IVV vs. VOO: A Comprehensive Comparison

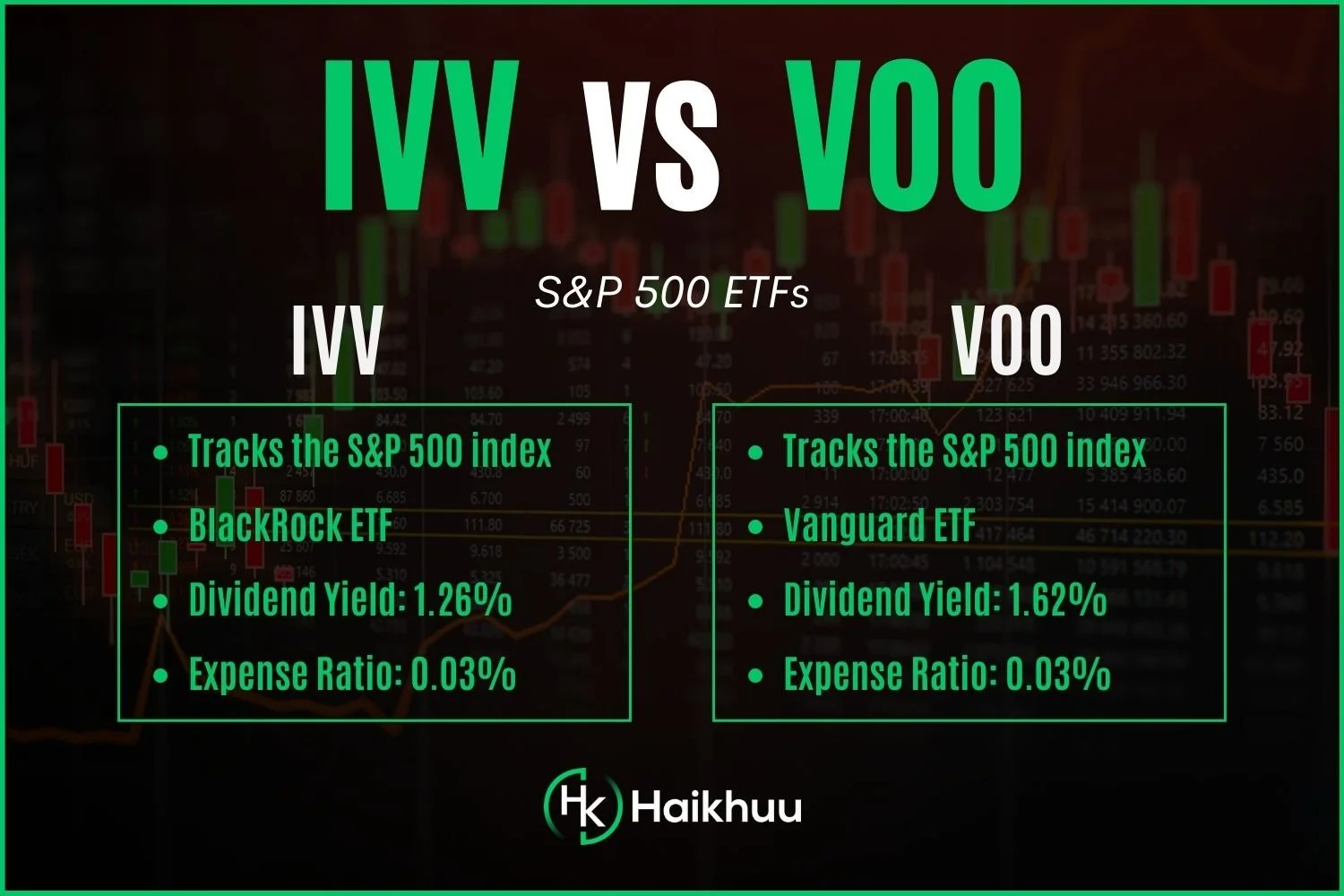

Exchange-traded funds (ETFs), such as the iShares Core S&P 500 ETF (IVV) and the Vanguard S&P 500 ETF (VOO), have become popular investment instruments due to their diversified exposure to numerous sectors and asset classes.

These ETFs are designed to track the S&P 500, a widely followed stock market index that represents the US’s largest and most influential companies.

However, each ETF offers its unique characteristics and details, igniting the IVV vs VOO debate among investors and traders on which option is more suitable for their portfolios.

Overall, the only difference between these ETFs is one is managed by Blackrock, and the other is managed by Vanguard. However, let’s take a closer look.

Vanguard S&P 500 ETF (VOO) vs iShares Core S&P 500 ETF (IVV)

Key Characteristics of IVV and VOO

iShares Core S&P 500 ETF (IVV)

IVV is designed to track the 500 largest (by market capitalization) U.S. domiciled stocks. These stocks represent about 80% of all U.S. equities. It offers broad exposure to large-establishment U.S. companies representing all sectors, making it a core holding for investors.

Vanguard S&P 500 ETF (VOO)

Just like IVV, VOO is a low-cost ETF providing exposure to a diverse selection of America’s 500 largest public companies ranging across all sectors. Due to this broad-based coverage, VOO is considered a placeholder for the “total U.S. market” and is also a frequent core holding for many investors.

Performance Comparison of IVV and VOO

The performance comparison of IVV and VOO depicts a striking yet unsurprising picture since these ETFs offer nearly identical performances. Evidently, their objective to replicate the S&P 500 puts them on an almost equal footing regarding performance metrics.

Expense Ratio Comparison of IVV and VOO

Considering the management of ETFs incurs costs, which are passed on to investors in the form of expense ratios. As of this writing, both IVV and VOO possess an impressively low expense ratio of 0.03%.

Dividend Comparison of IVV and VOO

Both IVV and VOO offer attractive dividend yields that are almost on par due to their similar investment objectives. However, investors should keep in mind that dividends may vary based on the earnings of the companies in the S&P 500 Index and can be influenced by broader market and economic changes.

Risk-Adjusted Performance Comparison of IVV and VOO

When comparing risk-adjusted performance, IVV and VOO again are neck and neck due to their related investment objectives. Both have similarly substantial amounts of assets under management and share almost identical risk profiles.

Sharpe Ratio Comparison of IVV and VOO

The Sharpe ratio measures how much risk you take compared to how much return is provided by an asset. Given that IVV and VOO have similar returns and risk levels, their Sharpe Ratios are also alike, indicating these ETFs provide nearly equal compensation for the risk involved.

To Conclude

Amid this IVV vs VOO debate, one thing is clear- both ETFs have a lot to offer. Whether IVV or VOO is a better fit for your portfolio depends entirely on your unique investment goals, risk tolerance, and portfolio composition.

Regardless, diversification, low expense ratios, comparable performance, and dividends make both IVV and VOO ideal candidates for being core components of any long-term portfolio. Always remember, every investment decision should pave the way for a well-balanced and diversified portfolio catered to your financial ambitions.

Opinions expressed here are solely the author’s and have not been accepted by the issuer of either VOO or IVV or any other third party. Remember, past performances are not indicative of future results, and it’s essential to do your research before making any investment decisions.

How to Learn More About the Stock Market

Investing in stocks can be a lonely journey, but it doesn’t have to be! You can learn how to become a more profitable trader and investor by joining the HaiKhuu Trading Community for free!

HaiKHuu offers daily morning reports, live trading calls, and access to an awesome community of experienced traders and investors. Joining a community of people who are stock market veterans is an excellent way to become a more successful investor.

You can join the HaiKhuu Trading Discord for free and start improving your skills today!

FAQ

What is the difference between SPY, VOO, and IVV?

SPY is the most liquid for active traders, while VOO and IVV are best for investors. SPY, VOO, and IVV all track the S&P 500 index but have different issuers, structures, and expense ratios. The SPDR S&P 500 ETF (SPY) is managed by State Street Global Advisors, VOO by Vanguard, and IVV by BlackRock’s iShares.

Is IVV a good long-term investment?

As a broad-based, low-cost ETF that tracks the S&P 500 Index, IVV can be a good choice for long-term investors looking for diversified exposure to the U.S. stock market. However, as with any investment, investors should consider their risk tolerance, investment objectives, and other factors when making a decision.