FZROX vs. VTSAX: Which Is Best For You?

If you are looking for a low-cost index fund that tracks the performance of the entire US stock market, you might be wondering which one is better: FZROX or VTSAX.

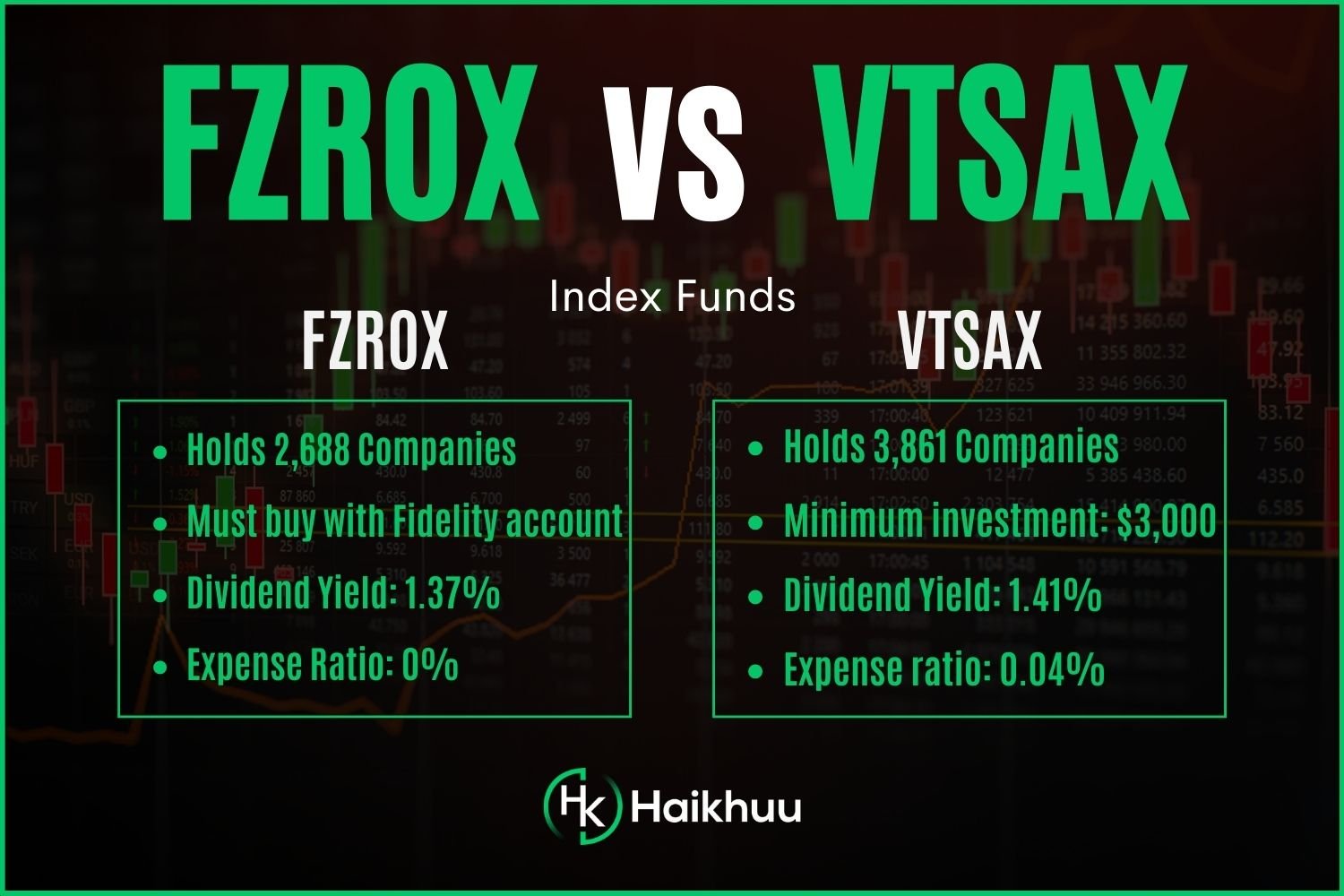

Both funds are very similar, but they have some differences that might affect your decision.

Overview of FZROX

FZROX is the Fidelity ZERO® Total Market Index Fund. It is a mutual fund that aims to provide investment results that correspond to the total return of a broad range of publicly traded companies in the US.

It does not charge any expense ratio at all, meaning that you don’t pay any fees to invest in this fund.

However, there is a catch: you can only buy and own this fund through Fidelity, and it is not transferable to other brokers. This means that if you want to switch brokers or access other funds, you will have to sell your FZROX shares and incur capital gains taxes.

Overview of VTSAX

VTSAX is the Vanguard Total Stock Market Index Fund Admiral Shares. It is also a mutual fund that seeks to track the performance of the CRSP US Total Market Index, which covers the entire US stock market.

It has a very low expense ratio of 0.04%, which means that you pay only $4 per year for every $10,000 invested in this fund. Unlike FZROX, you can buy and own this fund through various brokers, not just Vanguard. This gives you more flexibility and choice in your broker selection.

FZROX vs. VTSAX Expenses

The most obvious difference between FZROX and VTSAX is their expense ratios. FZROX does not charge any fees at all, while VTSAX charges 0.04%. This might seem like a huge advantage for FZROX, but in reality, the difference is negligible.

For example, if you invest $10,000 in each fund for 10 years and assume an annual return of 10%, you will end up with $25,937 in FZROX and $25,894 in VTSAX. That’s only a difference of $43 over a decade! The impact of fees becomes even smaller as your investment horizon increases.

FZROX vs. VTSAX Dividend Yield

FZROX has a dividend yield of 1.42%, while VTSAX has a dividend yield of 1.53%. This means that if you invest $10,000 in each fund, you will receive $142 from FZROX and $153 from VTSAX per year in dividends.

These dividend yields are relatively similar and not a significant factor when choosing between these funds.

FZROX vs. VTSAX Historical Performance

One of the most important factors to consider when comparing FZROX and VTSAX is their historical performance. After all, the main goal of investing is to grow your money over time.

However, since both funds have extremely similar investment goals, they perform essentially the same. It is worth noting that VTSAX pays quarterly dividends, which will compound better than FZROX’s yearly dividends.

FZROX vs. VTSAX Minimum Investment

FZROX does not have a minimum investment at all, meaning that you can start investing in this fund with any amount of money. This is great for beginners and small investors who want to get started right away.

VTSAX, on the other hand, has a minimum investment of $3,000, which might be a barrier for some investors who don’t have that much money to spare. However, once you reach the minimum investment, you can add more money to your VTSAX account with as little as $1.

Fidelity vs. Vanguard Funds

The last difference between FZROX and VTSAX is their availability. FZROX is only available through Fidelity, while VTSAX is available through various brokers, including Vanguard.

This means that if you want to invest in FZROX, you will have to open an account with Fidelity and keep your money there. This might limit your access to other funds and services that other brokers might offer.

On the other hand, if you want to invest in VTSAX, you can choose from a wide range of brokers that offer this fund, giving you more options and flexibility.

FZROX vs. VTSAX ETF Versions

If you prefer to invest in exchange-traded funds (ETFs) instead of mutual funds, you might be interested in the ETF versions of FZROX and VTSAX. An ETF is a type of fund that trades like a stock on an exchange and can be bought and sold throughout the day at market prices.

ETFs tend to have lower fees and higher tax efficiency than mutual funds, but they also have some drawbacks, such as bid-ask spreads and tracking errors. The ETF equivalent of FZROX and VTSAX is VTI, which is the Vanguard Total Stock Market ETF.

It has the same objective, holdings, and performance as VTSAX, but it has a slightly lower expense ratio of 0.03%.

FZROX vs. VTSAX | This One is Better!

So, which one is better: FZROX or VTSAX? The answer depends on your personal preferences and circumstances.

If you value convenience and simplicity over anything else, you might prefer FZROX for its zero fees and zero minimum investment. However, if you value flexibility and choice over anything else, you might prefer VTSAX for its availability through various brokers and its quarterly dividends.

However, there is another option that might be even better than both FZROX and VTSAX: VTI. VTI is the ETF version of VTSAX that has the same objective, holdings, and performance as VTSAX but with a slightly lower expense ratio of 0.03%.

Moreover, VTI is available through any broker that offers ETFs, giving you the ultimate flexibility and choice in your investing strategy.

How to Become a Better Investor

Whether you choose FZROX, VTSAX, or VTI for your portfolio, you should always strive to become a better investor. Investing is not just about picking the right funds or stocks; it’s also about having the right mindset, habits, and skills.

If you want to learn how to become a better investor, you should join the HaiKhuu Trading Community. HaiKhuu Trading Community is a platform where you can get hands-on help with the stock market and investing from experts and peers.

You will get access to daily morning reports, live trading calls, and thousands of other investors of all skill levels who can share their insights and experiences with you. You will also get access to exclusive tools and resources that can help you improve your investing skills and results.

Assessing Investment Quality

Finally, let's address some common questions:

Is FZROX a Good Investment? FZROX can be a good investment for those seeking broad market exposure with zero expense ratios. It's important to consider individual investment goals and risk tolerance.

Is VTSAX Better Than Fidelity? VTSAX and Fidelity's FZROX are both strong options, each with its own benefits. The choice depends on factors like dividend distribution, expense ratios, and minimum investment requirements.

Is Fidelity Index Fund Better Than Vanguard? Both Fidelity and Vanguard offer competitive index funds, and the decision ultimately depends on individual preferences, investment goals, and the specific funds in question.