Short Straddle Options Strategy | What is a Short Straddle?

The short straddle options strategy involves selling ATM options when you believe implied volatility will drop, and the stock will remain stagnant.

Key Takeaways

The short straddle is an options trading strategy where an investor sells both a call option and a put option with the same strike price and expiration date.

The strategy is typically used when an investor believes that the underlying asset will remain within a certain price range and there will be low volatility.

The potential profit for a short straddle is limited to the premiums received from selling the call and put options, while the potential loss is unlimited if the underlying asset's price moves significantly in either direction.

What is a Short Straddle?

A short straddle involves selling an ATM put and an ATM call within the same expiration date. Short straddles benefit from the underlying stock not moving and volatility decreasing.

The max profit of a short straddle is the initial credit collected, while the max loss is theoretically unlimited. Since you are selling naked options, you have an undefined risk and must manage your risk properly.

Short Straddle Risks

The primary risk of trading a short straddle is the underlying moving sharply in either direction. Since you are selling the ATM options, your profit range is tight, and the underlying doesn’t have much room to move like an iron condor or short strangle.

Additionally, selling naked calls has unlimited risk potential since stocks can continue higher indefinitely. Selling naked put options also has a lot of risks, but it is capped since stocks can only go down to 0.

A rapid increase in implied volatility is also a significant risk when selling straddles. When implied volatility rises, the general price of all options rises and will cause short straddles to lose money.

Short Straddle Max Profit

The max profit of a short straddle is equal to the amount of premium you initially collect. Therefore, if you collect $1 on the short put and $1 on the short call, your max profit is $2.

The max risk of a short straddle is theoretically unlimited, so you must ensure you understand how to manage your risk if the trade goes wrong. Options traders use techniques such as rolling and even stop losses to reduce their overall risk.

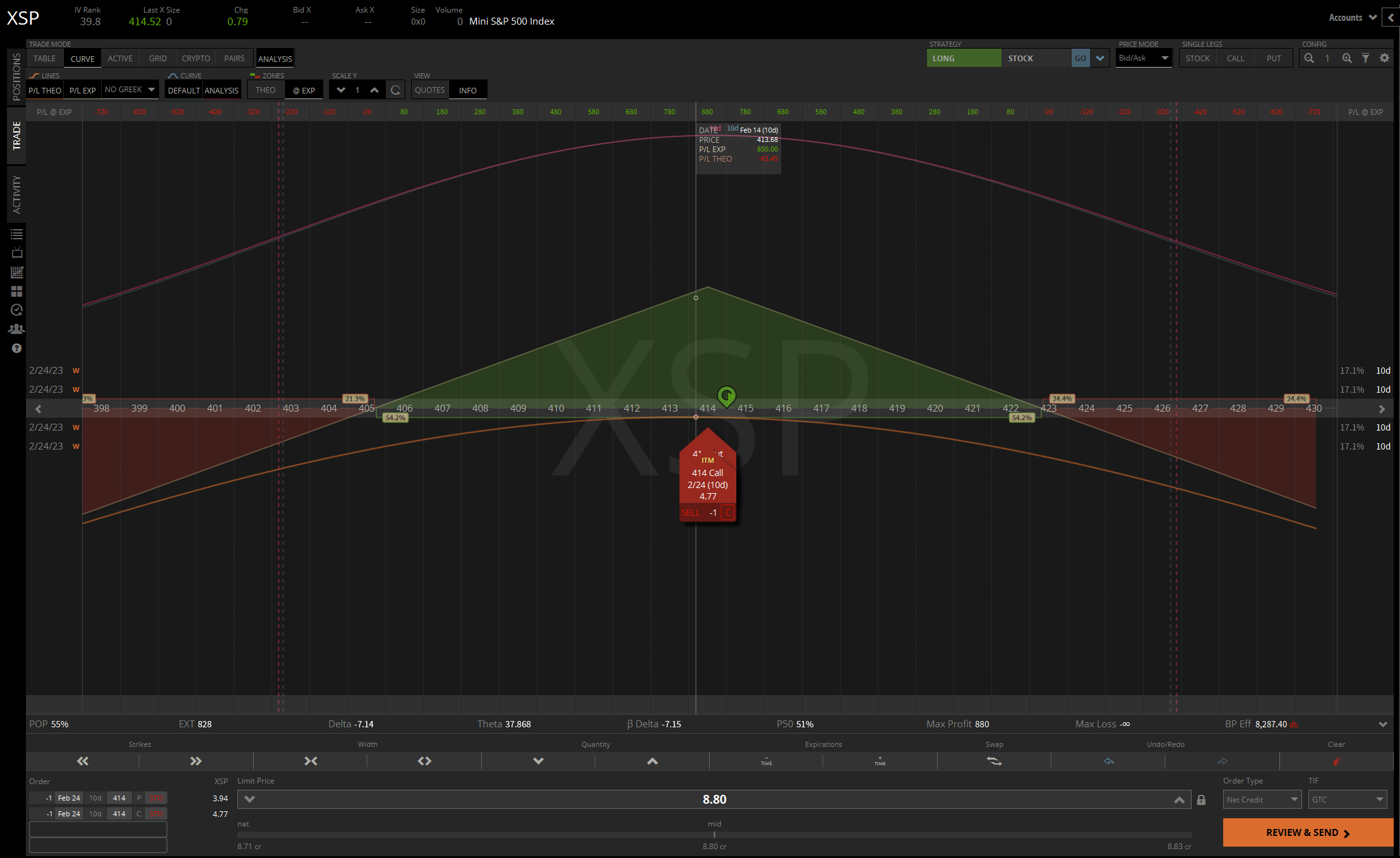

Short Straddle Payoff Diagram

The short straddle payoff diagram looks like an upside-down V, where the max profit is at the tip of the V. The max profit is realized if the underlying stock expires at the short strike price, but generally, traders take profit before expiration depending on their trading style.

The breakeven point of a short straddle is calculated by adding the premium to the strike price. For example, if you sell a $100 strike straddle for $5.00, your breakevens will be $105 and $95.

Short Straddle Options Strategy Example

Let’s say that stock XYZ is trading at $100 per share, and you believe that implied volatility is high and the stock won’t move far in either direction.

Therefore, you decide to sell a short straddle with a strike price of $100. Let’s break down what this will look like:

Sell -1 $100 call for $1.00

Sell -1 $100 put for $1.00

In this example, you will collect a total of $2.00 in premium, which means your max profit is $200.

Your breakevens will be $98 - $102, so you want the underlying to stay within this range. Additionally, the option will lose a lot of value if volatility decreases, and your short straddle will generate a profit.

Short Straddle vs. Long Straddle

A short straddle involves selling ATM options, while a long straddle involves buying ATM options.

When you buy a long straddle, you expect the stock to move hard in either direction and implied volatility to rise. Additionally, your maximum loss is capped to the premium you pay to open the long straddle.

On the other hand, when you sell a short straddle, you expect the implied volatility to decrease and the stock to remain stagnant.

The short and long straddles are the exact opposite of each other and come with entirely different expectations and risk profiles.

Tastytrade Disclosure

tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Marketing Agent (“HaiKhuu LLC.”) whereby tastytrade pays compensation to HaiKhuu LLC. to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of HaiKhuu LLC. by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of HaiKhuu LLC. or this website. tastytrade does not warrant the accuracy or content of the products or services offered by HaiKhuu LLC. or this website. HaiKhuu LLC. is independent and is not an affiliate of tastytrade.

tastytrade was previously known as tastyworks, Inc.