VTI vs. QQQ | Which is the Better Investment?

VTI and QQQ are ETFs that give investors exposure to some of the best companies on the stock market.

Key Takeaways

VTI and QQQ are both ETFs that track the performance of the U.S. stock market, but they have different compositions and strategies.

VTI tracks the CRSP US Total Market Index, which includes nearly all U.S. stocks, while QQQ tracks the NASDAQ 100 Index, which includes 100 of the largest non-financial companies listed on the NASDAQ stock exchange.

VTI may be a better option for investors seeking broader exposure to the entire U.S. stock market, while QQQ may offer more concentrated exposure to large-cap technology companies.

Both funds have relatively low expense ratios and are good long-term investment options.

VTI (Vanguard Total Stock Market) vs. QQQ (Nasdaq)

QQQ has historically outperformed VTI in the past, but this is due to the Nasdaq being tech-heavy. VTI and QQQ are two popular exchange-traded funds that provide investors with exposure to the U.S. stock market. VTI invests in all the CRSP US Total Market Index stocks, providing broad exposure to various sectors and industries.

On the other hand, QQQ tracks the performance of the Nasdaq-100 Index, which is composed of the 100 largest non-financial companies listed on the Nasdaq stock exchange, with a heavy focus on technology.

In this article, we'll compare and contrast VTI and QQQ in terms of their expense ratios, holdings, historical performance, and dividend yields to help investors make informed decisions about their investment choices.

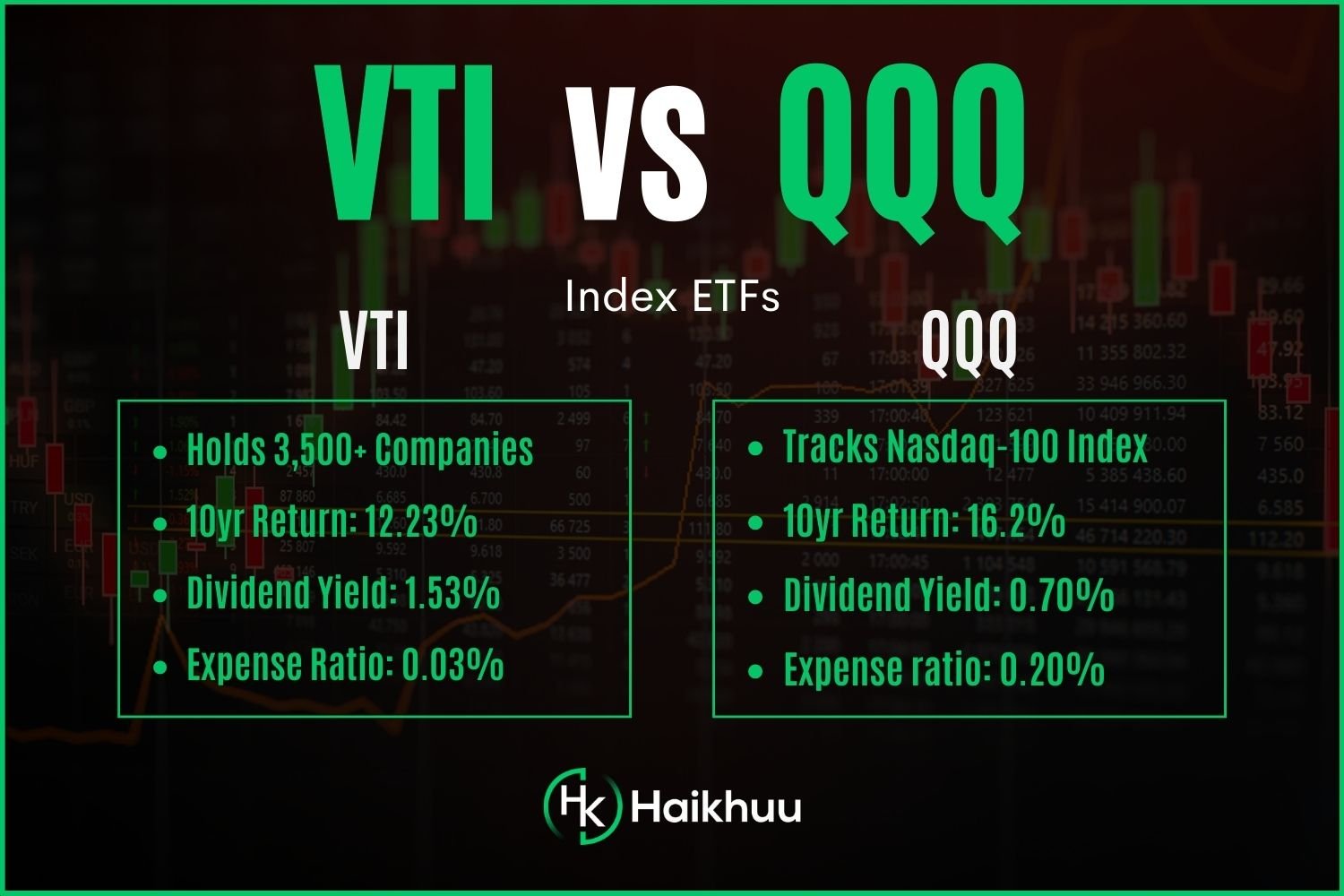

VTI Details

VTI Expense Ratio: 0.03%

VTI Dividend Yield: 1.53%

VTI 10yr Return: 12.23%

QQQ Details

QQQ Expense Ratio: 0.20%

QQQ Dividend Yield: 0.70%

QQQ 10yr Return: 16.20%

What is VTI?

VTI invests in all the stocks in the CRSP US Total Market Index, which includes more than 3,500 companies. As a result, VTI provides investors with exposure to the entire U.S. stock market, including companies in a wide range of sectors and industries.

The fund is designed to be a core holding in an investor's portfolio, providing broad-based exposure to the U.S. equity market.

Unlike mutual funds, investors can buy and sell shares of VTI on the stock exchange, just like they would with a stock. The fund's expense ratio is very low, allowing investors to gain exposure to the overall stock market with minimal fees. Additionally, VTI has a solid track record of performance and has historically provided returns similar to the broader U.S. stock market.

What is QQQ?

The QQQ ETF is an exchange-traded fund that tracks the performance of the Nasdaq-100 Index, which is composed of the 100 largest non-financial companies listed on the Nasdaq stock exchange.

The Nasdaq-100 Index is a modified market-capitalization-weighted index, which means that the weight of each stock in the index is determined by its market capitalization, with certain adjustments made to prevent any one stock from dominating the index.

Investors can buy and sell shares of the QQQ ETF on the stock exchange, just like they would with a stock. In addition, the fund's expense ratio is relatively low, so investors can invest in the fund at a relatively low cost.

The QQQ ETF has a solid track record of performance and has historically provided returns that have outperformed those of the broader U.S. stock market. However, it's important to note that the QQQ ETF is heavily weighted towards the technology sector, making it more volatile and susceptible to market swings than other types of ETFs.

VTI vs. QQQ Holdings

The holdings of an ETF are the securities that the ETF owns and holds in its portfolio. When you buy an ETF, you essentially invest in all its holdings.

VTI Holdings

The top ten holdings of the VTI ETF are dominated by some of the world's largest and most well-known companies. Technology giants like Apple, Microsoft, Amazon, and Google are all among the top holdings, reflecting the growing importance of technology in the modern economy.

Berkshire Hathaway, led by legendary investor Warren Buffett, is also a significant holding, providing exposure to various businesses across various industries. Meanwhile, Exxon Mobil, one of the world's largest oil and gas companies, represents the energy sector, while UnitedHealth provides exposure to the healthcare industry.

Finally, Tesla and Nvidia are high-growth companies leading the way in areas like electric vehicles and artificial intelligence, respectively. Together, these top holdings provide investors with exposure to a broad range of sectors and industries, helping to diversify their portfolios and reduce risk.

VTI holdings

QQQ Holdings

The top ten holdings of the QQQ ETF are dominated by some of the world's largest and most innovative technology companies. Microsoft, Apple, Amazon, and Google are among the top holdings, reflecting the growing importance of technology in the modern economy.

Nvidia, Tesla, and Broadcom are all leading semiconductor companies in areas like graphics processing, artificial intelligence, and wireless connectivity. Meta Platforms (formerly Facebook) is a social media giant, while PepsiCo represents the consumer goods sector. Together, these top holdings provide investors with exposure to a diverse range of innovative companies that are driving technological change and shaping the future of the global economy.

However, it's important to note that the QQQ ETF is heavily weighted towards the technology sector, making it more volatile and susceptible to market swings than other types of ETFs.

QQQ holdings

VTI vs. QQQ Historical Performance

Looking at the past ten years, the QQQ ETF has outperformed the VTI ETF in terms of investment returns. The QQQ ETF generated a return of 16.20%, while the VTI ETF generated a return of 12.23%. This difference in performance can be attributed to the fact that the QQQ ETF is heavily weighted towards the technology sector, which has been a strong performer in recent years due to the increasing role of technology in the global economy.

On the other hand, the VTI ETF provides exposure to a broader range of sectors and industries, which may have contributed to its slightly lower return over the same time period. However, it's important to note that past performance is not necessarily indicative of future results, and the QQQ may not outperform going forward.

VTI vs. QQQ Dividend History

The dividend yield of VTI is higher than that of QQQ, with VTI offering a yield of 1.53% compared to QQQ's 0.70%. This means that investors in VTI will receive a higher payout in the form of dividends for every dollar invested than investors in QQQ.

However, it's important to note that the dividend yield should not be the only factor considered when comparing ETFs. While a higher dividend yield may be attractive to some investors, it's essential to consider other factors, such as the fund's investment strategy, holdings, and past performance.

Additionally, some investors may prefer growth-oriented ETFs like QQQ that reinvest their earnings into the fund rather than pay out dividends.