Bull Put Spread | What is a Bull Put Credit Spread?

A bull put spread is a defined risk trade that benefits from an increasing stock price and decreasing volatility.

Key Takeaways

A bull put credit spread is an options trading strategy that involves selling a put option with a higher strike price and buying a put option with a lower strike price, with the same expiration date.

The strategy is used to generate income by receiving the premiums from selling the put option, while limiting potential losses through the purchase of the lower strike put option.

Bull put credit spreads can be constructed using either out-of-the-money or at-the-money put options, depending on the investor's outlook for the underlying asset.

The potential profit for a bull put credit spread is limited to the net premium received from selling the higher strike put option minus the premium paid for the lower strike put option.

The potential loss for a bull put credit spread is limited to the difference between the strike prices of the put options minus the net premium received.

All the Names of a Bull Put Spread

Before we explain a bull put spread, let’s cover all the strategy's alternative names.

Put credit spread

Bull put spread

Bullish put spread

Short put spread

All of these strategies are the same and simply have several different names.

What is a Bull Put Spread?

A bull put spread is when you sell a put and buy a lower strike put on the same underlying and expiration date to hedge the short put.

The easiest way to understand a put credit spread is as a cash-secured put with a hedge. When you sell a put, you promise to buy 100 shares in exchange for a premium.

If you buy a lower strike put on the same stock as your cash-secured put, this turns it into a bull put spread.

In essence, you are using some of the premium you collected from the cash-secured put to hedge against a significant downside move in the stock.

Why Trade a Bull Put Spread Over a Short Put?

There are a few reasons you would choose to trade a bull put spread over a cash-secured put or a short put.

Margin requirements

The first reason is for margin requirement purposes. If you don’t have a tier 3 margin account, you will be forced to put aside enough cash to buy 100 shares at the strike price of your short put, making it a cash-secured put.

However, if you buy a put to make it a put credit spread, your margin requirement will be much lower since you define your risk. For example, selling a $100 strike put requires $10k to be set aside. If you buy the $95 strike put with it, you will only need to set aside $500 (the difference between the strike prices times 100).

Hedge against downside volatility

The next reason is to hedge against downside volatility. For example, if you sell a put and volatility jumps higher, your short put will lose money, but the long put will hedge your losses and potentially make you money.

How to Set Up a Bull Put Spread

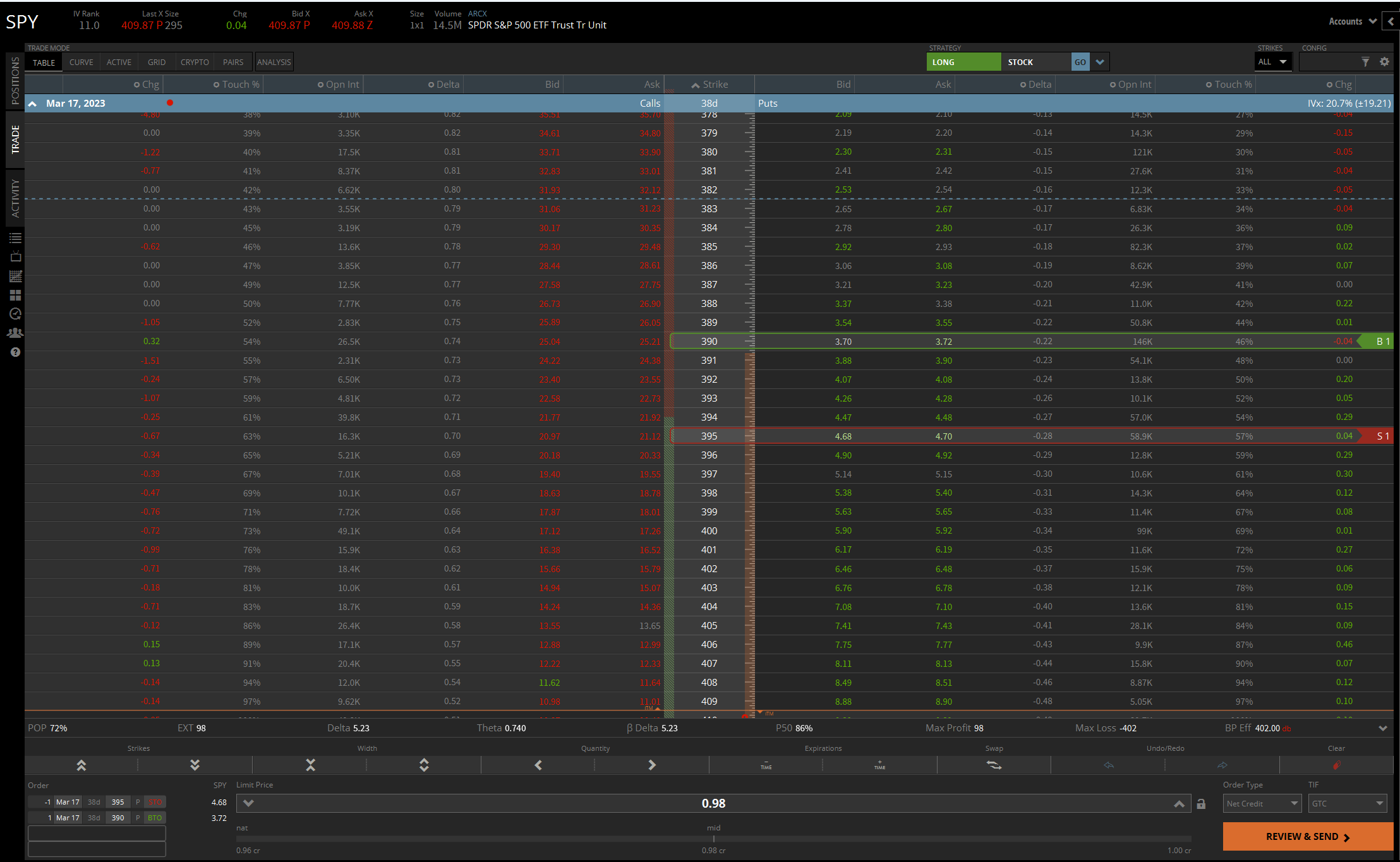

To set up a bull put spread, you can go to the options chain and find the put you want to sell.

Next, you go to a lower strike put within the same expiration, and buy it.

In the image below, you can see the red box is the put being sold, and the green box is the put being bought, creating a bull put spread.

The combination of selling a put and buying a lower strike put creates a bull put spread.

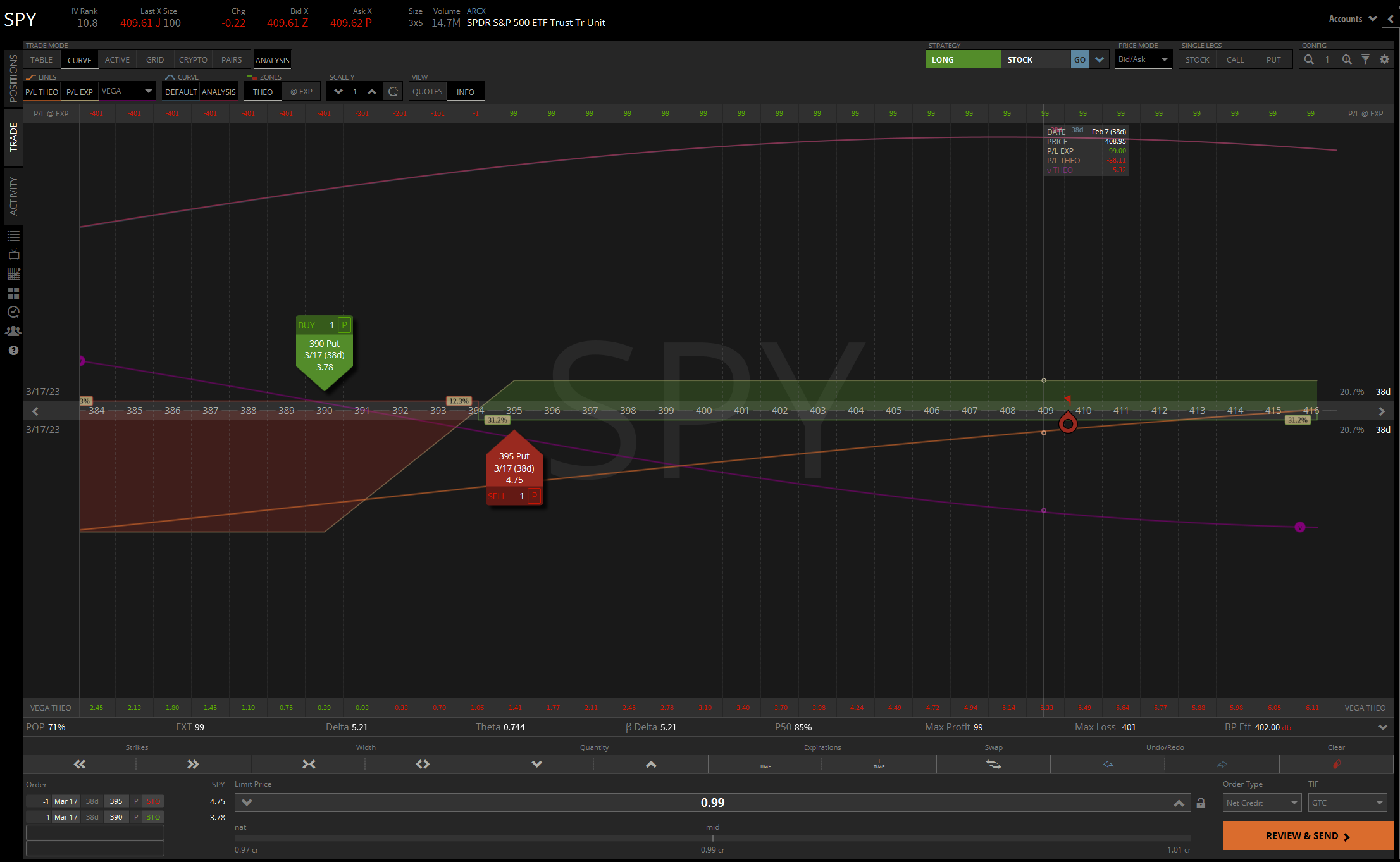

Bull Put Spread Payoff Diagram

The bull put spread payoff diagram demonstrates the trade's maximum profit and loss. If the stock stays above the short put by expiration, you will make the maximum profit.

On the other hand, if it expires below the short put strike, your loss is limited to the width of the strikes times 100 minus the premium collected.

For example, if you collect $100 selling a 5-wide bull put spread, your max loss is $400.

Bull Put Spread Example

Let’s go over an example trade to understand bull put spreads better. Let’s say stock XYZ is trading at $100 per share, and you are bullish.

You can trade your bullish assumption by selling the 90 strike put and buying the 80 strike put, creating a bull put spread.

Sell 90 strike put and collect $100

Buy 80 strike put and pay $50

Net credit = $50

In this example, you sold a put to collect $100 and sacrificed $50 of the premium to buy a hedge.

Three different scenarios can happen with this trade:

Scenario 1

The stock stays above the short put at expiration, and you make the maximum profit of $50. You can also close the trade early by buying the short put to close and selling the long put to close.

Scenario 2

The stock goes below the long 80 strike put at expiration, and you take the max loss of $950.

Scenario 3

The stock expires between the strike prices at 85, and you take a partial loss. If it expires and the stock is at 85, you will lose $400 on the short put and $50 on the long put, netting a $450 loss.

The Risk of Bull Put Spreads

The main risk of trading bull put spreads is making your position size too large. New options traders will often believe that allocating your entire portfolio into spreads is safe.

For example, if you trade with a $1,000 account, selling two 5-wide bull put spreads would use all of your buying power.

Additionally, if both trades end up at a max loss, you have successfully blown up your whole account.

Therefore, you must understand that taking the max loss is always a possibility and refrain from making your position size too large.

Bull Put Spreads | Bottom Line

Bull put spreads are a defined risk trade that offer a variety of benefits for traders looking to capitalize on a bullish stock. It involves selling a put and buying a lower strike put to hedge the short put, resulting in a lower margin requirement and protection against downside volatility.

Understanding the different scenarios and the potential risk involved in this strategy is crucial for traders looking to take advantage of it. You should also consider researching put debit spreads, the opposite of the put credit spread.

If you want to learn more about bull put spreads or options trading in general, we invite you to join our vibrant community of thousands of traders at HaiKhuu Trading.

Our community is a safe and friendly place where you can connect with fellow traders, ask questions, and gain valuable insights and advice. Join us today and start achieving your trading goals!

Tastytrade Disclosure

tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Marketing Agent (“HaiKhuu LLC.”) whereby tastytrade pays compensation to HaiKhuu LLC. to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of HaiKhuu LLC. by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of HaiKhuu LLC. or this website. tastytrade does not warrant the accuracy or content of the products or services offered by HaiKhuu LLC. or this website. HaiKhuu LLC. is independent and is not an affiliate of tastytrade.

tastytrade was previously known as tastyworks, Inc.