JEPI vs. SPY: Comparison of Popular ETFs

If you are looking for a long-term investment in the stock market, JEPI and SPY are two amazing options.

However, there are many differences between the two, and this article will compare them to help you determine which is right for you!

Understanding JEPI and SPY: A Detailed Analysis

JEPI is known for its active management strategy, aiming to deliver consistent income and moderate growth. Its approach involves a mix of equity holdings and options strategies.

In contrast, SPY adopts a passive management style, mirroring the performance of the S&P 500. This makes SPY a reflection of the broader market's performance, offering direct exposure to top U.S. companies.

JEPI

High dividend yield

Holds low volatility stocks

Sells options to generate dividend income for investors

SPY

Owns 500 of the best large-cap U.S. companies

More volatile than JEPI but has more return potential

Performance Analysis: JEPI vs. SPY

Since its inception, JEPI has been outperformed by SPY, and the stock market has been extremely bullish.

Performance under varying market conditions can be hard to predict. SPY excels in bullish markets, closely tracking the uptrends of the S&P 500.

JEPI, with its focus on income generation through options, tends to offer more stable returns, especially in volatile markets.

Overall, if you’re looking for slow and steady returns, JEPI is the best option for you.

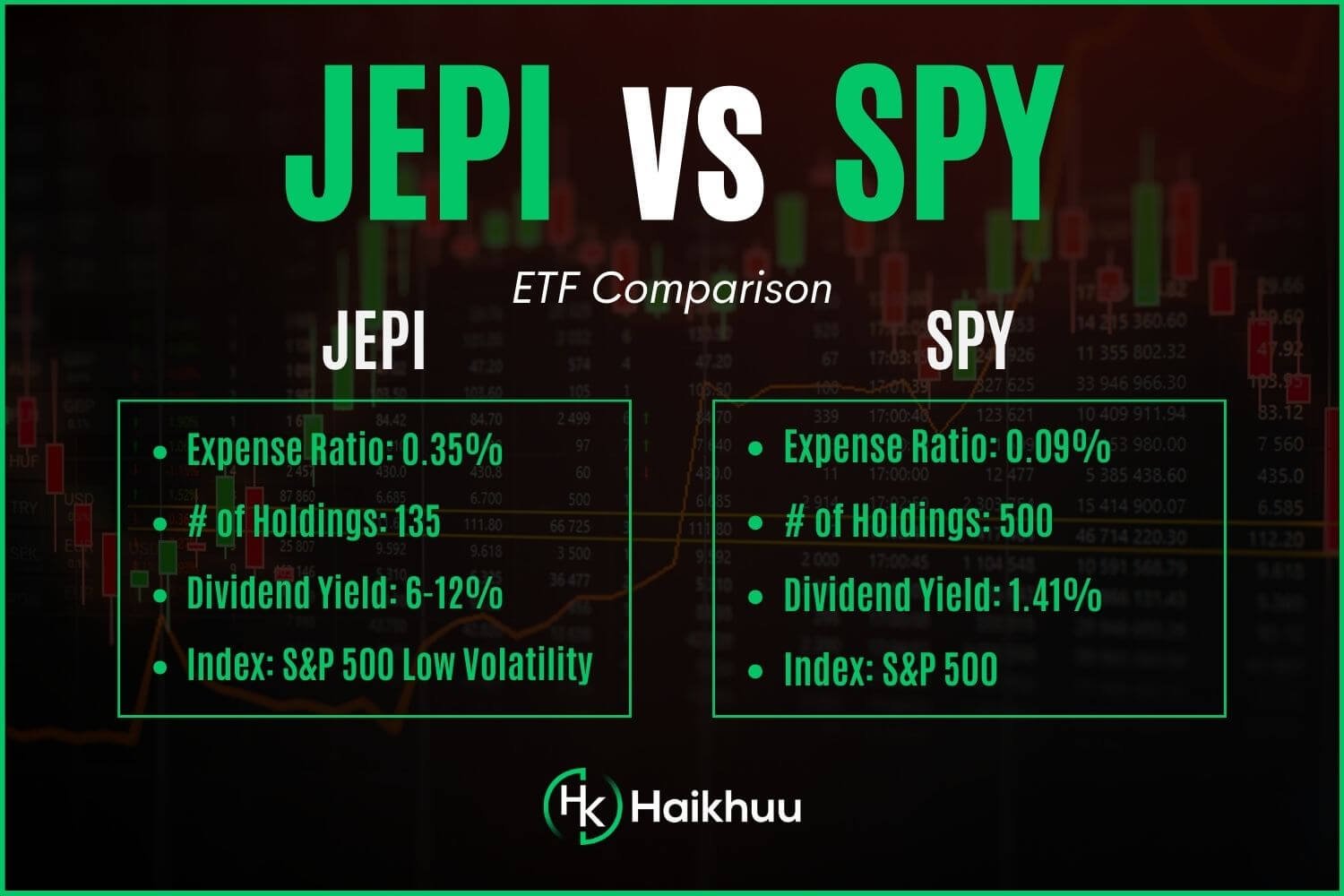

Expense Ratios: Evaluating the Costs

SPY’s lower ratio of 0.09% is attractive for cost-conscious investors.

JEPI, with a higher ratio of 0.35%, reflects the costs associated with its active management.

Since JEPI is actively managed, it comes with a higher expense ratio than SPY. However, it is still lower than most actively managed funds.

JEPI vs. SPY Dividends Compared

JEPI is the clear winner when it comes to dividend payments.

When it comes to dividend yields, JEPI leads with an approximate annual yield of 6-12%, compared to SPY's 1.41%.

Another important factor to consider is that JEPI does not pay qualified dividends, meaning they will be taxed at your regular income tax rate.

On the other hand, SPY does pay qualified dividends, meaning they are taxed at a more optimal tax rate.

Strategic Considerations for Investors

Choosing between JEPI and SPY depends on factors such as the account type and your overall goals.

JEPI is amazing in IRAs, specifically ROTH IRAs since the returns will be tax-free if you hold off on selling until retirement.

The same goes for SPY, but dividend payments are a large portion of the returns from JEPI, making it more significant.

SPY’s lower expense and alignment with the S&P 500 make it appealing for long-term growth, while JEPI’s strategy suits those seeking regular income and lower volatility.

Incorporating both in a diversified portfolio could strike a balance between growth and income.

If you want to learn more about investing in the stock market, you can join the HaiKhuu Trading Community.

HaiKhuu offers live trading calls, daily morning reports, and an awesome community of like-minded traders to learn from.

FAQ

What are the Disadvantages of JEPI

High portfolio turnover and tax implications of its income strategy are notable concerns. For investors outside tax-sheltered accounts, these factors can impact net returns.

Is JEPI a good retirement fund?

Potentially, JEPI’s substantial yield, low volatility, and model of generating sustainable income might make it a suitable candidate for retirement investment if it fits your retirement goals and risk tolerance.