FXAIX vs. VFIAX - Which is Best For You?

When it comes to investing in stocks, index funds are often touted as the ideal choice for beginners.

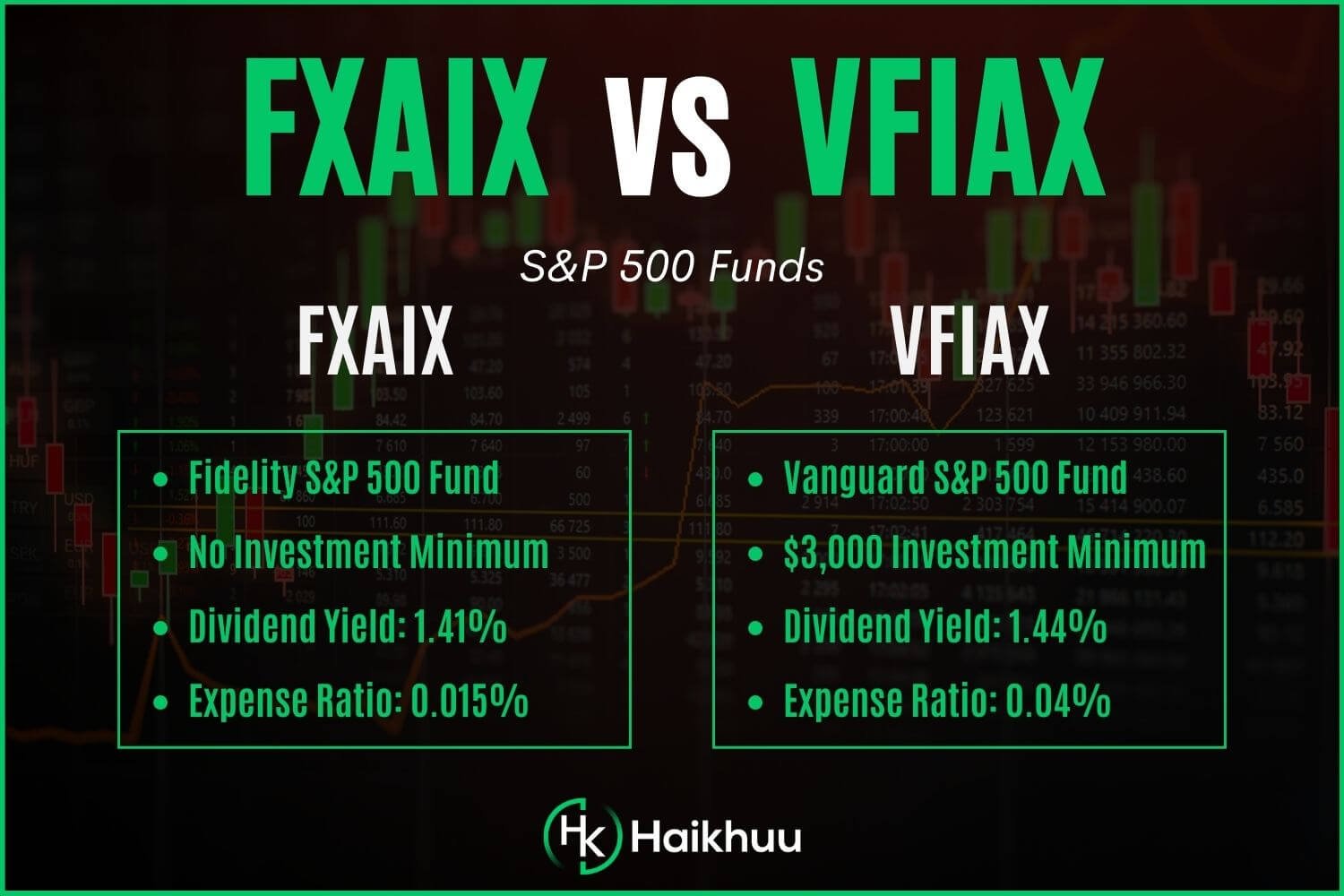

Today, we’re going to compare two popular S&P 500 index funds: Fidelity’s 500 Index Fund (FXAIX) and Vanguard’s 500 Index Fund Admiral Shares (VFIAX).

FXAIX vs. VFIAX: A Brief Overview

VFIAX has a higher expense ratio than FXAIX

Both of them track the S&P 500

VFIAX has a minimum investment of $3,000 and FXAIX has no minimum

FXAIX and VFIAX are both index funds designed to replicate the performance of the S&P 500 – an index consisting of 500 of the largest U.S. companies. Considered a barometer for the U.S. economy, many investors use S&P 500 funds as the backbone of their portfolio.

Fidelity’s FXAIX, launched in 1988, has built a reputation for its efficient index tracking and competitively low costs. Similarly, Vanguard’s VFIAX, incepted in 2000, makes the S&P 500 accessible to individual investors, featuring low expenses and a high degree of liquidity.

Expense Ratio Comparison: FXAIX vs. VFIAX

VFIAX - 0.04%

FXAIX - 0.015%

The expense ratio of an index fund is a crucial factor when choosing an investment, especially for long-term investors.

FXAIX wins in the expense ratio faceoff, coming in at a mere 0.015%, which is one of the lowest in the industry. VFIAX, while still reasonably low, has a slightly higher expense ratio of 0.04%.

Dividend Yield Comparison

When it comes to dividend yield, FXAIX and VFIAX are neck and neck.

FXAIX and VFIAX have a dividend yield of around 1.60%, making the dividend yield unimportant when comparing these funds.

Holdings Comparison

Both FXAIX and VFIAX aim to mirror the performance of the S&P 500, meaning their holdings are nearly identical.

They both hold a diversified mix of shares in large U.S. companies, spanning various sectors, including information technology, healthcare, finance, and consumer discretionary.

Performance Comparison

While both FXAIX and VFIAX strive to replicate the performance of the S&P 500, their returns could slightly differ due to a slight variation in expense ratios and tracking errors.

However, given their goal to track an index rather than outperform it, and their similar holdings, both funds’ performances have historically been closely tied to the performance of the S&P 500.

Which is Better for You: FXAIX or VFIAX?

It ultimately comes down to your personal requirements and preferences. Consider factors such as where you have your investment accounts (Fidelity or Vanguard), your investment strategy, and your tax considerations.

Furthermore, despite FXAIX’s lower expense ratio, if you place a higher priority on funds with more assets under management (which can be a stability indicator), you might lean toward VFIAX.

In a nutshell, both FXAIX and VFIAX are robust choices for a core U.S. large-cap stocks fund. No matter which you choose, either of these funds can serve as a strong foundation for a diversified investment portfolio.

If you want to learn more about the stock market, you can join the HaiKhuu Trading Community.

HaiKhuu offers live trading calls, daily morning reports, and an awesome community of like-minded traders to learn from.

FAQ

What is the equivalent of VFIAX in Fidelity?

The Fidelity equivalent of VFIAX is the FXAIX. Both are index funds that track the S&P 500 index, offering broad exposure to the U.S. large-cap equities market.