QYLD vs. SCHD: A Comprehensive Comparison

This comprehensive comparison will dive into two ETFs: the Global X NASDAQ 100 Covered Call ETF (QYLD) and the Schwab US Dividend Equity ETF (SCHD), highlighting their key features, performances, dividends, and expense ratios.

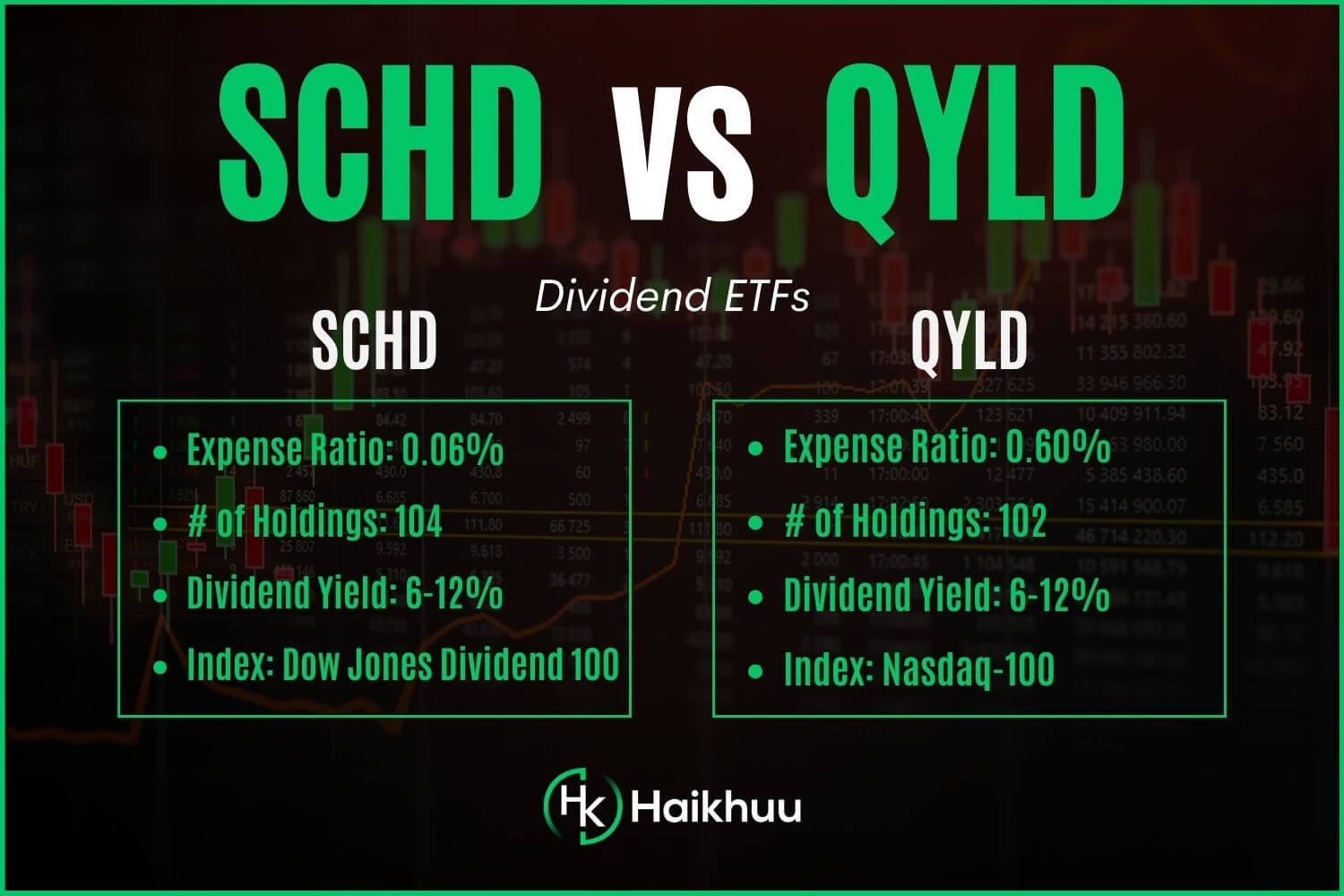

Key Characteristics

QYLD and SCHD, while both ETFs, vary greatly in their construct and the indices they aim to replicate.

QYLD seeks to track the performance of the CBOE NASDAQ-100 Buy Write V2 Index. This strategy involves buying the stocks in the NASDAQ-100 index and “writing” or selling corresponding call options. It aims to provide investment results that correspond generally to the price and yield performance of the index.

SCHD, on the other hand, attempts to track the performance of the Dow Jones U.S. Dividend 100 Index. The index is designed to measure the performance of high dividend-yielding U.S. stocks.

Performance Comparison: QYLD vs. SCHD

The performance of QYLD and SCHD depends on the market environment. Since QYLD is selling call options, it tends to do well when the markets are stagnant, falling, or rising moderately. Its primary target is not growth in net asset value but rather steady income from writing options.

SCHD, as a dividend-focused fund, combines the potential for price appreciation (stock price growth) and income generation (through regular dividends), making it a balanced selection for those longing for growth and moderate-income.

Dividend Comparison: QYLD vs. SCHD

QYLD - 6-12%

SCHD - 3.93%

QYLD stands out when it comes to yielding dividends. As a result of its call option strategy, its dividend payout is generally higher.

Conversely, SCHD targets companies with a consistent dividend payout history, emphasizing stability rather than yield. Thus, while SCHD’s dividend payout might be lower, it is generally consistent and reliable.

Expense Ratio Comparison: QYLD vs. SCHD

QYLD - 0.60%

SCHD - 0.06%

Another key consideration when choosing between ETFs is the expense ratio.

The expense ratio of SCHD, with only 0.06%, stands out as a cost-efficient option compared to QYLD’s expense ratio, which currently stands at 0.60%.

Hence, in terms of cost-efficiency, SCHD has the edge.

Risk-Adjusted Performance Comparison: QYLD vs. SCHD

As goes the basic principle of risk-return trade-off, QYLD’s reliance on an option-writing strategy might increase the possibility of higher volatility levels as levels of stock-market volatility influence the option premiums.

SCHD, on the other hand, maintaining its focus on companies with solid fundamentals and a strong track record of dividend payouts, often offers a better proposition from a risk-adjusted return perspective.

Which Dividend ETF is Better for You: QYLD or SCHD?

The apt choice between QYLD vs. SCHD depends on the individual’s risk appetite, financial goals, and investment horizon. If you prioritize current income over capital appreciation, QYLD’s strategy might be attractive.

However, if stability and a balanced growth-income approach are what you seek, SCHD might be a better choice.

If you want to learn more about investing in the stock market, you can join the HaiKhuu Trading Community.

HaiKhuu offers live trading calls, daily morning reports, and an awesome community of like-minded traders to learn from.

FAQ

Is investing in QYLD good?

QYLD, the Global X NASDAQ 100 Covered Call ETF, can offer potential benefits for those who are pursuing consistent income over the short term. With its strategy of selling call options, it has been known to make higher-than-average distributions. However, this strategy may limit potential gains from rising stock prices. Long-term capital appreciation may be limited, making it less suitable for investors seeking growth in their portfolios.

Why is SCHD so popular?

SCHD, the Schwab U.S Dividend Equity ETF, is popular due to its investing methodology in high-dividend U.S. stocks and lower expense ratio. The fund targets companies that have consistently paid dividends for at least 10 years, so the focus is more on stability and less on yield. This and its broad exposure to multiple sectors make it appealing for long-term growth investors.

Is SCHD a good long-term investment?

SCHD is often regarded as a good long-term investment due to its focus on companies with a strong track record of paying dividends. These are generally stable companies with mature businesses, lending stability to the fund’s performance over the long run. Additionally, its low expense ratio aids in maximizing returns.

Can you hold QYLD long term?

Technically, you can hold QYLD for as long as you intend. However, because QYLD’s strategy involves selling call options, it tends to excel in markets with moderate gains or when markets are down or stagnant. Long-term holders seeking growth in a bull market might face limited capital appreciation. Nevertheless, for those seeking steady income generation, QYLD could be a beneficial addition to a portfolio.