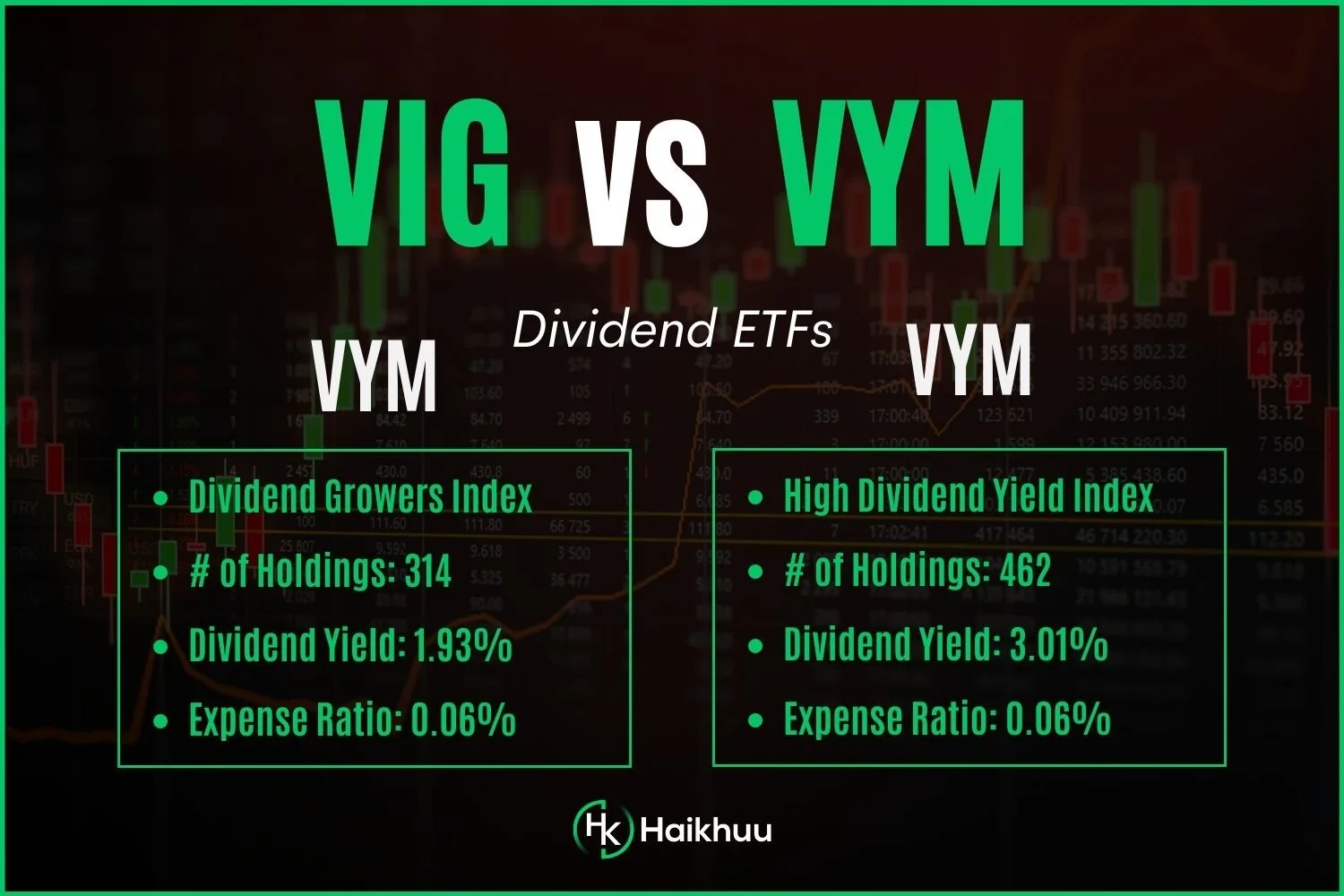

VIG vs. VYM | Comparing Vanguard Dividend ETFs

As an investor looking for opportunities in dividend-focused exchange-traded funds (ETFs), you might have come across VIG and VYM.

VIG, the Vanguard Dividend Appreciation ETF, and VYM, the Vanguard High Dividend Yield ETF, are popular funds from the Vanguard Group that focus on different aspects of dividend investing.

VIG (dividend growth) vs. VYM (high dividend yield) | What is the Difference?

VIG Overview

VIG, the Vanguard Dividend Appreciation ETF, focuses on dividend growth. This means that the ETF invests in companies with a history of consistently increasing their dividend payouts over time.

VIG seeks to track the performance of the Nasdaq US Dividend Achievers Select Index, which comprises companies with a record of growing dividends for at least ten consecutive years.

By investing in dividend growth stocks, VIG aims to expose investors to companies with the potential for long-term capital appreciation and a steadily increasing income stream.

VYM Overview

VYM, the Vanguard High Dividend Yield ETF, prioritizes high dividend yield. This means that the ETF invests in companies that pay a larger portion of their earnings as dividends relative to their stock price.

VYM seeks to track the performance of the FTSE High Dividend Yield Index, which comprises companies with higher-than-average dividend yields. The primary focus of VYM is to provide investors with a relatively high income stream and the potential for capital appreciation.

VIG Details

Expense Ratio: 0.06%

Dividend Yield: 1.93%

10yr Return: 11.25%

VYM Details

Expense Ratio: 0.06%

Dividend Yield: 3.01%

10yr Return: 10.61%

VIG Holdings

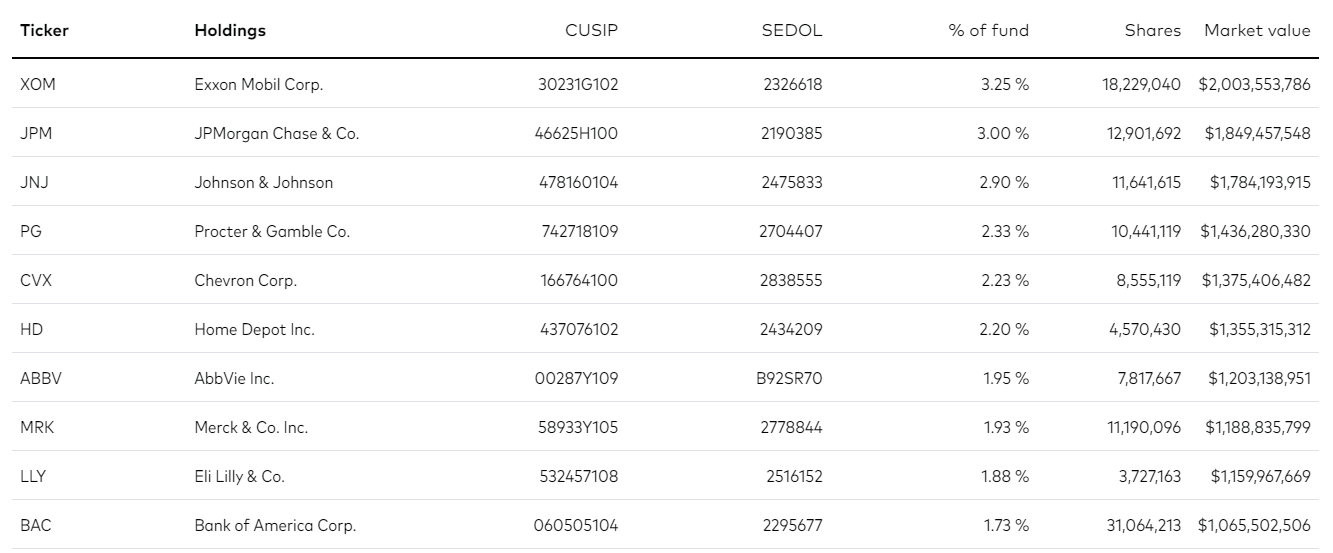

VYM Holdings

VIG vs. VYM Historical Returns

When comparing the historical returns of VIG and VYM, we can observe some differences in their performance. Over the past ten years, VIG has delivered an annualized return of 11.25%, while VYM has generated a slightly lower annualized return of 10.61%.

Although the difference may not seem significant, it can have a meaningful impact on your investment returns over the long term.

The performance difference between VIG and VYM can be attributed to their distinct investment strategies. VIG's focus on dividend growth companies has allowed it to benefit from the long-term capital appreciation and steadily increasing dividends these companies offer.

In contrast, VYM's emphasis on high-dividend-yielding companies provides a higher current income but may also expose the portfolio to companies with slower growth or higher payout ratios, which can limit capital appreciation.

Is VYM a good long-term investment?

VYM may be suitable for investors seeking a higher current income, such as retirees or income-focused investors. It may also be a good fit for those who prefer a more conservative investment approach or want to add some stability to their portfolio during uncertain market conditions.

Is a VIG a good investment?

VIG may be suitable for investors seeking long-term capital appreciation and a steadily increasing income stream. It can be an attractive option for those with a longer investment horizon and can withstand potential short-term market volatility. Additionally, VIG may appeal to investors who want to balance their exposure to interest rate risk by investing in dividend growth stocks.

What is the top holding of VIG?

As of 2023, the top holding of VIG is UnitedHealth Group (UNH).

Does VIG pay monthly dividends?

No, VIG pays dividends quarterly, not monthly.