SPY vs. IVV: Which is Best For You

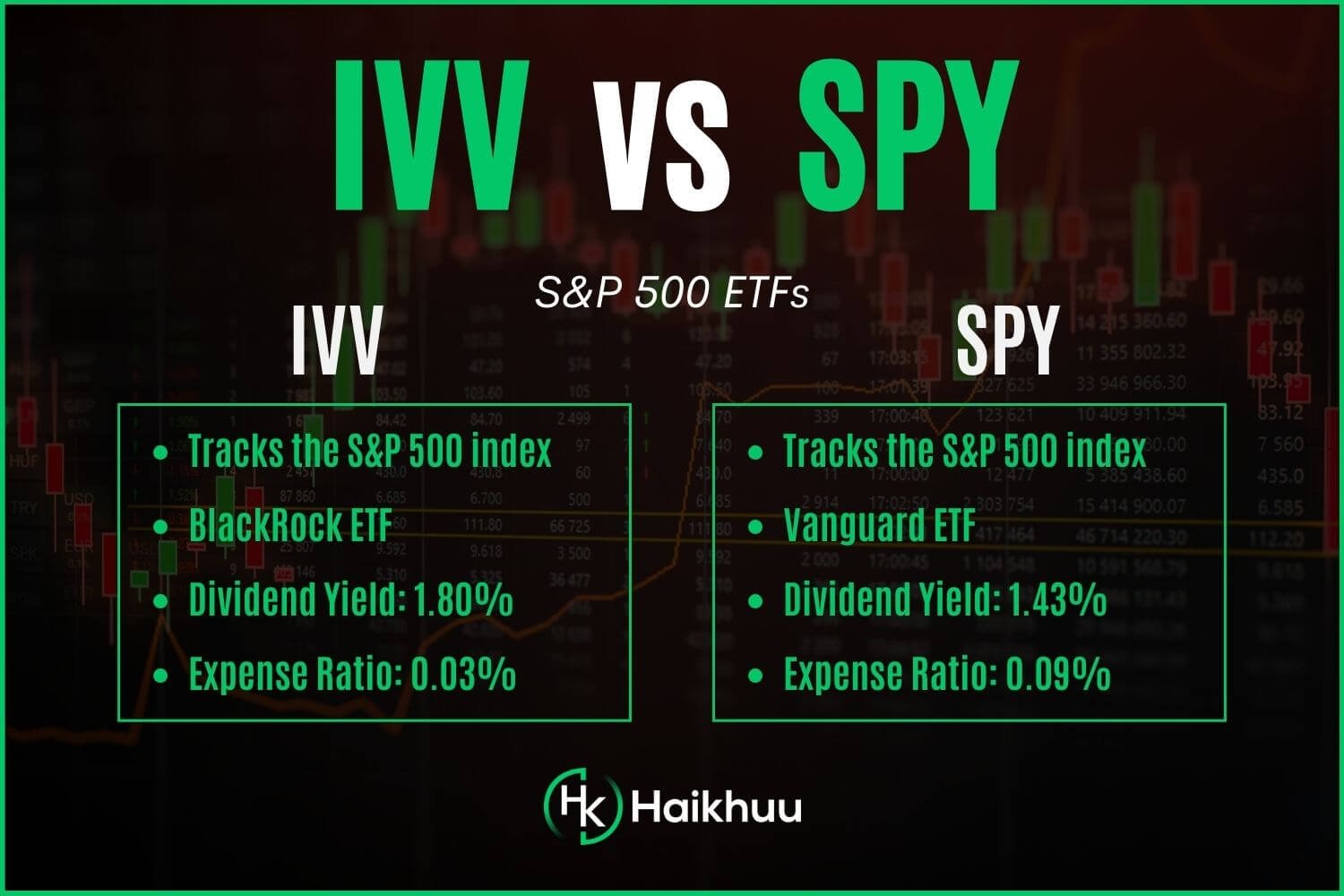

Both the ETFs SPY and IVV track the coveted S&P 500 index, providing extensive exposure to the broad U.S. stock market.

In this article, we will discuss the differences between SPY and IVV, touching upon some crucial features and metrics so you can determine which is best for you!

SPY vs. IVV Overview

SPY and IVV track the S&P 500 index, which includes the top 500 U.S. large-cap companies.

SPY is offered by State Street Global Advisors and has been around since 1993, making it the oldest ETF in existence.

IVV, on the other hand, is offered by BlackRock’s iShares brand and was launched in the year 2000.

Expense Ratio Comparison

IVV has an edge here as it charges a lower expense ratio of 0.03% compared to SPY’s 0.09%.

Over time, this small difference can translate into a substantial amount, especially for investors with significant assets in these funds.

Dividend Yield Comparison

Both funds sport similar dividend yields, with SPY paying out annual dividends corresponding to a yield of 1.43% and IVV yielding around 1.80%.

IVV does have a slightly higher dividend yield, but the long-term difference won’t affect you too much, since both ETFs track the same index.

Holdings Comparison

Both IVV and SPY track the S&P 500, making the holdings nearly identical.

However, micro differences could arise due to the methods applied for replication of the index and the rebalancing frequency.

Performance Comparison

Both SPY and IVV have demonstrated performances closely mirroring the S&P 500 index.

However, owing to its lower expense ratio, IVV might edge out SPY slightly in terms of total returns over an extended period.

In volatile markets, the disparity in liquidity between the two funds can cause minor performance deviations.

Which is Better For You?

For high-frequency traders desiring tighter spreads and better liquidity, SPY could be the preferred choice.

On the other hand, for long-term holders seeking lower costs and greater tax efficiency, IVV could be a more suitable alternative.

Truly, there is no ‘one-size-fits-all’ solution, and both of these funds will provide you with extremely similar exposure.

If you want to get hands-on help with your investment and trading strategies, you can join the free HaiKhuu Trading Community!

HaiKhuu offers live trading calls, daily trading reports, and an amazing community of like-minded investors.