VFIAX vs. SPY - A Comprehensive Comparison

Two of the most popular S&P 500 funds in the market today are the Vanguard 500 Index Fund Admiral Shares (VFIAX) and the SPDR S&P 500 ETF Trust (SPY).

Key Takeaways

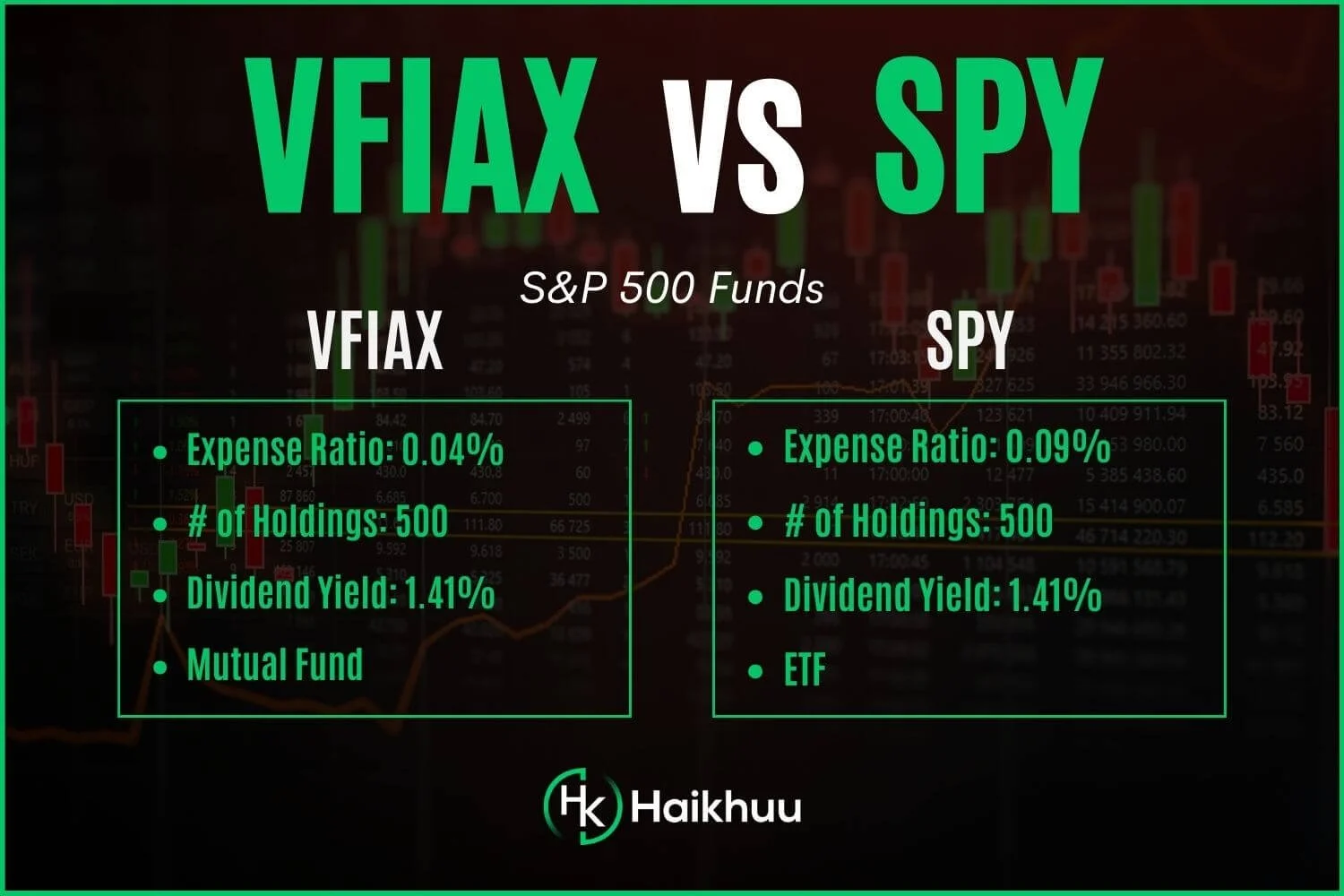

Both VFIAX and SPY track the S&P 500 Index, aiming to mirror its performance.

VFIAX is a mutual fund, while SPY is an ETF. This structural difference imbues each with different trading functionality and potential tax implications.

VFIAX has a lower expense ratio of 0.04%, while SPY charges 0.09%, slightly more.

Both are generally considered strong investments known for their low fees and well-executed strategies.

SPY is liquid and great for day traders and investors alike, while VFIAX is only good for investors.

VFIAX vs. SPY: Mutual Funds and ETFs

To begin unraveling this complex narrative, it’s important to understand the basic differences between VFIAX, a mutual fund, and SPY, an ETF.

Mutual funds like VFIAX are pooled investment vehicles that gather money from various investors and use it to purchase a diversified portfolio of stocks, bonds, or other assets. They are priced only once at the end of the trading day and are often ideal for long-term, buy-and-hold investors.

ETFs, like SPY, on the other hand, are similar to mutual funds insofar as they also represent a diversified pool of assets. However, they trade on an exchange, just like individual stocks, meaning you can buy or sell ETF shares throughout the trading day at fluctuating prices. Furthermore, ETF shares can be purchased in small quantities, making them more accessible for investors with less initial capital.

There are quite a few nuances intrinsic to both VFIAX and SPY that steer them in slightly disparate investment pathways. Here’s a more detailed comparative evaluation of both to help you make an informed choice.

What Are VFIAX and SPY?

Both VFIAX and SPY fall firmly within the passive investing camp, serving investors who aim to replicate and ride with market returns rather than attempting to beat the market.

VFIAX is a mutual fund managed by Vanguard. It tracks the S&P 500 Index in a bid to offer diversified exposure to 500 of the largest U.S. companies across various industries. Since it’s passively managed, the aim is to replicate the index performance, not outdo it.

On the flip side, we have SPY — an ETF managed by State Street Global Advisors. This fund also replicates the S&P 500 Index, and because of its structure, it offers more trading flexibility than a mutual fund. It is one of the oldest and largest ETFs in the world and a popular choice for traders and investors.

VFIAX vs. SPY - Fees

VFIAX benefits from Vanguard’s reputation for offering low-cost funds. Its expense ratio stands at an appealing 0.04%. Compared to the average mutual fund expense ratio sitting around 0.44%, this signifies a substantial saving opportunity, particularly for long-term investors.

SPY, meanwhile, has a higher net expense ratio of 0.09%, over double the cost of VFIAX. While still substantially lower than the average mutual fund, it’s worth noting this difference if fees play a paramount role in your choice of investment.

Always remember that lower fees can equate to better performance over the long haul due to savings accumulation and potential compounding.

Performance

Determining expected performance in absolute terms is a complex task since it hinges significantly on future market conditions, which are inherently unpredictable. However, given that both VFIAX and SPY pursue a similar aim of tracking the S&P 500, their performance tends to mirror each other pretty closely.

However, slight discrepancies might occur depending on the precision matching of the mutual fund and ETF to the performance of the S&P 500, which are dictated by the fund management’s rebalancing tactics and trading effectiveness.

Other Considerations

Aside from performance and fees, there are other factors at play that can influence an investor’s choice between VFIAX and SPY.

Tax Implications: ETFs generally grant a slight edge in tax efficiency compared to mutual funds. Unlike mutual funds, ETFs don’t need to sell shares to meet investor redemption, reducing potentially taxable capital gains distributions. Hence, funds like SPY may pose a more appealing choice for investors conscious of tax ramifications.

Purchase and Sale: Mutual fund shares like VFIAX can be bought or sold at the closing net asset value directly with the fund company. ETF shares, like SPY, trade on exchanges at market value, just like stock shares. This influences their liquidity, with ETFs offering the flexibility of intraday trading, appealing to more short-term traders.

Minimum Investment: VFIAX requires a minimum investment of $3,000, which might deter new or small-scale investors. On the other hand, SPY allows the purchase of fractional shares, offering a viable alternative to investors with lesser starting capital.

VFIAX vs. SPY - Dividend Comparison

Both VFIAX and SPY pay a nearly identical dividend yield of 1.41%, making it an irrelevant factor when comparing these funds.

Which Should You Choose? VFIAX or SPY?

Ultimately, VFIAX is great for investors, while SPY is great for those who would also like the ability to trade options or actively trade while still being a great long-term investment choice.

Whatever fund you lean towards, always remember to base your decision on thorough research, careful consideration of your own financial stead, and, ideally, personalized professional advice.

Final Thoughts

The most crucial takeaway here is the importance of understanding what you’re investing in and aligning your investment choices with your long-term financial goals and comfort with risk.

If you want to learn more about investing in the stock market, you can join the HaiKhuu Trading Community.

HaiKhuu offers live trading calls, daily morning reports, and an awesome community of like-minded traders to learn from.