HaiKhuu Daily Report - 08/13/2025

Good morning, and happy Wednesday! Wow, that is crazy that we are already halfway through the week. These conditions have only continued to become more and more volatile over the previous couple of trading days and have seen general difficulties not only while attempting to trade, but having the comfort and confidence necessary to continue to capitalize on these irrational levels.

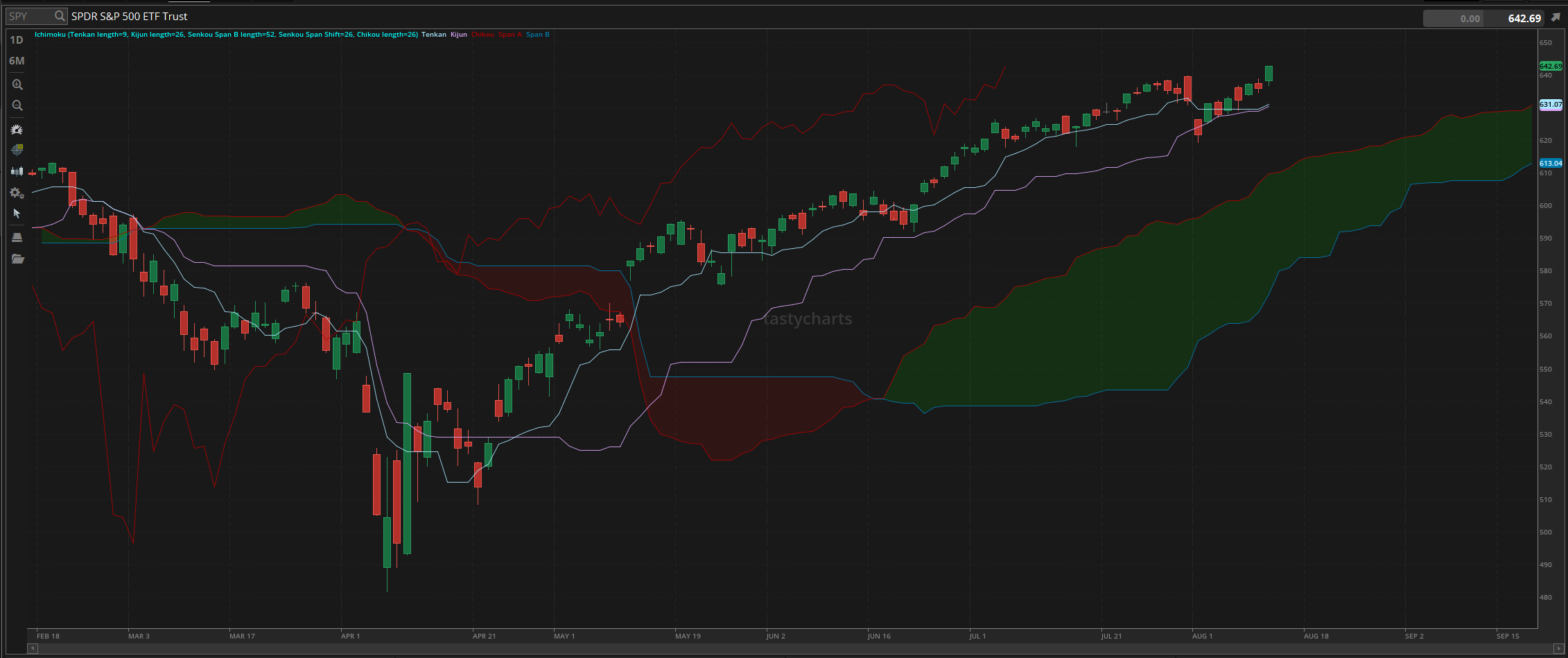

$SPY is up nicely at the moment during the pre-market session, and sentiment is extremely strong as $SPY is trading above the previous all-time high.

If you are attempting to trade today, being a skittish bull will easily win the race. Assuming market conditions continue to remain strong, you are going to be able to capitalize on the conditions with relative ease, continually realizing gains throughout the entire day, or we are going to be in an unfortunate position where the markets come down, but boo hoo, you stopped out on the first sign of bearish momentum.

So, just make sure you are smart and are practicing safe risk management when attempting to trade today, because you will either have a genuinely fantastic time or have a tough and terrible time. There won't likely be an in-between, so make the most of today, realize some gains, and have a fantastic time!

Good luck trading today, and let’s continue to see NEW all-time highs!

The updated $SPY daily levels are as follows:

Conversion Line Support: $631.07

Baseline Support: $630.45

Psychological Support: $640

Daily Cloud Support: $609.80

Thoughts & Comments from Yesterday - 08/12/2025

Yesterday was an absolutely amazing and perfect day for the markets. Conditions were amazing, markets went on to make a new all-time high, and we simply trended up the entire time with continued strength and bullish momentum. Traders had opportunities left and right to realize a significant amount of gains, and it is just a matter of being able to capitalize on the conditions. Many traders were able to accomplish success in the markets yesterday, so congrats if that was you!

So, we started the day with $SPY opening the day strong at $638.23, opening nicely above the previous close and displaying strength from CPI data. Markets rallied at open to reject $640, and went on to make the official low of the day trading at $636.79, before the strength in the markets was released.

Once the strength released, it was simply game over. Any skittish bullish easily won. Anyone who was simply bullish easily won, and anyone who simply held any long equities should have had an amazing time.

Markets started to rally just after 10am EST, we broke above $640 towards the beginning of the lunchtime sesson, and any and every new high of day afterward became the new official all-time high.

We watched as $SPY continued to display strength all of the way until close where $SPY went on to make a new high of the day within the final minute, trading at $642.84, before coming back down ever so slightly to officially end the day with $SPY trading at $642.69, up $6.77 for the day, or up 1.06%.

Unlike most days, I will say that yesterday was genuinely an amazing day with a significant amount of strnegth and opporrtunities. Traders were both comfortable and confident with their ability to actively trade and realize some gains, and hopefully you all were able to absolutely kill it yesterday. This is why I have warned you multiple times in the past about worrying about fighting the momentum, beacuse outside of that first quick short at open, there was genuinely no opportunity to fight the momentum.

So, I hope you all were able to generate a signfiicant amount of gains while attempting to trade yesterday, and are ready for another hopefully extremely fun day with a continuation of strength!!!

S&P 500 Heat Map - 08/12/2025

Thoughts & Comments for Today - 08/13/2025

Leading into today, I want to say that conditions are incredibly optimistic, but I want to also state that I am nervous for the large majority of you, because I genuinely believe there is a chance that this pre-market movement is sold off, and that there is a minor selling event in the markets.

I am not saying that we are going to drop, but what I am saying, is that historically, over the previous couple of weeks, we have seen extremely bullish conditions during the pre-market session often and quickly get sold off after open, and all of the gains that were previously generated were lost, to only go on to continue to make new highs after stopping some traders out.

Again, I am not trying to get you to be bearish, mostly with market conditions being strong. Still, the first thing that I want to do and to state before open, is that these market conditions are going to be extremely difficult to capitalize on in the short term. Any trader who is attemping to allocate in these conditions is going to be taking on a significant amount of risk allocating now in any capacity.

Please make sure to practice safe risk management. Just because the markets ARE at an all-time high does not mean that you necessarily are going to make money. This is not an attack on any individual, and I am not calling anyone out, but that is just facts. Just because the markets are performing well does not mean you will. These conditions are tough to navigate, and I would say that the average individual who is attempting to navigate these conditions blindly is going to get slaughtered over time. So, please make sure to practice risk management in these conditions.

So, now getting onto the fun part of the report. Let’s talk about being bullish.

With the previous warnings, please do not disregard any of them; they are stated for a reason. I have seen thousands of traders perish in conditions like these, and it is unfortunate whenever there are preventable deaths. Such is life in the markets, and all we can do is warn. But….

These market conditions are looking extremely bullish and optimistic. Traders should capitalize on these conditions and make the most of the momentum in the markets. Opportunities are being presented to us left and right, and everything is SO easy to capitalize on. Just look for momentum and strength in the markets, and simply follow it.

Being a skittish bull in these conditions will continue to print. Either you are in a position you are skeptical of that is making you money, or you are quickly out of a position with minimal loss because conditions looked less than ideal. So, just be smart and safe with how you want to allocate.

But do NOT be bearish. If you are attempting to be bearish on a short-term basis, trading the intraday momentum. In that case, I have zero problem with that, but if you are looking to continue to be bearish in the markets over an extended period of time, just know that I genuinely believe that you are going to get shot not only by theta or margin costs, but the markets are going to continue to move negatively against you, and realistically cut you out of your position for a massive loss.

So continue to be bullish and make the most of these conditions. Hidden gems and organizations that have momentum are the best places to realize gains in these conditions. Tech and $INTC have been an extremely fun time, and we are at a point where many more organizations could start to move up irrationally, so let’s be smart and safe in these conditions, and make the most out of today!

If I see any opportunities, or if I decide to get into any other plays, I’ll announce what I see in the HaiKhuu Discord.

My Personal Watchlist:

Note, just because something is on my watchlist does not mean it is a signal to buy or sell any equities

Watchlist:

$SPY, $JEPI, $INTC, SOL, $RIVN, $TSLA, $NVDA, $BRK/B

LONG OPPORTUNITIES:

Long-Term Dividend - $GAIN / $JEPI

Long-Term Investment - $INTC

Economic News for 08/13/2025 (ET):

Atlanta Fed President Bostic speaks - 12:30 pm

Notable Earnings for 08/13/2025:

Pre-Market Earnings:

Arcos Dorados Holdings (ARCO)

Brinker International (EAT)

Elbit Systems (ESLT)

Venture Global (VG)

Performance Food Group (PFGC)

Cae (CAE)

HudBay Minerals (HBM)

After Market Earnings:

Cisco Systems (CSCO)

Equinox Gold (EQX)

DLocal Limited (DLO)

Fidelis Insurance (FIHL)

Coherent (COHR)

Stantec (STN)

StandardAero (SORO)

Wrap up

Hopefully markets continue to rally and we watch as $SPY continues to make NEW all-time highs. Market conditions are strong going into open, but please tread lightly and be careful. I am not saying that we will dive and lose 100% of everything that has been generated over the previous couple of days, but this is a reminder that the markets HAVE dropped multiple times before where we rally pre-market, and dive afterward. Let’s hope that does not happen, and watch as the markets continue to move up with comfort and confidence.

Good luck trading, and let’s continue to make some all-time highs!!!