strategy benefits from high IV because you collect more premium and profit from theta decay. The short put also has a high probability of profit since you can profit as long as the stock stays above the strike price.

However, the short put also has unlimited risk since you can lose money if the stock drops below the strike price. The short put also requires a lot of margin and capital since you are selling naked options.

The Best Options Strategies for High IV | Bottom Line

These are some of the best options strategies for high IV, but they are not the only ones. There are many other factors that affect option pricing and profitability, such as delta, gamma, vega, rho, and theta. To learn more about trading options and how to use them effectively, you can join the HaiKhuu Trading community.

HaiKhuu Trading is a platform where you can connect with other traders, learn from experts, and access exclusive tools and resources. Whether you are a beginner or a seasoned trader, HaiKhuu Trading can help you take your trading to the next level.