Max Pain Options Calculator | What is the Max Pain Theory?

The max pain options point is derived from the maximum pain theory, which states that option buyers who hold their contracts until expiration will lose money.

Traders can use the max pain point to determine where a stock will gravitate towards at expiration.

Key Takeaways

The max pain theory is a concept in options trading that refers to the point at which options traders would experience maximum financial pain or losses if the underlying stock price were to move in a certain direction.

Max pain is calculated by analyzing the open interest, or the number of outstanding options contracts, at different strike prices for a given stock or index. The theory is that options market makers and traders will try to push the stock price toward the strike price with the highest open interest in order to minimize their losses and maximize their profits.

Max pain can be used as a tool to help traders identify potential support and resistance levels in the market, as well as to inform trading decisions such as the selection of strike prices and the timing of options trades.

The HaiKhuu Trading Discord offers a max pain calculator that is updated automatically throughout the day, you can join our Discord server for free!

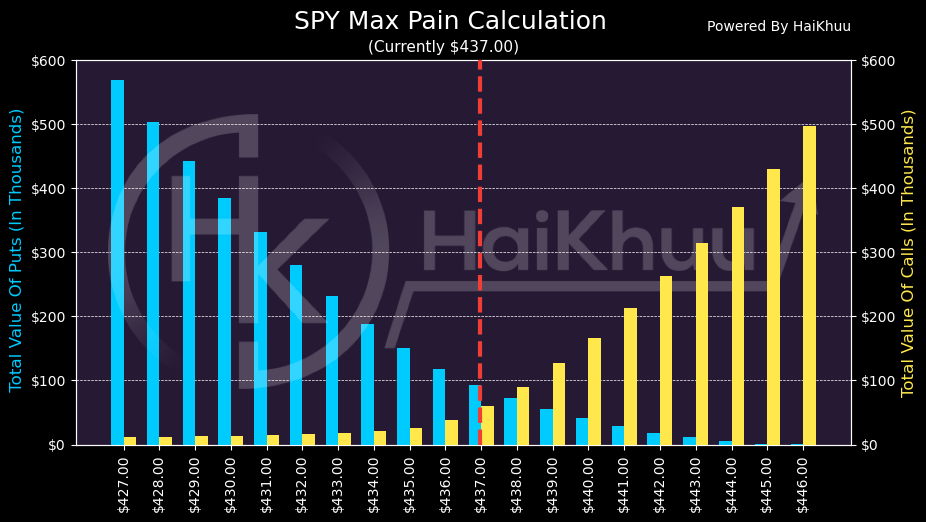

HaiKhuu Trading’s Max Pain Calculator

What is Max Pain (Options)

The max pain options point is the strike price, where puts and calls have the most open interest.

Understanding the Max Pain Options Point

The max pain theory states that the stock price will gravitate towards the max pain strike price. As a result, the option sellers will hedge the contracts they sell by buying and selling shares to neutralize their position.

The option sellers want their options to expire worthless, so they will attempt to buy and sell shares to drive the stock price toward a closing price that will make the option profitable and expire worthless.

For example, consider a market maker who sells a call and put option at the $100 strike price. To get these options to expire worthless, they will sell shares when the price rises above $100 and buy shares when it goes below $100.

Calculating the Max Pain Point

The max pain point is simple but time-consuming to calculate. The max pain calculation is the sum of the outstanding value of puts and calls for each in the money strike price.

To calculate the max pain point, follow these steps:

Calculate the difference between the underlying stock price and each in the money strike price.

Multiply the results of step one by the open interest at that strike price.

Find the sum of the dollar value for each put and call at the same strike price.

Repeat these steps for each strike price.

Determine the strike price with the highest dollar value. The result is the max pain price.

Alternatively, the following formula:

For each strike, determine the total intrinsic value among calls, assuming the underlying stock is at that price at the time of expiry

To do this, take the stock price we assume, minus the strike price for each call option with a strike below the assumed stock price

For each call option, multiply this result by the call’s open interest

Add these results for all call options

Do the same for put options

At each strike, add the results we calculated for the calls and puts

The strike with the lowest result is our max pain

Max Pain Options Example

For example, assume that a stock is trading at $100 per share, but lots of open interest is at the $105 strike price.

According to the max pain theory, the stock price will gravitate towards the $105 price as expiration nears.

Max Pain Calculator

The max pain options strike will change constantly, so it’s ideal to have software that calculates it automatically. For this reason, we have 2 bots that manage it on our discord server - one that calculates max pain for any ticker on command, and one that constantly monitors it for SPY max pain. It’s free to join, and we never charge to use these bots.

There are also a few websites you can use to calculate the max pain options price for you. While these tools are not available for every stock, most people will use the S&P 500 index ETFs like $SPY to gauge the overall market’s max pain point.

Examples of these sites are the following:

FAQ

What does max pain mean in options?

Max pain, or the max pain price, is the strike price with the most open options contracts (i.e., puts and calls), and it is the price at which the stock would cause financial losses for the largest number of option holders at expiration. The term max pain stems from the maximum pain theory, which states that most traders who buy and hold options contracts until expiration will lose money.

How often do stocks close at Max Pain?

There is no definitive answer to how often stocks close at max pain, as different studies have produced different results. Some studies have found that stocks tend to close near their max pain price on expiration day more often than by chance, while others have found no evidence of such a tendency. However, some traders and investors monitor max pain levels as a possible indicator of market sentiment and volatility.

How is the max pain price calculated?

The max pain point is simple but time-consuming to calculate. The max pain calculation is the sum of the outstanding value of puts and calls for each in the money strike price.

What is the purpose of max pain options theory?

The theory behind max pain options suggests that option sellers, also known as writers, have an incentive to manipulate the stock price towards the max pain price. By keeping the stock price close to the max pain price, option sellers aim to minimize their losses and maximize their profits. The theory also implies that option buyers, who are usually on the opposite side of option sellers, will experience maximum pain or losses at expiration.

How can max pain levels provide insights for traders and investors?

Max pain levels can provide insights into potential price movements. If the stock price deviates significantly from the max pain price, it may indicate a potential shift in market sentiment or increased volatility. Traders and investors often monitor max pain levels to gauge the potential behavior of market makers and institutional traders. For example, if the stock price is above the max pain price, it may suggest that there is more demand for call options than put options, or that option sellers are hedging their positions by buying shares of stock. Conversely, if the stock price is below the max pain price, it may suggest that there is more demand for put options than call options, or that option sellers are hedging their positions by selling shares of stock.

How can I find the max pain price for a particular stock?

The HaiKhuu Trading Discord server has a max pain calculator that you can use for free by typing /maxpain. Traders and investors can access this information to track the max pain price for a specific stock.

How to Learn More About the Stock Market

If you want to learn more about the stock market, joining a community of like-minded individuals is a great way to accelerate your learning curve.

Benefits of Joining a Trading Community

Converse with thousands of other experienced traders

When you join a community, you can talk with other traders with unique viewpoints on the stock market.

Learn new strategies

There are a million ways to trade on the stock market, and you will surely learn new strategies when you talk with other traders.

Stay up to date on the latest stock market news

Additionally, trading communities will keep you updated on the latest economic news. You can also ask questions if you don’t understand some of the complex financial terms.

The HaiKhuu Trading Community

The HaiKhuu Trading community is one of the largest stock trading communities online, with over a quarter million members within its communities.

The community includes beginner and professional traders who can assist with your day-to-day trading activities.