What is a Cash Secured Put? | Income Options Strategy Guide

The cash secured put is one of the best options strategies to learn how to trade options for income with little risk.

Continue reading to discover how cash secured puts work, what expiration to use, how to roll cash secured puts, and if selling naked puts is a good idea.

Key Takeaways

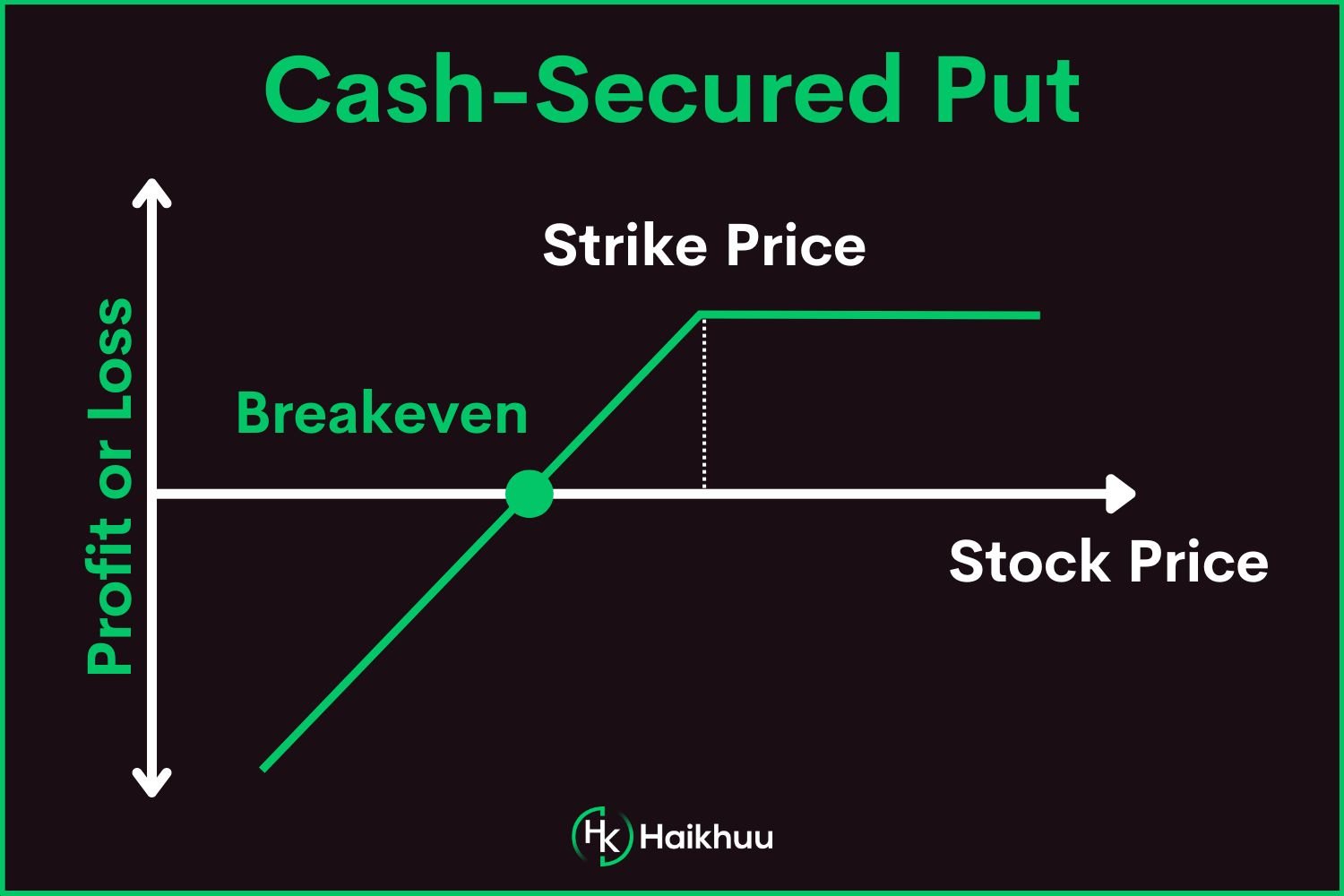

A cash-secured put is an options trading strategy that involves selling a put option on a stock or other underlying asset, while simultaneously setting aside cash in case the option is exercised.

The strategy can be attractive to investors who are interested in purchasing a stock at a lower price, and who are willing to potentially receive income from selling the put option.

How Does a Cash Secured Put Work?

A cash secured put is when you get paid to promise to buy a stock at a specific price.

Instead of buying the stock on the market, you can sell a cash secured put and get paid a premium while you wait to be assigned shares.

Cash secured puts do well when the stock market increases, stays flat, or even comes down a little bit.

However, if the stock crashes, you risk being forced to buy shares at a higher price than the stock is currently trading at.

How Much Money Do You Need to Sell a Cash Secured Put?

Selling cash secured puts requires you to set aside enough money to buy 100 shares at the strike price.

For example, if you sell a $10 strike put option, you must set aside $1,000 to place the trade.

Cash Secured Put Example

Cash secured puts may seem complicated initially, but it is a relatively simple options income strategy.

Let's go over an example cash secured put trade to help you understand all the things that can happen:

Let’s say stock ABC is trading at $100 per share.

You like the company as an investment but would rather buy it at a lower price, like $90 per share.

Instead of buying 100 shares, you can sell a $90 strike put option, collect a $100 premium, and promise to buy it at $90 per share instead.

You sell -1 $90 strike put option and collect a $100 premium.

This trade is you being paid $100 to promise to buy 100 shares of stock ABC IF it goes below $90.

The four scenarios that can happen:

1- The stock moves up, expiration comes, and you keep the $100 premium as cash, like a dividend.

2- The stock doesn’t move at all, expiration comes, and you keep the $100 income.

3- The stock moves down slightly to $95, expiration comes, and you keep the $100 income.

4- The stock drops below $90, expiration comes, and you are forced to buy 100 shares at $90 per share and keep the $100 income.

How to Sell a Cash Secured Put

The way to sell a cash secured put will vary for each brokerage, but you want to use a sell-to-open order on the put you are planning to sell.

Most of the HaiKhuu Trading Community uses the tastytrade platform for options trading.

To sell a cash secured put on tastytrade, you go to the trade tab, type the ticker you want to trade, open the options chain, and click on the bid price of the put to open a sell-to-open order.

How to Roll a Cash Secured Put

Rolling a cash secured put is when you buy to close your put to close it and then simultaneously sell a new one.

Traders roll their cash secured puts for various reasons, such as taking profit or reducing risk by lowering the strike price to keep the trade going.

If the stock sells off and gets close to your strike price, some traders may consider rolling the put down to a lower strike to reduce the price they pay for the stock upon assignment.

However, if you are planning to take assignment and don’t mind owning it at the strike price, you could just leave it and accept the shares.

When Does a Cash Secured Put Get Assigned?

A cash secured put can only be assigned if it goes in the money (ITM). ITM means the stock price is trading below the put's strike price.

When options expire, all ITM options will be automatically exercised unless the owner calls the broker and tells them not to.

Early Assignment on Cash Secured Puts

It is possible to be assigned before the expiration date on a cash secured put if it is ITM. The owner of the put may choose to exercise the put at any time before expiration.

Therefore, if you do not want to risk assignment, you should roll the put to a lower strike before it goes ITM.

What is the Best Expiration for a Cash Secured Put?

There are expiration dates ranging from 0 DTE (days til expiration) to multiple years.

You can sell cash secured puts with any expiration date, but you must know the advantages and disadvantages of each.

Selling Weekly Cash Secured Puts

Selling puts that expire within a week or less will provide quicker returns, given the stock moves up or stays flat after you sell it.

However, selling weekly puts means you collect less premium per contract and pay more overall commissions.

Additionally, you must pick strike prices closer to the stock price to receive a reasonable premium, meaning you have a higher chance of getting assigned if the market moves down quickly.

Selling Monthly Cash Secured Puts

Selling cash secured puts that expire in a month or longer allows you to collect more premium per contract and reduce your overall commission fees.

Additionally, you can sell strike prices that are further away from the current stock price, meaning you will get assigned at a lower price than selling a weekly option.

Selling Puts on Margin

If you have a high-tier margin account, you do not have to set aside all the capital required to accept assignment. Instead, you can set aside just 20% on most stocks.

For example, if you sell a $10 strike put with a high-tier margin account, you may only have to put up $200 rather than the full $1,000.

When you don’t have enough money to cover assignment on a short put, this is called selling a naked put.

Selling Naked Puts

Selling naked puts means you are using leverage, but you do not have to pay margin interest like you would with stock margin.

Only advanced options traders that understand how to manage risk should attempt to sell naked puts.

If the market tanks after you sell naked puts, you can be margin called and forced to close your positions at the worst time.

FAQ

What is a cash secured put?

A cash secured put is an income options strategy that involves writing a put option on a stock or ETF and simultaneously putting aside the capital to buy the stock if you are assigned. In simpler terms, it is when you promise to purchase 100 shares of stock in exchange for being paid a premium.

How does a cash secured put work?

When selling a cash secured put, the investor receives a premium from the buyer of the put option. If the stock price remains above the strike price until the option expires, the put expires worthless, and the investor keeps the premium as profit. If the stock price drops below the strike price, the investor may be assigned the stock and must purchase it using the cash set aside.

What is the purpose of a cash secured put?

The primary purpose of a cash secured put is to generate income through the premium received from selling the put option. It allows investors to potentially profit from the stock remaining above the strike price or to acquire the stock at a lower price if assigned.

What are the risks of selling cash secured puts?

Selling cash secured puts carries some risks. If the stock price drops significantly below the strike price, the investor may suffer a loss on the stock purchase. Additionally, there is always the possibility of assignment, which means the investor must be prepared to buy the stock at the strike price.

How is a cash secured put different from other options strategies?

A cash secured put is similar to other options strategies in that it involves selling options to generate income. However, unlike some strategies, such as naked puts, a cash secured put requires the investor to set aside enough cash to cover the potential stock purchase.

What are the disadvantages of cash secured puts?

Some major disadvantages of cash secured puts are:

No dividend benefits: As you are yet to own the shares, you will not be earning dividends on them.

Loss of opportunity: If the stock price does not go down below the strike price, you will miss the chance to buy the stock at a lower price than the current market price.

Repetitive process: You have to keep selling new puts every month or quarter to generate consistent income. This can be time-consuming and tedious.

Tax implication: The premium received from selling cash secured puts is taxed as ordinary income, not as capital gains. This can reduce your net profit margin.

How much cash do you need for a cash secured put?

The amount of cash you need for a cash secured put depends on the strike price and the number of contracts you sell. For every put option sold, the investor must have enough cash to buy 100 units of the stock or ETF that the option is based on. To calculate the cash required, you multiply the strike price by 100 and by the number of contracts. For example, if you sell one contract of a $50 strike put, you need $5,000 ($50 x 100 x 1) in cash to secure the put.

Are cash secured puts risky?

Cash secured puts are not risk-free, but they are less risky than some other options strategies. The main risk of selling cash secured puts is that the stock price drops significantly below the strike price, and you have to buy the stock at a higher price than the current market price. This can result in a loss on the stock purchase, which may or may not be offset by the premium received. However, this risk is similar to outright stock ownership, and it can be mitigated by choosing stocks that you are bullish on and willing to own in the long term. Another risk is that you may not have enough cash to cover the potential stock purchase if you are assigned. This can lead to a margin call from your broker, which can force you to liquidate other positions or deposit more funds. To avoid this risk, you should only sell cash secured puts with cash that you can afford to lock up until expiration.

What are the benefits of a cash secured put?

Some major benefits of a cash secured put are:

Income generation: You earn a premium from selling the put option, which is yours to keep regardless of whether the option expires worthless or is assigned.

Lower cost basis: You may secure a lower price to purchase a stock that you want to own anyway. If the option is assigned, you buy the stock at the strike price, which is lower than the current market price when you sold the put.

No margin requirement: You do not need to borrow money from your broker to sell cash secured puts, as long as you have enough cash in your account to cover the potential stock purchase. This reduces your interest expenses and leverage risks.

What is the difference between a cash secured put and a covered put?

A cash secured put and a covered put are both options strategies that involve selling a put option. However, they differ in how they secure the obligation to buy the stock if assigned. A cash secured put uses cash as collateral, while a covered put uses short stock as collateral. A covered put is also known as a synthetic short call, because it has the same payoff profile as selling a call option on the same stock with the same strike and expiration. A covered put is more bearish than a cash secured put, because it profits from both a decline in the stock price and an increase in volatility.

What is the maximum loss when selling a put?

The maximum loss when selling a put occurs when the stock price drops to zero and the option is assigned. In this case, you have to buy the stock at the strike price, which is higher than zero. The maximum loss is equal to the strike price minus the premium received. For example, if you sell one contract of a $50 strike put for $2 per share, your maximum loss is $4,800 ($50 - $2) x 100 x 1).

Can you sell calls against cash-secured puts?

Yes, you can sell calls against cash-secured puts if you own 100 shares and want to create a covered strangle strategy. A covered strangle involves selling an out-of-the-money call and an out-of-the-money put on the same stock with the same expiration date while owning 100 shares. The goal is to have both options expire worthless and keep both premiums as profit. However, if either option is in-the-money at expiration, you may be assigned and have to buy or sell 100 shares of stock per contract. Selling calls against cash-secured puts can increase your income potential but also increase your risk exposure.

Do you need margin to sell cash secured puts?

No, you do not need margin to sell cash secured puts as long as you have enough cash in your account to cover the potential stock purchase if assigned. However, some brokers may allow you to use margin for selling cash secured puts if you want to free up some capital for other trades. This can increase your leverage and return potential but also increase your risk and interest expenses.

How to Learn More About the Stock Market

If you want to learn more about the stock market, joining a community of like-minded individuals is a great way to accelerate your learning curve.

Benefits of Joining a Trading Community

Converse with thousands of other experienced traders

When you join a community, you can talk with other traders with unique viewpoints on the stock market.

Learn new strategies

There are a million ways to trade on the stock market, and you will surely learn new strategies when you talk with other traders.

Stay up to date on the latest stock market news

Additionally, trading communities will keep you updated on the latest economic news. You can also ask questions if you don’t understand some of the complex financial terms.

The HaiKhuu Trading Community

The HaiKhuu Trading community is one of the largest stock trading communities online, with over a quarter million members within its communities.

The community includes beginner and professional traders who can assist with your day-to-day trading activities.

Tastytrade Disclosure

tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Marketing Agent (“HaiKhuu LLC.”) whereby tastytrade pays compensation to HaiKhuu LLC. to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of HaiKhuu LLC. by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of HaiKhuu LLC. or this website. tastytrade does not warrant the accuracy or content of the products or services offered by HaiKhuu LLC. or this website. HaiKhuu LLC. is independent and is not an affiliate of tastytrade.

tastytrade was previously known as tastyworks, Inc.