JEPI vs. JEPQ - Comparing Income ETFs

When it comes to income-oriented ETFs, the choices can become a bit blurry, especially when they’re offered by the same financial institution.

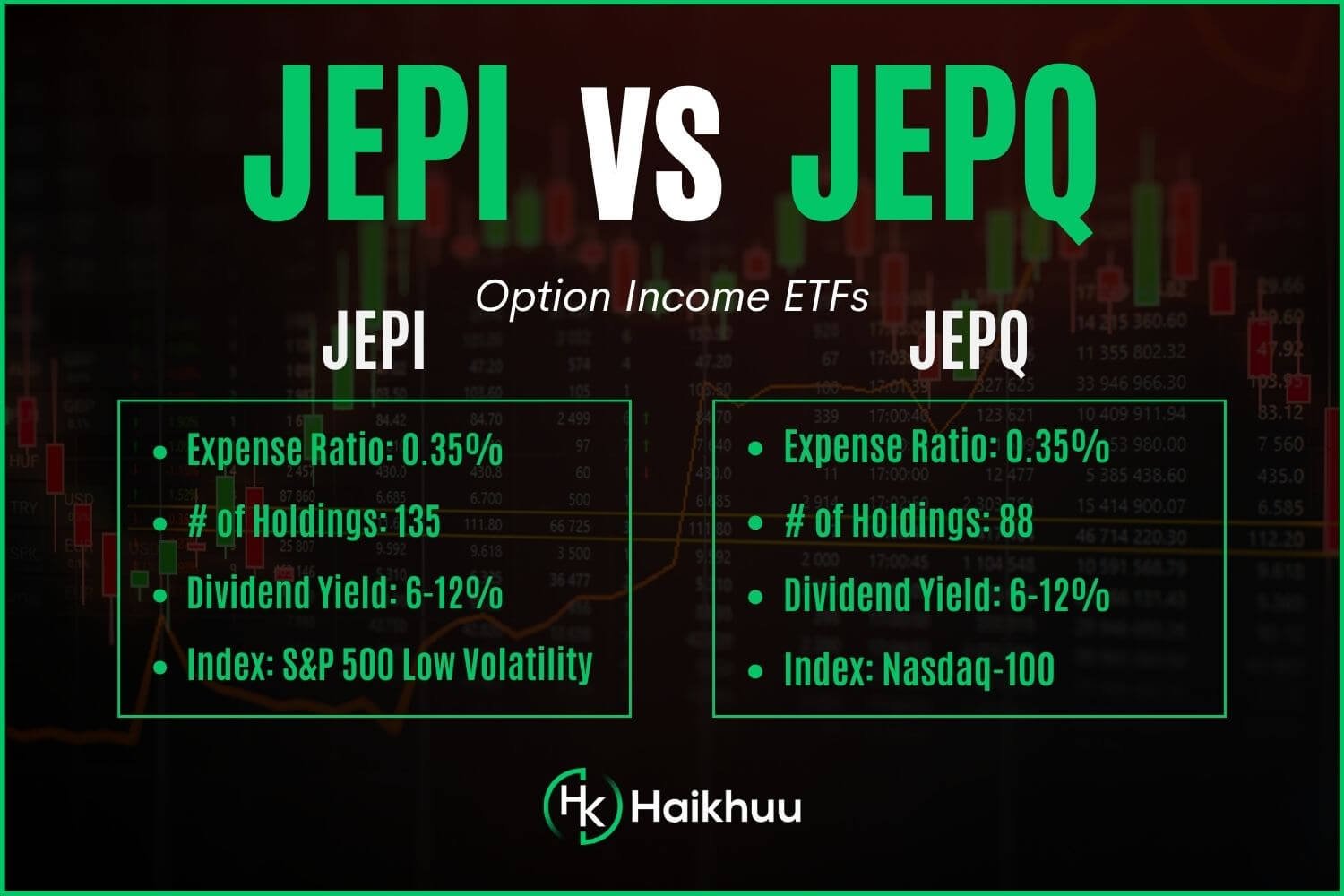

In this article, we’re going to make a deep dive into the JPMorgan Equity Premium Income ETF (JEPI) and JPMorgan Nasdaq Equity Premium Income ETF (JEPQ).

FAQ

What is the difference between JEPI and JEPQ?

JEPI and JEPQ are both income-oriented ETFs, meaning they aim to provide investors with consistent dividend income. The critical difference lies in their investment strategies: JEPI is based on S&P 500 equities, with a focus on low beta, high-quality stocks for less volatility. On the other hand, JEPQ only includes high-quality Nasdaq-listed stocks and does not focus on low-beta stocks.

Should I invest in JEPI or JEPQ?

JEPI is the better investment for those looking for low volatility. Contrarily, if you’re comfortable with a more concentrated portfolio and dig technology-oriented companies, JEPQ could be your better bet, given its focus on Nasdaq-listed stocks.

Is JEPQ a good investment?

Just like any investment, the suitability of JEPQ depends on your investment objectives and risk tolerance. JEPQ’s focus on Nasdaq stocks means it can offer more significant growth potential during bull markets but may face sharper declines during market downturns. Make sure to thoroughly research and understand the fund before committing your money.

With these burning questions out of the way, let’s comb through the essential aspects of these two funds.

Key Characteristics of JEPI and JEPQ

JEPI and JEPQ, launched in May 2020 and May 2022, respectively, are the fruits of JPMorgan’s quest to provide steady income to investors through a blend of dividends and option income. However, these funds do differ in significant ways.

JEPI vs. JEPQ Holdings

JEPI allocates its holdings primarily among low-beta, high-quality S&P 500 companies. Low-beta stocks, by definition, have less volatility in comparison to the market as a whole. This provides a foundation for stability in the portfolio.

On the other hand, JEPQ chooses to focus its portfolio on high-quality Nasdaq companies, which mainly include technology and growth-oriented companies.

Now that we have a general understanding of what these funds are and how they are composed let’s compare JEPI and JEPQ in various key financial aspects.

Dividend Comparisons

One of the attractive features of both JEPI and JEPQ is their significant dividend yields. JEPI and JEPQ have a dividend yield that ranges from 6-13%.

These high yields are achieved through their usage of an option writing strategy in addition to their holdings’ dividend payouts. By writing calls on their equities, JEPI and JEPQ can generate additional income through the collection of premiums.

Do note, however, that these distributions can vary month-to-month based on market conditions and the success of their option writing strategies.

Expense Ratio Comparisons

Keeping an eye on expense ratios is a critical aspect when choosing ETFs. Lower costs allow more of your money to stay invested and potentially grow over time. Both JEPI and JEPQ have identical expense ratios of 0.35%, which are generally considered reasonable for actively managed funds.

It’s worth noting however that while the ratios are the same, in dollar terms, it can vary depending on your level of investment. So, always bear in mind the cost implications of these ratios on your potential investment returns over time.

Performance Comparison

It’s important to remember that these ETFs aim not to outperform the broader market, as their purpose is to provide a steady stream of monthly income, which they have done quite successfully since their inception.

When comparing the two, it’s quite evident that their performances have varied based on overall market conditions. For instance, during periods of tech sector outperformance, JEPQ has performed commendably well thanks to its NASDAQ exposure.

On a risk-adjusted basis, both these funds have had decent returns, considering their main goal is consistent income and not significant capital appreciation.

Therefore, when considering these ETFs, it’s essential to measure your anticipated performance not just on capital appreciation but also on the regular income you expect to earn.

Risk-Adjusted Performance and Sharpe Ratio Comparison

When you look at the risk-adjusted performances of JEPI and JEPQ, they both shine in periods of market turbulence due to their high-quality, blue-chip equity holdings and option-writing techniques.

The Sharpe Ratio, a measure of risk-adjusted return, provides a way to compare portfolio performance considering the risks involved. While exact numbers will change over time and depend on the chosen risk-free rate for calculation, generally, both these ETFs have shown reasonable Sharpe ratios considering their income focus.

Drawdown and Volatility Comparison

In periods of market stress, both funds show resilience due to their defensive strategies. The drawdowns, or declines from their highest point, for both ETFs have been relatively lower than those of more aggressive, growth-oriented ETFs over the same period.

Regarding volatility, remember that JEPI targets low-beta S&P 500 stocks, which inherently are less volatile. While JEPQ’s tech-heavy NASDAQ focus could result in higher volatility, especially during sector-specific turmoil, it also provides greater potential for capital appreciation during tech outperformance.

JEPI and JEPQ for Monthly Income

Considering their income-generating strategies and high dividend yields, both JEPI and JEPQ are attractive options for investors seeking regular monthly income. Their income generation mechanisms have allowed them to maintain a high distribution yield despite periodic fluctuations.

Indeed, for those living off their investment income, such as retirees, both JEPI and JEPQ could be prime considerations. But know that while the income is usually impressive, their capital appreciation component could lag the broader market in strong bull phases.

Pros, Cons, and the Final Word

When you weigh the pros and cons, different aspects of these funds will appeal to different types of investors. Those who prefer a diversified, stable position with broad market exposure might gravitate toward JEPI. Investors who are comfortable with some additional risk in the hope of higher growth may opt for JEPQ.

Both JEPI and JEPQ are noteworthy ETFs providing regular income from their blend of dividends and options strategies. It boils down to your personal investment goals, risk tolerance, and the market segment you’re interested in establishing a position.

How to Learn More About Investing

To learn more about investing and trading, consider joining the HaiKhuu Trading Community!

Here, we offer daily morning reports, live trading calls, and as a member, you will have access to like-minded traders ready to support your trading journey.

Let’s hit our financial targets with informed confidence!