VTSAX vs. VOO | Total Stock Market vs. S&P 500 Funds

Discover the differences between VTSAX and VOO, two popular ETFs providing exposure to the US stock market.

VTSAX (Vanguard Total Stock Market) vs. VOO (Vanguard S&P 500)

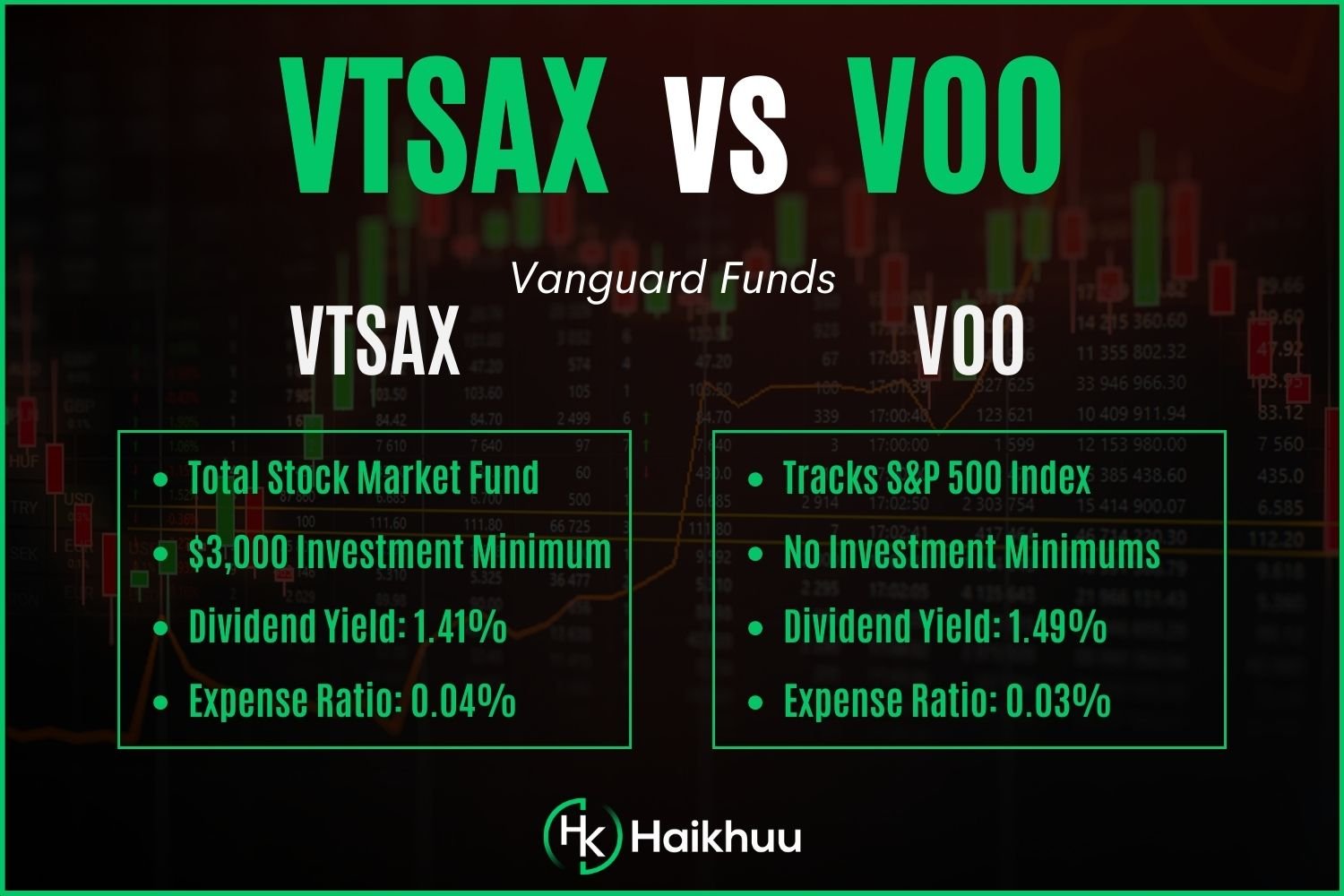

VTSAX and VOO are two of the most popular ETFs in the investment world. VTSAX, also known as the Vanguard Total Stock Market Index Fund, tracks the performance of the entire U.S. stock market, while VOO, also known as the Vanguard S&P 500 ETF, tracks the performance of the S&P 500 index.

Both ETFs are designed to provide investors with exposure to the U.S. stock market, but they have some key differences that make them unique. In this article, we will provide a comprehensive comparison of VTSAX and VOO, covering important factors such as historical performance, holdings, and dividend payouts.

VTSAX Details

Expense Ratio: 0.04%

Dividend Yield: 1.53%

10yr Return: 12.22%

VOO Details

Expense Ratio: 0.03%

Dividend Yield: 1.57%

10yr Return: 12.21%

VTSAX vs. VOO Historical Performance

It is important to examine historical performance when making investment decisions because it can provide insight into how the ETFs have performed in different market conditions and whether they have consistently generated returns for investors.

Over the last ten years, VTSAX has had an annual return of 12.22%, while VOO has had an annual return of 12.21%. However, over the previous five years, VOO has outperformed VTSAX with an annual return of 16.74% compared to VTSAX's 16.68%.

When making investment decisions, it is important to consider other factors, such as expense ratios, holdings, and dividend payouts, but historical performance is a key component.

VTSAX Holdings

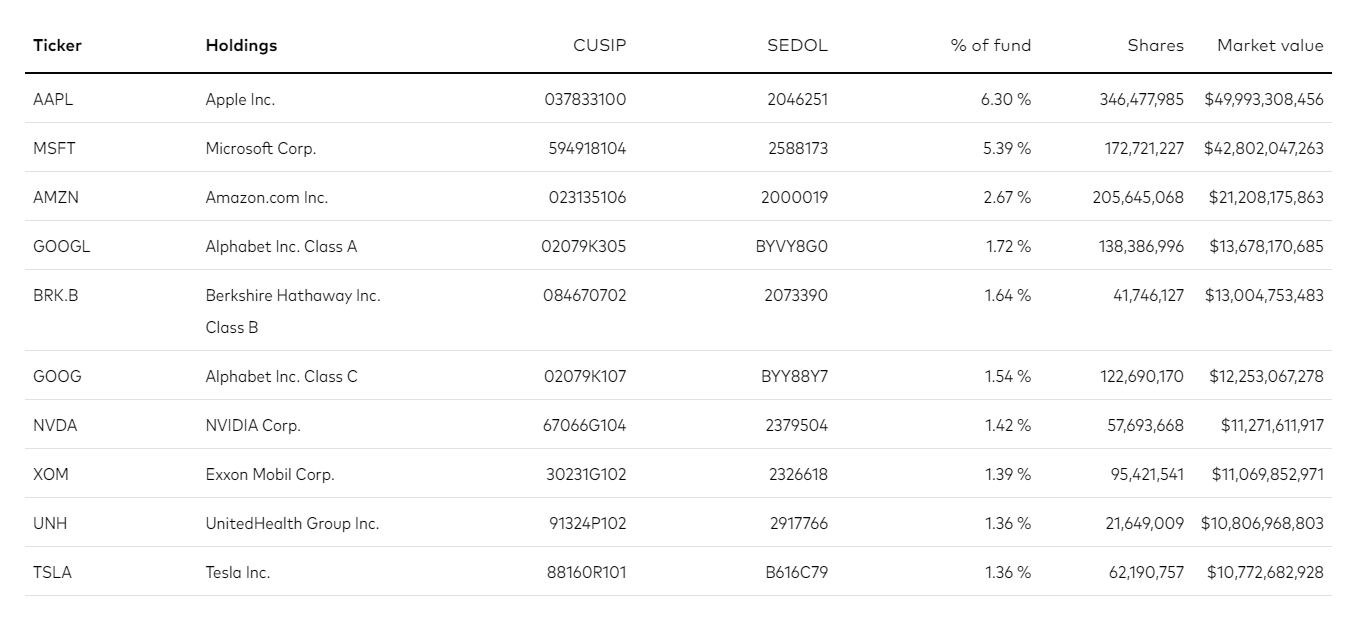

VOO Holdings

How Much Does VTSAX Pay in Dividends?

VTSAX pays dividends to its investors every quarter. The dividend payout is based on the dividends received from the underlying stocks in the ETF's portfolio. VTSAX has a dividend yield of 1.53%, which means that for every $100 invested in VTSAX, an investor can expect to receive $1.53 in dividends each year.

How Much Does VOO Pay in Dividends?

VOO also pays dividends quarterly, and its dividend payout is based on the dividends received from the underlying stocks in the S&P 500 index. VOO has a slightly higher dividend yield than VTSAX, with a yield of 1.57%.

While the difference in dividend yield between VTSAX and VOO is small, it is still important for investors to consider. Over time, the difference in dividend payouts can add up and impact an investor's overall returns.

Dividends are an important factor to consider when making investment decisions, as they can provide investors with a reliable income stream. Dividend-paying stocks and ETFs can also provide stability to a portfolio, as companies that pay dividends tend to be more established and financially stable.

What ETF is Equal to VTSAX?

VTSAX is an index fund managed by Vanguard that tracks the performance of the CRSP US Total Market Index. If you are interested in investing in an ETF equivalent to VTSAX, VTI, also managed by Vanguard, is a suitable option. VTI tracks the performance of the CRSP US Total Market Index, which is the same index that VTSAX tracks.

Both VTSAX and VTI are designed to provide investors with broad exposure to the U.S. stock market. The key difference between the two ETFs is that VTSAX is a mutual fund, while VTI is an ETF. This means that VTSAX can only be bought or sold at the end of the trading day, while VTI can be bought and sold throughout the trading day.

VTSAX vs. VOO | Bottom Line

We found that VTSAX and VOO have similar expense ratios, dividend yields, and historical performance. However, they differ in their holdings, with VTSAX having a more diversified portfolio and VOO only tracking the S&P 500 index. We also highlighted the importance of considering dividends when making investment decisions and discussed an equivalent ETF to VTSAX.

When choosing between VTSAX and VOO, or any other ETF, it is important to consider all factors that may impact investment returns. Historical performance, expense ratios, holdings, and dividend payouts are all important considerations that can help investors make informed investment decisions.