FXAIX vs. VOO: Which Is a Better Investment Option?

When it comes to investing in S&P 500 index funds, two popular choices that often come into question are the Fidelity 500 Index Fund (FXAIX) and the Vanguard S&P 500 ETF (VOO).

Here, we’ll compare these two and analyze the key aspects of each, such as their performances, expense ratios, tax efficiencies, and dividends - to help you determine which could be a better fit for your portfolio.

What is VOO?

VOO is an ETF managed by Vanguard that mimics the S&P 500. The inception for this fund was on September 7, 2010.

ETFs like VOO can be traded throughout the day like stocks, meaning they offer real-time pricing and higher liquidity compared to mutual funds.

What is FXAIX?

FXAIX, managed by Fidelity, is a mutual fund that also tracks the S&P 500.

Launched in 2011, FXAIX trades only at the end of the trading day, at its net asset value, offering a simpler investing process compared to VOO’s ETF structure.

FXAIX vs. VOO: Which S&P 500 Index Fund is Better?

Let’s further compare FXAIX and VOO based on six key factors.

Diversification – Tie

Since both FXAIX and VOO replicate the performance of the S&P 500 Index, the level of diversification they offer is essentially identical – covering a balanced mix of sectors in the US economy.

Minimum Investment – Tie

Both VOO and FXAIX can be purchased with the price of one share, removing any barriers of high minimum investments.

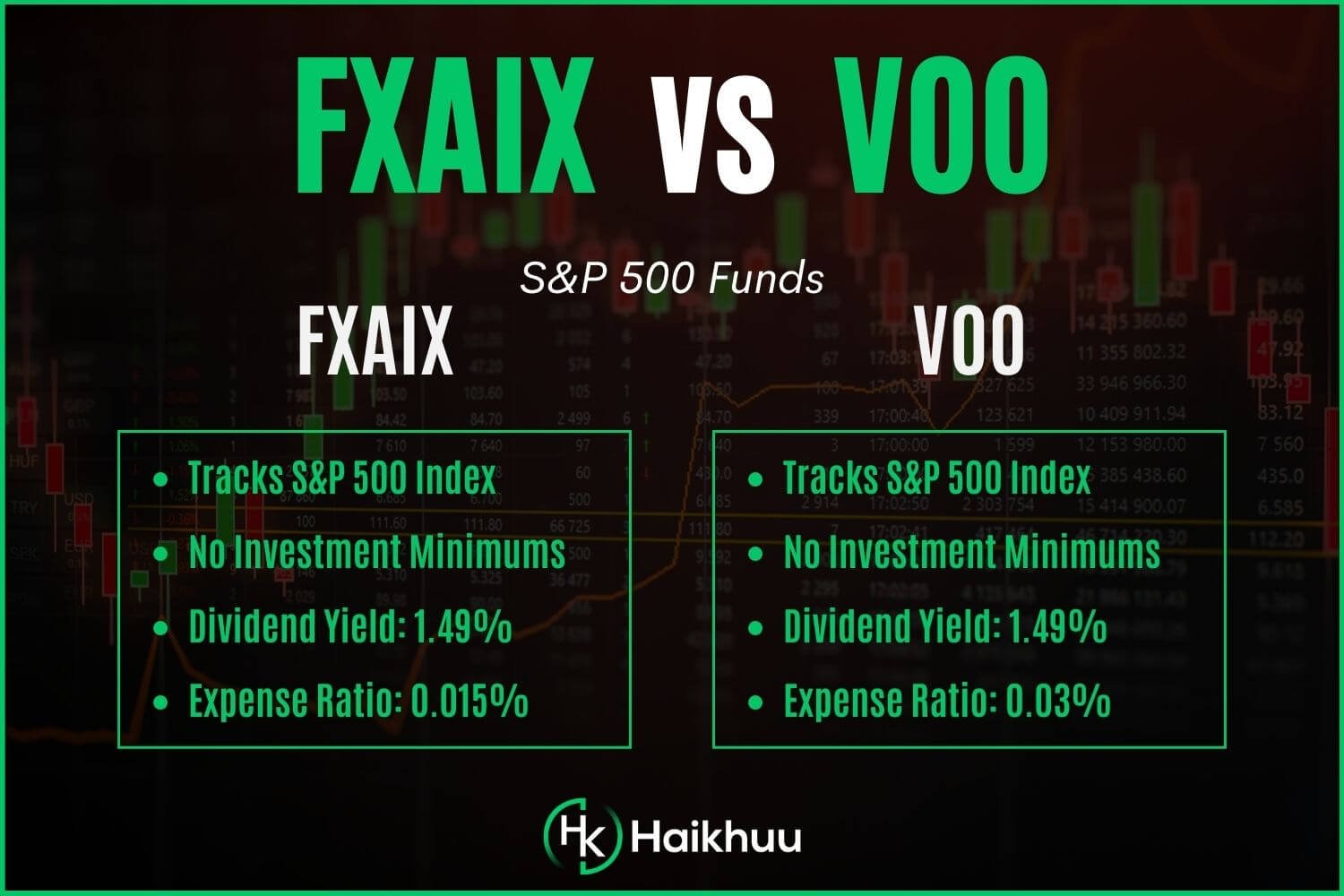

Expense Ratios – Slight Edge to FXAIX

FXAIX holds a slight advantage here with an expense ratio of 0.015% compared to VOO’s 0.03%. However, given these low expense ratios, the noticeable impact on your portfolio returns is quite insignificant.

Trading and Liquidity – Split Decision

With VOO trading as an ETF, it offers real-time trading flexibility. In contrast, FXAIX, being a mutual fund, allows only end-of-day trading, which is simpler but less flexible.

So, this aspect goes down to personal preference: instant trading (VOO) or ease-of-use (FXAIX).

Tax Efficiency – Slight Edge to VOO

Being an ETF, VOO generally offers slightly better tax efficiencies due to the “in-kind” creation and redemption, minimizing its capital gain distributions.

Performance and Dividends – Tie

As both VOO and FXAIX track the same index, their performance and dividend yields are almost undistinguishable, showing a virtual tie in this category at around 1.50%.

Vanguard vs. Fidelity

Both Vanguard and Fidelity are leading asset management companies, trusted for their low-cost index funds and ETFs.

So, the choice between Vanguard (VOO) and Fidelity (FXAIX) may ultimately come down to personal preferences like your preferred type of fund (ETF or mutual fund) and the trading platform you’re comfortable with.

FXAIX vs. VOO: Which One Should I Invest In?

Whether you opt for FXAIX (Fidelity Mutual Fund) or VOO (Vanguard ETF) hinges significantly on your investing style and preferences. The crucial element to remember is that both these funds offer almost identical exposure to the S&P 500 index, so your final decision shouldn’t significantly impact your overall portfolio performance.

In the complex world of trading, there is no one-size-fits-all solution. Success comes from devising a tailored, well-researched strategy, and one of these funds could be a valuable piece of that puzzle.

Remember, the race isn’t always to the swiftest but to those who keep running. Similarly, success in investing isn’t just about picking the correct fund. It’s about staying invested over the long run, patience, perseverance, and continuous learning!

If you want to learn more about investing and trading on the stock market, you can join the HaiKhuu Trading Community for free!

HaiKhuu offers live trading calls, daily morning reports, and an amazing community of traders willing to help you along your financial journey.

FAQ: Understanding FXAIX vs. VOO

What is the difference between FXAIX and VOO?

FXAIX is a mutual fund, while VOO is an Exchange Traded Fund (ETF). Both track the S&P 500, but they differ in their structure, trading mechanisms, tax efficiencies, and expense ratios.

Is FXAIX the best index fund?

FXAIX is widely known for its low-cost and efficient tracking of the S&P 500 index. Still, determining the “best” index fund depends on an investor’s preferences, financial goals, tax circumstances, and trading strategies.

Should I invest all my money in FXAIX?

It’s important to have a diversified portfolio, and while FXAIX does offer diversification across the 500 companies of the S&P Index, it’s still concentrated in U.S. large-cap stocks. So, allocation to FXAIX should be considered in the context of your overall investment strategy.

What is Fidelity’s equivalent to VOO?

FXAIX is Fidelity’s equivalent to VOO - both track the S&P 500 index, offering exposure to the large-cap U.S. equity market.