Technical Analysis

Options Trading

Fundamental Analysis

Recent Posts

Dollar Cost Averaging Calculator

Calculate your average purchase price with our easy-to-use Dollar Cost Averaging Calculator. Track multiple investments, assess your strategy, and optimize your cost basis.

Purchasing Power Risk | Understanding Inflation Risk

Explore purchasing power risk, its impact on finances, and how inflation affects it. Learn strategies to manage this risk for financial well-being.

Is Common Stock an Asset, Liability, or Equity?

Discover if common stock is an asset, liability, or equity. The answer may surprise you!

Inverse ETF List | The Best Inverse ETFs to Trade

Discover an inverse ETF list you can use to find ways to short the market.

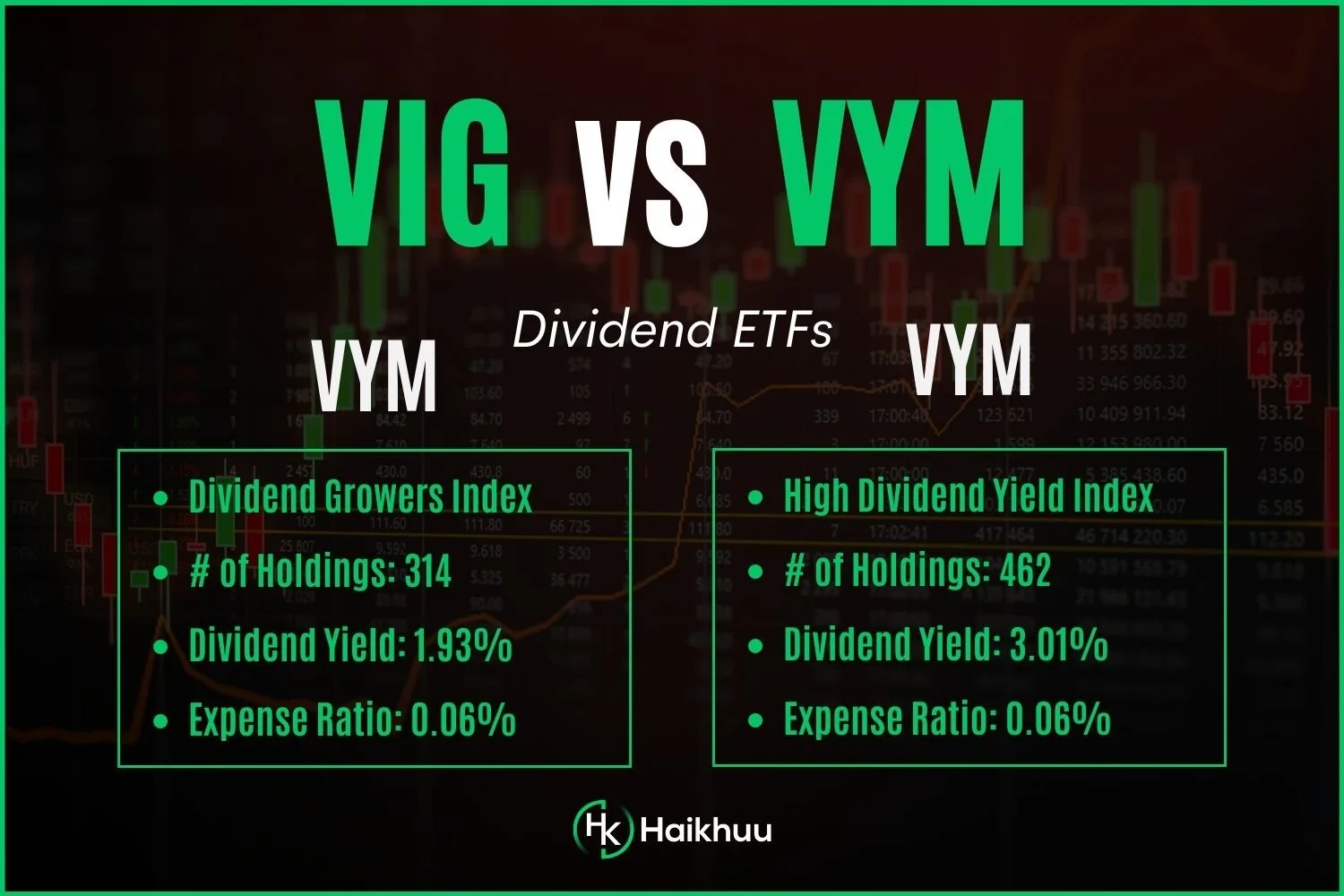

VIG vs. VYM | Comparing Vanguard Dividend ETFs

Discover the difference between VIG vs. VYM and which is best for your portfolio.

Power Hour Stocks | When is Power Hour in the Stock Market?

Uncover the secrets of power hour stocks, learn strategies to capitalize on market opportunities, and boost your trading success in the final hour.

What is a High Short Interest | Short Interest Ratio Explained

Discover what a high short interest is and how you can use it to find short squeezes.

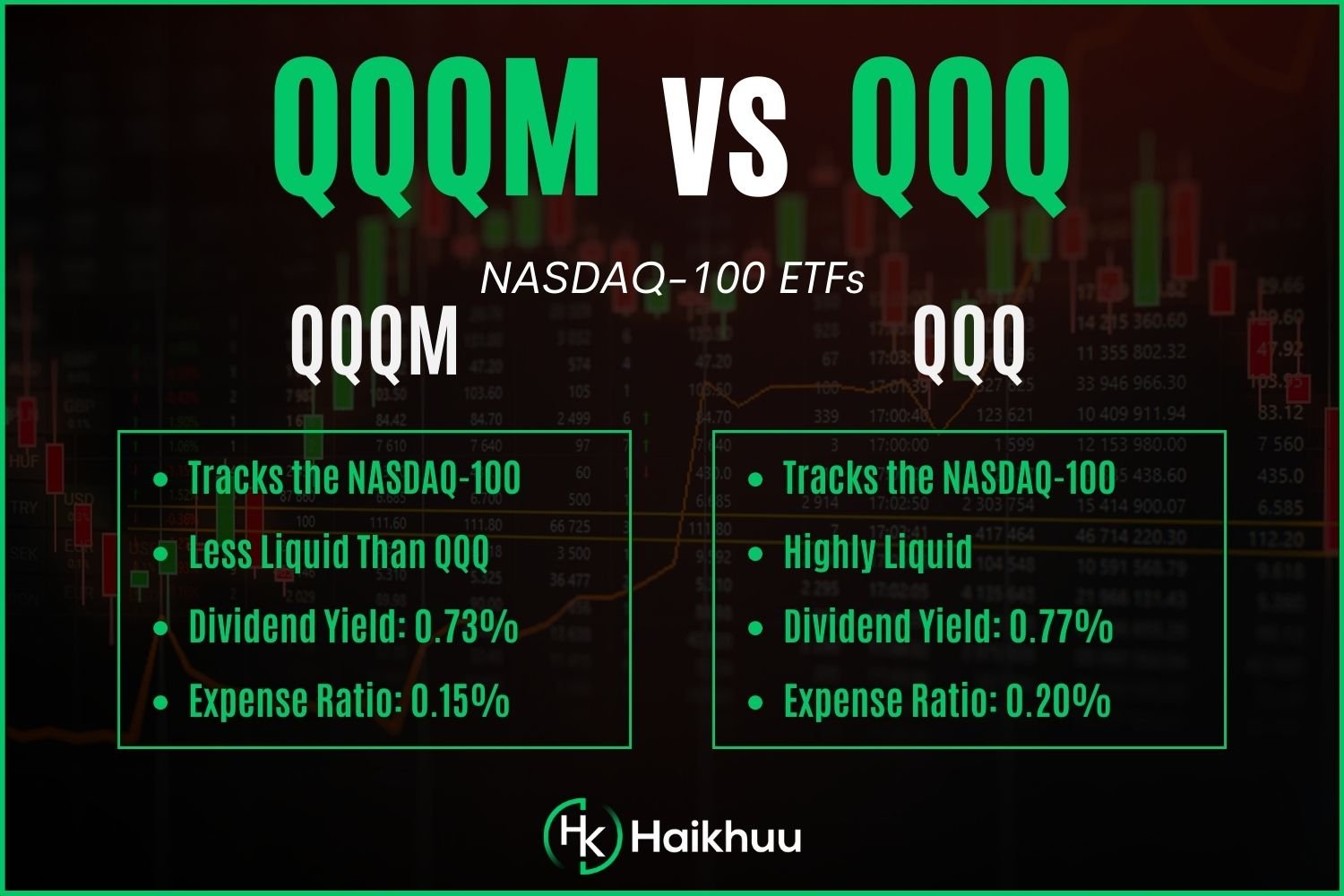

QQQM vs QQQ: The Ultimate Comparison

QQQM and QQQ are two popular exchange-traded funds (ETFs) that track the performance of the Nasdaq-100 index.

What is the Married Put Strategy? | Protective Puts vs. Married Puts Explained

Learn about the married put strategy and how they can help manage investment risk.

How You Can Build a Boglehead 3-Fund Portfolio

Learn how to create a Boglehead 3 Fund Portfolio, a simple and effective investment strategy for achieving long-term financial goals.

Collar Option Strategy: How to Protect Your Portfolio

Learn how to use the collar option strategy to protect your stock portfolio.

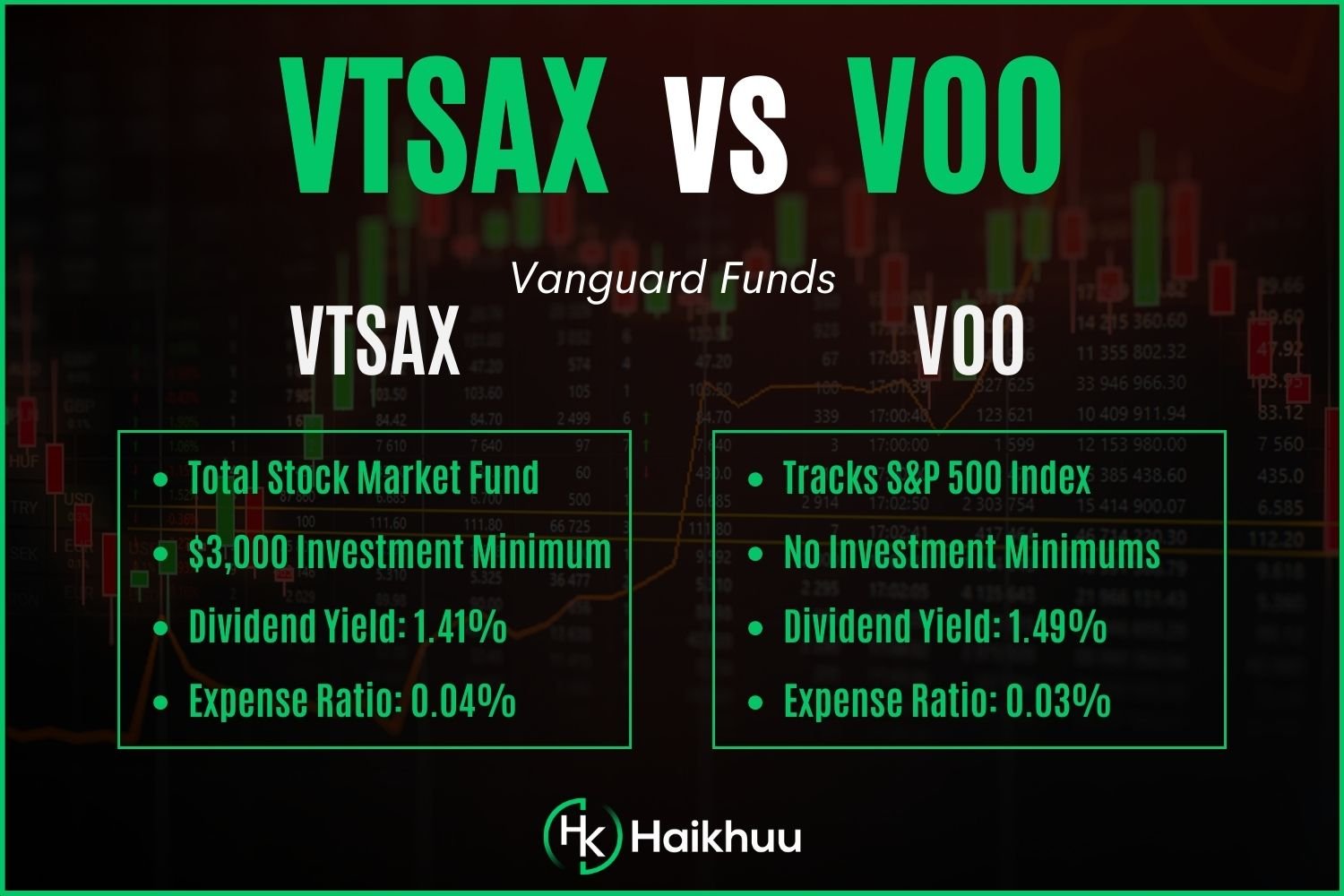

VTSAX vs. VOO | Total Stock Market vs. S&P 500 Funds

Discover the differences between VTSAX and VOO, two popular ETFs providing exposure to the US stock market.

Realized vs. Implied Volatility | You MUST Know the Difference

Learn about realized vs. implied volatility in options trading. Discover how to calculate both and whether implied volatility is overstated.

Cash-Settled Options | Everything You Need to Know

Cash-settled options are a type of financial derivative that settles the contract with cash payments instead of the delivery of the underlying asset.

VYM vs. VOO: Which ETF is the Best for Your Financial Future?

Compare VYM vs. VOO, two popular US equity ETFs. We analyze their historical performance, holdings, and fees to help you determine which is best for your portfolio.

How to Create Your Own All Weather Portfolio

Discover the All Weather Portfolio, an investment strategy developed by Ray Dalio to weather any storm.

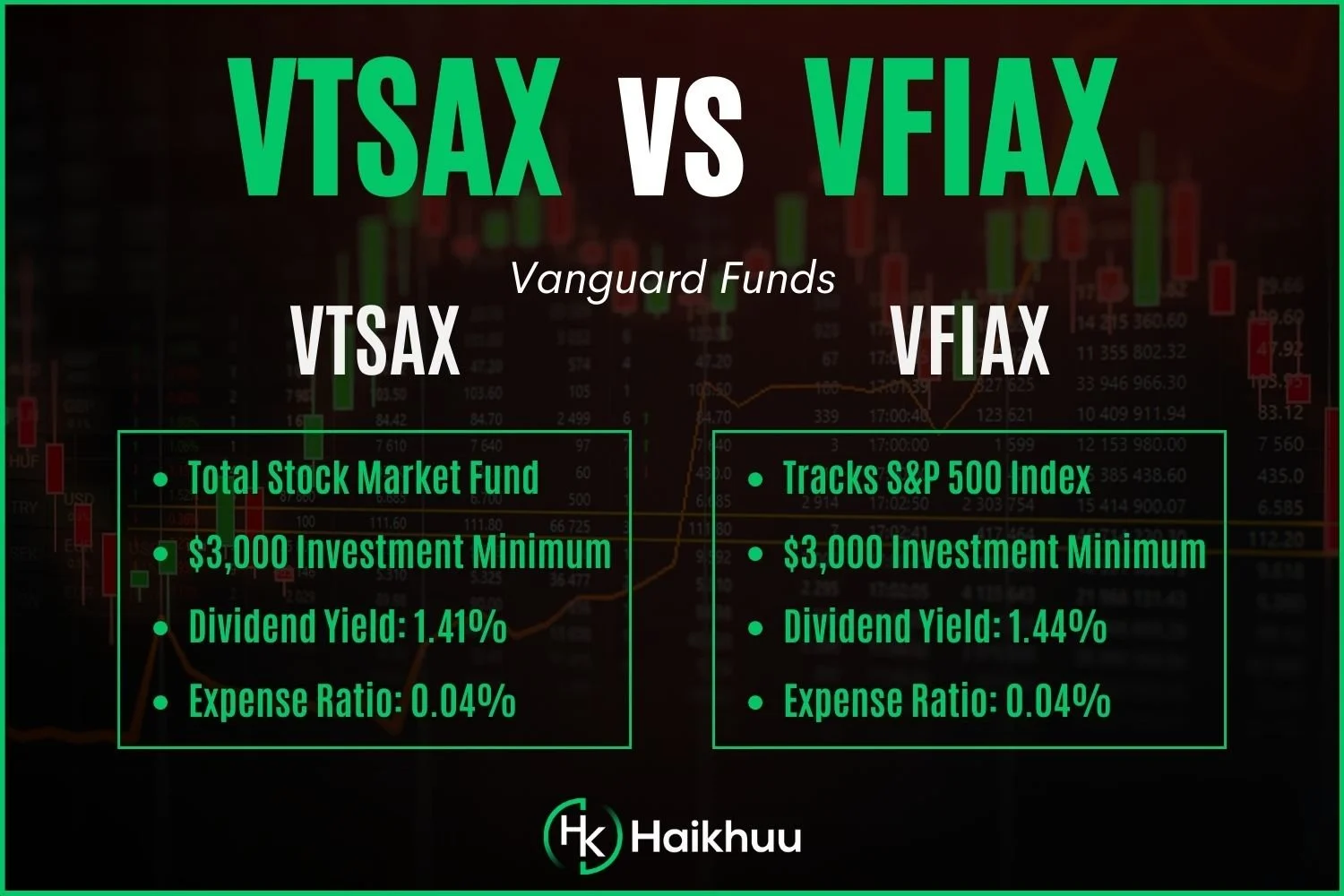

VFIAX vs. VTSAX | Vanguard 500 vs. Vanguard Total Stock Market

Looking to invest in the US stock market? Learn the key differences between VFIAX vs. VTSAX in performance, holdings, dividends, and more.

OpenAI Stock Symbol | How to Invest in ChatGPT

Looking for the OpenAI stock symbol? Learn why there isn't one, whether you can invest in OpenAI, and how the company makes money through AI tech.

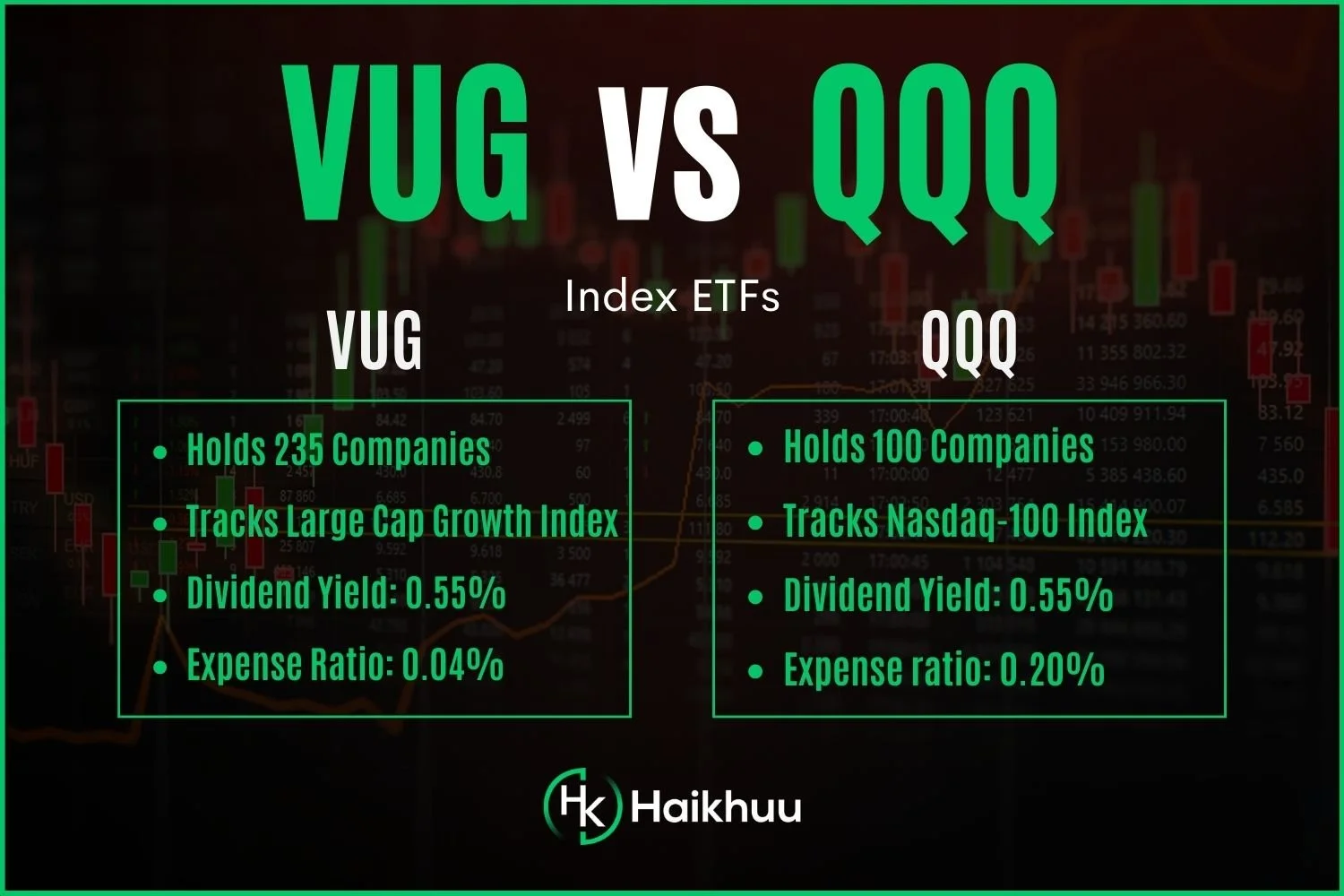

VUG vs. QQQ | Vanguard Growth vs. Nasdaq ETFs

This article compares VUG and QQQ ETFs, analyzing their historical performance, differences, and which may be best for your portfolio.

VUG vs. VOO | Vanguard Growth vs. S&P 500

Comparing VUG vs. VOO: Learn the historical performance, key differences, and which Vanguard ETF may be better for your portfolio.