What is a Call Credit Spread? | Bear Call Spread Explained

A call credit spread is a bearish options trading strategy that benefits from a drop in implied volatility.

Key Takeaways

A call credit spread is an options trading strategy that involves selling a call option with a higher strike price and buying a call option with a lower strike price, with the same expiration date.

The strategy is used to generate income by receiving the premiums from selling the call option, while limiting potential losses through the purchase of the lower strike call option.

Call credit spreads can be constructed using either out-of-the-money or at-the-money call options, depending on the investor's outlook for the underlying asset.

The potential profit for a call credit spread is limited to the net premium received from selling the higher strike call option minus the premium paid for the lower strike call option.

The potential loss for a call credit spread is limited to the difference between the strike prices of the call options minus the net premium received.

The Different Names for a Call Credit Spread

There are several ways to describe a call credit spread, such as the following:

Bear call spread

Short call spread

Bearish call spread

All of these names describe the same options strategy and are not to be confused with each other.

What is a Call Credit Spread

A call credit spread is when you sell a call option and buy a higher strike call option on the same underlying and expiration date to hedge the short call.

The easiest way to understand a call credit spread is as a covered call with a hedge. You promise to sell 100 shares in exchange for a premium when you sell a covered call.

If you buy a higher strike call option on the same stock as your covered call, you will create a bearish call credit spread.

Essentially, you are hedging your covered call against a large stock price increase.

How to Set Up a Call Credit Spread

You can set up a call credit spread by finding a call option you’d like to sell.

Once you know which call you want to sell, you go to a higher strike price call and buy that call.

For example, on a $100 stock, you could sell the 110 strike and buy the 120 strike call to create a bear call spread.

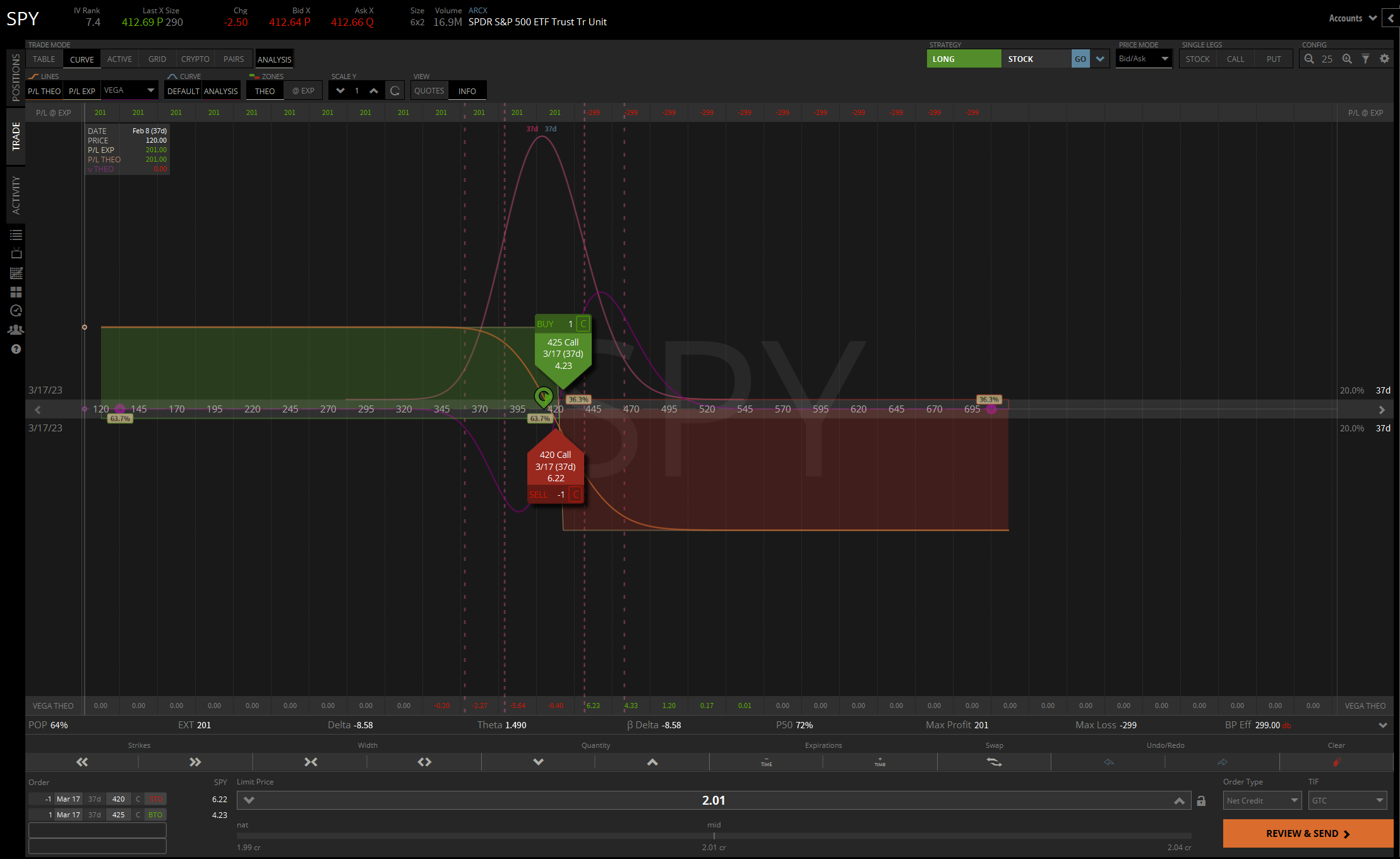

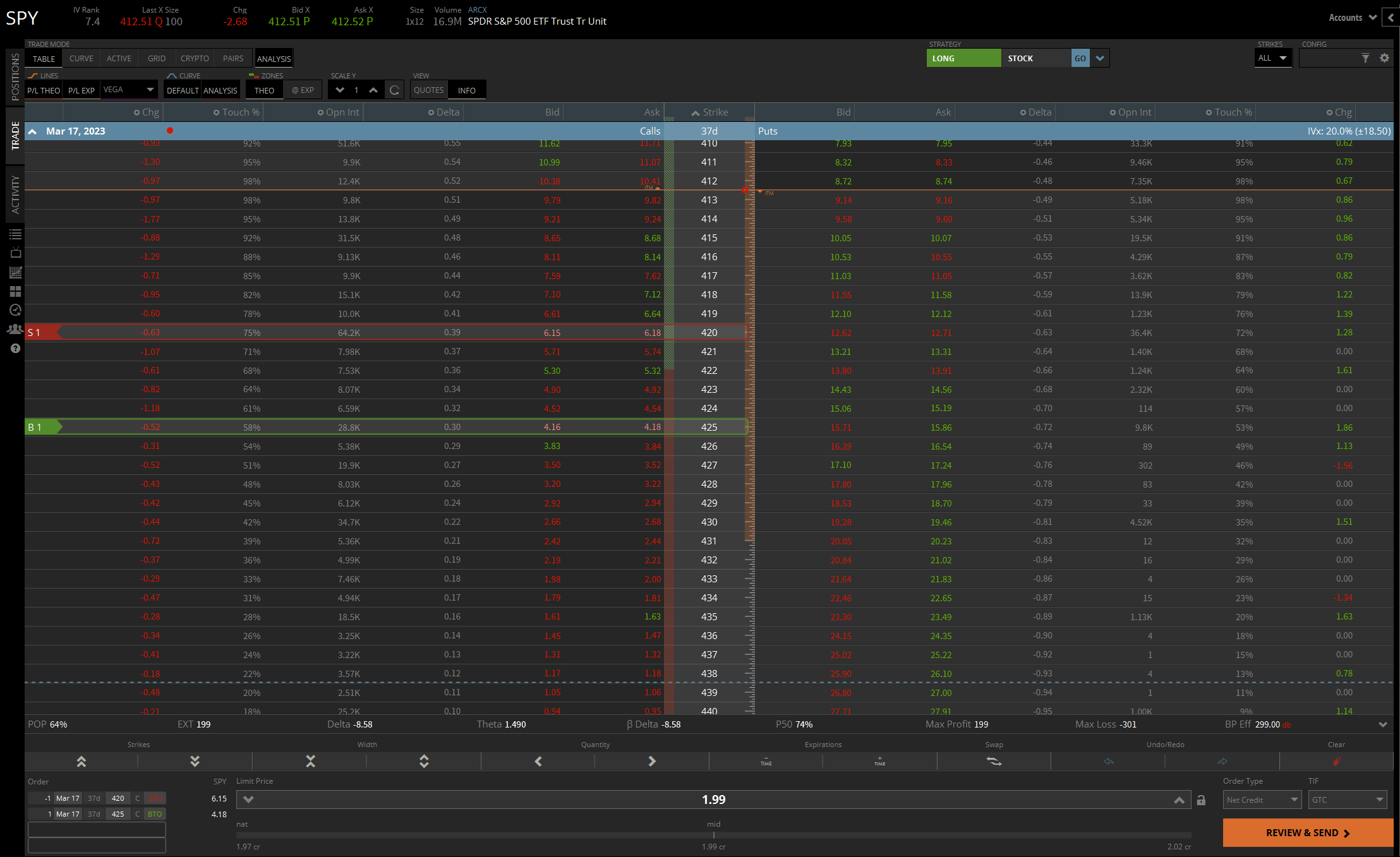

Call Credit Spread Payoff Diagram

The call credit spread payoff diagram demonstrates how there is defined risk and defined max profit.

The green area shows where the stock must trade to receive max profit. Conversely, the red area shows where the stock must trade to receive max loss.

Call Credit Spread Example

To understand call credit spreads, let’s take a look at an example trade. Let’s say stock XYZ is trading at $100 per share, and you are bearish.

You can sell a 110 strike call and buy the 120 strike call option to create a call credit spread.

Sell 110 call and receive $100 premium

Buy 120 call and pay $50 premium

Net credit = $50

In this example, you sold a call to collect $100 and sacrificed $50 of that premium to finance a hedge call.

Three different scenarios can happen after you place this call credit spread trade:

Scenario 1

The stock stays below the short call strike price at expiration, and you make the maximum profit of $50. You can also close the bear call spread early, before expiration.

Scenario 2

The stock rises above the 110 short call strike price at expiration, and you take the max loss of $950.

Scenario 3

The stock price is between the strike prices at expiration, and you take a partial loss. If the stock price is $115 at expiration, you will lose $400 on the short call and $50 on the long call, netting a $450 loss.

Risks of Call Credit Spreads

The main risk of trading put credit spreads or call credit spreads is trading too large for your account. Beginner options traders may believe that since there is a max risk, they can allocate all of their account to spreads.

Remember that you risk your total account balance if you allocate your entire account to spreads. It is recommended to develop a risk management strategy because there is always a possibility you will take the max loss.

When to Close a Call Credit Spread

Depending on your strategy, there are various ways you can manage a call credit spread. Many traders may decide to take profit on their spreads when they collect 50% of the premium.

For example, if you collect $100 on a spread, you can buy it back for $50 and collect 50% of the premium.

Additionally, if the trade goes against you, you can consider using a stop loss. However, since there is defined risk, some traders decide to accept the max loss if necessary.

Call Debit Spread vs. Call Credit Spread

A call debit spread is a bullish trade that benefits from an increase in volatility. While a call credit spread is a bearish trade that benefits from a drop in implied volatility.

A call debit spread is the exact opposite of a call credit spread. You simply buy a call and then sell a call with a higher strike price.

Call Credit Spreads | Bottom Line

A call credit spread is a type of options strategy that involves selling a call option and buying a higher strike call option on the same underlying and expiration date to hedge the short call. It is a bearish trade that benefits from a drop in implied volatility and can be set up by finding a call option to sell and then buying a higher strike call option.

The payoff diagram shows defined risk and max profit, and the main risk of trading a call credit spread is trading too large for your account. The best time to close a call credit spread depends on your strategy and can be decided based on factors such as collecting 50% of the premium or using a stop loss.

How to Learn More About Options Trading

If you want to take your options trading skills to the next level and become a more successful trader, don't hesitate to join the Haikhuu Trading community. With thousands of traders who are passionate about the stock market and eager to share their knowledge, this is the perfect place to start.

By connecting with like-minded individuals and learning from the best, you can get the support and guidance you need to achieve your financial goals and take your options trading skills to the next level. Join the Haikhuu Trading community today and start your journey to success!