FZROX vs. FXAIX: A Comprehensive Comparison

FZROX and FXAIX, representing the total stock market and S&P 500, respectively, are both excellent choices for a core investment holding.

FZROX vs. FXAIX: An Overview

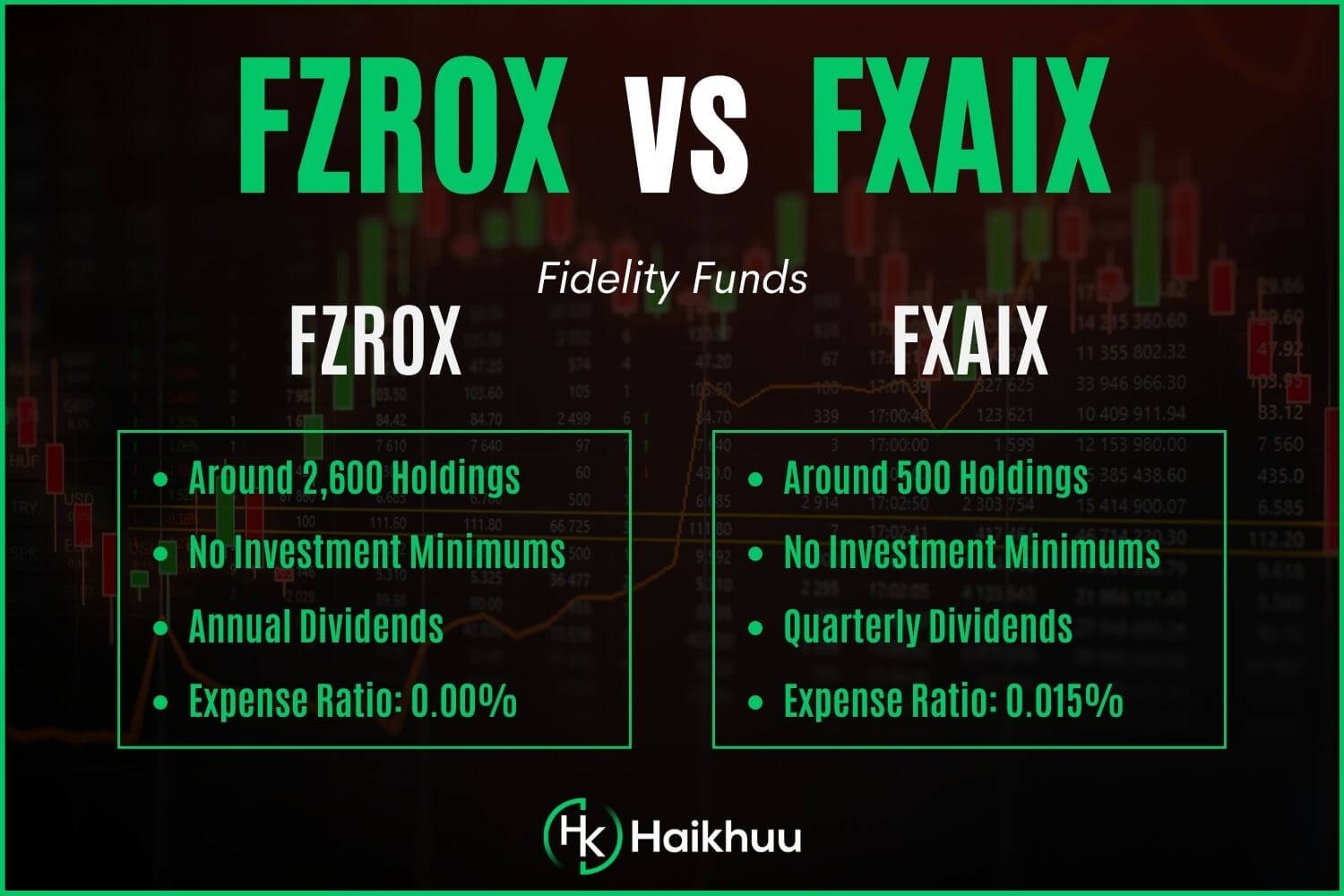

FZROX does not have an expense ratio, while FXAIX’s is 0.015%

FZROX holds all U.S. companies, while FXAIX holds the top 500 largest companies

FZROX pays annual dividends, while FXAIX pays quarterly dividends

Fidelity 500 Index Fund (FXAIX) and Fidelity Zero Total Market Index Fund (FZROX) are both low-cost index mutual funds managed by Fidelity Investments. While both funds provide broad exposure to U.S. stocks, there are major differences in their composition, scope, and fees.

FXAIX aims to replicate the performance of the S&P 500 – widely considered the benchmark of U.S. stock performance – meaning it’s composed primarily of large-cap stocks. FZROX, on the other hand, aims to mirror the total U.S. stock market’s performance, including small, mid-, and large-cap stocks, thus providing a wider diversification.

Expense Ratio Comparison

One essential factor to consider when assessing mutual funds is their expense ratios – the fees you pay to the fund company for managing the fund. These fees can significantly impact your investment returns over time.

FXAIX has a mere expense ratio of 0.015%. FZROX, however, amps up the competition even further with an expense ratio of… 0%! Yes, investing in FZROX is free of management expenses, which can make quite a difference over the long run.

Dividend Comparison

When analyzing the potential returns of these funds, we must also consider their dividend payouts.

The most significant difference between the dividend payouts of these funds is the FZROX only pays dividends once a year, while FXAIX pays them quarterly.

The dividend yields of both of these funds are nearly identical. However, FZROX pays a slightly higher yield since it primarily invests in large-cap companies, which tend to be more stable and pay dividends.

Holdings Comparison

Beyond expense ratios and dividends, what these funds are actually investing in is of paramount importance. As mentioned earlier, FXAIX tracks the S&P 500, which comprises around 500 (in actuality, over 500) of the largest U.S. companies. Thus, it leans heavily toward large-cap stocks.

FZROX, in contrast, captures the entire spectrum of the U.S. stock market, spanning over 2,600 stocks. This includes not just the big-cap stocks but also medium- and small-cap stocks, providing vast diversification across market sectors and company sizes.

Performance Comparison

As for performance, both FZROX and FXAIX will generate nearly identical returns.

FXAIX closely matches the performance of the S&P 500, regarded as a reliable indicator of the U.S. economy’s overall health. Hence, in bullish market conditions, where large-cap stocks often excel, FXAIX could potentially outperform.

FZROX, with its total market strategy, provides wider exposure to various market segments. In market conditions favoring smaller companies, FZROX could witness stronger returns. Fast-growing small and mid-cap companies can provide a significant return potential that FXAIX might miss out on.

Which is Better for You?

Deciding between FXAIX and FZROX boils down to what type of investor you are and what your investment goals are.

FXAIX might be a better choice if you are seeking an investment closely mirroring the performance of the U.S. large-cap stocks with a slightly higher dividend yield.

On the other hand, FZROX would be the better option if you want broader diversification across company sizes and desire to save as much as possible on expense ratios.

Ultimately, both funds represent cost-effective investment vehicles capable of providing broad exposure to U.S. equities. Which fund you choose should depend on your individual financial goals, investment timeline, and comfort with market risk.

If you want to learn more about the stock market, you can join the HaiKhuu Trading Community.

HaiKhuu offers live trading calls, daily morning reports, and an awesome community of like-minded traders to learn from.