Technical Analysis

Options Trading

Fundamental Analysis

Recent Posts

VOO vs. VOOG | Comparing Growth vs. Broad Market ETFs

VOO and VOOG are excellent ETFs for your investment portfolio, but they have differences you must be aware of before investing.

QQQ vs. VOOG | Comparing Growth ETFs

The differences between QQQ vs. VOOG are minimal, but you should compare the ETFs to determine which is better for your portfolio.

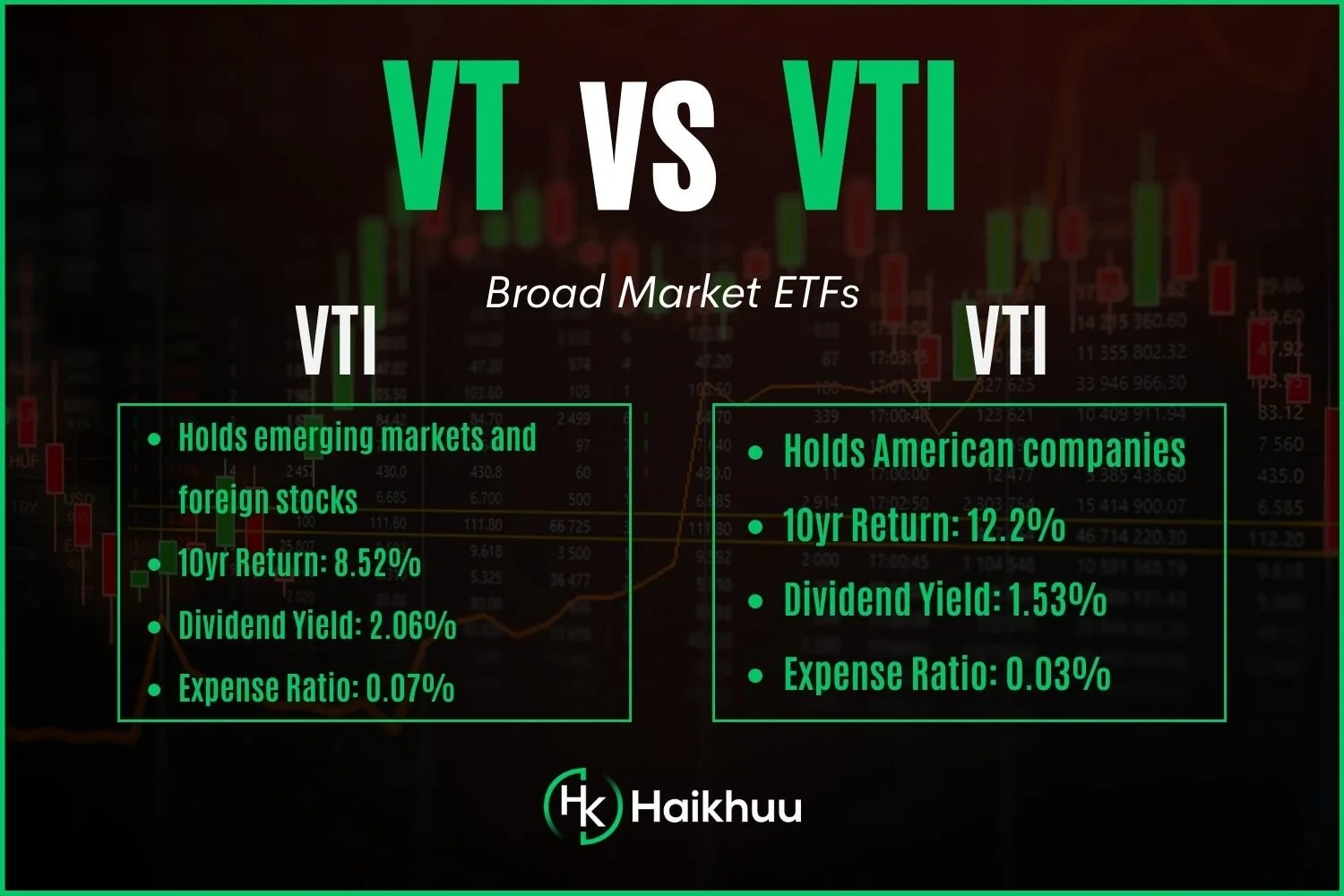

VT vs. VTI | The Best Total Stock Market ETFs

VT and VTI are broad market ETFs, but they have some differences investors must be aware of before investing.

VGT vs. QQQ | Which is the Best Growth ETF?

Discover the differences between VGT vs. QQQ to help you decide which is best for your investment portfolio.

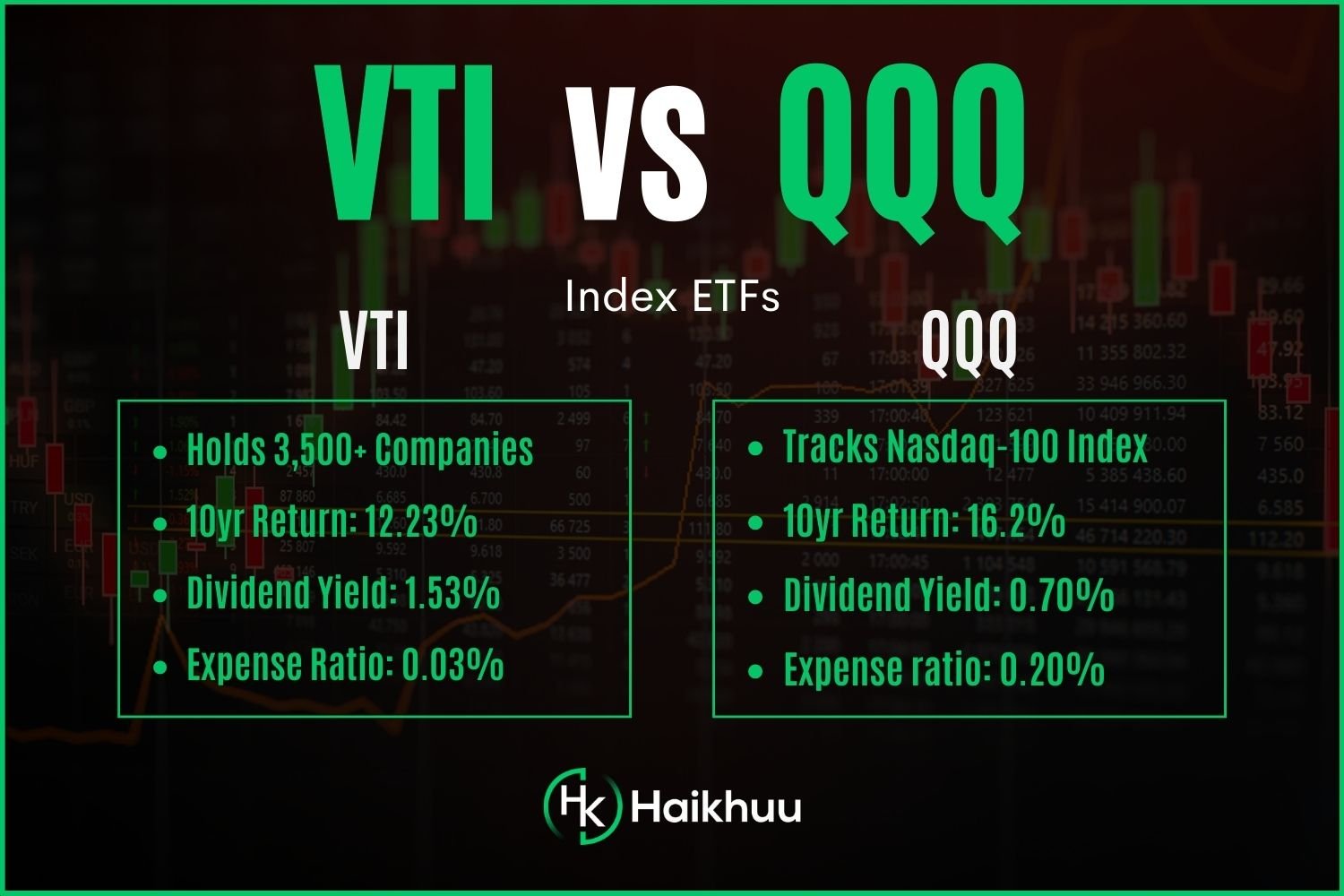

VTI vs. QQQ | Which is the Better Investment?

VTI and QQQ are ETFs that give investors exposure to some of the best companies on the stock market.

Short Straddle Options Strategy | What is a Short Straddle?

The short straddle options strategy involves selling ATM options when you believe implied volatility will drop, and the stock will remain stagnant.

Iron Butterfly Options Strategy | What are Iron Butterflies?

The iron butterfly options strategy is an excellent way to short volatility and take advantage of theta decay as an options trader.

What are Calendar Spreads? | Calendar Spread Options Strategy

Calendar spreads are a low-risk options strategy that you can use to take advantage of the volatility term structure with a slight directional bias.

Ex-Dividend Date vs. Record Date | When to Buy a Stock to Receive a Dividend

Learn the difference between the ex-dividend date vs. the record date and when you must own a stock to receive a dividend.

What is a Call Credit Spread? | Bear Call Spread Explained

A call credit spread is a bearish options trading strategy that benefits from a drop in implied volatility.

Bull Put Spread | What is a Bull Put Credit Spread?

A bull put credit spread is a defined risk trade that benefits from an increasing stock price and decreasing volatility.

Sell to Open vs. Sell to Close | Options Order Guide

Discover the difference between sell to open vs. sell to close orders as an options trader.

Valley of Despair in Trading | The Dunning Kruger Effect Explained

Discover how to conquer the valley of despair in the stock market through proper education, experience, and discipline.

Broken Wing Butterfly Options Trading Strategy | The Skip Strike Butterfly

The broken wing butterfly is an excellent options trading strategy with several advantages over a standard credit spread.

Options Vega Explained | Options Greeks Guide

Discover how options vega cam affects your options trading positions and how to utilize it to make better trades.

Weekly vs. Monthly Options | Which Should You Trade?

Weekly vs. monthly options come with their individual pros and cons, so understanding the difference will make a significant difference in your trading strategy.

The Difference Between Price Return and Total Return

The price return vs. total return of an investment can significantly alter the performance of a dividend-paying stock.

Can You Buy Bonds on Robinhood?

You cannot directly buy bonds on Robinhood. However, you can buy bond ETFs to gain bond exposure.

European vs. American Style Options | Differences Explained

European and American options are similar, but some key differences make a big difference depending on your trading strategy.

ITM vs. ATM VS. OTM in Options Trading

ITM (In-The-Money) options and ATM (At-The-Money) options differ in their intrinsic value and how they can be used in trading.